Ethereum stays strong above $2,500, outshining Bitcoin as whales accumulate and pressure builds for a breakout.

Trading Exchange RSS

As Bitcoin enters a new phase of maturity, an unexpected phenomenon redefines its scarcity: every day, more BTC become inactive for ten years or more than new coins are mined. A silent but consequential reversal.

Economist Peter Schiff is openly opposing the U.S. government on the future of stablecoins. While Washington relies on these cryptocurrencies to strengthen the dollar, Schiff predicts the opposite. But is he right to be concerned?

While Bitcoin is stagnating, some altcoins are wavering. This is the case with Pi Network, whose token PI, still not officially listed, just brushed against a new low of $0.40. This sharp drop, followed by a slight rebound, fuels a renewed tension around a project that is as closely followed as it is questioned. Between intense speculation, conflicting technical indicators, and imminent deadlines, the cryptocurrency is now moving in a critical zone that could determine its short-term future.

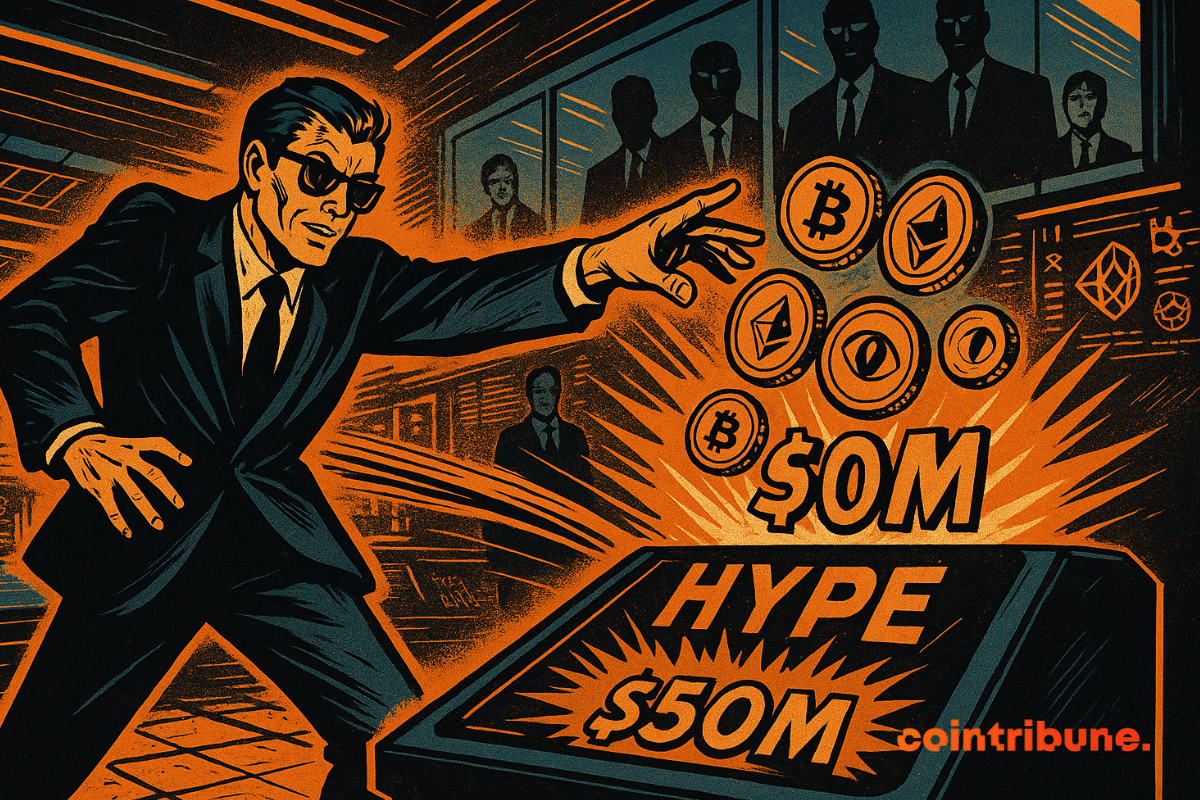

Eyenovia has made a bold leap into crypto, raising $50 million to back the HYPE token and rebranding as Hyperion DeFi.

For several months, France has been bustling on the digital scene. At the heart of this excitement: Telegram, the messaging app favored by digital dissidents. Its founder, Pavel Durov, is no longer content with defending freedom of expression: he directly accuses the French authorities. In a recent interview, he raised a serious alarm. According to him, France is drifting, and this drift could precipitate a societal collapse.

American President Donald Trump is urging Congress to promptly pass the GENIUS Act on stablecoins. A race against time is on to make the United States the global leader in digital assets. But does this rush conceal personal interests?

As they clash with missile strikes, Israel and Iran are launching attacks... on the blockchain. Nobitex has suffered from it, cryptocurrency hacked, propaganda unleashed.

While Trump buries the digital dollar, Beijing is setting up its own on all continents. One click, one yuan, and finance trembles. The United States watches... gritting its teeth.

For five years, the Ripple vs SEC case has crystallized tensions between crypto innovation and American regulation. On June 17, Ripple filed a strategic motion with Judge Analisa Torres, aiming to close the case without further judicial confrontation. If accepted, this initiative could accelerate the resolution of the dispute, but also redefine the relationship between blockchain companies and financial authorities in the United States. A legal precedent may be on the verge of being established.

By maintaining its benchmark rates for the fourth consecutive time, the Fed has not simply extended a monetary policy. It has taken a stance in a tense economic and political landscape. Stubborn inflation, weakened growth, barely concealed political pressure... The status quo decided on June 18 resembles a statement of intent. Behind the silence of the numbers, a strategy of resistance is taking shape as the central bank finds itself at the heart of an increasingly unstable balancing act.

Christine Lagarde urges Europe to boost its global role by strengthening trade, economy, and governance—moves that may also open new doors for crypto growth across the region.

Despite some profit-taking, the bullish pressure remains strong. A new high awaits Bitcoin.

Elon Musk stops at nothing to make xAI a titan of artificial intelligence. His startup is preparing for a historic fundraising of $4.3 billion in equity, in addition to the $5 billion already targeted through a bond issuance. A major financial offensive to try to catch up with giants like OpenAI.

JPMorgan Chase is finally realizing its crypto ambitions with the launch of JPMD. After filing its trademark application earlier this week, the bank is launching its "deposit token" on Coinbase's Base. How does this token work, and what issues are at stake behind this strategic choice?

While Israeli strikes target sensitive Iranian sites and Tehran responds with missiles on Tel Aviv, the military escalation is redefining balances in the Middle East. However, a strategic absence intrigues: that of the BRICS. A newcomer to the bloc, Iran was counting on solid support against its sworn enemy. Yet neither Moscow, nor Beijing, nor New Delhi are committing. This silence exposes the limits of an alliance that Tehran saw as a counterweight to Western hegemony.

When Bitget joins UNICEF, it's the blockchain that arrives at school! A global educational crypto invasion to turn female gamers into blockchain coders.

Ethereum is breaking records with 35.35 million ETH staked. Is the accumulation preparing for a rebound? Full analysis here!

While Trump rakes in millions in home tokens, the Senate blesses stablecoins. New digital dollar or old electoral trick? A deep dive into the American crypto theater.

Bitcoin and crypto markets dip as rising concerns over Middle East tensions and Trump’s unexpected actions stir uncertainty.

Wall Street's offensive knows no bounds. In less than a year, spot Bitcoin ETFs have captured a quarter of the global trading volumes of the flagship cryptocurrency. This spectacular breakthrough is reshuffling the cards between traditional finance and native crypto platforms, revealing a profound transformation in the sector.

Europe, once a pioneer in the regulation of cryptocurrencies, might soon become just a simple corridor traversed by innovation without ever holding onto it. While the United States and Asia are making concrete advances, the Old Continent is bogged down in caution. Catriona Kellas, legal officer at Franklin Templeton, pulls no punches: the EU risks being relegated to the status of a spectator, unable to compete with the dynamics of major rival powers.

Military tensions in the Middle East are entering a critical phase. While Israel intensifies its strikes against Iran, prediction markets are going wild. The likelihood of a U.S. strike is reaching unprecedented levels. This increase in volatility fuels fears of a regional conflagration, closely monitored by investors, particularly in the crypto ecosystem.

As the world enters a new zone of turbulence, with war in the Middle East, soaring energy prices, and monetary uncertainty, one anomaly persists: Bitcoin is not falling. It is rising. This is a striking paradox in a climate where traditional assets are wavering. Should this be seen as further proof of its transformation into a safe-haven asset? Or merely an illusion of stability fueled by market euphoria?

As the legal tug-of-war between the SEC and Ripple drags on, XRP refuses to give in to pessimism. On the contrary, the asset displays an astonishing vitality in the derivatives markets. This unexpected resilience raises an essential question: Is XRP preparing for a strategic turnaround, counter to the current regulatory climate?

Major crypto exchanges Coinbase and Gemini are close to securing licences to operate legally across the European Union (EU) under the Markets in Crypto-Assets (MiCA) regulation. With these licences, they would join other global exchanges like Bybit, which gained approval from Austria’s Financial Market Authority in May.

While the planet burns, Dogecoin is buzzing! Inflated volume, flashing signals: the crypto joke could become serious again. Should we buy before it explodes?

In June 2025, the quantum industry reached a historic milestone. Oxford University announced a world record with a quantum gate achieving an error rate of only 0.000015%, or one error every 6.7 million operations. A few days later, IBM unveiled its roadmap to a 200 logical qubit quantum computer, named Starling, expected in 2029. Meanwhile, Nvidia CEO Jensen Huang stated that the quantum computing sector has reached an inflection point, heralding a new technological era. In light of this acceleration, a major question arises: Is Web3 ready for the post-quantum world? The reality is more concerning than it appears.

In the turmoil of global commercial reconfigurations, Beijing is advancing its pawns. China announces the complete removal of tariffs on exports from 53 African countries, expanding preferential access to its market. Behind this gesture lies a targeted diplomatic offensive as Washington, under the leadership of Donald Trump, reactivates protectionist levers against the continent. Africa, long peripheral in geo-economic arbitration, is becoming the epicenter of a clash of influences where industrial ambitions, strategic alliances, and narratives of sovereignty intersect.

CoinShares joins the growing list of firms filing for a Solana spot ETF as market interest builds.