BitMine bets 97M$ on Ethereum in the middle of a bearish market. A risky bet or a calculated plan? Detailed analysis in this article.

une

While the crypto market is slowing down, TRON's TRX shows exceptional performance, defying all expectations. A 10% rise since December 2024, strategic investments, and optimistic forecasts: discover why this crypto attracts all attention and what the future holds for it.

The silver price crash revives Nassim Taleb's criticisms of bitcoin. This renowned analyst sounds the alarm.

An annoyed Dragon, a relaxed Trump, missiles on the move: the global economy wobbles while Taiwan grits its teeth, and Beijing flexes its muscles to play war.

The supply of XRP on exchange platforms has fallen to its lowest level in eight years. This liquidity contraction coincides with a massive disengagement of short-term investors and a retreat to custody solutions. Thus, the prospect of a rally in 2026 reemerges, without a clear consensus.

While the market watches the price of crypto, another indicator emerges. Ethereum recorded a record 8.7 million smart contracts deployed in the fourth quarter, according to Token Terminal. This peak in activity, reached despite a price drop, confirms the strength of network usage. Far from cyclical effects, the on-chain dynamics outline a discreet but structuring underlying trend.

Grayscale has just filed a dossier with the SEC to launch a Bittensor ETF, a first in the United States. This project could revolutionize access to decentralized AI for institutional investors. TAO, the flagship token of Bittensor, is preparing for massive adoption. A historic milestone for crypto and artificial intelligence.

Binance has suspended withdrawals via Visa and Mastercard for its users in Ukraine. The measure, linked to its fiat provider Bifinity, comes amid increasing regulatory pressures in Europe. This decision complicates access to funds for Ukrainians, already weakened by war and financial restrictions.

Bitcoin and Ether are showing early signs of a shift in investor behavior, even as broader market conditions remain weak. Long-term Bitcoin holders are easing selling pressure, while large Ether holders are adding to their positions. Prices, however, remain under pressure amid caution, macro risks, and year-end positioning.

Despite a 40% drop in trading activity, derivatives open interest rose $2 billion in December, driven by Bitcoin and Ethereum futures positions.

In 2026, cryptos could experience an unprecedented boom. Record public debt, finally clarified regulation, and massive adoption by institutions: Grayscale predicts a historic bull run. Bitcoin, Ethereum, and stablecoins are at the heart of this financial revolution. A year that will be decisive for investors!

Cardano founder Charles Hoskinson has said he will no longer address questions about the Genesis ADA audit, stating that the matter is settled following the release of the full audit report. The comments come as debate resurfaces within the Cardano community over transparency and governance tied to early ADA allocations.

Metaplanet just signed an end-of-year move that looks less like a "trade" and more like a statement. The Tokyo-listed company added 4,279 bitcoins for an acquisition cost of about $451 million, bringing its treasury to 35,102 BTC, around $3 billion at the current rate.

Crypto giants rush into a rapidly growing market: tokenized stocks. Discover the latest figures!

While the crypto market is struggling, onchain perpetual contracts are breaking records. A discreet but massive explosion that reshapes the backstage of an overheated DeFi.

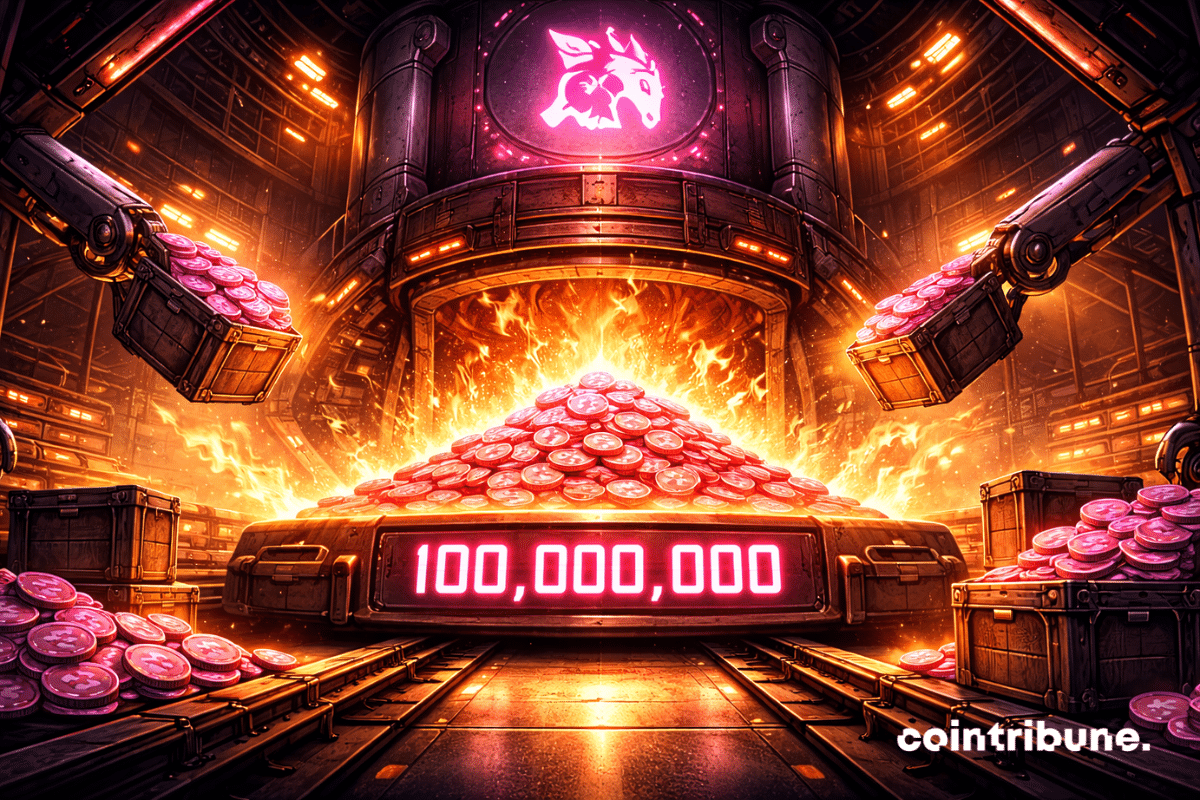

Uniswap has just burned 100 million UNI tokens to boost its value, but the crypto market reacted oppositely: a 6% drop. Between disappointed hopes and controversial mechanisms, this historic burn raises a burning question: what if the solution became the problem?

The American dollar has lost 10.41% of its value over this year. A significant drop for the world's main reserve currency, amidst economic tensions and loss of confidence. Meanwhile, gold and silver have seen spectacular rises, becoming safe haven assets again. This movement reflects a shift in market balance, where the role of the dollar as a safe haven is increasingly challenged.

As the crypto market closes a year under high tension, XRP takes a sharp turn. After riding a wave of optimism fueled by institutional flows and regulatory hopes, Ripple's asset faces increasing selling pressure. The reversal is clear, technical signals turn red, and investor sentiment flips. This downturn could well mark a new chapter in the trajectory of one of the most watched tokens on the market.

Bitcoin wavers as the New Year's Eve approaches: whales, options, silver ratios... What if 2026 rhymes with hangover in the crypto jungle? Holy tree!

Michael Saylor's company Strategy resumes its weekly bitcoin purchases at a time when the markets are doubtful. Details here!

We've seen louder trends pass by. But rarely such a corporate trend. In 2025, the CTAs, those companies that put Bitcoin or other crypto-assets at the heart of their treasury, multiplied at an almost suspicious speed. And already, some leaders in the sector are talking about 2026 as a narrow corridor where many will not pass.

Bitcoin threatens to finish the year in the red. Can it still rebound before the end of 2025? An analyst warns of a crucial technical threshold.

Cardano founder Charles Hoskinson has addressed growing questions about ADA’s weak price performance amid growing interest in Midnight ($NIGHT), a new project linked to the Cardano ecosystem. Midnight has quickly gained attention across the crypto market, highlighting a clear contrast between rising development interest and ADA’s stagnant price action. Hoskinson’s remarks offer insight into both the project’s ambitions and the broader state of the crypto market.

Gold and silver surge in 2025 as Bitcoin dips, with analysts pointing to rotation, seasonal trends, and a possible rebound ahead.

Ethereum is taking a strategic turn in 2026, with two major updates planned within a few months: Glamsterdam in the first half, followed by Hegota at the end of the year. Long criticized for the slowness of its development, the blockchain is now opting for a faster schedule, aligned with the growing demands of its ecosystem. This acceleration marks a turning point in the protocol's governance and opens a new technical phase for Ethereum, as the sector enters an era of consolidation.

Stellar partners with LayerZero to connect 150 blockchains and facilitate crypto asset transfers. Meanwhile, XLM fights to maintain its key support at $0.22. Could this partnership trigger a historic rise?

They promised the moon, but XRP falls silently. Even robots are worried... What if the dreamed crypto became the forgotten anecdote of New Year's Eve?

Bitcoin is playing big at the end of this year. For the first time since its creation, the flagship crypto could close a post-halving year in the red. An unprecedented scenario that would call into question one of the historic pillars of crypto analysis: the famous 4-year cycle theory. While BTC stagnates below $88,000, investors and analysts hold their breath. A bearish close would mark a symbolic and potentially structural turning point for the entire market.

Crypto is plunging, Google is coughing, and retail traders are running away. The market is now just a VIP lounge for insiders lacking an audience. When will the sheep return?

On December 28, Uniswap carried out the destruction of 100 million UNI tokens, worth nearly 596 million dollars. This decision, validated by a massive community vote, marks the entry into force of a new economic framework called "UNIfication." It inaugurates a structural change in the governance of the protocol, based on the activation of protocol fees and a sustainable burn mechanism. Uniswap thus initiates a new phase of its evolution, focused on active management of the value created.