1 Zettahash, a technical victory for Bitcoin, but a chilling economic blow for miners: a record power that hides compressed margins and falling prices.

Miners

At $105,000 per Bitcoin, miners are singing in the rain of exahashes. Fierce competition, stellar margins: it’s a dance of numbers and electricity.

Like a cut breath, Bitcoin hesitates below $100,000. Fewer sales, more waiting: where is it going?

How to know how much you can earn from BTC mining? Discover the answer in this comprehensive guide to bitcoin mining. Before knowing how much bitcoin mining can yield, one must first understand how this activity works.

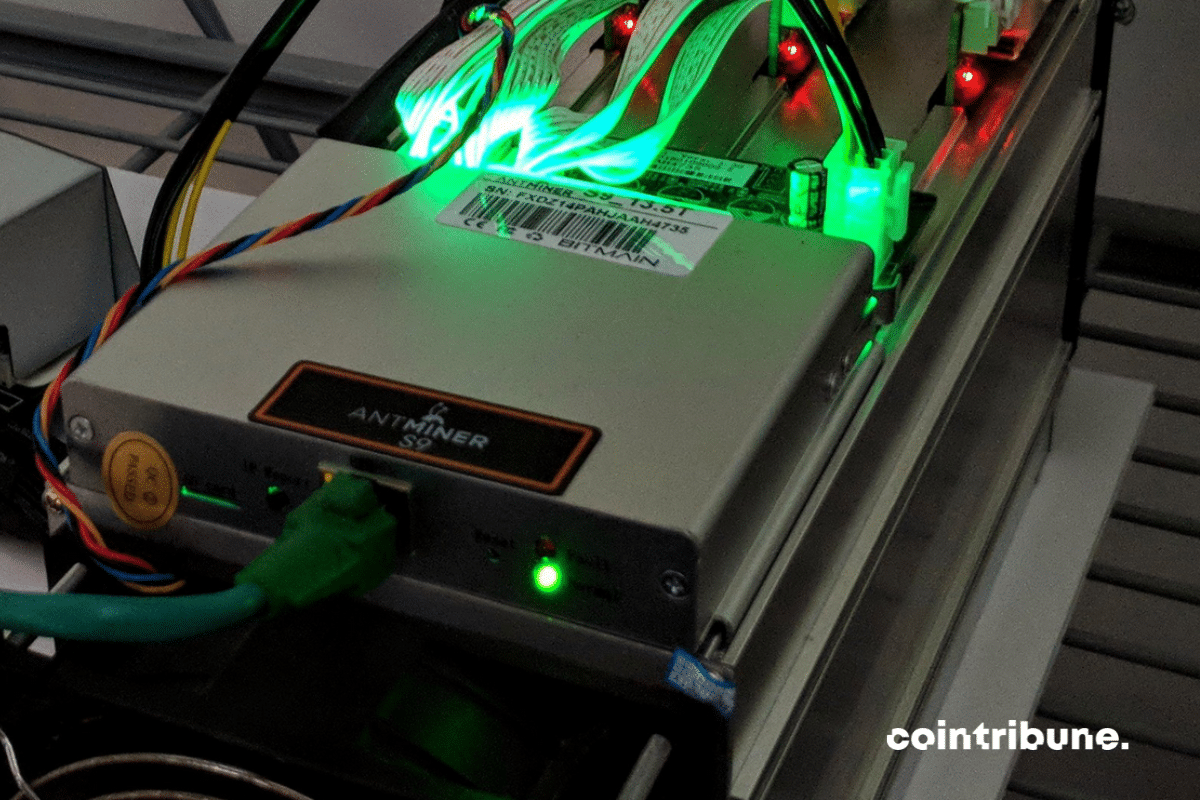

Mining involves using powerful computers to solve complex problems and validate transactions on the blockchain. Among the equipment used to mine Bitcoin, ASICs are certainly the most widespread in the industry. Discover everything you need to know to get started with ASIC mining!

Are you interested in mining Bitcoin (BTC) and hesitating to start with a processor (CPU)? Know that it is entirely possible to mine Bitcoin using the processing power of your computer. In fact, it is an easy way to get started in cryptocurrency mining, as you do not need expensive hardware or special knowledge. In this article, we will guide you through your first steps in CPU mining.

Have you ever heard of FPGA? It is a type of hardware used for mining cryptocurrency, whose popularity continues to grow. This article covers all the necessary steps to mine Bitcoin (BTC) with this device. But before diving into the heart of the matter, let’s start by defining the concept and what the advantages and disadvantages of this practice are.

Are you looking for the best software to mine Bitcoin (BTC)? If so, you're in luck! In this article, we will give you an overview of some of the most popular software for Bitcoin mining. We will explain the different features of each solution and discuss the advantages and disadvantages to help you decide which one is best suited to your needs.

The Stratum mining protocol is an essential component of the Bitcoin (BTC) network. It allows mining software to connect efficiently and securely to the blockchain, optimizing the mining process. Developed in 2012, Stratum has since become the most popular protocol used for mining bitcoins. In this post, we will explore the definition of this technology and the reasons why it is so important for Satoshi Nakamoto's network.

Bitcoin mining is the process by which new units of bitcoins (BTC) are created. It is an effective method if you want to acquire Bitcoin. But before you dive into this activity, you may be wondering how long it takes to generate BTC. In this article, we will explore this question in depth. You will discover, among other things, how difficulty, hash rate, and other parameters influence this metric.

The hashprice is a very important metric for crypto miners. It is particularly useful when it comes to determining the profitability of their operations. Therefore, if you are interested in Bitcoin (BTC) mining, or if you are simply a cryptocurrency enthusiast, you will probably want to learn more about it. This article explains in detail what hash price is and why it is so relevant in the crypto industry.

Initially, Bitcoin (BTC) mining was an activity practiced exclusively by a handful of insiders. However, over time, more and more people began to engage in it. As the phenomenon grew, mining farms started to emerge. In this article, we will explore what these platforms are, how they operate, and why they are interesting. We will also look at how they are powered, whether they are profitable, and what their future holds.

When Bitcoin doesn't take off, miners row against the current, and their profitability is sinking. Stuck below the surface!

Bitcoin is selling like hotcakes, miners are overwhelmed producing five times less than demand. Beware of the bubble!

75% of Bitcoins have not moved, but panic is spreading among traders. Miners are preparing to capitulate.

When Bitcoin's hash rate plays yo-yo, miners risk their shirts between energy costs and competition.

The massive sales of bitcoins by miners are causing the market to plunge, raising concerns among traders.

The Bitcoin Halving, scheduled for mid-April, promises to change everything. It is expected to significantly impact the price of BTC, with many analysts associating the block reward halving with a potential bull run. However, major upheavals are also to be expected on the side of Bitcoin miners after the halving. The average cost of mining will be revised upward during this period, putting several companies at risk.

The crypto trader REKT proposes 5 distinct steps of the Bitcoin halving.

The Bitcoin halving is a major event in the cryptosphere. Good news for some, it could unfortunately have devastating consequences for miners.

What is the probability of winning 6.25 bitcoins by mining alone, i.e. without using a pool?

A solo miner defies the odds and hits the jackpot! With a one in 5,500 chance, this independent miner struck gold by solving a Bitcoin block worth 6 BTC, approximately $160,000. What makes this remarkable feat even more impressive is that it was achieved using mining hardware that is six years old.

Every four years, the Bitcoin protocol experiences an event known as the Halving. It is undoubtedly one of the most significant events in the network. This highly anticipated event involves a change in the protocol's monetary policy by halving block rewards. In April 2024, the block reward will drop to 3.125 BTC. With this crucial deadline approaching, how can you best prepare?

The Bitcoin network is experiencing intense activity with the speculative frenzy surrounding Ordinal's BRC-20. This influx has led to real network congestion, resulting in a drastic increase in transaction fees. Yesterday, block number 788695 set a historical record by reaching 6.7 bitcoins in fees, exceeding the 6.25 bitcoin block subsidy.

Binance is facing massive withdrawals as well as transaction fees multiplied by the latest fashionable nonsense: the BRC-20…