Over the past few months, many analysts have predicted that Ripple would win its case against the SEC. However, it now seems that this prediction is about to change. Could the recent disappointing revelations about the Hinman documents be turning the tide?

Securities and Exchange Commission (SEC)

The SEC's legal action against Binance continues to make headlines in the crypto world. Binance executives have vowed to fight and defend their platform. But does the SEC, the one who initiated the battle, really have the means to win this showdown? Carol Alexander has her doubts. Here's why.

The Hinman documents, previously held by a former SEC executive, are at the core of the legal battle between the SEC and Ripple. According to Ripple, their disclosure is crucial to the outcome of the case. The disclosure has finally happened but falls short of Ripple's expectations, leaving its executives disappointed.

In the SEC VS Binance case, a US federal judge has rejected the request from the US regulator. Quick breakdown: Binance US assets will not be frozen. However, the judge demands further negotiations between the SEC and Binance lawyers. The goal is to define boundaries and resolve security issues.

The SEC appears determined to take drastic measures in the crypto sector. After officially targeting two major crypto exchanges, it is now intervening in cryptocurrencies. The classification of certain cryptos as unregistered securities has triggered a price drop for many altcoins. Among them, Algorand and Flow reached their lowest levels over the weekend.

For several months, the crypto industry has been under pressure. The culprit is the heavy regulatory burden imposed by Gary Gensler, the head of the SEC. He has been launching offensives to exert his power over crypto firms, but some politicians are unwilling to let him deploy his strategy, which they consider fundamentally incoherent.

Usually, when the SEC classifies any token as a “security,” it is followed by sanctions for fraud or illegal sale of an “unregistered security.” And to make matters worse, the digital asset witnesses a plunge in its price. Three famous crypto projects, Solana, Cardano, and Polygon, recently concerned about the actions of the SEC, are taking a stand to avoid the worst.

Legal actions against crypto firm Binance have become one of the significant events in the crypto news this week. The news has caused a wave of consequences that could significantly impact the company's performance.

ADA, the native cryptocurrency of Cardano, is now among a list of 61 cryptos classified as securities. A legal expert believes that the reasons behind this SEC classification don't hold up. Here's his analysis.

The legal battle initiated by the SEC against Coinbase and Binance is significantly harming the crypto industry. Some experts believe that it exacerbates the already existing risks in this sector, to the detriment of users who now have to think about protecting their interests.

There's no doubt that the SEC lawsuits have cost the crypto firm Ripple a fortune. But what about the financial consequences of this case for XRP users and enthusiasts? That's the question addressed in a recent report by Valhil Capital.

SEC-inspired memecoins are experiencing a significant surge in value following the legal actions taken against exchanges Binance and Coinbase. Tokens like Good Gensler (GENSLR) and Fuck Gary Gensler (FKGARY) have seen a price explosion, capturing the attention of investors eager for quick gains.

In a recent series of tweets, long-time Bitcoin (BTC) advocate and Twitter founder Jack Dorsey ignited a heated controversy. According to him, Ethereum (ETH) is a security. This statement quickly prompted passionate reactions from crypto experts, exposing the ongoing debates surrounding the classification of ETH and existing regulations.

The SEC has been on a witch hunt against crypto firms for several weeks now. It staunchly defends its position to clean up the American crypto industry and promote its growth. However, many players in this industry do not see the regulator's actions in the same light.

Gary Gensler faced the press to explain the serious accusations brought by the SEC against the exchanges Coinbase and Binance.

Last Tuesday, the SEC, through its chairman, Gary Gensler, filed legal proceedings against the crypto platform Coinbase. The case could see its first twist as Coinbase claims to have evidence of potential bad faith on Gary Gensler's part in this matter.

“We don't need more digital currencies,” said Gary Gensler on CNBC. Is this why the SEC is targeting both Binance and Coinbase, which have hundreds of millions of crypto investors? In any case, the heads of these exchanges declare that they will respond to the SEC's attacks.

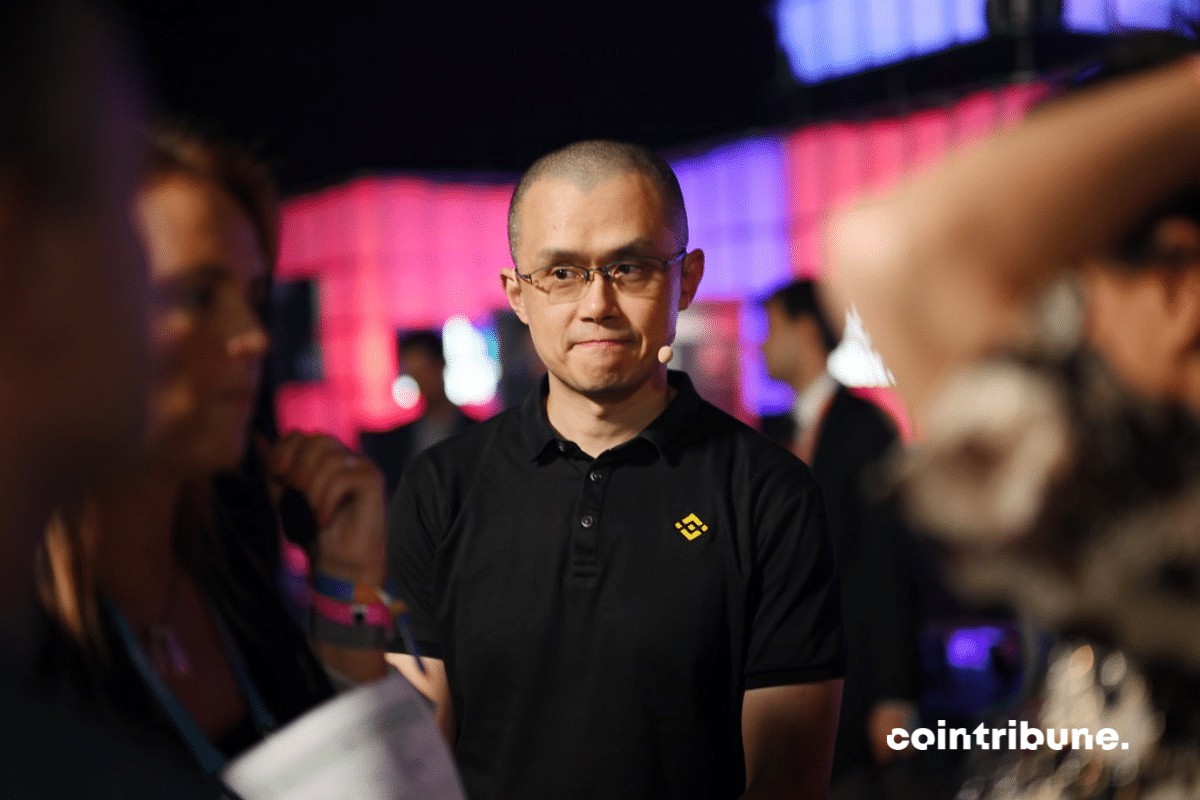

The Binance-SEC case seems to be progressing very quickly. Just one day after filing a complaint against the crypto exchange, the regulator is taking a new step. The SEC is currently seeking to freeze Binance's assets and even wants to go further by blocking any access of Binance and its CEO Changpeng Zhao to the funds of U.S. clients.

In a context of increasing tension between financial regulators and crypto platforms, the announcement of a new lawsuit by the Securities and Exchange Commission (SEC) against Binance has stirred up a storm. The SEC accuses Binance of artificially inflating its transaction volumes and violating several rules, particularly regarding access for US users to its platform. However, a detail has caught the attention of some observers: the unexpected absence of Ripple's XRP from the list of cryptocurrencies that the SEC now considers securities. While XRP has been under attack by the SEC for the past two years, this absence raises numerous questions. Why is XRP missing from this list? Is it a deliberate strategy on the part of the SEC? What could be the repercussions of this decision?

What does the SEC really want by shaking up Binance? The collapse of the crypto industry or its regulation? Many see Gary Gensler and his team's recent initiatives as developing a visceral hatred towards the cryptosphere. In addition to targeting the world's largest exchange, they have also decided to go after 10 tokens traded on the secondary market, such as Cardano's ADA.

The ongoing legal battle between the SEC and Ripple remains at the forefront of discussions within the crypto community. American attorney and founder of CryptoLaw, John Deaton, recently shed light on the case in an exclusive interview on the “Good Morning Crypto Show” of the 3T Warrior Academy. According to Deaton, the chances of XRP emerging victorious from this legal battle stand at 75%.

The crypto community is in a frenzy. Indeed, several experts, including Ripple CEO Brad Garlinghouse, believe that the Ripple vs. SEC trial in the United States could wrap up this month. Ripple holders are eagerly hoping for this outcome.

Hinman's emails, the former head of the SEC, are crucial in its lawsuit against Ripple. It is believed that they could contain the evidence that settles the debate on the nature of XRP, Ripple's native asset. However, access to these emails has been blocked by the court. But this lock could potentially be fully lifted.

Several analysts are betting on the SEC's defeat against Ripple after a long and tough legal battle. We just have to wait for Judge Torres' verdict, which they believe will favor Brad Garlinghouse's company. As this case approaches its conclusion, crypto investors see positive signs everywhere. The robust performance of XRP and the enthusiasm of whales for this cryptocurrency speak volumes on the matter.

During the Bitcoin 2023 conference in Miami, Michael Saylor, Executive Chairman and Co-founder of MicroStrategy, shared his thoughts on the superiority of Bitcoin. He also took the opportunity to express his views on crypto regulation in the United States, questioning whether the uncertainty and regulatory ambiguity are deliberate.

Currently, Bitcoin (BTC) seems to be facing difficulties, struggling to gain momentum. Indeed, the price of the flagship cryptocurrency is having a hard time surpassing the $27,000 mark. This situation is causing a lot of concern within the Bitcoin community. There are now many uncertainties regarding the future trajectory of the crypto's price. However, some analysts are already predicting a bleak future for the queen of cryptos. One of them, renowned strategist Michael J. Kramer, recently expressed particularly pessimistic views on the future price of BTC.

The United States government is struggling to find a solution to the debt ceiling. As a result, the markets are holding their breath and fearing default. In our previous article, we discussed the role of long cycles in monetary policy. In this context, French debt is also a cause for concern. The presented stability plan already appears optimistic. It is evident that difficulties in managing public debts would have dramatic consequences for the markets and the global economy. Let's take a closer look.

The Ripple vs. SEC trial has been a long-awaited event. Although Judge Torres has not yet delivered her final verdict, the recent decision she made indicates a potential victory for the company behind XRP in the near future.

The SEC has urged the judge to dismiss Coinbase's petition for an explanation on the rules applied by the stock market regulator in the crypto industry. Immediately, Paul Grewal, Coinbase's Chief Legal Officer, expressed concerns about this response. According to him, the SEC will continue to oversee the crypto sector by enforcing regulations forcefully.

Crypto company Binance has been in the hot seat for the past few days. As regulators closely scrutinize the exchange, the situation seems to be going from bad to worse. Recent calls from a former SEC official are adding to the company's troubles.