ETHEREUM ETFs will not be approved before 2025 or 2026! According to new forecasts from TD Cowen Bank

Securities and Exchange Commission (SEC)

Bitcoin ETFs faced with a dilemma: BlackRock criticizes the liquidity creation model and warns the SEC. Details here!

BlackRock wants an Ethereum ETF, but the SEC, the guardian of the rules, is delaying, leaving uncertainty hanging over the crypto future.

Discover how the SEC's approval of Bitcoin ETFs is redefining the financial landscape with unique perspectives on Bitcoin.

The price drop of Bitcoin does not affect its intrinsic value, which is based on its scarcity, security, and decentralization.

The advent of a regulated stablecoin marks a revolution in the crypto universe. It promises a haven of stability and security for investors. Figure Technologies Inc., guided by the expertise of Mike Cagney, is gearing up to unveil this major innovation. With a bold approach, this startup is poised to transform the landscape of digital assets. Its ambitious project? To launch the first regulated stablecoin in the United States.

"SEC vs crypto giant Coinbase: Ripple's Chief Lawyer, Alderoty, denounced that the regulator made a major mistake."

US banks are diving into the magic of Ripple's XRP, speeding up international payments for an enchanting financial future.

"The SEC postpones its decision on Fidelity's spot Ethereum ETF proposal until March 5th. An analyst predicts a final verdict in late May."

"The crypto exchange Binance has recorded net inflows of $4.6 billion since its agreement with US authorities."

By surpassing money, Bitcoin establishes itself as the second largest American ETF!

In the context of a case opposing it to the SEC, the crypto exchange Coinbase questions the Howey test. More details!

Despite the high-profile launch of ETFs, the bitcoin has returned to its level at the beginning of the year, above $40,000. Why?

Currently, attention is focused on the possible approval by the SEC of a Bitcoin Spot ETF. If this possibility materializes, the emergence of an Ethereum Spot ETF should mobilize the interest of the crypto community. A perspective that would only be beneficial for the ecosystem around the market's second largest crypto.

"Cathie Wood, leader of ARK Invest, predicts a surge in Bitcoin to $1.5 million, supported by the blessing of Bitcoin ETFs."

The power dynamics within the SEC are emerging. And after the Bitcoin ETF, eyes are already turning towards a possible Ethereum ETF.

The date of January 10, 2024 is now etched in golden letters in the annals of crypto. Indeed, the anticipation of this deadline for months by the crypto and financial community has not been in vain, as it has sanctioned the approval of a Bitcoin spot ETF. The decision of the Securities and Exchange Commission (SEC) was eagerly awaited on this date. And it is favorable. Now, a positive impact is expected on Bitcoin (BTC). But this outlook could also impact the entire crypto industry, including Ethereum. In this context, effects on the Ether (ETH) market, Ethereum's native crypto, are also being considered. That being said, how would ETH react to this new development? Let's see together in this article.

The denial tweet from Gensler has been captured and transformed into a digital artwork, recorded as an ordinal on the Bitcoin blockchain.

"Bitcoin ETF approvals are imminent (and this time, it's serious). Eric Balchunas shares this excellent news on his X account."

The SEC's Twitter account has been hacked on the eve of its announcements regarding the Bitcoin ETF. A collection of hilarious reactions.

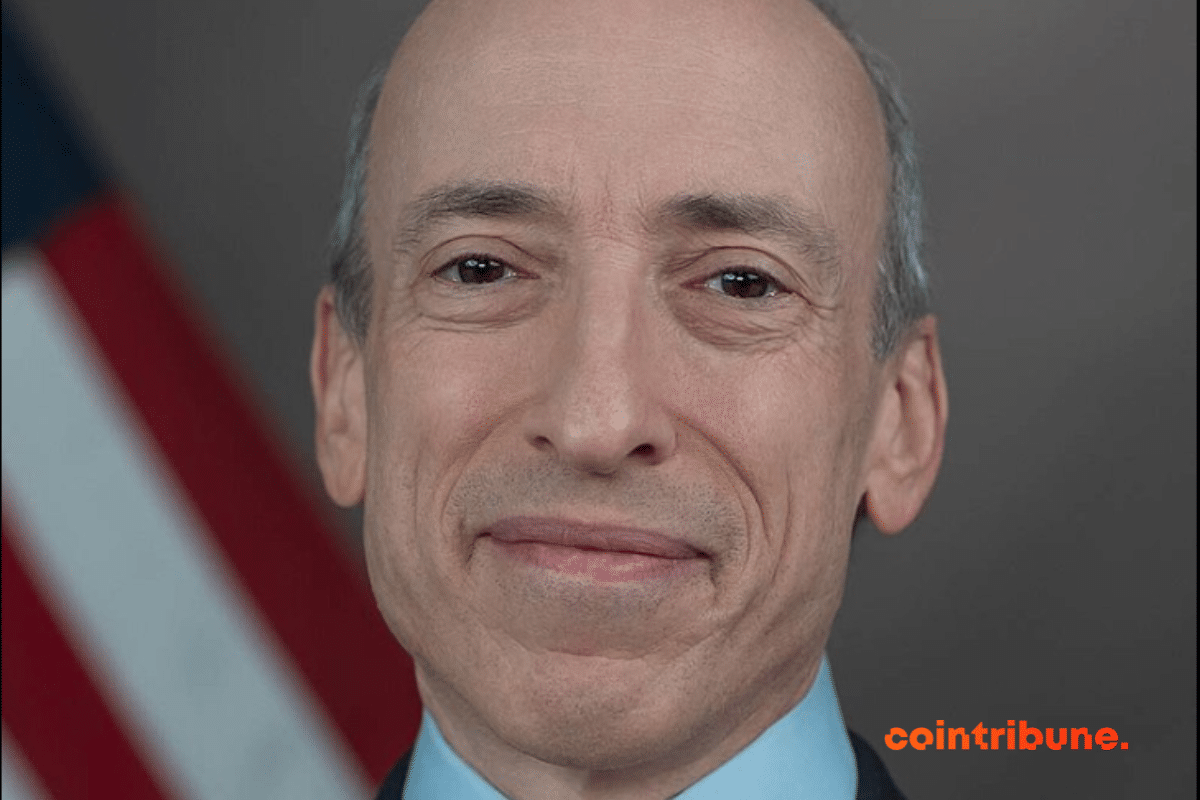

The race for Bitcoin ETFs has reached its climax, but Gary Gensler, the big boss of the U.S. Securities and Exchange Commission (SEC), has just issued a serious warning. Yesterday, via his Twitter account, he shared some crucial advice for those considering investing in crypto assets. Stay tuned to find out everything!

The SEC is expected to make a long-awaited decision this week on Bitcoin spot ETF applications. Approval seems very close, but is still being awaited. In the event of a green light, ETFs could start trading as early as the following business day.

We are now 2 days away from the deadline set by the SEC for the approval of the first Bitcoin Spot ETFs. To date, this regulatory institution has not made a statement regarding these new financial instruments. In case you want to closely follow the progress of the situation, we…

According to analysis, the Bitcoin ETF could attract a colossal influx of $100 billion in 2024, provided that the SEC gives its approval.

The year 2023 has ended, but the case involving the SEC and Binance is not yet over. As recently as yesterday, the U.S. crypto regulator filed a notice of supplemental authority, inviting the court to consider a decision made in the SEC vs. Terraform Labs lawsuit. Binance's legal team has their work cut out for them once again.

Better to make a wise decision regarding Bitcoin spot ETFs than to wait for new congressional bills on cryptos.

Spot Bitcoin ETFs are at the heart of discussions lately. While some speculations revolve around a rejection or approval of these new financial products, others focus on the impact of trackers on BTC from a financial perspective. Indeed, more and more analysts do not dismiss the theory of a migration of fresh capital into the market after the SEC's green light. Gabor Gurbacs, an advisor at VanEck, provides some clarification on this subject.

As the prospective dates for approval of Bitcoin Spot ETFs approach, BlackRock, Fidelity, Valkyrie, Bitwise and other applicants for authorization of these financial instruments are fine-tuning their dossiers. Lately, many of them have once again filed documents in which they designate the “authorized participants” for their trackers. The cream of…

As the magic of the holiday season fills our hearts, another kind of magic is happening in the crypto sphere: the countdown to the launch of Bitcoin spot ETFs. With the US SEC setting December 29 as the ultimate deadline for filing applications, a true financial ballet is unfolding, where giants like BlackRock and Grayscale play leading roles.

The moment of truth is approaching. Will the SEC soon approve Spot Bitcoin ETF applications? Or will it go as far as to postpone its decision? Recently, issuers of similar requests have been increasing meetings with officials from this U.S. financial regulatory body. Gary Gensler and his team must be under pressure.