The ETH/BTC ratio is dangerously close to the critical level that triggered a spectacular rise in Ethereum in 2019. Technical indicators and proposals from Vitalik Buterin are fueling hopes for a major turnaround.

Theme Trading

As the symbolic threshold of 100,000 dollars approaches, Bitcoin enters a turbulent zone. Behind the spectacular rise, long-term holders are recording unrealized gains of nearly 350%, a level historically associated with massive profit-taking. This critical signal comes as the market remains vulnerable, hindered by ongoing technical tensions and a demand that struggles to keep pace with potential supply.

The countdown has begun. Indeed, Bitcoin could reach a new all-time high much sooner than we imagine. A recent analysis by Timothy Peterson, a recognized economist in the Bitcoin network, predicts a surge to $135,000 within the next 100 days. The origin of this projection: the drop in the VIX index, a symbol of a renewed appetite for risk, and an aligned macroeconomic context. This could reignite the bullish ambitions of a market in search of solid catalysts.

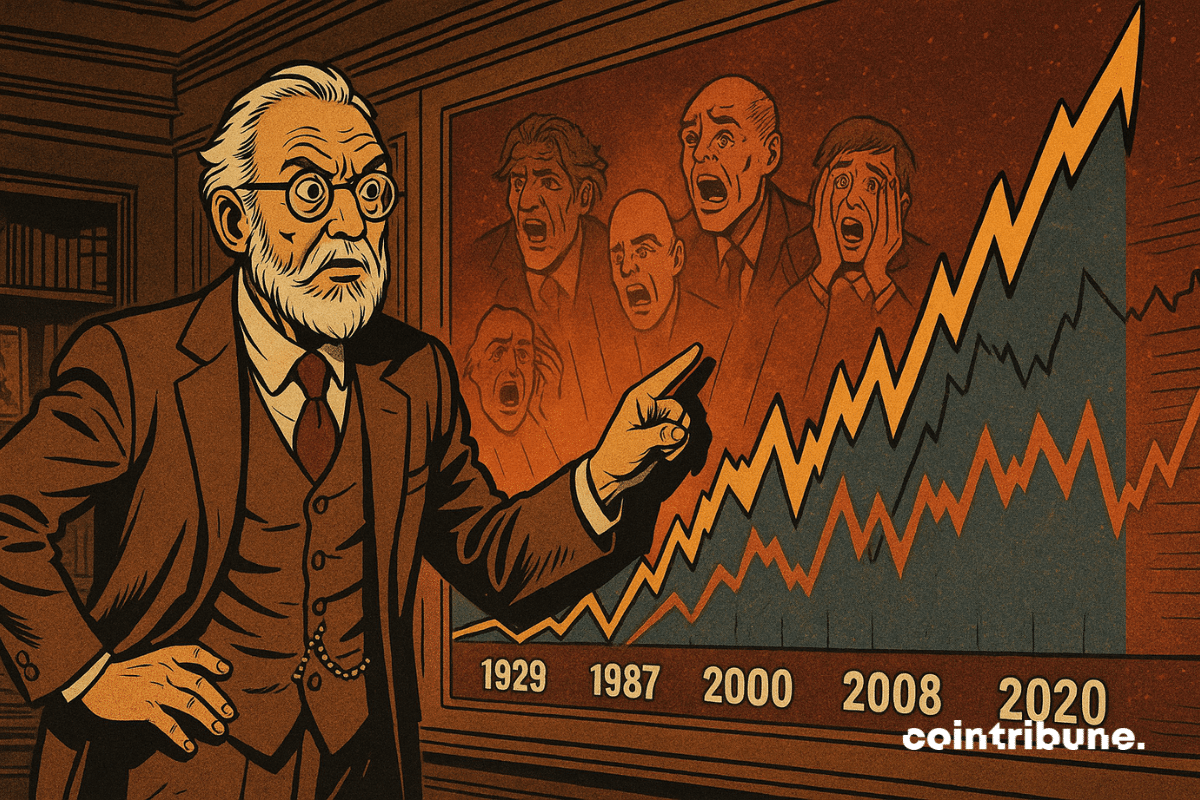

What if the markets were following a tempo that escapes economic logic? While the U.S. GDP is declining, the S&P 500 is rebounding after a sharp drop of nearly 20%. This unexpected turnaround, fueled by contradictory signals, intrigues even in trading rooms. Indeed, at BNP Paribas, strategists are wondering: does this sudden correction fit into a global tradition? To understand it, they delve back into a century of stock market crash history.

In the span of two months, Pi Network has lost nearly 90% of its value. The cryptocurrency fell from $2.99 to a low of $0.40. This collapse could have marked the end of the hype, but a recent rebound is rekindling interest. While some see it as just a temporary surge, others suggest it could be the beginning of a turnaround. As the project is poised to reach a key milestone, the price movement in the coming days could reshape the trajectory of this controversial cryptocurrency.

Global stock markets are plunging with significant losses on Wall Street and internationally. This drop, exacerbated by economic uncertainty, falling oil prices, and the trade war between the United States and China, raises questions about the short-term outlook for financial markets.

While uncertainty persists in the crypto market, Ethereum stands out with a dynamic that draws attention. Boosted by a massive return of institutional capital, solid on-chain indicators, and a favorable technical setup, the asset appears ready to challenge the resistance of $2,000. In the face of ongoing volatility, ETH is regaining a central place in investment strategies, driven by converging signals that market operators cannot ignore.

As Bitcoin breaks through new psychological thresholds, it reshapes the landscape of digital economic cycles. A consensus is now emerging among experts: support around $90,000 could become a sustainable strategic base. Between validation from on-chain data and projections from recognized valuation models, this hypothesis is gaining traction and fueling market expectations, already buoyed by the rise of institutional adoption.

Stock Market: Stock markets fluctuate under the effect of tariff tensions. Discover what this means for investors.

Despite a bleak market climate, Ethereum is sending a strong signal: 449,000 ETH have been transferred in one day to accumulation addresses, an all-time record. This strategic movement, observed amid falling prices, reveals a persistent confidence among some long-term investors. Contrary to the prevailing sentiment, this operation raises questions about a possible cycle change, as volatility remains high and economic uncertainties continue to weigh on the entire crypto sector.

The British fintech Revolut shows exceptional performance in 2024, doubling its profits to $1.3 billion. This spectacular growth is explained by the influx of 15 million new users and the explosion of crypto trading following the rise of the markets.

While Web3 projects compete with announcements, Pi Network surprises with a marked surge in its token. Within 24 hours, its price rises by 5%, accompanied by a trading volume increase of 66%. This resurgence of interest coincides with a long-awaited milestone: the launch of the migration to the mainnet. For a project often deemed enigmatic, this shift to a fully operational blockchain environment redefines expectations around its credibility and roadmap.

Bitcoin flirts with new highs and shakes the market. By crossing the $94,000 mark, the cryptocurrency triggered a series of liquidations worth hundreds of millions of dollars, causing bearish positions to wobble. In a climate filled with macroeconomic uncertainties, this surge fuels speculation about a leap toward $100,000. The euphoria of bullish investors faces the nervousness of short sellers in a market where every move seems dictated by fear, tension... and instinct.

With Trump, we are witnessing the transition from a trade war to a total economic war between the United States and China.

Under pressure for several months, XRP is back on the market's radar. After a 40% decline from its peak of $3.40, the asset may be about to undergo a strategic turning point. Coinbase has just received the green light from the CFTC to launch XRP futures contracts, paving the way for a new phase of institutional legitimacy. In an environment where every technical or regulatory signal can tip the scales, this announcement re-ignites attention on this cryptocurrency.

In the volatile arena of cryptocurrencies, where every signal can sway the market, XRP is drawing the spotlight. While volumes are dwindling, its technical indicators show a bullish turn. The imminent formation of a golden cross could kick off a rally as early as July, providing a counterpoint to current trends. In a context of widespread caution, this setup is capturing the attention of traders seeking confirmation.

Peter Brandt's explosive prediction about Ethereum (ETH) has electrified the crypto community. This veteran trader, whose career spans five decades, anticipates a collapse in the price to around $800, a level unseen since 2022. While ETH struggles to stabilize above $1,600, this warning reignites debates about the uncertain future of the second-largest cryptocurrency. Between relentless technical analysis and the unwavering optimism of certain industry figures, the market is divided. But who is really right?

While the crypto market oscillates without a clear direction, some internal dynamics are stirring tensions. This month, the Pi Network project is preparing to inject a massive amount of tokens into the market. This operation is being closely watched, as its scale could worsen the selling pressure on the price of Pi, an already fragile asset. The chosen timeline, combined with alarming technical signals, outlines a scenario to be monitored very closely.

As uncertainty grips global markets, a strong signal emerges from the Bitcoin network: more than 170,000 BTC, nearly 14 billion dollars, have left dormant wallets. Such a rare and massive movement reactivates the specter of high volatility. In response to this on-chain shock, investor strategies are fragmenting between distrust and accumulation.

Despite a recent rebound above the psychological threshold of $0.60, Cardano (ADA) remains under bearish pressure. The flagship crypto of the Cardano ecosystem temporarily reclaimed this critical zone, but market data and technical analysis suggest that sellers maintain the short-term advantage.

Solana is back in the spotlight. After a downturn marked by a massive outflow of capital, the network has recorded an unexpected return of funds. Nearly $120 million was transferred into its ecosystem within a month. This reversal intrigues analysts and sparks speculation about a recovery of SOL, its native token. While some see it as a strong signal of regained confidence, others remain cautious due to an still fragile market structure. What does this renewed interest really conceal?

Against all odds, the crypto market started 2025 in decline, catching investors off guard. Bitcoin and Ether, usually strong performers in the first quarter, recorded their worst historical performances during this period. This sharp reversal, breaking with known seasonal dynamics, reignites debates about a potential rebound in the second quarter, while economic uncertainties weigh on all risk assets.

XRP has just achieved a feat few anticipated: surpassing Ethereum in market capitalization, if only for a few hours. This surge, unprecedented since 2018, is not insignificant. In a market undergoing reshaping, it reveals a possible shift in the balance of power. Indeed, it is no longer just a matter of price, but of perception, usage, and institutional recognition. This strong signal, coming from an asset long considered secondary, raises questions about the real position of the historical giants in the crypto ecosystem.

While the crypto market remains unsettled by speculative shocks, a subtle signal is capturing the attention of insiders: Bitcoin whales are strengthening their positions. The number of addresses holding between 1,000 and 10,000 BTC has just reached 2,014, a peak since April 2024. This dynamic, far from insignificant, reflects a thoughtful accumulation strategy. Behind this silent movement, some already see the early signs of a possible bullish turnaround.

While markets nervously scrutinize the signals from the Federal Reserve, Michael Saylor, Executive Chairman of Strategy and a leading figure in Bitcoin maximalism, surprises everyone with a statement as enigmatic as it is calculated. On X, he posts a phrase: "Bitcoin is a chess game," accompanied by an AI-generated image of him posing in front of a chessboard. A minimalist but strategically weighed message that reignites the debate about his long-term vision for crypto.

While Beijing maintains a strict ban on cryptocurrencies, a paradoxical reality is emerging: local governments are quietly selling off seized digital assets, filling their public coffers. Between opacity and financial urgency, this practice reveals the cracks in a system torn between repression and economic pragmatism. A tangle that reignites the debate on the legal framework for these assets, in a geopolitical context where China watches with suspicion the crypto-American advances.

Ethereum's dominance in the crypto market has dropped to 7.18%, a level close to its all-time low. A bearish chart pattern now suggests a possible correction towards $1,100 in the coming weeks.

Bitcoin is nearing its peaks, but a specter hovers over its trajectory. While the asset tests $86,000, a dreaded technical indicator remains frozen: the "death cross." This crossover of moving averages, often associated with bearish reversals, persists despite the current surge. Why does such a signal persist? Is it merely an anomaly or a serious warning? As positions accumulate, traders oscillate between confidence and caution, torn by a market in full dissonance.

Storms can erupt in the blink of an eye in the crypto sphere. Mantra (OM), once hailed by its supporters, has just experienced a dizzying 95% drop. As accusations of manipulation and opacity fly, John Mullin, CEO of the project, steps up. Between firm denial and promises of recovery, the scenario mixes a crisis of confidence with survival strategies.

The recent imposition of massive tariffs by Donald Trump, followed by an unexpected pause on certain Chinese products, has thrown financial markets into turmoil. While some see this as a deliberate strategy to reorganize the global economic landscape, others interpret this turnaround as a capitulation to market pressures and Chinese intransigence.