Alphabet is back in focus after a Bloomberg report indicated rising investor confidence in its in-house semiconductor strategy. Interest in the company’s tensor processing units (TPUs) is reshaping expectations for future revenue and altering market sentiment. Many investors now see the chip program as a potential long-term growth driver, not just a tool used within Google Cloud.

Gemini

Google hides its spy in your dashboard: Gemini, a talkative, geolocated, multitasking AI that guides you... and maybe watches you. Soon a driving license for robots?

Prediction markets are about to disrupt crypto finance, and Gemini has just made the move. Between disruptive innovation, tense regulation, and Ethereum’s key role, this revolution could redefine investment. Analysis of the stakes and opportunities not to be missed.

Solana (SOL) hovered near $191.95 on October 25 after briefly testing $195 earlier in the day. The token has shown resilience amid shifting market momentum, with traders watching to see if it can turn the $192–$195 range into a new support zone.

When Trump roars "I am the boss", the Winklevoss texts remind him that the kings of Bitcoin crypto sometimes pull more strings than a president on stage.

Gemini is moving toward a settlement with the SEC over its years-long Earn case, marking progress in a key dispute while also celebrating its $425M Nasdaq debut.

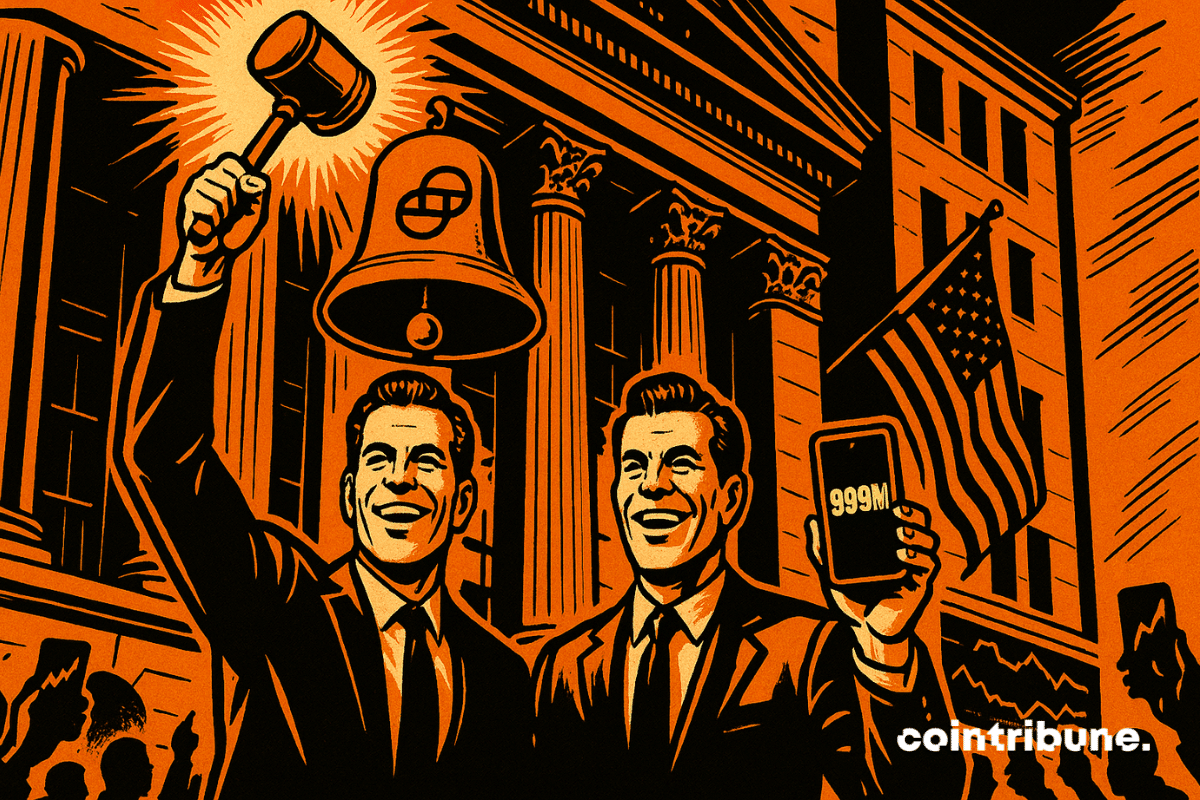

Gemini makes its debut on the Nasdaq under the symbol GEMI. The Winklevoss brothers' crypto platform successfully launched its IPO at 28 dollars per share, a price set beyond initial expectations. This listing comes as the crypto sector tries to regain market confidence in a climate still marked by regulatory uncertainties and the quest for profitability.

Eyes are fixed on the market as many financial firms warm up to go public on Wall Street this week. Among these potential debutants, American crypto exchange Gemini has increased its share price ahead of its initial public offering (IPO) scheduled for Friday.

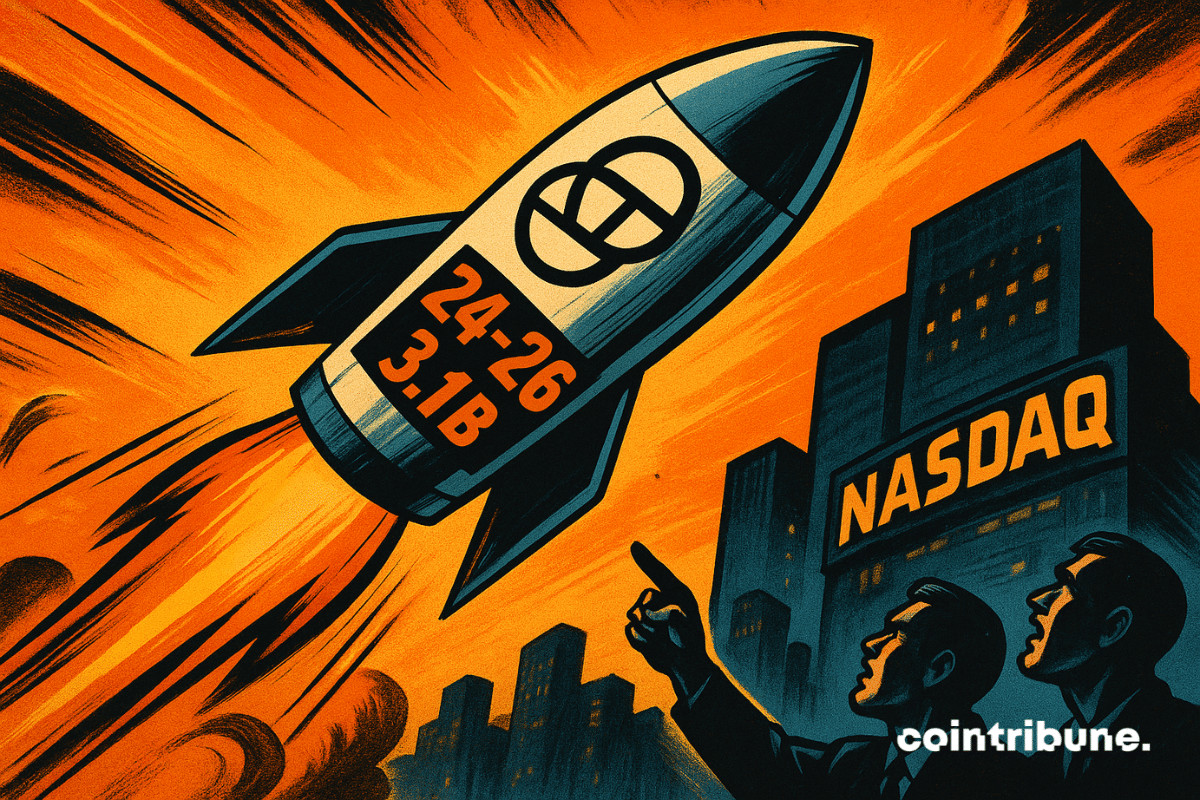

Gemini has officially filed for its IPO, a step that could bring the decade-old platform to Nasdaq under the ticker symbol GEMI.

Prediction markets are shaping a new landscape for artificial intelligence. While ChatGPT seemed unshakable, Kalshi data reveals a surprising upheaval: 57% of bettors now wager on Gemini to become the best text-based AI model by the end of 2025.

Gemini, the exchange founded by the Winklevoss brothers, has officially filed its S-1 with the SEC for a Nasdaq IPO. In a context marked by the multiplication of crypto IPOs, this initiative raises as much enthusiasm as questions. The platform's repeated losses and the market's persistent volatility indeed call for a thorough analysis. Will Gemini manage to attract Wall Street despite disappointing financial results?

Major crypto exchanges Coinbase and Gemini are close to securing licences to operate legally across the European Union (EU) under the Markets in Crypto-Assets (MiCA) regulation. With these licences, they would join other global exchanges like Bybit, which gained approval from Austria’s Financial Market Authority in May.

Gemini takes a strategic step with the filing of an IPO project with the SEC. In an industry where every initiative from a historical player can reshape the market, the platform founded by the Winklevoss brothers aligns itself with traditional finance without renouncing its crypto roots. Against a backdrop of regulatory relaxation and renewed enthusiasm for cryptocurrencies, this decision is not merely a tactical move, as it lays the groundwork for a new balance between decentralized innovation and traditional stock market infrastructures.

Advances in artificial intelligence (AI) offer numerous opportunities, but they also attract the attention of cybercriminals. Recently, Google's Threat Intelligence department released a report titled "Adversarial Misuse of Generative AI," highlighting attempts by hackers, including government-sponsored groups, to exploit their AI chatbot, Gemini.

Google recently unveiled Gemini 2.0, a major advancement in the field of artificial intelligence (AI) agents. This new version marks a significant milestone in the evolution of AI technologies, aimed at enhancing the interaction and efficiency of intelligent agents with humans.

The famous American platform Gemini, founded by the Winklevoss twins, has officially established itself in France. With a clear regulatory framework and growing interest in digital assets, the French market appears tailor-made for this arrival. But what does Gemini really bring to French investors, and why is this launch strategic? Let’s explore this new crypto adventure.

Massive outflows at Grayscale: Bitcoin under pressure, market on alert.

It appears that the outflows from the GBTC ETF related to Genesis' asset liquidation have started. Hence the halt in Bitcoin.

By suspending the generation of images of people through its AI tool Gemini, Google puts ideology before technological progress

The Bitcoin ETFs are breaking all records despite the outflows from the GBTC ETF, which could soon intensify due to sales from the Gemini exchange.

"A new massive sale of bitcoins deposited in Grayscale's GBTC ETF is looming following the resolution of the case involving bankrupt Genesis and Gemini Exchange."

Crypto in France: Gemini exchange has obtained approval as a digital asset service provider.