After six quarters of decline, the French real estate market surprises with an unexpected flicker: prices are slightly rising again. According to notaries and the Insee, the 0.5% increase at the beginning of 2025 marks a discreet yet strategic break. While many were betting on a continuation of the decline, this signal rekindles bets on the sector's evolution. For investors seeking diversification, including in the crypto sphere, this shift could very well reshuffle the cards of short-term wealth allocations.

Home » Archives for Luc Jose Adjinacou » Page 8

Luc Jose A.

Diplômé de Sciences Po Toulouse et titulaire d'une certification consultant blockchain délivrée par Alyra, j'ai rejoint l'aventure Cointribune en 2019. Convaincu du potentiel de la blockchain pour transformer de nombreux secteurs de l'économie, j'ai pris l'engagement de sensibiliser et d'informer le grand public sur cet écosystème en constante évolution. Mon objectif est de permettre à chacun de mieux comprendre la blockchain et de saisir les opportunités qu'elle offre. Je m'efforce chaque jour de fournir une analyse objective de l'actualité, de décrypter les tendances du marché, de relayer les dernières innovations technologiques et de mettre en perspective les enjeux économiques et sociétaux de cette révolution en marche.

While financial giants tread cautiously in the realm of cryptocurrencies, Paris Saint-Germain creates a surprise by incorporating bitcoin into its cash reserves. This bold choice goes beyond a mere branding operation. It marks a turning point in the way cryptocurrencies are perceived outside the financial sector. By positioning itself as a pioneer in the professional sports world, PSG illustrates the gradual extension of bitcoin into unexpected spheres and confirms its increasing foothold in institutional strategies.

As the crypto market fluctuates between hopes of recovery and signals of caution, a discreet indicator draws attention: the evolution of staking on XRP. Despite recent upward movements, on-chain data reveals a clear decline in engagement on the XRP Ledger network. This disinterest, which contrasts with the apparent momentum of the crypto, could reflect a general loss of confidence among investors in the project's short-term viability.

May 2025 will go down in history: Bitcoin has surpassed 111,970 dollars, an unprecedented peak that electrifies the market. However, behind the euphoria, analysts are tempering expectations. This surge comes on the eve of a historically fragile third quarter for the asset. Amid speculative excitement and signs of consolidation, uncertainty grips investors. Should this be viewed as the beginning of a new cycle or the start of a strategic pullback? Doubt settles in, fueled by lessons from the past and upcoming tensions.

Interoperability is the great unfinished promise of Web3. As blockchains remain siloed, MetaMask, the quintessential Ethereum wallet, makes a strong move by integrating Solana, one of the fastest and most popular ecosystems at the moment. Thanks to its Snaps technology, this technical advancement paves the way for unified management. This is a strong signal in a sector that still struggles to fulfill its promise of a seamless decentralized web, where the investor controls their assets without borders or friction.

Dogecoin has just experienced a disruption that goes beyond the usual volatility of the crypto market. In one hour, the memecoin faced a liquidation imbalance of 200%, triggering a wave of losses on long positions. This unusual figure reveals far more than erratic movement. It highlights the increasing exposure of traders to relentless market mechanics. This is not an epiphenomenon, but a revealing signal of latent tension, in a climate where consolidation often conceals imminent breakages.

The price of Bitcoin is reaching historic peaks, but the interest it generates has never been so divisive. While some see it as a final opportunity, others question the relevance of an investment at this stage. This year, signals from financial institutions, influential investors, and the markets themselves are fueling a strategic debate: should we still buy Bitcoin, or has that train already left?

In a crypto ecosystem where every move is scrutinized by investors, the sudden rise of XRP on the regulatory scene is intriguing. In just a few days, the likelihood of approval for a spot ETF backed by this asset has jumped to 83%, according to Polymarket. This figure, far from trivial, crystallizes a strategic turning point in the battle between the crypto industry and the SEC. More than just a speculative signal, it embodies a possible shift towards long-awaited institutional legitimization.

What if the euro finally established itself as a global reference? In Berlin, Christine Lagarde surprised her audience by asserting that the European single currency could replace the dollar as the main pillar of international reserves. Behind this bold statement, the president of the ECB outlines a clear strategy: to provide the European Union with the necessary levers to exert financial and geopolitical influence. Thus, in a reshaping world, this ambition redefines monetary power dynamics and places the euro at the center of a new global equilibrium in the making.

And if the digital future still needed cash? While Sweden and Norway are rediscovering the importance of cash in the face of systemic risks, Vitalik Buterin is reigniting the debate. In a statement shared on X, the co-founder of Ethereum calls for strengthening the resilience and privacy of the protocol. The goal is to make Ethereum a credible alternative to cash. This statement marks a strategic turning point in the design of blockchain uses in the post-cash era.

XRP is faltering against Bitcoin. A feared technical crossover, the "death cross", has just appeared on the XRP/BTC pair, rekindling investor concerns. This signal, associated with a marked bearish trend, contrasts with the strength displayed by Bitcoin. However, against the backdrop of this grim picture, some technical indicators on longer time frames suggest a possible reversal. Amid short-term tensions and hopes of a rebound, XRP is once again capturing the attention of a crypto market searching for benchmarks.

A discreet yet decisive shift is stirring global markets. The traditional pillars of finance are losing their luster, while assets once considered marginal are gaining legitimacy. Indeed, the growing distrust in sovereign debts is shaking the bond market, which was once a foundation of stability. In this climate of uncertainty, a question arises: is Bitcoin, often labeled as speculative, beginning to establish itself as a true safe haven?

Elon Musk doesn't need official announcements to shake up the crypto market: an image is enough. In April 2023, he replaced Twitter's logo with that of Dogecoin, triggering an immediate surge. Two years later, he lightly revives this episode, calling the act a "great idea." Behind this wink, the community perceives a message: Dogecoin hasn't left the stage. This statement once again opens up speculation about its future role in the X ecosystem.

€635.64 billion is the amount reached by the financial wealth of French households, an absolute record revealed by the Bank of France. This figure far exceeds the national public debt and surpasses the capitalization of the CAC 40. Behind this impressive accumulation lies a societal choice: that of massive savings, oriented towards security rather than yield. A French paradox, at a time when the economy calls for innovation and markets for measured risk-taking.

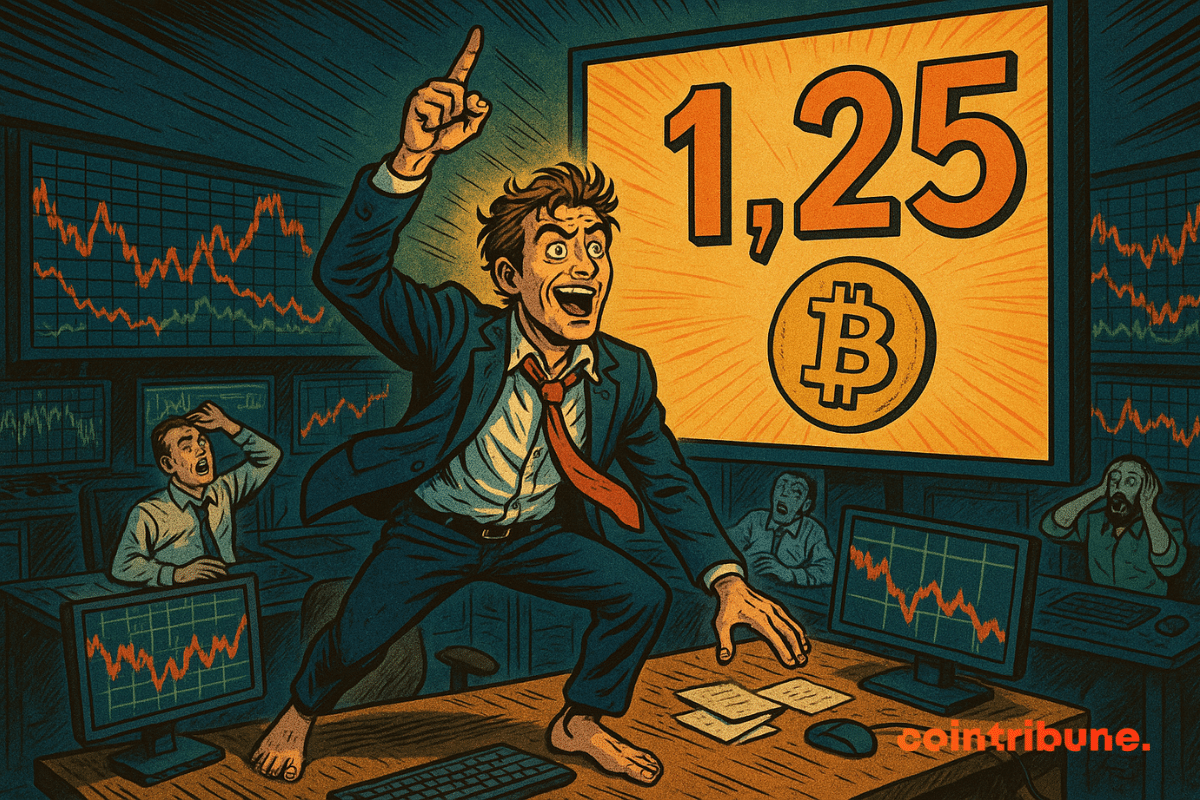

In a market where volatility is constant, James Wynn stood out with an extraordinary maneuver: a long position of $1.25 billion on bitcoin with a 40x leverage via Hyperliquid. A controversial figure in speculative trading, Wynn seemed to be riding a bullish wave... until an announcement from Donald Trump about a massive tax against the EU. Within a few hours, the geopolitical shock reversed the trend, melting away $29 million in potential gains, a bold bet caught up by the reality of the markets.