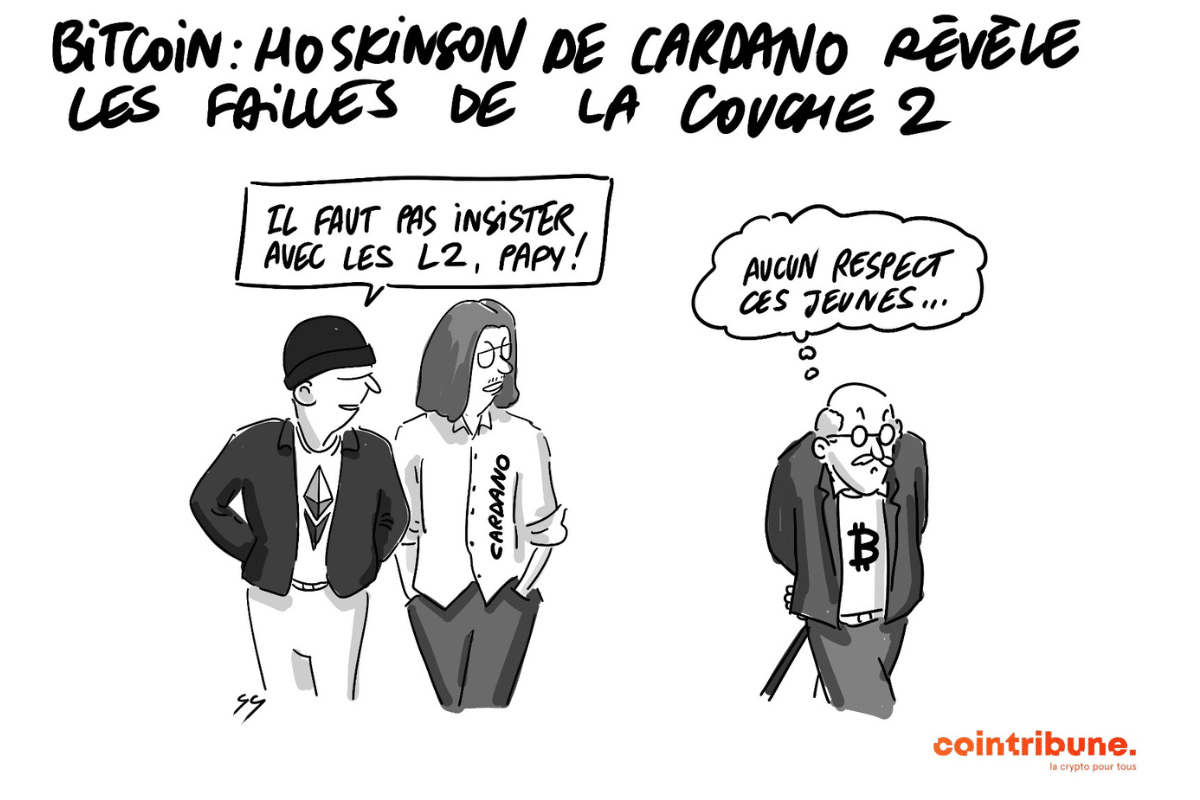

It was 2018… and for the first time in crypto history, Bitcoin wasn't the project with the highest number of transactions in one day. Within 24 hours, BitShares reached 1,513,308 transactions, roughly 17.5 per second.

Article long

The Total Value Locked (TVL) in the context of decentralized finance (DeFi) defines the total value of assets locked in DeFi protocols and smart contracts. In other words, it measures the total amount of locked and utilized cryptocurrencies in various decentralized financial services, including liquidity pools, borrowing and lending protocols, decentralized exchange (DEX) platforms, among others. TVL is often seen as an indicator of the popularity and adoption of different DeFi protocols. It acts as a barometer of this crypto ecosystem. Indeed, according to recent data, the TVL of DeFi is in its best shape thanks to the dynamism of Ethereum. This article explains the ins and outs of this trend.

Exactly one year ago, the price of bitcoin (BTC) was around $20,000. Throughout the year 2023, the flagship cryptocurrency made headlines for its remarkable dynamism despite the ups and downs. Today, the asset is valued at over $50,000. A level it had not reached since December 2021. The surge of BTC to reach this level is from this point of view a major event for the crypto industry, whose resurgence in 2024 has been announced by a panel of experts. But how can we reasonably explain that in the space of a week, BTC has increased its valuation by 19% to currently trade around $51,600? This article will provide you with some answers.

It's Valentine's Day! If you're looking for a unique gift that combines romance with the modern world of finance, consider cryptocurrencies. In 2024, giving these assets is not just a trend. It is a forward-thinking gesture that can prove beneficial in the long term. So here is a brief list of 10 cryptocurrencies whose price is less than $10. Perfect to give for the celebration of love.

Bitcoin recorded a rise of over 13% last week and begins a new week by reaching a new peak. Let's examine together the future prospects of the BTC price.

Meme coins have been around since DOGE went live over ten years ago. Today's market has hundreds of memes in circulation, many of which outperformed BTC, ETH, and many other well-established altcoins. Meme coins proved they are no joke. Just look at PEPE's incredible rise to the top in 2023. Some of the earliest investors saw returns of over 5,000,000%, an absolutely jaw-dropping number, despite having no real-world use cases.

Tucker Carlson, the former Fox News journalist and potential future vice-president of Donald Trump, recently visited Russia to interview Vladimir Putin. This exciting interview comes at a time when Donald Trump has reaffirmed his desire to dismantle NATO and even encourage Putin to invade Europe. Should we expect a Polish invasion by Putin, 80 years after Adolf Hitler?

From the spectacular rise of Bitcoin, reaching almost $50,000, to innovative collaborations breaking the boundaries between the traditional web and the decentralized web, the cryptocurrency ecosystem continues to demonstrate its ability to evolve and adapt to regulatory, technical, and economic challenges. Here is a summary of the most significant crypto news of the week!

The crypto industry has been booming since the advent of registrations. These digital data open up new perspectives for the Bitcoin network and other platforms. On one side, there are Bitcoin Ordinal registrations that bring a new dynamic to the pioneering blockchain. On the other side, registrations on EVM-compatible blockchains like Ethereum have seen rapid growth followed by stabilization. Although their future remains uncertain, registrations are a promising track for extension to a wide range of blockchains. In this article, based on a Binance report, we explore the landscape of registrations, analyzing their impact on the Bitcoin network and EVM-compatible blockchains. This is done with a focus on platforms active in this field.

The most important emerging nations are abandoning the dollar. The next international reserve currency will be Bitcoin.

The future of bitcoin (BTC) is currently attracting great interest. Recently, some crypto analysts have expressed their prediction of a profound disruption in the flagship crypto market. As the bitcoin (BTC) halving approaches, they anticipate an exceptional supply "shock". These projections hint at significant implications regarding the price dynamics of the flagship crypto and its ecosystem. In this article, we will attempt to explain the implications of an explosion in the supply of bitcoin (BTC). This will be done through the lens of the current context of the flagship crypto in the crypto market.

The interview of Vladimir Putin by American journalist Carlson Tucker was colorful. Especially the conversation about the dollar.

Artificial intelligence (AI) is revolutionizing the professional world, opening up new possibilities. Among these is the vision of a three-day work week. Recently, billionaire and founder of Microsoft, Bill Gates, has become a champion of this vision of the work world. An idea that finds support in the business community, notably with banker Jamie Dimon. The prospect of a working world operating on a three-day work week can seem enticing at first glance. But it still raises debates surrounding its feasibility and potential implications. In this article, we examine the sustainability of this perspective and its potential implications.

Monero experienced a drop of over 30% before correcting by half the next day. Let's take a closer look at the future outlook for the price of XMR.

Bitcoin Almost Dips Below $42K Amidst Soaring Interest Rates, While Chainlink’s LINK Bucks the Trend

As the Federal Reserve is making its first announcement regarding interest rates in 2024, the crypto market is watching closely to see how it will be affected.

Towards the end of the 1990s, the emerging Internet technology at the time raised doubts and skepticism about its adoption potential. However, here we are nearly three decades later, with the Internet having become ubiquitous in everyday life. Will cryptocurrencies, which cannot be issued without blockchain technology, follow the same path? Or, on the contrary, will they experience a different fate and fizzle out over time? In a recent report, leading investment bank Architect Partners attempts to answer these crucial questions in light of the crypto industry's recent momentum. Here, in this article, is the essence of what should be remembered from it.

Given the recent increase in Bitcoin transaction fees, it is appropriate to discuss UTXO consolidation.

If the Fed decided to lower its interest rates, we could very well witness a soaring of the markets. Money would flow abundantly, and certain financial assets like bitcoin (BTC) could reach unprecedented heights.

The bearish-minded cryptocurrency analyst, renowned as the il Capo Of Crypto, discussed the recovering nature of Bitcoin in his recent remarks. Having previously predicted an ascent in Bitcoin's value followed by a decline, he anticipates a range of $44,000 to $45,000 in the upcoming phase, expressing confidence that $50,000 might be achieved in the coming days.

"From the remarkable rise of Bitcoin ETFs to the rise of Solana in the DeFi space, to the strategic initiatives of financial giants such as Visa, the crypto ecosystem continues to demonstrate its resilience and innovation. While Binance forges alliances with the Swiss banking sector to strengthen the security of digital assets, Visa is simplifying crypto transactions in 145 countries, highlighting the increasing integration of cryptocurrency into the traditional financial system. Meanwhile, Russia is considering the use of cryptocurrencies for foreign trade, defying international sanctions and exploring new paths for the digital economy. These developments, among others, not only shape the current landscape of cryptocurrency but also outline its future. Let's dive together into a detailed recap of these significant events."

Meme coins are back in the game, according to numerous crypto experts. This niche was in a slump since the middle of 2023 after PEPE’s 9000% surge.

Interview with Nathan Douet, COO of Wecan, to delve deeper into their vision and achievements.

January 10, 2024 is memorable for crypto. This date marks the approval by the Securities and Exchange Commission (SEC) for the creation of a Bitcoin Spot ETF. After months of waiting, the US financial regulator will finally give the green light for a Bitcoin spot ETF. This long-awaited decision by the crypto industry players has confirmed the legitimacy of Bitcoin (BTC) as a financial asset. The scope of this regulatory authorization could have been further reinforced if it had been followed by a green light for options on Bitcoin spot ETFs. For now, regulators hesitate to take the plunge. In this article, we explain why hesitations on this issue could still last a while.

Explore how Bitcoin is getting involved in DeFi, revealing immense potential despite significant risks.

L’avènement des security tokens marque une évolution significative dans le monde de la finance numérique, offrant une nouvelle façon de représenter les actifs financiers sur la blockchain. Ces tokens, qui allient les avantages de la technologie blockchain à la conformité réglementaire, sont en train de transformer les méthodes traditionnelles de financement et d’investissement. Toutefois, le processus de création et de gestion d’un security token est complexe et nécessite une compréhension approfondie de plusieurs aspects clés. Cet article se propose de détailler les étapes cruciales de ce processus, de la conception initiale à la gestion post-lancement, offrant ainsi un guide pratique pour les entreprises qui envisagent d’entrer dans cet espace innovant.

Security tokens are emerging as a major innovation in the world of digital finance. By merging blockchain technology with the demands of traditional financial markets, they offer a new perspective on investment and asset tokenization. However, this advancement is not without challenges, particularly in terms of regulatory compliance and technological integration. Let's explore the specifics of these assets.

Security tokens are transforming the landscape of digital finance, introducing a new and regulated dimension to the world of cryptocurrencies. Anchored in blockchain technology, these tokens stand out for their ability to represent real financial assets while offering increased security and transparency. However, their integration into the financial market poses significant challenges, particularly in terms of regulation and investor understanding. This article aims to demystify the concept of security tokens by exploring their functionality, the regulatory frameworks governing them, as well as the advantages and risks they present to investors.

The digital age has seen the emergence of cryptocurrencies and, with them, new opportunities to maximize profits on the blockchain through MEV Bots. These automated tools, designed to exploit the maximum extractable value from transactions, have become a key element in cryptocurrency trading. However, building a high-performing MEV Bot requires deep understanding and specific technical skills. This article aims to break down the process of creating an MEV Bot, covering essential technical aspects, development steps, and strategies to optimize its efficiency and profitability.

In the dynamic world of blockchain and cryptocurrencies, the concept of Maximum Extractable Value (MEV) has emerged as an essential topic of discussion. This complex yet crucial phenomenon influences how transactions are processed and secured on blockchain networks, particularly Ethereum. MEV Bots are also gaining popularity. While MEV offers profit opportunities, it also raises questions of fairness and security. This article explores in detail how MEV works, its implications, its interaction with Ethereum 2.0, and its role in decentralized finance (DeFi).

The rise of cryptocurrencies has opened new avenues in the investment world, notably through Bitcoin ETFs. These funds, which replicate Bitcoin's performance while being traded on traditional exchanges, represent a fascinating fusion between digital finance and conventional investment. For investors eager to enter the cryptocurrency universe without the complexities of directly managing these assets, Bitcoin ETFs present an attractive solution. This article provides a comprehensive guide on buying Bitcoin ETFs, covering the platforms where to find them, the key steps to acquire them, and the pitfalls to avoid for a successful investment.