When Elon Musk plays politics with Trump, it's Tesla that stumbles at the start. Between free falls, a hesitant board, and angry tweets, the Empire of the tweet dangerously wavers.

France

Cannes, famous for its film festival and luxury boutiques, is preparing to become one of the first French cities to massively adopt cryptocurrencies. By the summer of 2025, nearly 90% of businesses in the azure city will accept payments in crypto.

The CAC 40 is taking a significant hit. In just a few sessions, the Paris index has dropped over 6.5%, driven by a dramatic return of trade tensions. The announcement by Donald Trump of new tariffs on Chinese and European imports triggered a wave of massive sell-offs. Thus, on April 3, the Paris Stock Exchange fell by 2.25%, indicating a climate of widespread nervousness that revives the specter of a global economic war.

Telegram sent an unequivocal message to its French users this Tuesday, firmly defending the principle of encryption in private messaging. This communication comes after the rejection of a controversial amendment in the National Assembly that aimed to impose "backdoors" in encrypted messaging applications.

Under the pressure of sluggish growth and enduring geopolitical instability, the government is implementing an unprecedented austerity measure. By official decree, 3.1 billion euros in credits are being canceled for 2025, indicating a determined budgetary reorientation. The objective is to maintain the course of restoring public finances in the face of a weakened economic context. The cuts will severely impact key sectors such as ecology, the economy, and research, revealing the priorities of a public management that is now under strain.

At 1.7%, the Livret A no longer inspires dreams. The LEP saves the furniture, while the youth flee to greener, or more volatile, pastures.

A viral video on TikTok claims that a law banning cash has been adopted in France. In just a few days, this clip has reignited fears about the end of cash and a fully digitized society. However, this claim is false, as no legal text confirms such a ban. Behind this misleading narrative, a very real topic deserves attention: the digital euro project put forward by the ECB, which aims to complement cash rather than eliminate it.

The possible removal of the 10% tax allowance on retirement pensions is stirring public debate. Announced in a government note, the measure is as concerning as it is divisive. What was once just a budgetary avenue has now become a strong social marker, crystallizing tensions around taxation and the treatment of retirees. In a pressured economic climate, this potential reform raises a central question: how far can the State go without breaking the balance between generations?

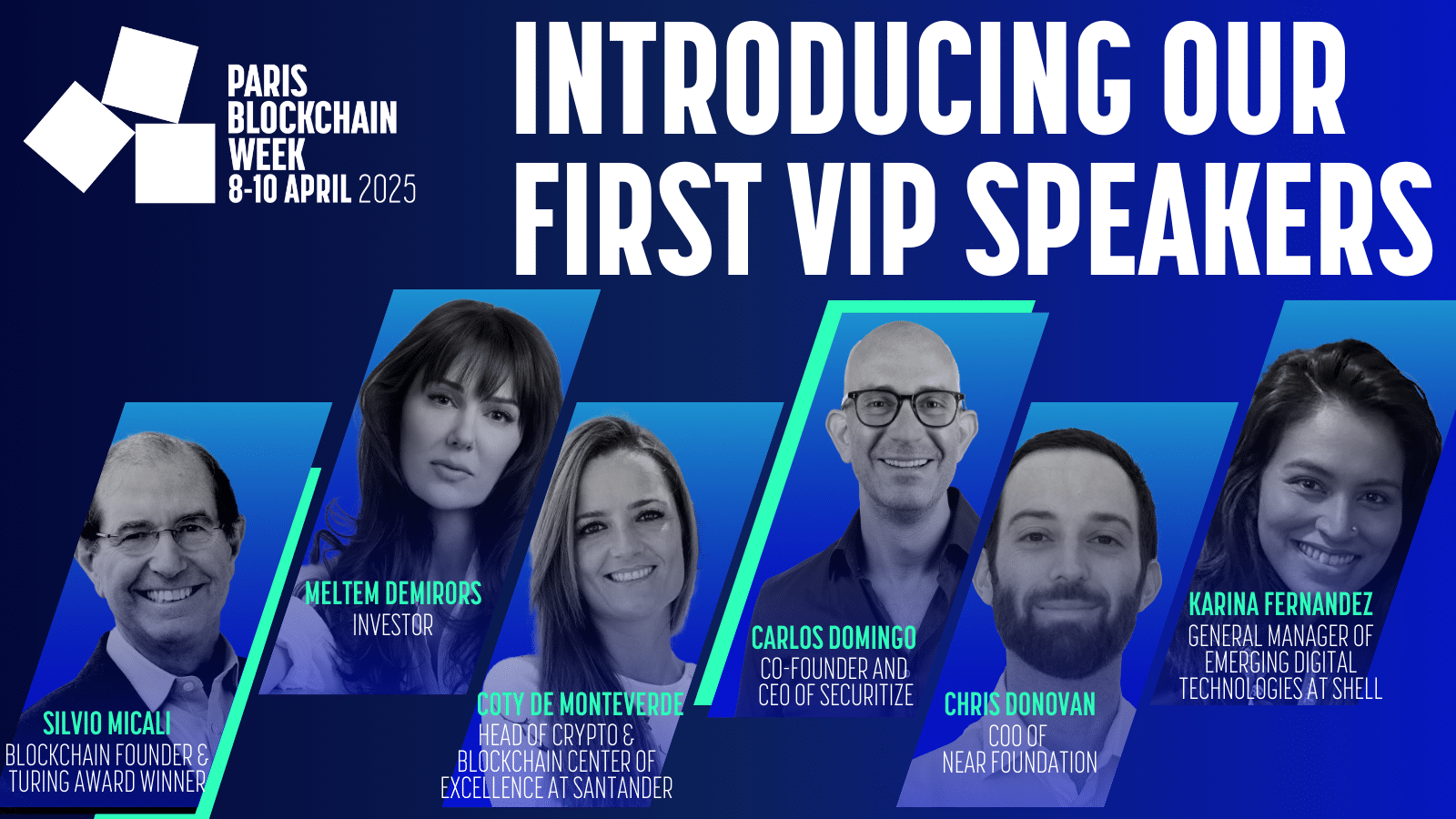

Paris Blockchain Week, Europe's premier blockchain and Web3 event, wrapped up its sixth edition at the iconic Carrousel du Louvre, setting a new standard for industry gatherings. The event was a resounding success, drawing over 9,600 attendees from 95 countries, including an impressive 67% C-suite executives, demonstrating the strategic significance of blockchain across global business leadership.

France is struggling with a massive deficit, Bayrou calls for more work, but amid social cuts and political tensions, the reform risks triggering a governance crisis.

Crypto in France is moving out of its phase of euphoria towards a more mature structuring. This 2025 study by Adan (Association for the Development of Digital Assets), conducted with Deloitte and Ipsos, presents a clear assessment: stabilized adoption, asserted industrial ambitions, but persistent challenges. Amid the rise of Web3, institutional openness, and regulatory barriers, the French ecosystem is carving its path towards sustainable integration. This survey sheds light on the springs of a dynamic in full redefinition, where the strategic future of cryptocurrencies in Europe is at stake.

A new trade confrontation is beginning between the two shores of the Atlantic. Through the announcement of a 20% tariff on all European products, Washington directly targets exports from the Old Continent. France, on the front line, faces the threat of a major economic shock. Between the vulnerability of strategic sectors and diplomatic urgencies, Paris must react quickly. Behind this American decision lies much more than a tariff battle: the entire architecture of transatlantic trade relations is at stake.

After a bleak week, the CAC 40 fell by 8%, shaken by the trade war, market volatility, and grim economic outlooks, with a rebound still uncertain.

Donald Trump triggered a new trade earthquake on the night of April 2 to 3, 2025. By announcing an increase in tariffs of up to 20% on products from the European Union, the current head of the White House is reviving transatlantic tensions. But France and Europe are not going to take it lying down and are going on the offensive!

Real estate is regaining its color. After a long period of waiting, prices are rising again in many French cities, signaling an unexpected turning point in the market. This upturn, which began at the start of the year, is intensifying due to more attractive borrowing rates and a gradual return of buyers. Both professionals and individuals are closely watching this emerging dynamic, which reshuffles the cards after months of stagnation. In light of this resurgence in activity, observers are pondering: is this a simple cyclical rebound or a true reversal of the cycle?

In 2025, declaring your cryptocurrencies has never been so strategic. With the entry into force of the European MiCA regulation and the tightening of tax controls, holders of Bitcoin, Ethereum, or other digital assets must be extra vigilant. Mistakes can be costly: penalties, adjustments, or even suspicions of fraud. Here is a powerful guide to navigate the key dates and nuances of the French tax regime, without getting lost in administrative maze.

A global study reveals that real estate remains widely used for money laundering, with gaps identified in all the analyzed countries, including France, which nevertheless ranks among the good students.

Bpifrance has announced a strategic investment of 25 million euros to support blockchain projects with a "strong French footprint." This initiative aims to strengthen France's position in the rapidly expanding global crypto industry.

Finally, the wall of distrust is crumbling. BoursoBank, the French giant of online banking, reaches a historic milestone by incorporating crypto ETPs into its offering. A notable turnaround for this subsidiary of Société Générale, which has long been distant towards digital assets. By partnering with CoinShares, the European leader in the sector, the platform breaks into the traditional world of finance. Bitcoin, Ethereum, XRP... These names now resonate in the portfolios of ordinary investors. One more step towards the normalization of cryptos? Much more: a silent revolution.

The Bank of France finds itself in 2024 facing an unprecedented financial situation with an operating loss of 17.7 billion euros. This loss, far from being anecdotal, highlights deep vulnerabilities within the European financial system, exacerbated by inflation, rising interest rates, and the management of public debts.

Normandy could soon host the first bitcoin mining farm in France, financed by the Sultanate of Oman. This unique project, at the intersection of energy, technological, and geopolitical issues, crystallizes French ambitions in the digital economy. At a time when energy sovereignty is becoming central, this initiative raises questions about the role that France wants to play in the global crypto ecosystem.

Paris Blockchain Week, the premier global event for blockchain professionals, reveals the first six headline speakers for its sixth edition, which will take place from April 8-10th, 2025, at the Carrousel du Louvre.

In response to the strategic urgency, France is changing course: to support its defense industry, the state is inviting citizens to invest at least 500 euros in a fund managed by Bpifrance. This unprecedented call for popular savings comes amid growing geopolitical tensions and accelerated rearmament, raising as many questions as it intrigues regarding the risks and ambitions of such a financial commitment.

A recent study reveals that all leaders of small and medium enterprises are now aware of cryptocurrencies, and more than a third personally invest in them, despite still limited professional adoption.

Tesla, once a star of the roads, is now heading towards the abyss: in France, outraged bosses and emptied fleets are signing the commercial death certificate of King Musk.

Buying a property without a significant down payment is an increasingly difficult challenge, especially for first-time buyers. While mortgage rates continue to exceed 3%, and new prices remain high despite the crisis, the government is expanding access conditions for zero-interest loans (PTZ) starting from April 1, 2025. This is a new initiative that pertains to two lesser-known schemes that allow purchasing a home at a lower cost and spreading out the acquisition.

As of March 17, 2025, Tisséo allows residents of Toulouse to pay for their bus, metro, tramway, and cable car tickets in cryptocurrency. This initiative, a first for a European transport network, aims to diversify payment methods and keep up with the evolution of financial practices.

As central banks around the world run out of steam in an endless race of monetary printing, François Asselineau, president of the UPR, proposes a radical shift: integrating 5 to 10% of Bitcoin into the reserves of the Bank of France. An idea that shakes traditional economic certainties and questions our relationship with sovereignty. Behind this proposal lies an undeniable observation: Bitcoin is not just a simple cryptocurrency, but a tool of resistance against the erosion of financial freedoms.

Durov flies to Dubai, leaving behind French justice. A stroke of genius or the last act before the fall? The crypto world holds its breath.

The European financial landscape has just undergone a major turning point with the European Central Bank's (ECB) decision to lower its key interest rates by 0.25 percentage points. This measure does not go unnoticed in a context where access to mortgage credit remains a key issue for households and investors. This decrease could stimulate demand and reshape market dynamics, but observers remain divided on its actual impact.