And if a trade war could lead to a nuclear confrontation? The hypothesis seems extreme, until it is put forward by Warren Buffett. Indeed, during the annual meeting of Berkshire Hathaway, the investor warned that Donald Trump's economic policies, perceived as aggressive, could fuel global tensions with uncontrollable consequences. An unusual stance, heavy with implications, in an international context already weakened by growing rivalries.

Finance News

China hoped to restore its economic reputation through conciliatory gestures towards the United States. Alas, despite a partial reduction in tariffs, the outlook remains bleak. The Chinese economy wavers, trapped by its own inertia and a frigid global environment.

The recent scandal surrounding Mantra (OM) has shaken the crypto sphere, rekindling deep concerns about governance and transparency in the realm of real-world assets (RWA). However, beyond the turmoil, some players like RealFin see in this crisis an opportunity: to demonstrate that another model is not only possible but necessary.

Market: after a loss of 2.4%, gold rebounds ahead of the FED meeting. A strategy to follow for investors? Analysis.

In the crypto market, opportunities do not announce themselves. They explode. At a time when every pump can generate exceptional gains in just a few hours, missing these movements often means missing the essence. However, detecting and capturing these impulses in real-time is a true challenge, even for a seasoned trader. Hence the interest in automating one's strategy with Runbot and the SuperTrend indicator.

Powell slows down, Trump strikes, the markets are in a frenzy. Between surtaxes and threats of dismissal, monetary independence is riding a rodeo amid the discreet applause of 6-dollar eggs.

As oil prices plummet and demand remains sluggish, OPEC+ surprises by announcing a massive increase in its production starting in June. Eight members of the cartel break with recent caution and reignite uncertainty in an already tense market. Behind this turnaround lies a possible geopolitical and economic turning point, between a strategy of recovery and calculated risk-taking. This decision could reshape global energy balances.

The dollar has slowed down, but global markets are holding their breath. After three weeks of rising, the greenback is losing ground, driven by a more robust employment report than expected. However, tensions persist: a resilient growth, stagnant rates, and ongoing tariff uncertainties. Cryptos are not exempt from this monetary ballet. For crypto traders, every fluctuation of the dollar redraws the risk map, shifts the boundary of volatility, and reshapes liquidity expectations.

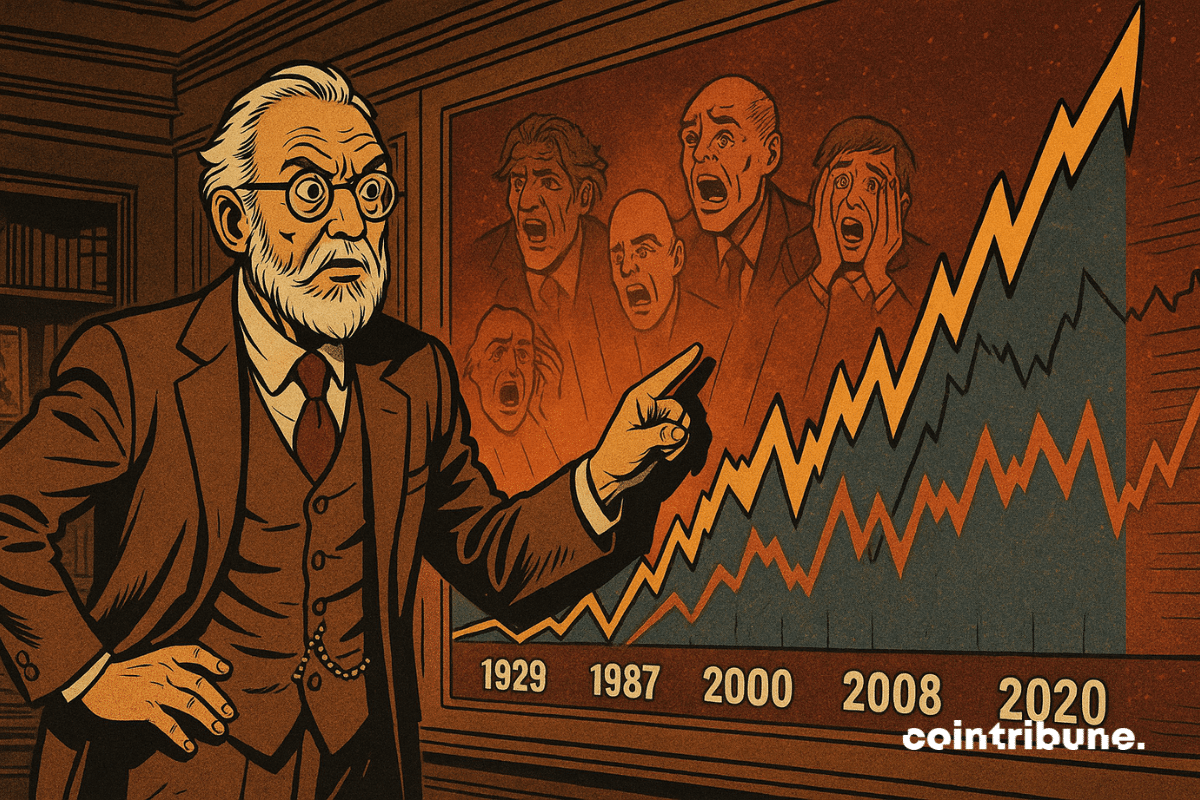

What if the markets were following a tempo that escapes economic logic? While the U.S. GDP is declining, the S&P 500 is rebounding after a sharp drop of nearly 20%. This unexpected turnaround, fueled by contradictory signals, intrigues even in trading rooms. Indeed, at BNP Paribas, strategists are wondering: does this sudden correction fit into a global tradition? To understand it, they delve back into a century of stock market crash history.

The EU is trying to avoid a trade war that would harm its economy. This article explains how.

In a context where traditional finance struggles to meet the needs for returns and accessibility, RealT continues to shape the story of tokenization. After democratizing fractional real estate investment, the platform is launching a new, unprecedented product: the Factoring Token, a tokenized financial asset offering up to 12% annual returns. An innovation tailored for savvy crypto investors and enthusiasts of alternative finance.

The crypto market for RWA (Real World Assets) would be a largely overvalued illusion according to Chris Yin, CEO of Plume. He questions the official figures and asserts that the current enthusiasm is based on false data, far from reflecting the reality on the ground or the actual interest of institutions.

Europe, once hesitant about Bitcoin, wants its MicroStrategy: TBG plans for 260,000 BTC by 2033. A strong plan that tickles the ECB and shakes the markets.

The CAC 40 is taking a significant hit. In just a few sessions, the Paris index has dropped over 6.5%, driven by a dramatic return of trade tensions. The announcement by Donald Trump of new tariffs on Chinese and European imports triggered a wave of massive sell-offs. Thus, on April 3, the Paris Stock Exchange fell by 2.25%, indicating a climate of widespread nervousness that revives the specter of a global economic war.

Solana shows a promising technical rebound. Find our complete analysis and the current technical outlook for SOL.

The American economy is declining for the first time since 2022. Heading towards a recession? Discover some key figures in this article!

The Chinese industry is showing signs of weakness. For the first time in over a year, the country's manufacturing activity has contracted, according to the latest figures from the National Bureau of Statistics. Indeed, the new tariff offensive launched by Donald Trump, with customs duties reaching up to 145%, is beginning to have an effect. In Wall Street as in Beijing, concern is rising. This trade standoff between the two powers awakens fears of a global slowdown with systemic consequences.

Global stock markets are plunging with significant losses on Wall Street and internationally. This drop, exacerbated by economic uncertainty, falling oil prices, and the trade war between the United States and China, raises questions about the short-term outlook for financial markets.

Ethereum remains in a waiting phase, between consolidation and potential recovery. Find our complete analysis and the current technical outlook for ETH.

While economic sanctions aimed to suffocate Moscow, Russia recorded a growth of 4.1% in 2023. This figure, confirmed by Russian authorities, shakes the certainties of Washington and its allies. In a climate of war in Ukraine and a reshaping of monetary alliances, the resurgence of the Russian economy reveals an effective circumvention strategy, supported by the BRICS. This data raises questions about the effectiveness of Western sanctions and reshuffles the cards in the geoeconomic game.

Bunq, the well-known European neobank for digital nomads, is expanding its offering: it's time for cryptocurrencies! The app now allows users to manage savings and crypto in one basket, thanks to Kraken.

The American economy, that giant which once seemed untamable, today wobbles on a tightrope, caught between heightened trade tensions and a loss of domestic confidence. While some spoke of a mere gust of wind, the storm could very well be of unexpected violence.

Bitcoin is beginning a promising recovery: find our comprehensive analysis and the current technical outlook for BTC.

El Salvador "respects" the IMF agreement… while continuing to stack Bitcoin. The art of promising to stop, without ever slowing down.

Under the pressure of sluggish growth and enduring geopolitical instability, the government is implementing an unprecedented austerity measure. By official decree, 3.1 billion euros in credits are being canceled for 2025, indicating a determined budgetary reorientation. The objective is to maintain the course of restoring public finances in the face of a weakened economic context. The cuts will severely impact key sectors such as ecology, the economy, and research, revealing the priorities of a public management that is now under strain.

The global economy is undergoing a major transformation with the advent of blockchain, and real estate is not escaping this revolution. Deloitte predicts that tokenized real estate will reach $4 trillion in assets by 2035. This impressive figure highlights a profound shift in real estate investment, making it more accessible and liquid. Tokenization is redefining the rules of the real estate market, opening up new possibilities for a more decentralized global economy.

As international monetary tensions intensify, China is ramping up its offensive against the dominance of the dollar. Beijing is formalizing the launch of a strategic plan to impose its own international payment system. This initiative marks a major turning point in the redefinition of global financial flows, reinforcing China's ambition for a multipolar economic order. By directly targeting traditional networks dominated by the West, this maneuver is now capturing the attention of markets, governments, and major financial institutions.

Stock Market: Stock markets fluctuate under the effect of tariff tensions. Discover what this means for investors.

While the dollar tap dances on a thread of presidential tweets, the euro is trotting towards the monetary throne, galvanized by the missteps of its starry rival.

The crypto scene could have marked a historic turning point. A partnership between Nvidia and a blockchain network, an official recognition of crypto by a giant in the semiconductor industry. Yet, as usual, hope turned into a mirage. Just a few hours before the announcement, Nvidia withdrew its support, leaving the project in uncertainty. A scenario that summarizes a tumultuous relationship: despite the technological advancements of blockchain, the Californian company sticks to a clear stance. Crypto remains persona non grata in its ecosystem.