Trump slams the door on the G7 and brings out his tariff weapons. Canada suffers, the economy wavers, and copper prices soar. What is the star chef of protectionism really cooking up?

Trade

France's economy recorded a trade deficit of 7.6 billion euros in May. A concerning trend for investors.

The economy is at risk of a commercial earthquake: the suspended tariffs could come into effect in August. The details here!

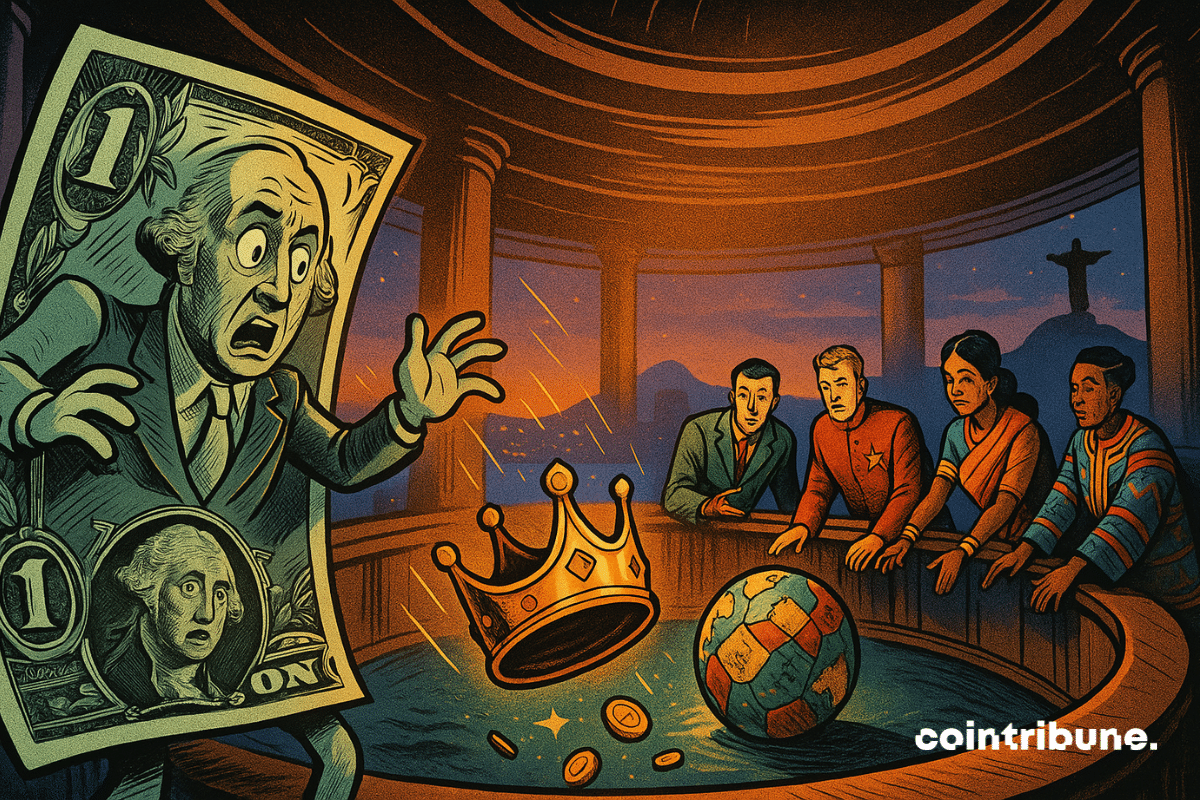

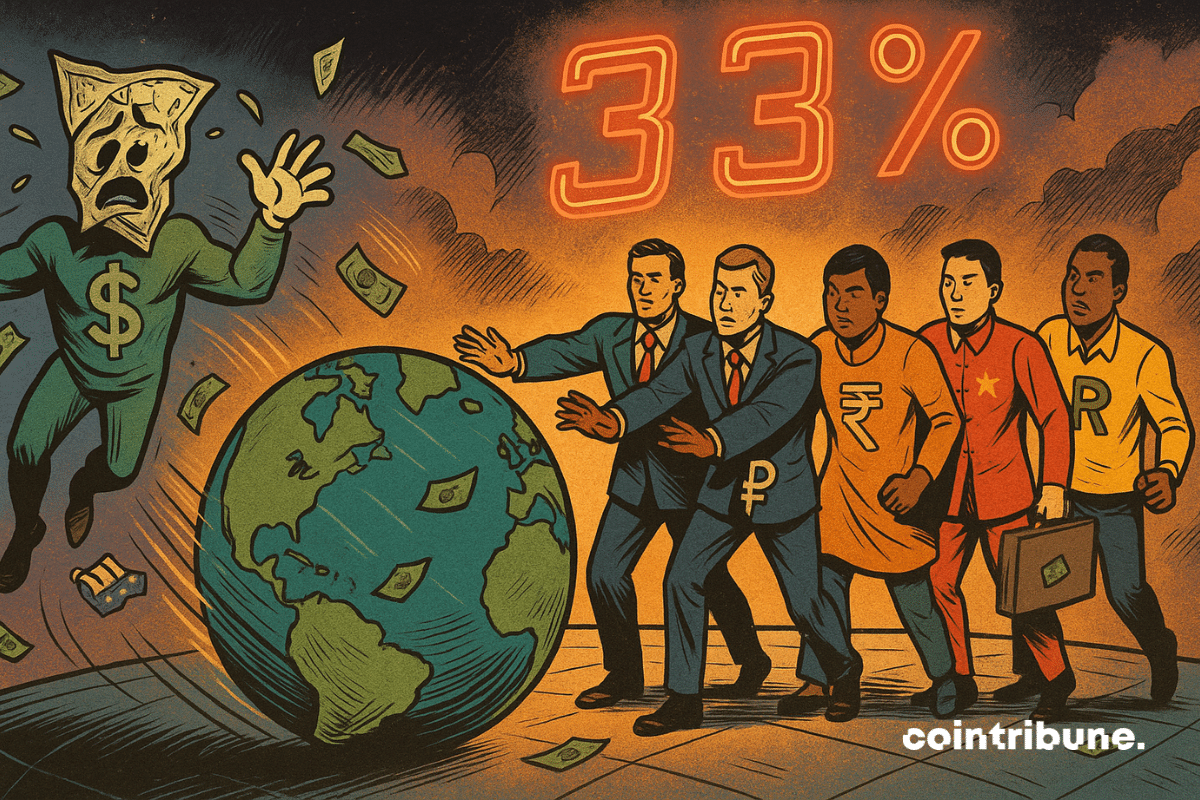

Can the dollar lose its global supremacy? What was once speculation is now taking a concrete diplomatic turn. As the BRICS summit approaches in Rio, major emerging economies are placing local currency transactions at the heart of their strategy. This shift occurs within a context of growing geopolitical tensions and demands from the Global South for a more balanced financial system. Behind this dynamic lies a possible redefinition of the rules of global trade.

As Washington and Beijing reopen a diplomatic channel in London, tensions over rare earths and semiconductors threaten the global balance. In the face of the Chinese delegation, Washington demonstrates its firmness. Donald Trump, true to his style, sets the tone: "China is not easy." Behind this statement lies a reality: neither side seems willing to yield on such strategic and explosive issues.

Trump keeps the suspense going, Brussels breathes, the stock market dances. But behind the curtain, the threats still loom. Who will emerge victorious from this customs waltz?

A phone call, a truce? Trump puts away the customs missiles. The European economy is breathing, but for how long? Ursula whispers, Donald retreats. Suspense is high until July.

When a consumer product surpasses oil and diamonds in the exports of a country like India, it is no longer just an industrial success, but a strategic shift. The meteoric rise of smartphones as the leading export item reflects a redeployment of the country's economic priorities. This turning point marks the emergence of a manufacturing India connected to global value chains, with possible repercussions on the balance of international trade, technological flows, and ultimately, on digital uses and the dynamics of the crypto economy.

The return of Donald Trump to the global economic arena was enough to shake the markets. On Friday, a terse statement on Truth Social ignited the powder keg: 50% tariffs on European imports starting June 1. The reaction was swift. Wall Street wavered at the opening, traders hurriedly adjusted their positions, and the crypto market felt the shock: Bitcoin dropped by 4%, leading to liquidations of over 300 million dollars.

The maritime industry, a pillar of global trade, has long been grappling with outdated financial systems. Companies must manage inefficiencies, slow processes, and fraud risks, complicated by the complexity of cross-border transactions and compliance with multi-jurisdictional regulations. These challenges limit access to capital, delay transactions, and lead to an overall lack of financial transparency. With traditional institutions hesitant to engage, the industry faces significant gaps in financial solutions.

Polymarket reached an all-time high in new market creation in April, but trader activity and trading volume have slowed since the 2024 U.S. election. Speculation around a possible token launch could drive renewed engagement and further growth.

Trump eases up (a bit) on customs tariffs: the economy breathes, analysts cough, and Beijing chuckles. 90 days of truce, or 90 days until the storm?

The U.S. and China agree to pause tariffs for 90 days, boosting crypto market optimism with Bitcoin and others seeing strong gains.

Chinese economy: prices are sinking, the people are saving, Beijing is patching things up, dishes are changing. The dragon is coughing, but still plays the mystery card to avoid being roasted.

The global monetary architecture is shaking on its foundations. By reducing the share of the dollar in their exchanges to 33%, the BRICS are signaling a historic break. Their trade now largely relies on their own currencies. Behind this shift lies a deliberate strategy to fragment a system dominated by the greenback. This is no longer an intention; it is a movement underway. And it is reshaping the balances of a financial order that has until now been under the influence of Washington.

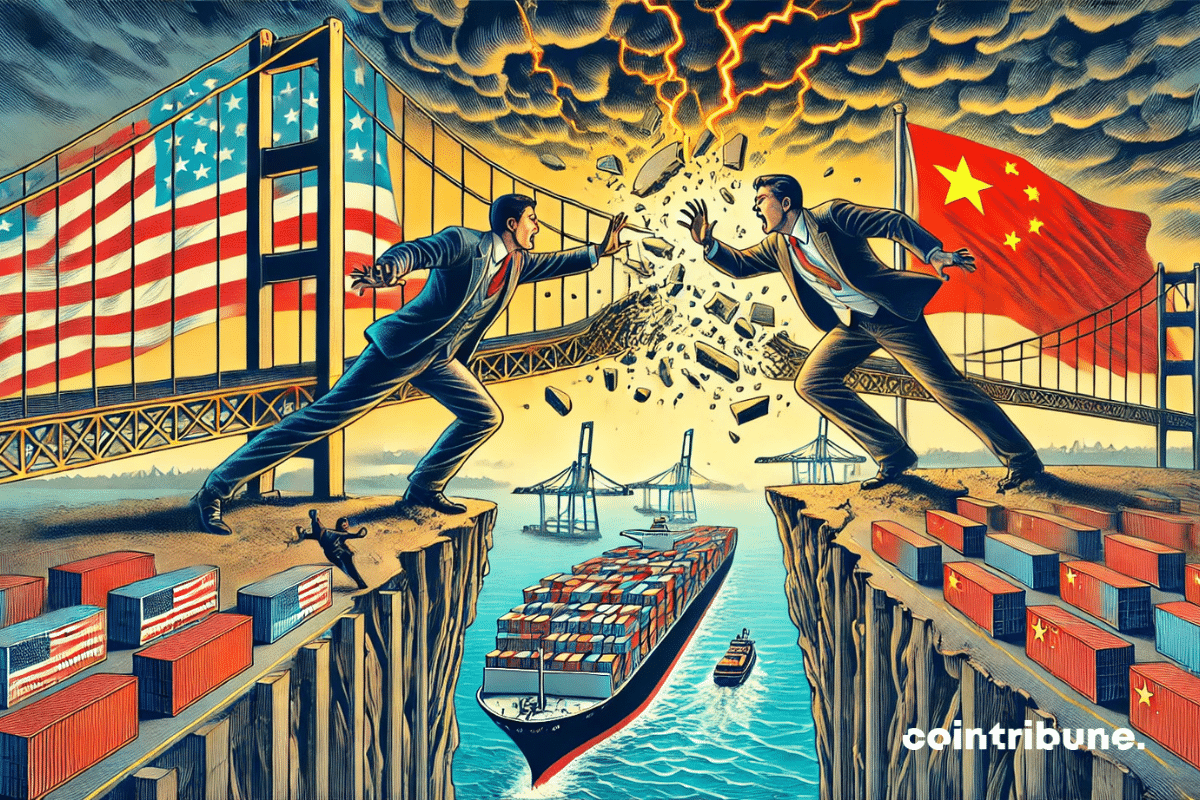

While the Sino-American trade war seemed frozen in an endless game of retaliation, an unexpected gesture has rekindled hope: Beijing agrees to official talks with Washington. A first in months. This meeting, much more than a simple diplomatic exchange, crystallizes the deep tensions shaking global trade and the economy of the two giants.

And if a trade war could lead to a nuclear confrontation? The hypothesis seems extreme, until it is put forward by Warren Buffett. Indeed, during the annual meeting of Berkshire Hathaway, the investor warned that Donald Trump's economic policies, perceived as aggressive, could fuel global tensions with uncontrollable consequences. An unusual stance, heavy with implications, in an international context already weakened by growing rivalries.

The EU is trying to avoid a trade war that would harm its economy. This article explains how.

The American economy is declining for the first time since 2022. Heading towards a recession? Discover some key figures in this article!

In the midst of a commercial battle, the European Union agrees to negotiate the elimination of tariffs on Chinese electric vehicles. Supported by massive subsidies, these low-cost models disrupt the balance of the European market. This turnaround marks a turning point, as Europe, torn between industrial protectionism and ecological transition, opens itself to a risky compromise. In a key sector, this rapprochement could reshuffle the cards between two rival powers, linked by competition as much as by interdependence.

The surprising decision by U.S. President Donald Trump to temporarily suspend reciprocal tariff rights has quickly reassured the markets and reduced the prospects of an economic recession.

As the BRICS intensify their dedollarization strategy, Beijing and Moscow are taking an unprecedented step: using bitcoin to settle certain trade transactions. This initiative, revealed by VanEck, marks a symbolic turning point in the internationalization of cryptocurrencies. It reflects a clear intention to break free from financial circuits dominated by the West, aiming to give bitcoin a new geopolitical role. This shift could herald a new monetary order in which cryptocurrencies redefine the levers of economic sovereignty.

Global trade is wobbling under the effect of a new escalation between Washington and Beijing. Donald Trump is reigniting the tariff offensive against China, rekindling a trade war that marked his previous term. Beijing, far from backing down, is deploying a firm response, determined to defend its strategic interests. This renewed showdown between the two superpowers resonates well beyond customs, threatens global economic balances, and stirs tensions in international markets. A confrontation whose implications could be felt well beyond American and Chinese borders.

Trump's new taxes destabilize the markets. What are the consequences for the American economy? The full analysis here!

Donald Trump is once again making his mark at the helm of the United States. By launching a vast tariff offensive against almost all of the country's trading partners, the president is triggering an economic and diplomatic earthquake. Wall Street is falling, allies are worried, and Beijing is retaliating. This decision, as much strategic as ideological, marks the overt return of hard protectionism and places American economic sovereignty at the center of the global game.

Donald Trump has caused an economic shockwave by announcing significant tariffs targeting almost all countries in the world. The figures presented by the White House are being thoroughly analyzed by experts and raise questions among the United States' trading partners.

Under a heavy fiscal sky, cryptos and stocks waver. Trump's "Liberation" resembles a storm. The wind shifts, and hopes dwindle, one tweet after another.

Tensions between Washington and Brussels are taking a disturbing turn. While transatlantic trade represents a colossal market of $9.5 trillion, the new tariffs imposed by Donald Trump risk upsetting an already fragile balance. A trade war between the two economic powers could lead to increased production costs, a drastic drop in trade, and growing instability for businesses.

The EU defends its economy against new American sanctions. We provide all the details in this article.

The global economic scene is in full turmoil. In just a few months, trade tensions between China and the United States have reached a new level, severely impacting the foreign trade of the Asian giant. Official figures released by Chinese customs indicate a brutal slowdown, much more pronounced than expected, in exports and imports. In the background, a declining internal consumption and an uncertain economic climate amplify concerns. As Beijing sets an ambitious growth target, this halt raises many questions about the country's ability to maintain its dynamism in the face of repeated attacks from Washington.