Tokens we thought were safe, a report that strikes, the BIS takes aim at stablecoins. Crypto-mania or toxic bubble? The global finance reassesses its strategies... under high tension.

Regulated

The Court of Justice of the European Union could dismiss Google's appeal against a fine of $4.7 billion. This judicial setback is not just an antitrust matter: it embodies the growing tensions between American tech giants and European digital sovereignty.

The French crypto sector is dragging its feet in the face of MiCA. The AMF is sounding the alarm: will you be ready before the fateful date? Find out why the race against time has just begun!

X, formerly Twitter, soon to be a bank, wallet, and exchange? Musk is betting big with X Money, the "crazy ambition" to dethrone banks… stay tuned!

Revolut is setting up in Paris, spending a billion, hiring 200 people... But behind the neobank, will crypto go all in to dominate the European economy? A mystery to follow.

As cryptocurrencies emerge as a major lever of individual financial sovereignty, the United Kingdom decides to tighten its regulations. Starting in 2026, every transaction will be scrutinized, every user identified. Anonymity, the cornerstone of the crypto ecosystem, falters under the blows of fiscal regulations.

Mark Carney, a political and economic victory for Canada, but beware! He may be preparing to bury cryptocurrencies in order to welcome CBDCs with open arms. Bitcoin, get ready to pack your bags.

The crypto market is facing a harsh reality for investors who bet on locked tokens. According to recent data, between May 2024 and April 2025, these investors recorded an average loss of 50% compared to over-the-counter (OTC) valuations, exacerbating distrust towards new projects.

The year 2025 could mark a historic turning point for crypto ETFs in the United States. More than 70 funds are awaiting approval from the SEC, covering assets ranging from Bitcoin to memecoins. This momentum could transform institutional access to crypto, but there is no guarantee of success for all.

In response to the turbulence in the financial markets amplified by Donald Trump's trade policies, Susan Collins, president of the Boston FED, announced that the Federal Reserve is preparing to intervene. Among the options considered to stabilize the markets, a reduction in interest rates could become inevitable if the situation deteriorates.

Is the XRP case coming to an end? Ripple and the SEC suspend their appeals. The crypto ecosystem could emerge stronger. Details!

Crypto: Banking giant BBVA gets the green light to offer Bitcoin and Ether. Find out the details in this article!

Bitcoin continues to assert itself. This time, twelve American states are making headlines with a colossal investment of 330 million dollars in Strategy, formerly known as MicroStrategy. This move marks a major turning point in the integration of crypto into institutional portfolios.

The Federal Deposit Insurance Corporation (FDIC) is at a decisive crossroads, facing challenges related to the "debanking" of crypto businesses and calls for regulatory reform. Debanking refers to the practice by which banks refuse or restrict access to financial services for certain sectors, including the cryptocurrency sector. What position will the FDIC take regarding crypto businesses in the United States?

In the arena of public blockchains, Deutsche Bank chooses Ethereum and ZKsync for its innovative response to compliance challenges, a test that could disrupt the standards of global finance.

These key events will influence the crypto market this week and may have an impact on price volatility!

The SEC, accused of over-regulating, is facing seven U.S. states to protect the crypto market and innovation.

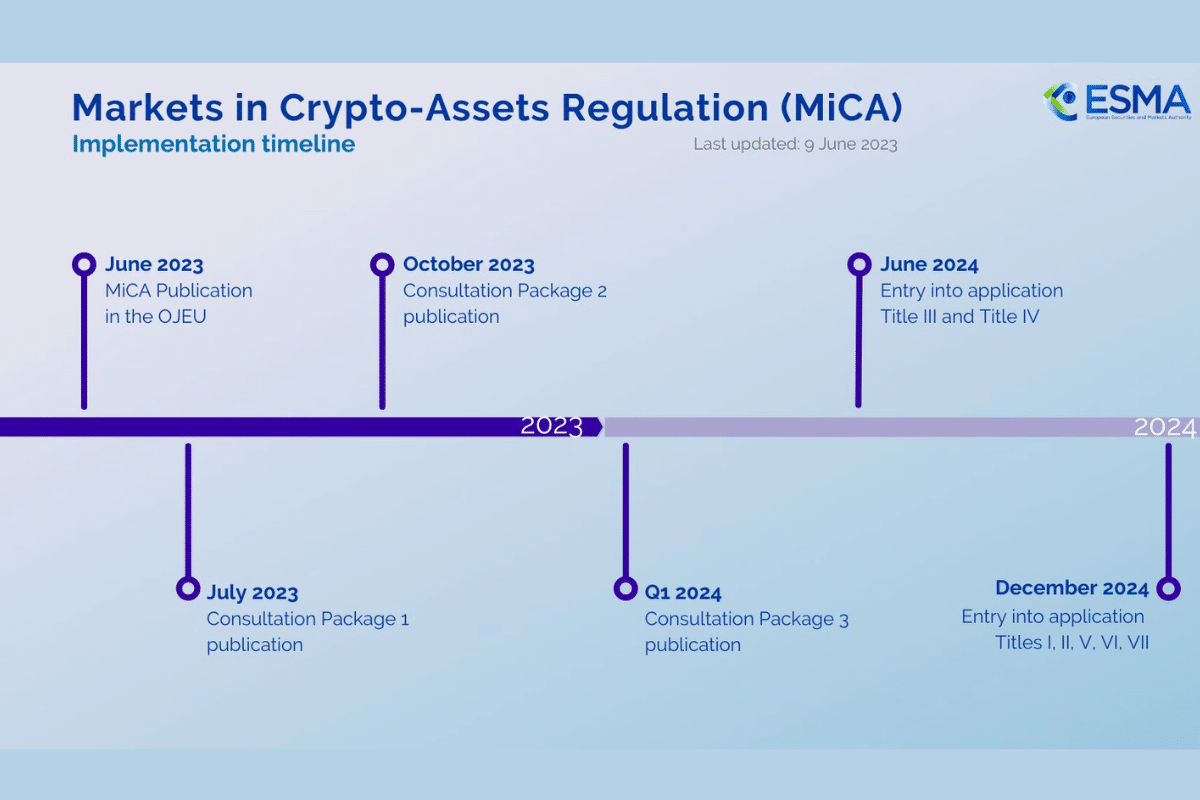

Crypto: New MiCA standards for regulatory clarity in Europe

The Basel Committee, under the auspices of the Bank for International Settlements (BIS), has just approved an innovative framework for disclosing bank exposures to crypto. This decision marks a turning point in the regulation of the digital assets market, aiming to enhance transparency and risk management.

The new European legislation forces Apple to delay its AI and crypto features, posing challenges for data security.

The concentration of memecoins in the hands of a few investors increases the risks of manipulation and volatility.

Discover how the European Union (EU) is fighting Miner Extractable Value (MEV) market manipulation to secure the crypto ecosystem!

A report reveals the plans of the SEC and the EU to regulate the crypto sector in 2024. More details in this article!

Discover the ultimate showdown between Ripple and the SEC: a legal battle revealing the tensions between crypto innovation and regulation.

ESMA seeks experts' input on the MiCA standard. Open consultation to shape the future of crypto regulation in Europe.

"The crypto exchange Binance has recorded net inflows of $4.6 billion since its agreement with US authorities."

We are now 2 days away from the deadline set by the SEC for the approval of the first Bitcoin Spot ETFs. To date, this regulatory institution has not made a statement regarding these new financial instruments. In case you want to closely follow the progress of the situation, we…

The moment of truth is approaching. Will the SEC soon approve Spot Bitcoin ETF applications? Or will it go as far as to postpone its decision? Recently, issuers of similar requests have been increasing meetings with officials from this U.S. financial regulatory body. Gary Gensler and his team must be under pressure.

Stablecoins, much like crypto assets, do not enjoy unanimous support from governments. Even though stablecoins appear to offer more security, Japan is grappling with a crucial question: are they as reliable as they seem? And in case they are not, how can greater security be ensured in the sector?

Crypto regulation remains a subject that is both complex and controversial. The reason for this is that, at the current moment, there is still no clear and harmonized legal framework within the European Union. Indeed, the European Parliament has already adopted the MiCA crypto standard. However, some uncertainties persist. Hence the second consultation launched by ESMA, the European Securities and Markets Authority.