Shiba Inu heads into the weekend under mounting pressure. On-chain data shows that more than 531 billion SHIB flowed into exchanges over the past 24 hours—a figure well above recent norms. The surge tilts short-term control toward sellers. With technical signals weak and weekend liquidity thinning, downside risks are increasing.

Bearish

Bitcoin network activity has fallen nearly 50% since 2021, revealing a sharp drop in on-chain engagement even as market caps climbed.

Bitcoin is going through one of its toughest phases in months. Nearly half of the circulating supply is at a loss, ETFs are bleeding billions, and yet — miners and long-term holders refuse to give in. Should this be seen as a sign of hope, or simply the denial of a market that has not yet hit bottom?

Memecoins have faced heavy selling pressure over the past month, reinforcing the view among many traders that the sector’s best days are over. Social media sentiment has turned sharply negative, and market participants are increasingly writing off meme tokens as a failed trend. However, crypto analytics firm Santiment argues that such widespread pessimism may signal a potential reversal rather than a permanent decline.

Zcash has entered a prolonged pullback after a strong run late last year. Prices have fallen sharply since November, erasing gains that once made the token a market leader in 2025. At the same time, activity from a key corporate holder has slowed, raising questions about near-term demand. Elsewhere in crypto, other treasury firms continue to buy despite heavy paper losses.

Shiba Inu (SHIB) is under renewed pressure as its market position weakens. Once ranked among the top 15 cryptocurrencies, SHIB now sits near the lower end of the top 40 by market capitalization. Recent price movement and fading interest have raised questions about whether the token can recover in the next market cycle.

Bitcoin markets are sending mixed signals as price weakness meets rising trader confidence. While the asset remains under pressure after months of declines, activity in derivatives markets continues to point to steady dip buying. Data from Bitfinex shows traders increasing bullish exposure, even as sentiment across the broader market remains cautious.

BONK continues to face steady selling pressure, with price action offering no clear signs of a rebound. Recent moves reflect hesitation rather than strength, leaving traders cautious. As expected, the market remains without a clear direction, and volatility stays muted.

Market conditions continue to tighten around Bitcoin as traders confront nearly $2 billion in leveraged long positions that could be liquidated if prices fall to $80,000. Recent swings reveal how fragile derivative exposure has become, with borrowed positions at risk of automatic liquidation during sharp price moves.

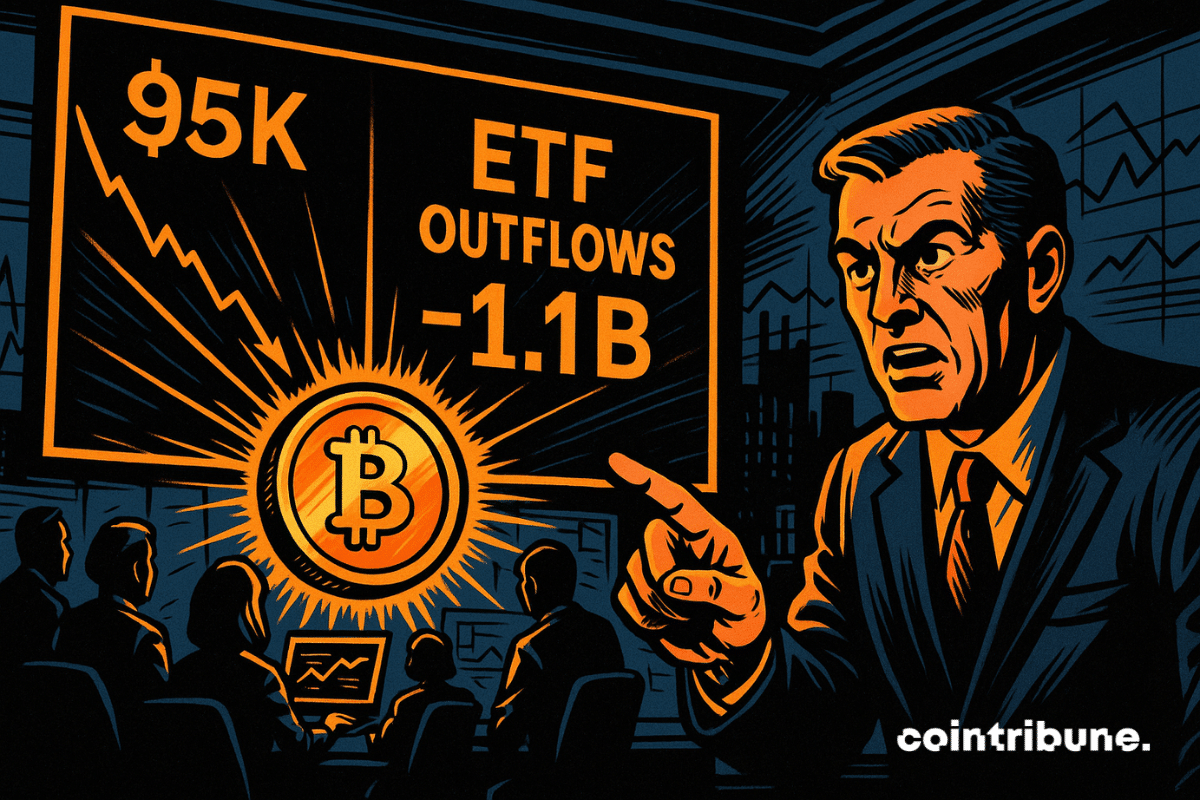

Bitcoin fell to $80,000 as crypto funds saw massive outflows, but analysts point to improving liquidity that could spark a December rally.

Bitcoin’s fall under $90,000 on Wednesday revived market fear and extended a sell-off that has already lasted several days. Prices slipped to levels not seen since earlier periods of stress this year. Traders responded by stepping back from risk and reducing exposure across both spot and derivatives markets.

Global cryptocurrency markets are under heavy pressure after a sharp decline in Bitcoin's value damaged sentiment across the sector. Prices are now giving back most of the gains made earlier in the year, while smaller tokens are falling to multi-year lows. Investors are reassessing risk, trading volumes are shrinking, and several analysts warn that further declines remain possible.

U.S. Bitcoin ETFs faced another difficult week as steady capital outflows added strain to an already uneasy market. Investor caution increased as withdrawals accelerated, pushing Bitcoin further below the $100,000 mark and signaling a broader loss of confidence in digital assets.

A sharp shift in sentiment has taken hold across digital assets after a week of sell-offs, weaker macro signals, and thinning liquidity. Markets now sit in a cautious posture, with fear climbing as large-cap tokens retreat toward multi-month lows.

Bitcoin’s recent price action is drawing comparisons to one of the most dramatic commodity bubbles in modern history. Veteran trader Peter Brandt says the cryptocurrency’s chart now resembles the 1970s soybean market—an era defined by a sharp boom-and-bust cycle.

Ethereum’s latest rally has once again lost momentum, with the cryptocurrency struggling to stay above the $4,000 mark. With weak demand and declining spot ETF inflows weighing on sentiment, analysts warn that Ether (ETH) could face a deeper correction toward $3,100 if buyers fail to regain control.

Bitcoin ended the week under pressure as investors rotated toward safer assets amid renewed US-China trade tensions and broader market weakness. Despite robust inflows into Bitcoin exchange-traded funds (ETFs), derivatives data suggest traders remain cautious about the sustainability of current price levels.

Bitcoin plunges to 113,000 dollars, triggering panic among retail investors. Technical analysis, institutional strategy, and potential bearish trap: discover why this correction could hide an unexpected buying opportunity for the most strategic.

Ethereum saw the biggest short liquidation in the crypto market on Friday, wiping out $105 million in bearish bets as the price surged past $4,000 for the first time in eight months. The move drew reactions from high-profile figures, including Eric Trump, who warned traders against betting against Bitcoin and Ethereum.

The conflict between Israel and Iran raises fears of a major escalation, yet U.S. indices are flirting with their all-time highs. Following U.S. bombings in Iran, this situation could change very quickly, casting doubt on a sudden market collapse.

Donald Trump's announcement on March 2 to include XRP in a U.S. strategic reserve alongside Solana and Cardano propelled the altcoin by +34% in 24 hours. A fleeting flash of glory: by the next day, the price retraced 50%, while on-chain data revealed a massive exit of institutional investors. Is crypto going through a classic pump and dump scenario amplified by politics, or does this pullback hide a discreet accumulation before a rebound?

In light of the recent drop in the crypto market, Richard Teng, CEO of Binance, shows measured optimism. In an analysis published on February 25, he describes this decline as a mere "tactical retreat" rather than a fundamental shift in trend, reminding of the historical resilience of the sector.

The crypto market is currently experiencing a period of uncertainty, as Bitcoin, which had recently reached historical highs, is showing signs of weakness. Experts from CryptoQuant have identified concerning indicators suggesting a possible impending bearish phase.

Following the collapse of the Chinese real estate sector, which accounted for 30% of the country's GDP, China is heading towards a recession. Is China on the verge of experiencing its "2008 crisis"?

Solana stumbles, trips, and slips. The rebound seems as likely as a return of dinosaurs to Wall Street.

S&P 500 toward 5,000, Bitcoin in precarious balance: the great show of the American financial market.

This week, the crypto market has experienced notable turbulence, orchestrated mainly by bitcoin. A shadow of decline now looms, leading to a widespread and immediate plunge in altcoins.

The leading cryptocurrency continues to establish a consolidation phase around the $30,000 mark. The expected announcement of the FED's interest rate decision on Wednesday should bring further movement to the market. Although investors anticipate an imminent bullish rally, a slight correction in bitcoin (BTC) could emerge.

With the US CPI due for release on July 12, Bitcoin (BTC) and Ether (ETH) are stabilizing, raising investor expectations. The previous month, these two cryptocurrencies soared in response to this economic indicator. Could this trend be repeated this month?

BTC continues to hold in the $30,000 to $31,000 range. Large investors seem to remain optimistic and continue to accumulate. The long-term price trend for bitcoin (BTC) remains bullish, although a new DIP cannot be ruled out. Short-term selling could be attractive.