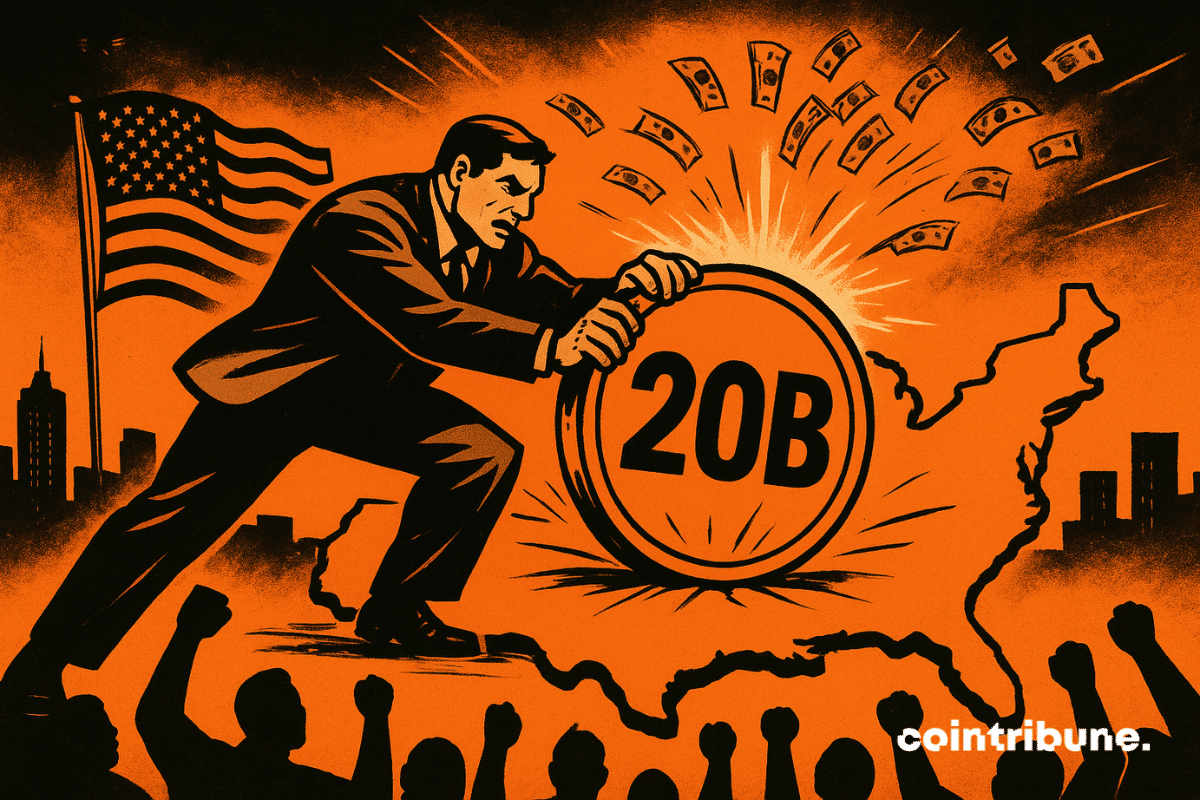

Bitcoin falls, Saylor buys. Two billion injected in two weeks, while the market panics. What if, after all, the crypto oracle wore a tie and sold shares?

Investment

Michael Saylor’s company, Strategy, is facing growing pressure as it challenges MSCI’s plan to exclude crypto-treasury firms from major stock indexes. Strategy, which holds the world’s largest corporate Bitcoin reserve, warned that the proposal misjudges how digital-asset treasuries operate. More so, the plan risks distorting fair index standards.

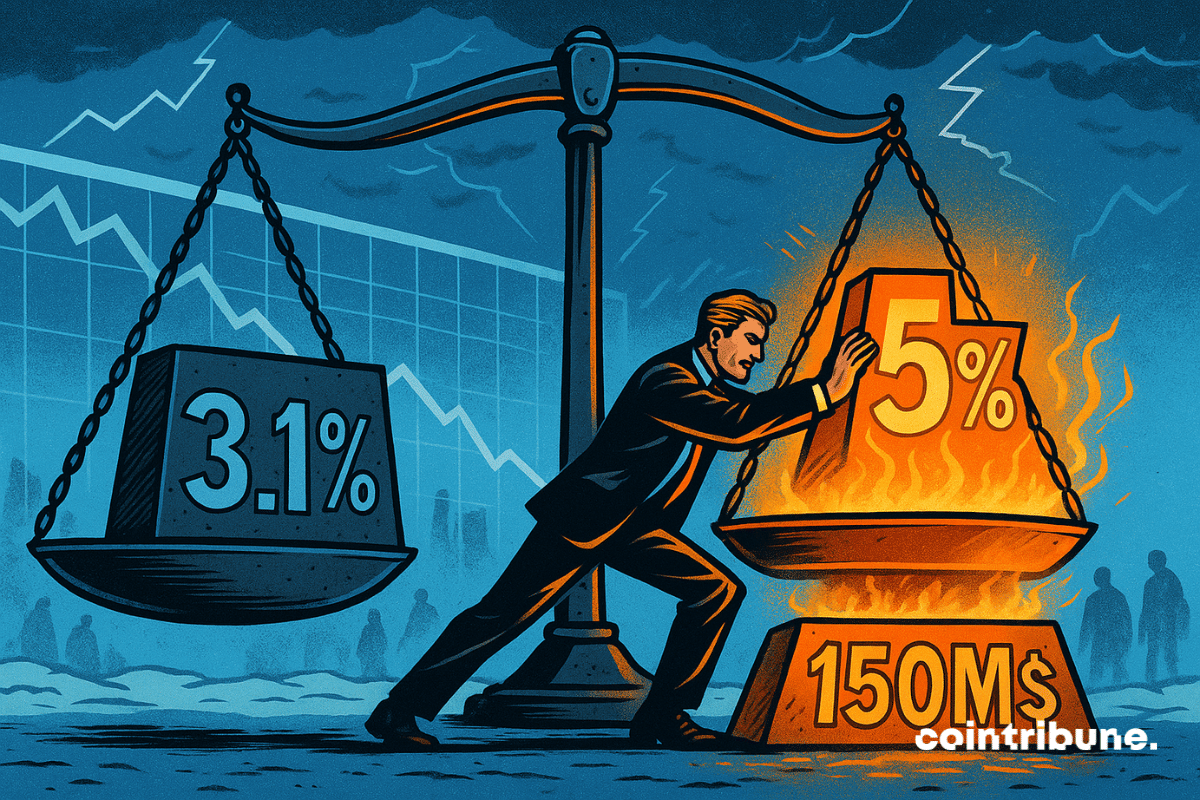

While the small holders sell, BitMine stuffs itself with ether: $150 million at once, aiming for 5%. Soon, Ethereum will be to Tom Lee what Twitter is to Musk.

When Ethereum no longer inspires companies, BitMine feasts, the small ones die... and the crypto market wonders: is it a pause or the end of recess?

Ark Invest, led by Cathie Wood, has increased its stakes in crypto-linked companies, including Coinbase and Circle, while revising Bitcoin’s 2030 target to $1.2M.

Ethereum crashes, BitMine persists: MAVAN, dividend, patriotism... The ultimate crypto pirouette of a giant who prefers to bet big rather than fold to Wall Street.

Young investors are increasingly moving their assets to advisors who offer crypto access, making digital assets a key factor in wealth decisions.

Tokyo throws 17 trillion yen, dreams of AI everywhere… but its hotels close due to a lack of workers. What if Japan also programmed a robot to hire?

Growing interest in digital assets is prompting investors to reassess which tokens deserve long-term attention. Recent shifts in sentiment around Solana, XRP, and other major networks reflect a market still trying to determine its next set of leaders.

While some flee the crypto ship, Saylor fills up on bitcoins. And if the stubborn captain was right? Guaranteed plunge into Strategy's digital vaults.

When JPMorgan flirts with Ethereum without ever slipping the ring on its finger... 102 million slipped into Bitmine, it's discreet, clever, and above all very, very crypto-compatible.

Trump believed he held the key to the crypto kingdom… Result? A stock market bloodbath, billions lost, and a truth stinging more than his tweets: crypto does not forgive.

Naoris Protocol was recently cited in a U.S. SEC filing as a reference model for quantum-resilient blockchain infrastructure.

Solana (SOL) hovered near $191.95 on October 25 after briefly testing $195 earlier in the day. The token has shown resilience amid shifting market momentum, with traders watching to see if it can turn the $192–$195 range into a new support zone.

In a crypto sector marked by insolvency scandals, led by FTX, financial transparency has become a decisive criterion for investors. OKX, one of the leading global exchange platforms, has understood this well: since October 2022, it has been publishing its Proof of Reserves (PoR) monthly, a cryptographic report that allows verification that user deposits are actually covered by real assets. With its 29th report published on March 31, 2025, the exchange shows 24.6 billion dollars in primary assets and a reserve ratio above 100%. But what exactly does this proof of reserves mean? And why does OKX stand out in this area?

Ethereum-based exchange-traded funds (ETFs) are losing traction as investor demand cools, marking a second consecutive week of outflows. In contrast, Bitcoin ETFs are experiencing a strong resurgence, drawing hundreds of millions in new capital as institutional investors rotate back into the market’s leading digital asset. The diverging flows highlight a shift in sentiment, with traders favoring Bitcoin’s relative stability over Ethereum’s recent weakness.

The American exchange platform Kraken has just introduced a new feature called "Bundles", allowing users to purchase a diversified basket of cryptocurrencies grouped by theme in a single transaction. Officially launched in September 2025, this service targets both beginner and experienced investors who want to gain exposure to multiple digital assets without having to manually compose a portfolio.

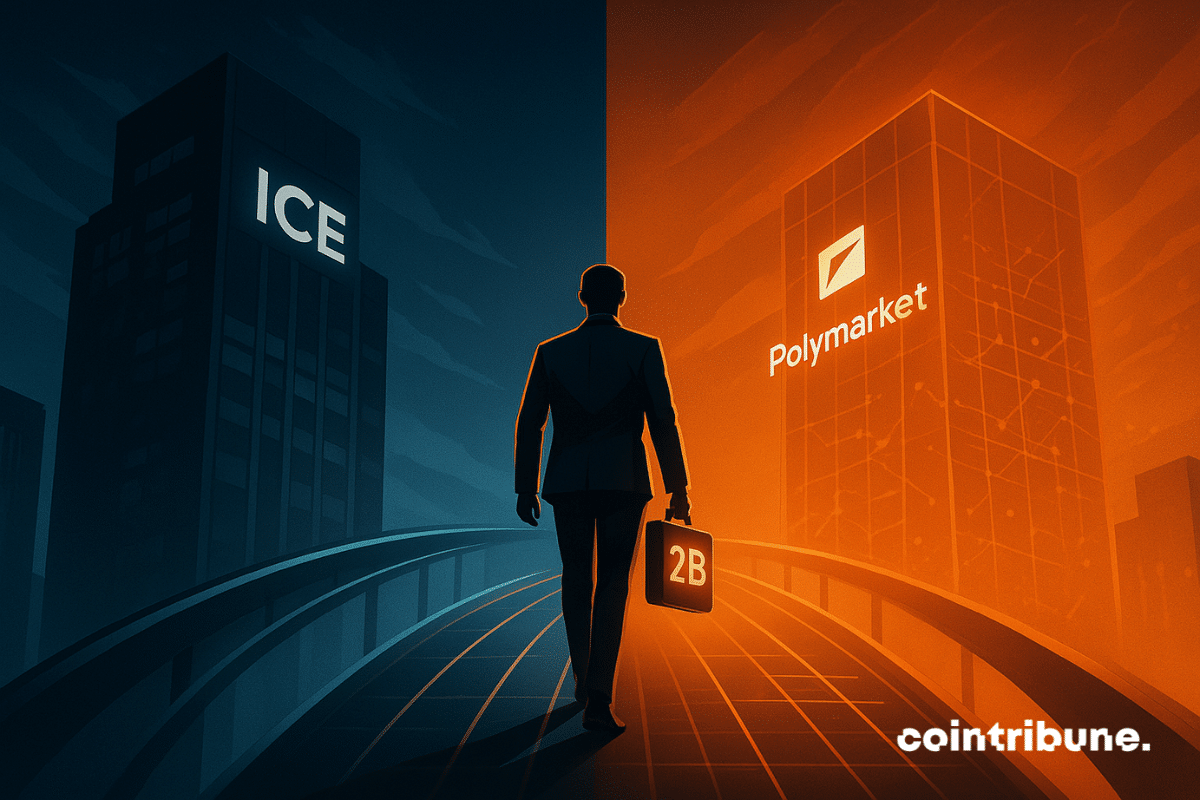

Prediction markets have received a major vote of confidence after Intercontinental Exchange (ICE)—the operator of the New York Stock Exchange—announced a $2 billion strategic investment in Polymarket. The deal values the platform at roughly $8 billion, marking a stunning turnaround for a company that faced regulatory fire just three years ago.

Polymarket introduces annualized rewards for long-term positions, supporting accurate pricing in high-profile political and global markets.

Bloomberg sources report that Tether Holdings SA is in private discussions to raise roughly $20 billion—a move that could push the USDT stablecoin issuer’s valuation to about $500 billion. If finalized, the deal would position Tether among the world’s most highly valued private companies.

At Saylor's, the vaults overflow: 639,835 bitcoins in reserve! While Wall Street grimaces, Strategy plays the global treasurer of an increasingly coveted digital gold.

U.S. spot Bitcoin exchange-traded funds (ETFs) are flying high at the moment, pulling in investments totaling $2.3 billion over the past week. Following a five-day inflow streak from September 8 to September 12, BTC investment vehicles recorded their best weekly outing in the past three months.

Bitcoin wavers, whales sell, Wall Street sulks... and Strategy laughs. The former MicroStrategy continues to fill its vaults, defying volatility and skeptics of a crypto market that is always surprising.

Capital Group’s crypto investment appears to have paid off, according to recent reports, with its $1 billion Bitcoin-related stock surging by over 400%. The American asset management firm entered the Bitcoin treasury market a few years ago, following significant investments in Metaplanet and Strategy.

Recent chatters within crypto chat rooms indicate that prediction platforms Polymarket and Kalshi are exploring ways to raise capital, with Polymarket aiming for a higher valuation than Kalshi. Interestingly, this comes as decentralized betting begins to catch the eyes of top firms within the crypto space.

While bitcoin wavers, Michael Saylor forces a smile: he spends 217 million, stacks 638,460 BTC, and transforms Strategy into a financial factory dedicated to cryptos.

At this back-to-school period, major banks are revising their outlook. Faced with a clear slowdown in the American economy, the idea of two to three rate cuts this year is gradually taking hold. Investors, hanging on the Fed’s slightest signals, see in this change of course a potential turning point.

SharpLink throws its dollars into ether like confetti: 39,008 ETH quietly bought, Joseph Lubin as the conductor of a risky all-in crypto.

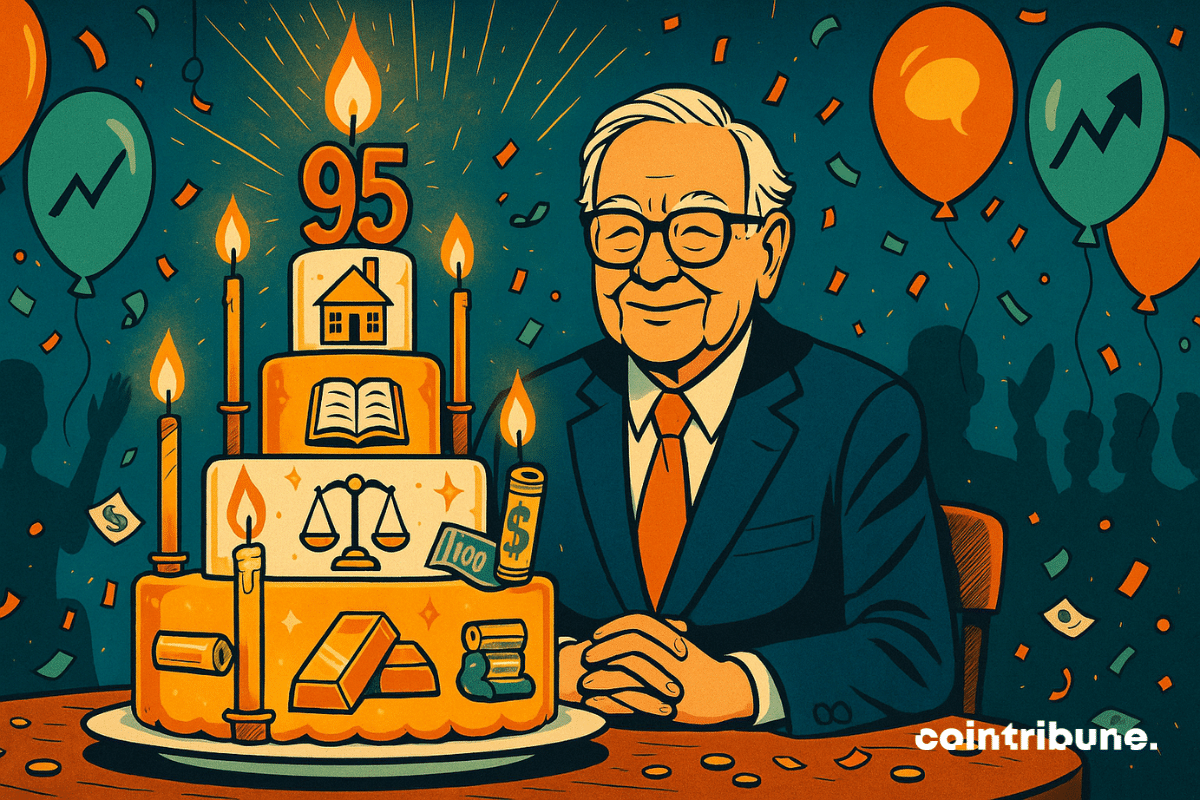

At 95 years old, Warren Buffett remains one of the last bastions of capitalism based on patience and value. While markets ignite to the rhythm of algorithms and viral tweets, the Oracle of Omaha remains faithful to an immutable strategy: investing in what one understands, for the long term. Besides his birthday, this week also marks a turning page for Berkshire Hathaway.

Spot crypto exchange-traded funds (ETFs) are currently on a smooth sail, posting strong inflow records week-on-week. Although these investment products struggled during the early parts of the year following the broader market drop, their performances have picked up in this quarter—particularly in the U.S. market