France alerts: crypto companies ignore the MiCA regulation. Imminent shutdown? We tell you everything in this article.

France

The crypto sector, already weakened by tax issues and complex regulation, faces a new threat: the leak of sensitive data. An investigation in France reveals that a tax agent allegedly exposed private information about crypto owners. This revelation raises concerns about the security of tax data and the increased risk of physical attacks against investors. Such a scandal highlights the vulnerabilities of a system meant to protect citizens' confidentiality.

In Manosque, France, a woman experienced a true nightmare: kidnapped and assaulted at gunpoint for cryptos. This shocking news story reveals an alarming trend, criminals increasingly targeting holders of digital assets. Why this violence and how to protect yourself? The investigation and answers in this article.

Behind the new name The Bitcoin Society (TBSO), Eric Larchevêque orchestrates the transformation of a small listed Parisian company, Société de Tayninh, into a hybrid vehicle: both a "bitcoin treasury company" and a network company focused on individual financial sovereignty. In other words: a MicroStrategy the French way, but grafted onto an activist community.

While the ECB dreams of a well-behaved digital euro, a French crypto startup is spending £30 million to hack the bank... but with the regulator's approval. Hats off.

In Brussels, while some regulate AI to the point of suffocation, Paris and Berlin advocate for breathing space. Bureaucrats panic, startups suffocate, and innovation awaits an emergency exit.

Are cryptos on their way to becoming a burden for French investors? A recently adopted amendment in the National Assembly could change the game. Bitcoin, Ethereum, and other digital assets would soon be taxed as "unproductive wealth," on the same level as yachts and hoarded gold.

What if the future of monetary reserves no longer relied on gold or fiat currencies, but on bitcoin? In France, a bill supported by the UDR party plans to create a national reserve of 420,000 BTC. A groundbreaking initiative which, although driven by a minority parliamentary group, challenges the foundations of monetary sovereignty. At a time when states are groping with cryptos, this project revives a major strategic debate.

Binance has just hit hard. More than 600 accounts have been closed for abusive exploitation of the Alpha platform via “bot farms”. The announcement dated October 19 targets actors who manipulated the rewards structure and falsified access to crypto token sales and airdrops. This assumed decision repositions the platform on a zero-tolerance line against predatory automation.

In Brussels, a subtle power struggle is shaping the future of crypto regulation in Europe. France, at the forefront, intends to influence the implementation of the MiCA regulation and establish itself as the center of gravity for platform oversight. While the Union enters a critical phase of harmonization, Paris toughens its rhetoric and actions towards industry giants. Binance, a flagship among targeted exchanges, becomes a symbol of a strategic showdown.

France is taking a major step in modernizing its financial markets with the launch of the Lightning Stock Exchange (Lise), a fully tokenized equity platform designed for small and medium-sized enterprises (SMEs). Backed by leading French banks and armed with a new regulatory license, Lise aims to bring blockchain efficiency to traditional stock listings and reshape how companies go public.

Éric Ciotti triggers a political bomb: what if France mined bitcoin with its nuclear energy? Between energy sovereignty and the battle against the United States, discover how BTC becomes the explosive issue of 2025 – and why it will change everything. #Bitcoin #France #BTC

The prospect of increasing the flat tax resurfaces in budget discussions. Ahead of the 2026 finance bill, Bercy would consider raising the single flat tax, set since 2018 at 30%. No decision has been made yet, but the return of this measure, long considered a fiscal marker of Macronism, is already causing tensions. In a context of structural deficit and revenue pressures, the stability of the savings tax framework could be called into question.

Strasbourg could soon become the first major French city to adopt a municipal crypto. What was yesterday reserved for Web3 activist circles is now entering the local public debate. The City Council has adopted an unprecedented motion: to study the feasibility of a local digital currency. The goal is to explore new economic, social, and technological avenues. An unprecedented initiative for a major French metropolis, which explores digital levers serving the local economy and citizen participation.

Pavel Durov breaks his silence and hits hard. The founder of Telegram claims that French intelligence services tried to force him to censor political content related to the Moldovan elections. A revelation that rekindles tensions between the messaging platform and French authorities. The case takes a worrying turn for freedom of expression in Europe.

France is preparing to give up its surplus nuclear energy to an American bitcoin miner instead of favoring the French solution.

Fitch has downgraded France's sovereign rating from AA- to A+, mainly due to governmental instability and difficulties in reducing the public deficit. This situation reveals the failure of the French government, but also massive interventions by the European Central Bank (ECB).

France threatens to block the MiCA passport for certain crypto companies deemed too lenient. Towards stricter regulation in Europe?

While OpenAI blazes at 500 billion, the start-up Mistral inflates its sails to 11.7 billion. Cocorico or European mirage? AI has found its Gaulish rooster.

The hierarchy of European sovereign debts has just shifted. On Tuesday, September 9, France borrows at a higher rate than Italy on ten-year bonds. Less than 24 hours after the fall of the Bayrou government, the markets have decided: the French signature is no longer a refuge. This reversal, unprecedented in over a decade, marks a loss of confidence affecting the State's budgetary credibility.

The crypto platform Finst officially enters the French market on September 9, 2025, promising to shake up cryptocurrency investing with ultra-competitive rates and a transparent approach. Founded by former DEGIRO executives and regulated by the Dutch Financial Markets Authority (AFM), this Dutch platform aims to democratize access to crypto-assets in France.

Crypto crime cases related to digital assets are taking an increasingly worrying turn in Europe. In France, a new kidnapping involving a young Swiss person has just been foiled, recalling previous waves of attacks that had sown panic in the Web3 ecosystem. Seven suspects have been arrested, but many grey areas remain.

American crypto exchange Kraken has completed an ambitious tour of France with 21 stops across the country. Stated objective: move beyond major metropolitan areas to meet users in the regions. This unprecedented initiative reveals a deeper strategy for conquering the French market.

The debt is making headlines again on both sides of the Atlantic. Bitcoin is ready to soar if the Fed and the ECB were to bring back the printing press.

Crypto everywhere, cheap ransom, and an ex-trader freed at dawn: France invents discount kidnapping. Who will be the next digital wallet?

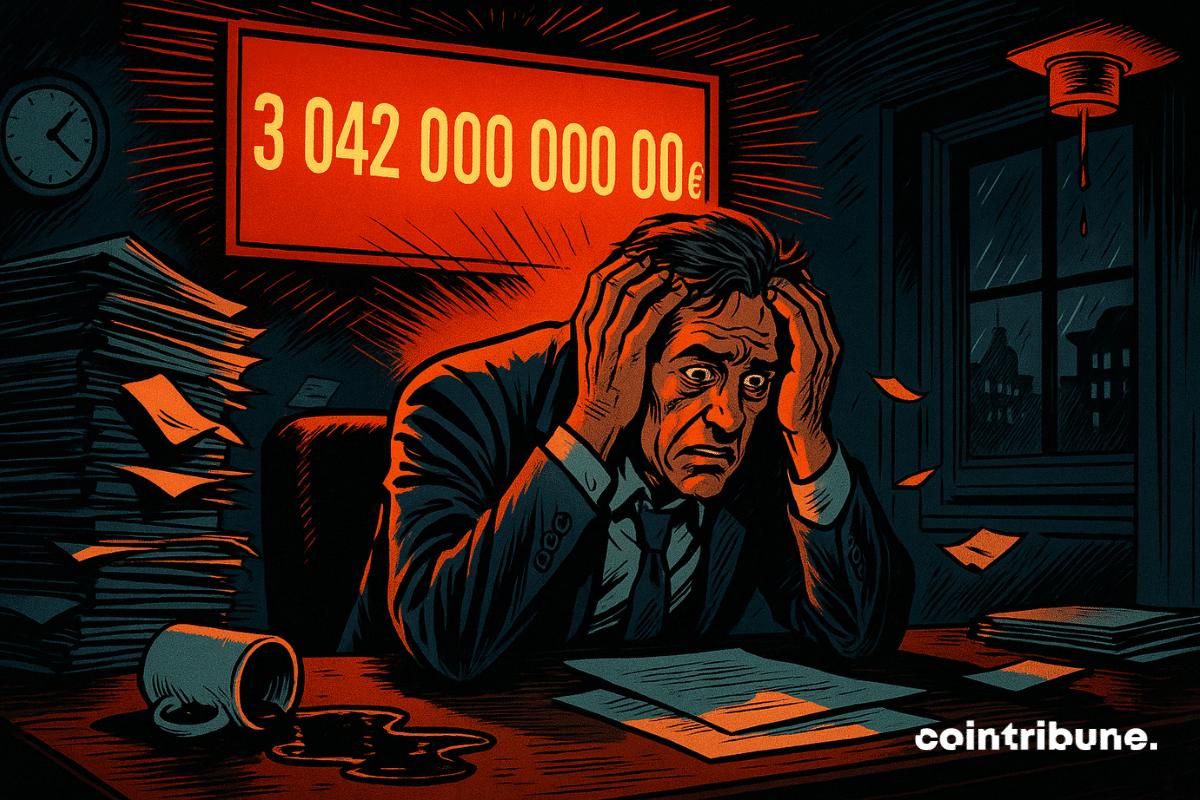

In France, public debt crystallizes political tensions, shocks the markets, and weakens budgetary sovereignty. With more than €3,400 billion to repay and sharply rising rates, the country faces an unprecedented risk. François Bayrou even raised the threat of being put under IMF supervision, while investors are beginning to doubt.

While inflation slows on a national scale, property owners do not escape the reality of the figures. Since August 25, the first property tax notices have arrived, with a national increase set at 1.7%. Indeed, behind this mechanical revaluation, much higher local increases are quietly added. This tax burden, far from being insignificant, reveals growing tensions between budget-pressured local authorities and already weakened taxpayers.

Kraken unfolds its roadmap and makes its own tour of France. Heading to marketplaces, village halls and provincial media libraries. The idea is simple, almost obvious: go where the French live, to talk crypto without filter or jargon, face to face. No cold keynote or impersonal livestream: a physical presence, concrete demonstrations, Q&A at eye level.

The Paris stock market rises by 0.76% as the Fed could ease its policy in response to the American economic slowdown.

While Bayrou struggles with the budget, Occitanie is mining convictions: France's local regions are flirting with crypto, and it could very well earn them more than a Livret A.