The conflict between Israel and Iran raises fears of a major escalation, yet U.S. indices are flirting with their all-time highs. Following U.S. bombings in Iran, this situation could change very quickly, casting doubt on a sudden market collapse.

Israel

As they clash with missile strikes, Israel and Iran are launching attacks... on the blockchain. Nobitex has suffered from it, cryptocurrency hacked, propaganda unleashed.

While Israeli strikes target sensitive Iranian sites and Tehran responds with missiles on Tel Aviv, the military escalation is redefining balances in the Middle East. However, a strategic absence intrigues: that of the BRICS. A newcomer to the bloc, Iran was counting on solid support against its sworn enemy. Yet neither Moscow, nor Beijing, nor New Delhi are committing. This silence exposes the limits of an alliance that Tehran saw as a counterweight to Western hegemony.

With $1 billion invested, Strategy boosts its bitcoin yield to 19%. A profitable or dangerous strategy? Experts are questioning!

June 13, 2025 marks a turning point in the Iran-Israel conflict. Massive Israeli strikes targeted the heart of the Iranian military infrastructure. Iran retaliated later that evening with 300 ballistic missiles, crossing a new threshold in this long-standing war.

As tensions mount between Israel and Iran, Michael Saylor revives the machine. The co-founder of Strategy (formerly MicroStrategy), a fervent advocate of bitcoin, suggested this weekend a new massive purchase of BTC. This announcement comes in an explosive context, with targeted strikes in Tehran and risks of regional escalation. Against the grain of traditional markets, Saylor confirms his accumulation strategy, once again defying the logic of cycles and crises.

In just a few hours, cryptocurrencies have faltered under the weight of a major geopolitical event. Following Israeli strikes in Iran, over one billion dollars in positions were liquidated, taking with them the market's recent gains. This is not just a simple episode of volatility, but a tangible sign that these assets, which stem from a promise of sovereignty, remain exposed to real-world shocks.

Missiles in the Middle East, markets in turmoil: while the economy catches a cold, some are making a fortune off barrels... and others prefer to flee into solid gold. Guess who is pulling the strings?

Geopolitical tensions in the Middle East have once again shaken the crypto markets. Bitcoin sharply dropped below the psychological barrier of $105,000 after Tel Aviv claimed a series of attacks against Iran. This spectacular decline raises the question: does Bitcoin really deserve its status as a safe-haven asset?

The Middle East is currently undergoing a profound reconfiguration of its alliances and historical rivalries. The gradual collapse of the Syrian regime and the weakening of Iran are reshuffling the cards in an already unstable region. This new dynamic is bringing Turkey to the forefront as a regional expansionist power, potentially pushing Israel and certain Arab countries towards an unprecedented alliance.

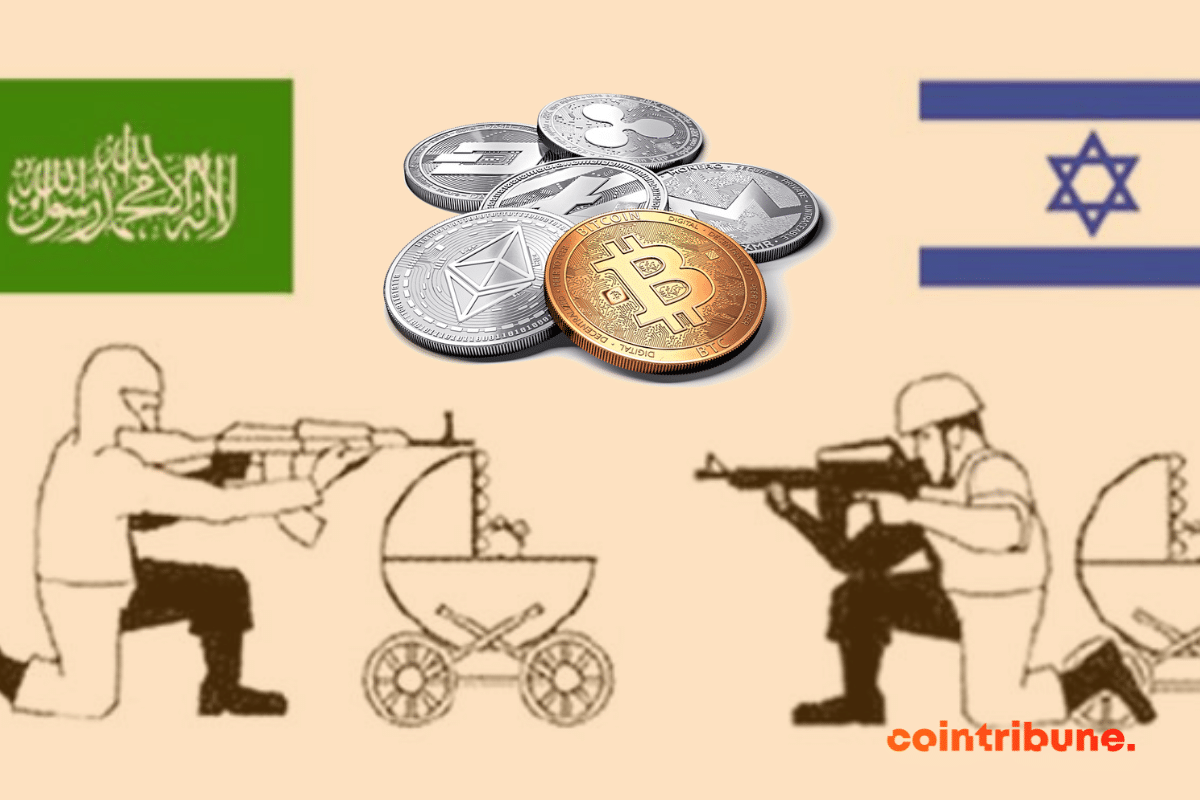

The world's largest cryptocurrency exchange is facing new accusations, this time regarding alleged links to Hamas. During a hearing in federal court in New York on January 30, Binance firmly rejected these allegations, seeking the dismissal of a complaint filed by the families of the victims of the October 2023 attacks.

The return of Donald Trump to the White House in January 2025 marks a historic break in American politics. In less than a week, the president signed 78 decrees affecting various areas such as domestic policy and international aid.

The Syrian regime of Bashar al-Assad is on the verge of collapsing after 13 years of civil war, and it changes absolutely everything!

Israel is today governed by extreme right-wing millenarian fanatics. In short, fascists.

The conflict between Israel and Iran, reignited by a series of military attacks, is shaking the region as well as global markets, particularly the crypto market. In a context where volatility is often the watchword, Bitcoin seems to be more sensitive than ever to geopolitical events, experiencing a new drop of 4% on October 4, which draws the attention of investors worldwide.

As the Middle East goes up in flames, Bitcoin stumbles. Gold, on the other hand, sparkles like a Napoleon found under a mattress.

After the Israeli attack on Iran, Bitcoin and other crypto assets took a hit before partially rebounding!

The Iran-Israel tension influences the markets: gold rises, oil fluctuates. What are the repercussions on the stock market and the oil sector?

Brazil, one of the founding countries of BRICS, has just broken its bilateral relations with Israel. The cause is a statement by Brazilian President Lula da Silva on the war being waged by the Israeli state in the Gaza Strip.

Iran has recently called on the BRICS to establish a common currency to replace the dollar. This challenge to the dollar by Iran, but also increasingly by Saudi Arabia, explains why the Americans want to put an end to the Iranian regime. The end of the petrodollar would no longer allow the United States to finance its monstrous deficits through other countries.

L'embargo maritime Israël pourrait raviver l’inflation et enlever momentanément un facteur de hausse pour le bitcoin.

Following the recent attacks funded by Hamas through crypto, European lawmakers are considering tightening regulations by imposing identity verifications for all cryptocurrency transactions, even those below €1,000.

It's going to be a “long and painful” war, warned Israeli Prime Minister Benjamin Netanyahu last Sunday. Following the series of deadly surprise attacks by Hamas last Saturday, the world is inexorably witnessing yet another bloody Israeli-Arab conflict. At present, provisional reports indicate more than 700 deaths and 2,000 injuries on the Israeli side and approximately 400 deaths on the Palestinian side. Strangely, the 'Al-Aqsa deluge' has not yet affected the cryptocurrency market. However, the crypto community remains on alert.

Entre le tumulte et le déchirement d’un conflit ancien et persistant, le monde observe, souvent impuissant, la dévastation au Proche-Orient. Cependant, dans ce tourbillon de tragédies et de violences, le Bitcoin demeure un roc apparemment inébranlable, dont la résilience interpelle autant qu’elle étonne.

You may have noticed that the financial markets have been at a standstill for several weeks. In the midst of this quiet time, some people are taking their time to build the successes of tomorrow. This is particularly true for the Israeli singer Omer Adam, singer of the worldwide hit Tel-Aviv who has made his first steps in the Web3. We have had the opportunity to exchange a few words with him and to go over his collaboration with the French company Stage11.