A wave of panic is blowing over crypto ETPs. In the space of one week, over $2 billion has been withdrawn from these financial products, marking their largest outflow since February. This is a strong signal for an institutional market plagued by doubt, amid economic uncertainties and monetary tensions. As traditional markets waver, investors are reassessing their exposure to cryptos. This situation could mark a turning point in the strategy of major holders.

Trading Exchange RSS

A few days before Thanksgiving, Washington and Beijing are preparing to conclude a decisive agreement on rare earths, these vital materials for the technology industry, defense, and crypto mining. In a tense geopolitical climate, this compromise could defuse a crisis with heavy consequences for global supply chains. Faced with the threat of US customs sanctions and Chinese export restrictions, this agreement marks a strategic turning point, but nothing is decided yet.

Bitcoin, in slide mode, flirts with the precipice of the CME Gap while whales do their shopping. Bounce to come or final plunge? Suspense guaranteed.

Ethereum faces steady ETF outflows, with investors viewing it as riskier than Bitcoin, signaling caution in the market.

Bitcoin facing the law: Nick Szabo reveals a worrying vulnerability that even developers underestimate. Details here!

The Real-World Asset (RWA) tokenization market is experiencing exponential growth, rising from $85 million in 2020 to $24 billion in June 2025, a 308-fold increase in three years according to the latest reports from RedStone, Gauntlet, and RWA.xyz. In this context of radical transformation of financial markets, Stobox and REAL Finance have signed a Memorandum of Understanding (MoU) to explore new technical and commercial synergies between regulated tokenization platforms and emerging blockchain networks.

Artificial intelligence is reshaping how people experience and interact with the online world. Major platforms now face a surge of non-human traffic and synthetic content, pushing the internet into a stage where real users must question both what—and whom—they are interacting with. Researchers say this shift is eroding trust as machine-generated material spreads across spaces once dominated by people.

After BitMine, SharpLink plays the crypto rentier: a safe filled with Ethereum, dividends pouring... and a strategy that would make many central banks envious.

The Bybit EU exchange, the world’s second-largest platform by transaction volume, is launching a highly attractive new promotional campaign for European users. The flagship offer right now: deposit 100€ and receive up to 70 USDC as a bonus. This initiative is part of a broader strategy to conquer the European market, now regulated by the MiCA (Markets in Crypto-Assets) regulation.

U.S. Bitcoin ETFs faced another difficult week as steady capital outflows added strain to an already uneasy market. Investor caution increased as withdrawals accelerated, pushing Bitcoin further below the $100,000 mark and signaling a broader loss of confidence in digital assets.

The debate between gold and bitcoin takes a new turn. Peter Schiff accuses Michael Saylor of steering Strategy according to a "fraudulent" model based on promises of illusory returns. He proposes a public debate during Binance Blockchain Week in Dubai, in December. In a volatile market, this confrontation crystallizes tensions around the integration of bitcoin into business strategies.

As tension rises in the market, Bitcoin is about to cross a critical technical threshold: the "death cross." This signal, feared by traders, occurs at a pivotal moment, at the intersection of a 25% correction and an uncertain macroeconomic climate. While some see it as a classic bearish indicator, others recall it coincided with market lows. In this context, certainties waver, and each candlestick becomes a test for investor morale.

Tokyo throws 17 trillion yen, dreams of AI everywhere… but its hotels close due to a lack of workers. What if Japan also programmed a robot to hire?

A sharp shift in sentiment has taken hold across digital assets after a week of sell-offs, weaker macro signals, and thinning liquidity. Markets now sit in a cautious posture, with fear climbing as large-cap tokens retreat toward multi-month lows.

Tokenized gold hits $3.9B with gold-based tokens XAUT and PAXG leading the market while stablecoin supply continues to grow.

Growing interest in digital assets is prompting investors to reassess which tokens deserve long-term attention. Recent shifts in sentiment around Solana, XRP, and other major networks reflect a market still trying to determine its next set of leaders.

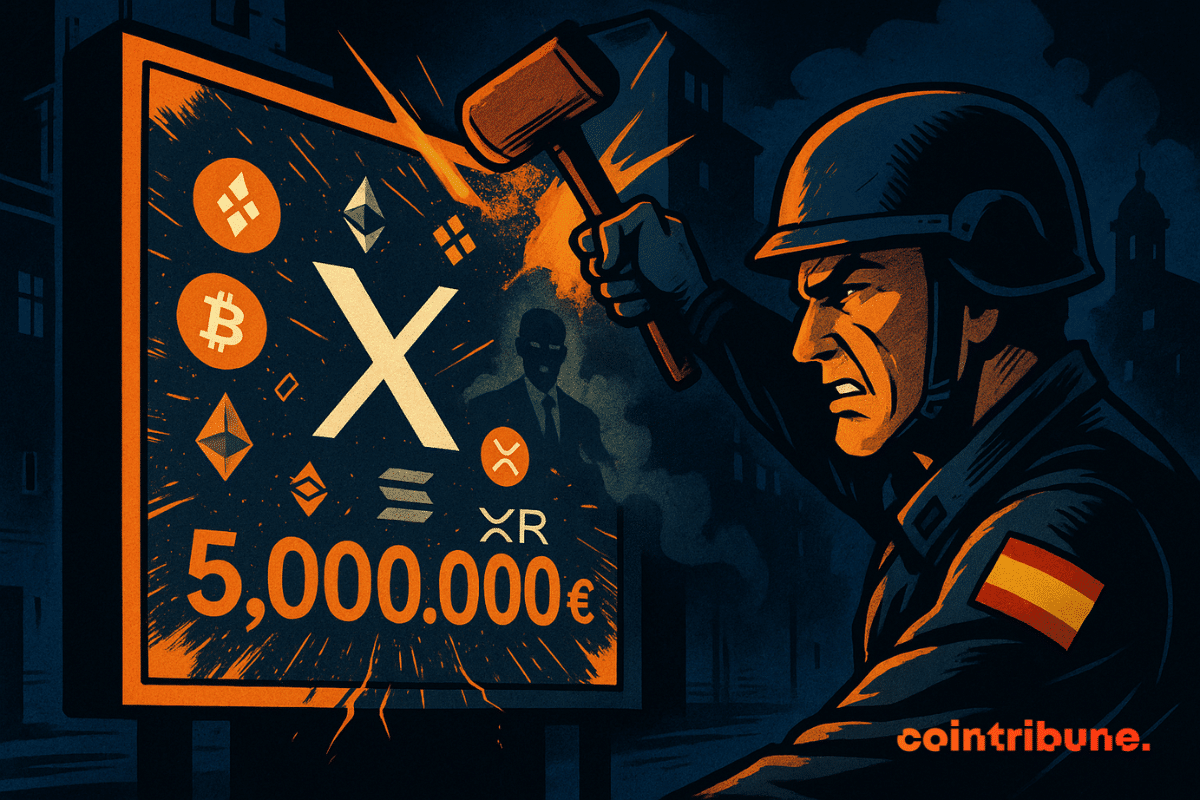

Crypto on promo, X turns a blind eye, Spain pulls out the fine book. Musk aimed for the stars but ends up with his feet in regulatory mud. Cryptos cost.

Chainlink takes the lead in the RWA sector just as the crypto market corrects. Development data on GitHub shows a clear gap with Hedera, Avalanche and others, confirming that Chainlink establishes itself as the technical benchmark of the segment. For institutional investors, this code dominance, despite the price drop, becomes a signal hard to ignore.

CMC messes up, CZ takes a risk, Aster takes off... and the curious watch the screen. When an altcoin creates a rebound while the crypto universe collapses, should you believe it or flee?

At each ETF launch, the crypto market anticipates a price jump. For XRP, backed by the new XRPC fund from Canary Capital, the expected effect did not occur. Despite solid opening volume, the price remained frozen before dropping by 7%. A striking contrast with previous surges triggered by similar announcements. Why hasn’t XRP, despite being in the spotlight, benefited from this institutional momentum?

What if the real economic threat was neither inflation nor rates, but a global liquidity collapse? This is the alert issued by Robert Kiyosaki, author of the bestseller Rich Dad, Poor Dad. In a series of messages on X, he claims that markets are wavering not because of fragile fundamentals, but because the world is severely lacking cash. A shortage that, according to him, could trigger a new wave of money printing with unpredictable consequences.

While the crypto market seeks a new balance, an analysis by Glassnode reveals a major strategic divergence: bitcoin holders hold, Ethereum holders mobilize. Beyond community rivalries, these data reveal two opposing visions of crypto value. One is based on reserve, the other on use. This behavioral gap, often neglected, could well redefine the power balance within a rapidly evolving ecosystem.

While crypto traders tremble at the thought of a crash, the charts whisper promises. Should you flee or buy? Breath-taking suspense in the token jungle.

BlackRock’s BUIDL Token Gains Institutional Traction as Binance Expands Support

Market pressure spiked on Friday as cryptocurrencies dropped sharply, pushing Bitcoin below $94,000 for the first time in six months. The slide stirred fresh concern across trading circles, where rumors spread that Michael Saylor’s firm, Strategy, was unloading part of its massive Bitcoin holdings. However, Saylor quickly stepped in to dismiss the claims, confirming that Strategy hadn’t sold any BTC and had actually increased its position during the week.

Aave Labs has taken a significant step toward regulated on-chain finance in Europe. The company has received authorization under the EU’s Markets in Crypto-Assets (MiCA) framework, allowing euro-to-stablecoin conversions at no cost. This places Aave among the first major DeFi projects cleared to offer compliant payment services across the European Economic Area.

Harvard made major moves in its investment portfolio by sharply increasing its Bitcoin and gold ETF holdings.

The crypto market is wavering again, and the same question arises: has bitcoin finally hit rock bottom? While analysts are getting carried away and predictions are proliferating, the Santiment platform calls for caution. According to it, the real market bottoms never occur when everyone is expecting them. Behind collective optimism, it sees a formidable emotional trap, where overconfidence could precede a new downturn. What if the worst is not over yet?

Markets hate unpredictability. Yet, within a few days, their certainties collapsed. The probability of a rate cut by the Fed in December, previously the majority view, is now below 50%. This abrupt change of direction has revived tensions across all asset classes. In the crypto ecosystem, already severely tested by a corrective phase, this resurgence of uncertainty acts as a catalyst for volatility.

While ETFs backed by SOL have recorded steady inflows for nearly two weeks, its price is plunging, reaching a five-month low. This striking paradox between institutional enthusiasm and spot market weakness raises the question: why does such a supported asset fall so sharply? Away from classic patterns, Solana reveals the deep, sometimes contradictory tensions currently affecting the crypto ecosystem.