The BRICS Are Accelerating Their Transition To Local Currencies.

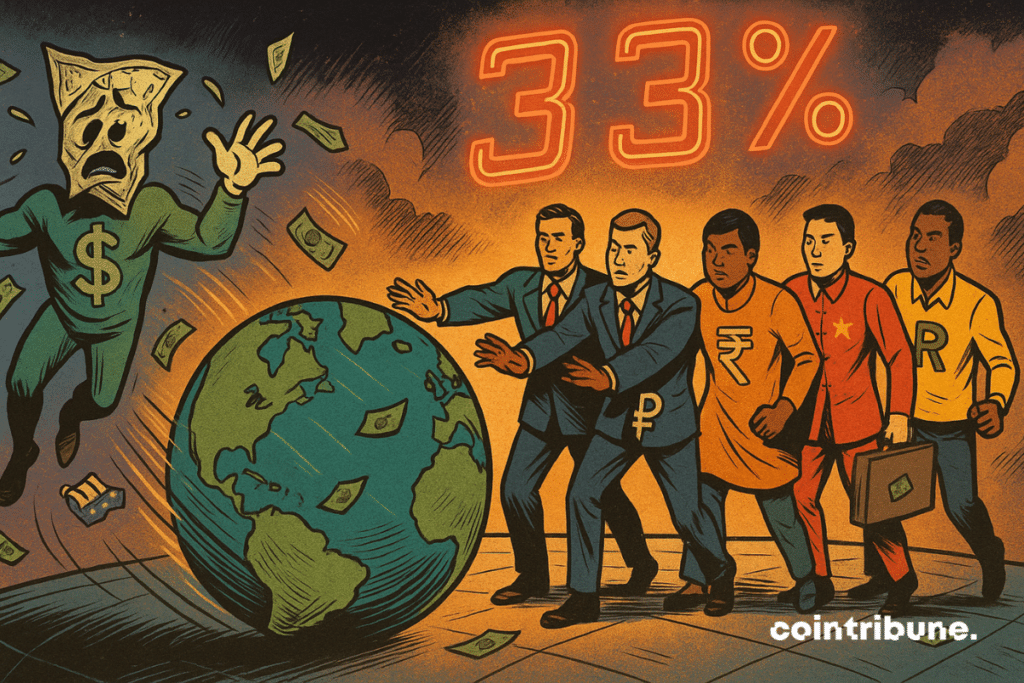

The global monetary architecture is shaking on its foundations. By reducing the dollar’s share in their trade to 33%, the BRICS are marking a historic break. Their trade is now mostly based on their own currencies. Behind this shift lies an assumed strategy, that of fragmenting a system dominated by the greenback. It is no longer just an intention, it is a movement underway. And it is redrawing the balances of a financial order until now under Washington’s influence.

In Brief

- The BRICS cross a historic milestone by announcing that only 33% of their trade exchanges are still conducted in dollars.

- Sergey Lavrov, Russian Foreign Minister, states that 67% of intra-BRICS transactions are now carried out in local currencies.

- The bloc not only trades without the dollar but also develops its own financial tools to strengthen its autonomy.

- These initiatives could accelerate the fragmentation of the global monetary system and further weaken the dominant position of the dollar.

The dollar retreats against local currencies in intra-BRICS trade

Sergey Lavrov, Russian Foreign Minister, declared that “national currencies now represent more than 65% of trade exchanges within the BRICS”. Furthermore, he adds that “the dollar share has fallen to a third”.

In other words, 67% of intra-BRICS transactions are now settled in local currencies. This figure, revealed unequivocally, illustrates a methodical shift in the group’s trade practices, embodying the long-standing dedollarization project carried by its members.

The data highlighted by Lavrov confirms an economic realignment based on several concrete pillars:

- The strengthened economic weight of the BRICS: these economies now have a combined GDP larger than that of the G7 in purchasing power parity.

- Diversification of reserves: China, Russia, and Brazil have significantly reduced their dependence on U.S. Treasury bonds.

- The rise of the yuan in payments: the Chinese currency is expected to represent 24% of trade settlements by 2025.

- The strategic role of resources: control over raw materials like oil (Brent) gives members a bargaining leverage.

- An assumed political stance: dedollarization is no longer a defensive posture but a clear and collective strategy.

Through this data, it is no longer a simple diplomatic intention but indeed an ongoing economic process that the BRICS openly embrace.

New financial infrastructures to consolidate dedollarization

Beyond trade flows, it is on the institutional ground that the BRICS now seem to focus their efforts. Indeed, during a recent ministerial meeting, the bloc formalized its intention to “strengthen the use of local currencies in trade and financial settlements with BRICS partners”.

The statement also specifies that the ministers emphasized “the importance of continuously expanding financing in local currencies,” thus showing the will to build an internal financial ecosystem freed from the dollar.

At the same time, they discussed creating a new investment tool designed to boost capital flows to member economies. The objective is twofold: reduce dependence on the Western financial system while promoting the rise of a shared platform capable of supporting the emergence of a multipolar financial order.

This initiative, though technical, illustrates the transition from a phase of intention to concrete implementation. The BRICS summit planned for 2025 should clarify these projects, notably a possible advance toward a common stablecoin.

This approach could, in the long term, reshape the global financial hierarchy. By consolidating their own settlement and financing infrastructure, the BRICS open themselves to a monetary autonomy trajectory that could attract other emerging countries. If this strategy were extended to new members or trade partners, the United States might see their international financial leverage further erode. The next decade could well seal the evolution of a more fragmented monetary system, in which the dollar would no longer necessarily be the sole reference.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Diplômé de Sciences Po Toulouse et titulaire d'une certification consultant blockchain délivrée par Alyra, j'ai rejoint l'aventure Cointribune en 2019. Convaincu du potentiel de la blockchain pour transformer de nombreux secteurs de l'économie, j'ai pris l'engagement de sensibiliser et d'informer le grand public sur cet écosystème en constante évolution. Mon objectif est de permettre à chacun de mieux comprendre la blockchain et de saisir les opportunités qu'elle offre. Je m'efforce chaque jour de fournir une analyse objective de l'actualité, de décrypter les tendances du marché, de relayer les dernières innovations technologiques et de mettre en perspective les enjeux économiques et sociétaux de cette révolution en marche.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.