JPMorgan will allow institutional clients to use Bitcoin and Ethereum as collateral for loans, marking a major step in mainstream crypto adoption.

JPMorgan Chase

Despite a correction of more than 4% after a historic peak at $126,219, bitcoin maintains a solid bullish momentum, supported by robust institutional fundamentals. Massive flows to ETFs and renewed Wall Street confidence paint the picture of a maturing market. From Citibank to JPMorgan, the giants of American finance now anticipate a rise to $150,000 by December.

Blockchains are maturing but losing cash. Less volatility, less revenue: is crypto growing up... or just getting seriously bored?

Economy: JPMorgan anticipates tensions on the Fed and integrates stablecoins without fearing for its deposits. We tell you more here!

S&P 500 rejected Strategy’s inclusion despite its Bitcoin holdings, with JPMorgan calling it a blow to crypto treasuries.

Bitcoin is currently undervalued according to JPMorgan. In a note signed by analyst Nikolaos Panigirtzoglou, the American bank estimates that BTC should reach 126,000 dollars by the end of the year, given its historically low volatility. As its risk-return profile approaches that of gold, bitcoin may be entering the most critical phase of its institutional adoption. This is a projection full of meaning for major capital allocators.

While the market watches ETFs and bitcoin monopolizes headlines, another dynamic, less noisy but more structuring, is underway: the rise of stablecoins. Backed by fiat currencies, these long secondary assets are becoming the backbone of the new digital finance. And at the heart of this transformation, one player stands out: Ethereum. The network is on track to become the central infrastructure of the tokenized monetary system.

The U.S. Federal Reserve could initiate a major shift as early as September with a first reduction in its key rates. A scenario now considered by several large banks, including Goldman Sachs, which reshapes the outlook for financial markets. For crypto investors, faced for months with a restrictive monetary context, this expected pivot could rekindle the appetite for risk and serve as a catalyst for a new bullish cycle.

JPMorgan and Coinbase team up to let Chase customers buy crypto with cards and link bank accounts to Coinbase wallets.

Faced with the persistent uncertainties of traditional markets, cryptocurrencies are establishing themselves as a strategic refuge. In 2025, flows into these assets reached an unprecedented threshold: 60 billion dollars injected since January, according to JPMorgan. This astonishing 50% increase since May confirms an unprecedented institutional dynamic. Such a turning point redefines the balance of capital and illustrates the increasing normalization of cryptocurrencies in the financial universe.

JPMorgan Chase is reportedly exploring a new lending product that would allow clients to borrow against their crypto holdings. According to sources cited by the Financial Times, the U.S. banking giant is in internal discussions to launch crypto-collateralized loans, potentially as early as next year. The plan would let clients use cryptocurrencies such as Bitcoin, Ethereum, or even crypto-focused ETFs as collateral in exchange for cash or credit. While still in its exploratory phase, the product would be JPMorgan’s clearest signal yet that it is taking crypto seriously.

JPMorgan and Citigroup are stepping into the stablecoin space as fintech competition intensifies and U.S. lawmakers push ahead with new crypto regulations under the GENIUS Act, signaling a broader shift in traditional banking.

JPMorgan Chase is finally realizing its crypto ambitions with the launch of JPMD. After filing its trademark application earlier this week, the bank is launching its "deposit token" on Coinbase's Base. How does this token work, and what issues are at stake behind this strategic choice?

While Trump rakes in millions in home tokens, the Senate blesses stablecoins. New digital dollar or old electoral trick? A deep dive into the American crypto theater.

The American banking giant JP Morgan has just filed a mysterious trademark application called "JPMD" with the U.S. Patent and Trademark Office. This initiative fuels speculation about a potential new stablecoin. But what is this discreet move really hiding?

JPMorgan, long hesitant about cryptocurrencies, marks a major turning point in the banking sector. The American bank announces the integration of Bitcoin ETFs as loan collateral, a decisive step towards the adoption of these assets. As regulation takes shape and institutional investor interest grows, this evolution could redefine the relationship between traditional finance and blockchain. This change signals a new era for financial products, placing cryptocurrencies at the heart of mainstream banking services.

Boom or bubble? AI will sweep all in its path in 2025, attracting capital and desire. Boosted startups, crazy valuations... But how far will this fever go? A surprising parallel with bitcoin could change everything.

JPMorgan's CEO, Jamie Dimon, tears apart bitcoin in the midst of geopolitical turmoil. In his view, it is better to stockpile missiles than cryptocurrencies. A stance that shakes the White House... Bitcoin: digital hope or strategic mirage?

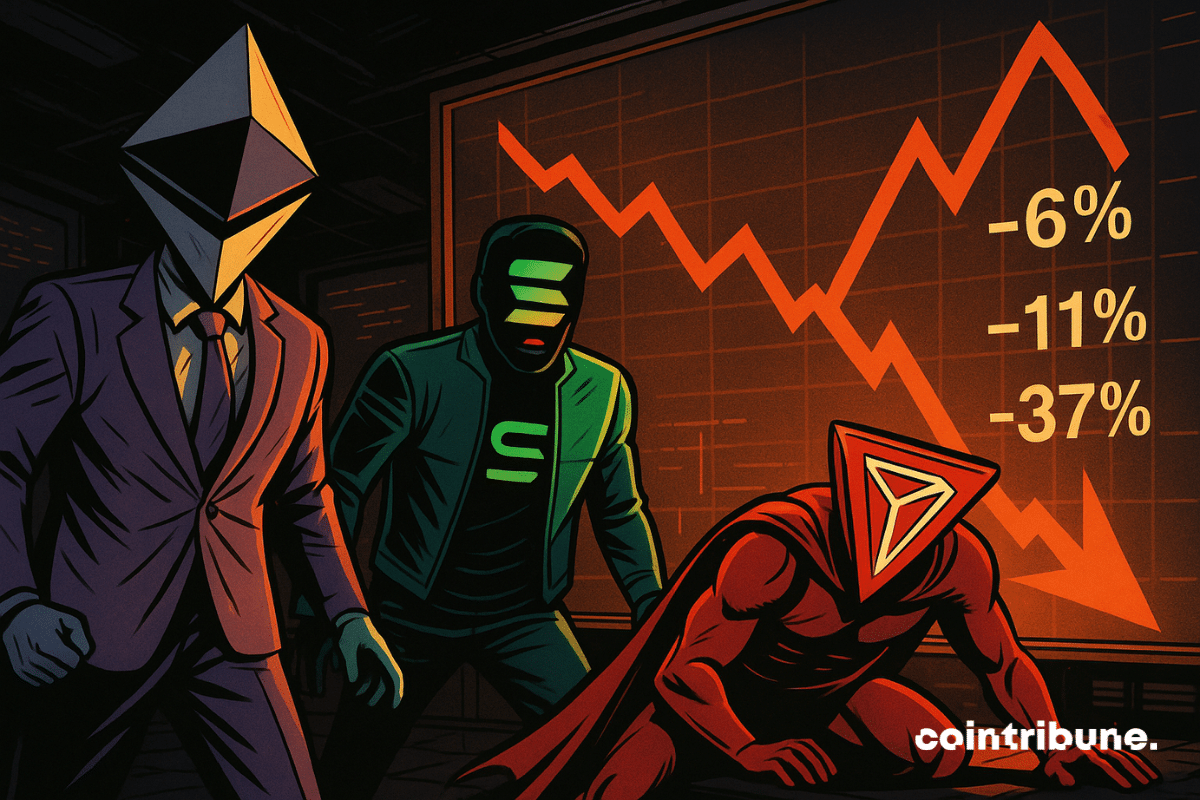

Recent technical improvements to Ethereum struggle to convince JPMorgan analysts. Despite promising innovations and a renewed institutional interest, on-chain activity remains desperately low. Should investors be concerned about this stagnation?

The world of traditional finance has just experienced a decisive turning point. Jamie Dimon, one of the most vocal critics of bitcoin, has finally capitulated. This spectacular turnaround by the CEO of JPMorgan Chase signifies much more than just a change in business strategy: it is the entire financial establishment that is reluctantly acknowledging the growing legitimacy of Satoshi Nakamoto's invention.

JPMorgan crushes forecasts but tempers euphoria. Through the publication of historical results for the first quarter of 2025, the leading American bank asserts its power amid ongoing volatility. However, Jamie Dimon is not celebrating victory. He warns of an accumulation of systemic risks, from inflation to geopolitical tensions. This dual signal, between accounting triumph and strategic warning, summarizes the paradoxes of a banking sector facing an uncertain world.

Is Bitcoin losing its status as "digital gold"? JPMorgan reveals a massive shift toward gold. Details here!

Financial markets do not only react to numbers but also to the feelings and expectations of investors. In the crypto universe, where volatility is the norm, every signal emitted by a major institution can influence trends. This time, it is JPMorgan that makes a splash: the American bank believes that the Bitcoin and Ethereum markets are facing an increased bearish risk due to a disengagement of institutional investors. Such an analysis is based on the evolution of CME futures contracts, which show signs of critical weakness.

Crypto: Tether strikes back after JPMorgan's predictions of a massive Bitcoin sell-off. Should we be worried? Analysis.

A new survey by JPMorgan reveals that the majority of institutional investors remain hesitant about cryptocurrencies, despite the improving regulatory framework in the United States. Only 29% of participants are active or plan to engage in this market.

The year 2025 is shaping up under favorable auspices for the global economy, despite ongoing challenges. As recession fears fade and inflation begins to normalize, several indicators suggest a positive momentum for the months ahead.

JPMorgan Chase CEO Jamie Dimon is reportedly providing behind-the-scenes support to Vice President Kamala Harris, even considering a position as Treasury Secretary in a potential Harris administration, the New York Times reveals. This discreet stance, maintained out of fear of retaliation in the event of a Donald Trump victory, highlights the complexity of the relationship between Wall Street and American politics in 2024.

In a volatile context, JPMorgan analysts identified in a report the key elements likely to influence the upcoming weeks for Bitcoin, Ethereum, and the entire crypto market. These observations are particularly relevant at a time when regulation, monetary policies, and technological advancements converge to reshape an ever-changing ecosystem.

The giants of finance such as JP Morgan and Wells Fargo announce increasing exposure to Bitcoin ETFs, reflecting a shift in perception of Bitcoin by traditional financial institutions.

The American bank JPMorgan Chase has stated that it holds shares in several Bitcoin spot ETFs, including those offered by Grayscale, ProShares, Bitwise, BlackRock, and Fidelity, for a total amount of approximately $760,000.