The SEC is taking a very close look at the Ethereum foundation and appears determined to categorize it as a "security," which would jeopardize ETF hopes.

Gary Gensler

Gensler emphasizes the importance of increased regulation in a rapidly growing crypto market, calling for more resources.

The SEC (Securities and Exchange Commission) has postponed its decision regarding the approval of BlackRock's Ethereum ETF.

While the debate rages on the legitimacy of bitcoin as a currency, SEC Chairman Gary Gensler recently highlighted distinctions between crypto and fiat currencies like the US dollar. His response once again resonates as a critique of Satoshi's invention.

The SEC delays approval of Ethereum ETFs, while predictions differ on potential future validation.

BlackRock wants an Ethereum ETF, but the SEC, the guardian of the rules, is delaying, leaving uncertainty hanging over the crypto future.

Despite the high-profile launch of ETFs, the bitcoin has returned to its level at the beginning of the year, above $40,000. Why?

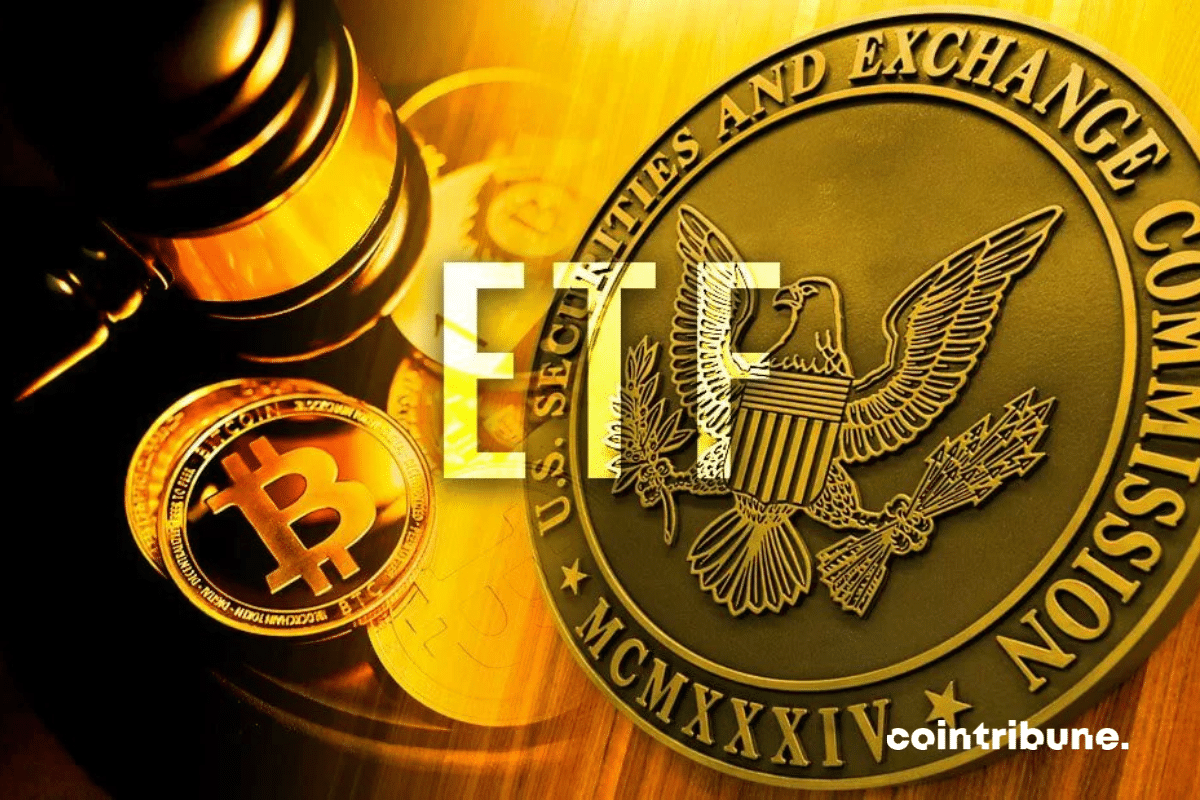

The power dynamics within the SEC are emerging. And after the Bitcoin ETF, eyes are already turning towards a possible Ethereum ETF.

The denial tweet from Gensler has been captured and transformed into a digital artwork, recorded as an ordinal on the Bitcoin blockchain.

The SEC's Twitter account has been hacked on the eve of its announcements regarding the Bitcoin ETF. A collection of hilarious reactions.

Yesterday, the United States Securities and Exchange Commission released information stating that Bitcoin ETFs had been approved. However, according to recent news, this announcement turns out to be false, even though it was disseminated on the official X account of the financial watchdog. Two hypotheses emerge: either the SEC’s account…

The race for Bitcoin ETFs has reached its climax, but Gary Gensler, the big boss of the U.S. Securities and Exchange Commission (SEC), has just issued a serious warning. Yesterday, via his Twitter account, he shared some crucial advice for those considering investing in crypto assets. Stay tuned to find out everything!

We are now 2 days away from the deadline set by the SEC for the approval of the first Bitcoin Spot ETFs. To date, this regulatory institution has not made a statement regarding these new financial instruments. In case you want to closely follow the progress of the situation, we…

The year 2023 has ended, but the case involving the SEC and Binance is not yet over. As recently as yesterday, the U.S. crypto regulator filed a notice of supplemental authority, inviting the court to consider a decision made in the SEC vs. Terraform Labs lawsuit. Binance's legal team has their work cut out for them once again.

Better to make a wise decision regarding Bitcoin spot ETFs than to wait for new congressional bills on cryptos.

Spot Bitcoin ETFs are at the heart of discussions lately. While some speculations revolve around a rejection or approval of these new financial products, others focus on the impact of trackers on BTC from a financial perspective. Indeed, more and more analysts do not dismiss the theory of a migration of fresh capital into the market after the SEC's green light. Gabor Gurbacs, an advisor at VanEck, provides some clarification on this subject.

The moment of truth is approaching. Will the SEC soon approve Spot Bitcoin ETF applications? Or will it go as far as to postpone its decision? Recently, issuers of similar requests have been increasing meetings with officials from this U.S. financial regulatory body. Gary Gensler and his team must be under pressure.

The SEC has lost and will continue to lose lawsuits, celebrates Ripple's lawyer.

The SEC is now out of options, according to pro-crypto law experts who have followed the case against Ripple from the start. However, the matter is not quite closed. Aside from the remediation phase in which the crypto company might pay a hefty fine, a new showdown before the Supreme Court could soon take place between the two parties.

The financial market is eagerly awaiting the possible approval of a bitcoin spot ETF. In this regard, Fidelity, Ark Invest, and Invesco have recently updated their requests with the SEC. This is in response to letters demanding clarification on the matter. The crypto community perceives this action as a positive sign of ongoing dialogue between the companies and the regulatory authority.

Rumor has it that the SEC is about to approve Ishares' Bitcoin ETF. Verdict tomorrow.

During a congressional hearing, SEC Chairman Gary Gensler reaffirmed that Bitcoin is not a security. However, he refrained from categorizing it as a commodity, leaving doubts about the exact classification of this flagship cryptocurrency.

In a climate of heightened anticipation, the crypto community eagerly awaits the SEC's verdict on Bitcoin spot ETFs. Several U.S. lawmakers, recognizing the significance of the matter, are actively urging the SEC to approve these ETFs without further delay.

In an interview, Gary Gensler stresses that we shouldn't underestimate AI's potential to cause future financial crises. He therefore calls for rigorous regulation to minimize the risks.

Scams, hacks, crackdowns, aggressive regularization… so many stories marring the crypto-sphere. When will these terrible nightmares end? No one has the answer yet. We might as well redouble our vigilance to avoid being fleeced by ill-intentioned project promoters like the scammers behind BALD.

Securities and Exchange Commission (SEC) Chairman Gary Gensler testified before the Senate during a session of the SEC's FY2024 Budget Subcommittee. During his speech, he raised important issues related to the regulation of the crypto sector, calling certain aspects “the Wild West”.

Ripple's battle with the SEC came to an end last week. While the settlement company must feel relieved, the regulator hasn't said its last word. If CEO Gary Gensler's statements are anything to go by, it's not all over yet.

Judge Analisa Torres believes that XRP is not a security. Basically, Ripple won its case against the SEC.

The SEC boss is extremely controversial among members of the crypto community. In fact, they are eager to see him go, whatever it takes. For the time being, they'll have to be content with seeing him remain in his position, and potentially continue to crack down on them.

The Hinman documents, previously held by a former SEC executive, are at the core of the legal battle between the SEC and Ripple. According to Ripple, their disclosure is crucial to the outcome of the case. The disclosure has finally happened but falls short of Ripple's expectations, leaving its executives disappointed.