A solo miner used rented on-demand hashrate to mine a rare Bitcoin block, earning 3.125 BTC worth around $200,000.

Mining

Bitdeer Technologies has fully liquidated its corporate bitcoin holdings, reporting zero BTC on its balance sheet as of Feb. 20. A weekly production update posted on X confirmed the move. The decision marks a sharp break from common industry practice, where most listed miners continue to accumulate or hold reserves. It also comes at a time of tightening mining margins and the company's recent capital raises.

MARA makes a big move by taking control of 64% of Exaion, EDF's technological gem. A strategic acquisition marking the end of traditional Bitcoin mining and the start of an era dominated by artificial intelligence (AI).

While the bitcoin price struggles to regain its peaks, the network itself shows robust health. The mining difficulty has just recorded its largest increase since 2021, a paradox worth examining.

Bitcoin miners have no money left. So they promise 30 GW to AI. Problem: only 11 GW actually exist. The rest is air. But it looks nice.

Starboard urges Riot to move faster in using its power capacity for AI and high-performance computing, pointing to sites that could unlock up to $21 billion in value.

Bitcoin is going through one of its toughest phases in months. Nearly half of the circulating supply is at a loss, ETFs are bleeding billions, and yet — miners and long-term holders refuse to give in. Should this be seen as a sign of hope, or simply the denial of a market that has not yet hit bottom?

Payments firm Block Inc. has begun notifying hundreds of employees that their roles could be cut during annual performance reviews. As per reports, the move is part of a broader restructuring as the company adjusts its business focus. Workforce changes may affect up to one in ten staff members. Management is pushing to align teams with revised product priorities and cost targets.

The Bitcoin network has just absorbed a major technical shock. Its mining difficulty has dropped by 11.16%, the biggest decrease recorded since the mining ban in China in 2021. This sharp decline, revealing structural tensions, renews concerns about the system's robustness and the growing pressure on mining companies. While difficulty is supposed to guarantee protocol stability, its current plunge acts as a silent warning about the network's real state and the resilience of its infrastructure.

BitRiver founder Igor Runets is under house arrest as the company struggles with debt and operational challenges.

Tether launches an open-source system for bitcoin mining, marking a major breakthrough in the global crypto infrastructure.

The Bitcoin network is faltering in the face of the American winter. In January, an extreme cold wave paralyzed part of the territory of the United States, causing a sharp slowdown in mining activity. As the United States now concentrates a large share of the global hashrate, this episode highlights the sector's dependence on local energy infrastructures. The sudden drop in production raises questions about the network's real ability to withstand climate shocks and the limits of a model nonetheless considered resilient.

AI data centers nibble away at electricity and the patience of local residents: the same recipe as with bitcoin, but wrapped in a well-oiled progress discourse.

While US markets showed mixed signals this Friday, another trend emerged on the sidelines of major indices: the strong rise of shares linked to bitcoin mining. This contrast with the Nasdaq’s dynamic and the Dow’s decline raises questions about a possible repositioning of investors towards crypto-correlated assets, ahead of key economic decisions. A careful reading of these movements reveals much more than a simple technical variation.

Why has the Bitcoin hashrate just fallen below the symbolic threshold of 1 zettahash per second? Are miners abandoning the network for more profitable AI (artificial intelligence)? A silent battle is redefining the future of mining and blockchain.

Bitcoin mining loves podiums. One number climbs, another falls, and the ecosystem tells itself a simple story. Except that in this industry, the way you count matters almost as much as the machines. And that’s exactly what makes the “Bitdeer moment” interesting. Bitdeer claims to have reached 71 EH/s of…

While Bitcoin naps, BitMine stacks ETH: one million staked, billions locked... and an ambition that would make even traditional finance blushing on Ethereum drip.

Russia is moving to impose tougher penalties on illegal cryptocurrency mining after officials reported low compliance with new registration rules. A draft bill from the Justice Ministry proposes fines, forced labor, and prison terms for miners operating outside the law. Officials say the measures are intended to bring a rapidly expanding sector under state oversight and into the tax system.

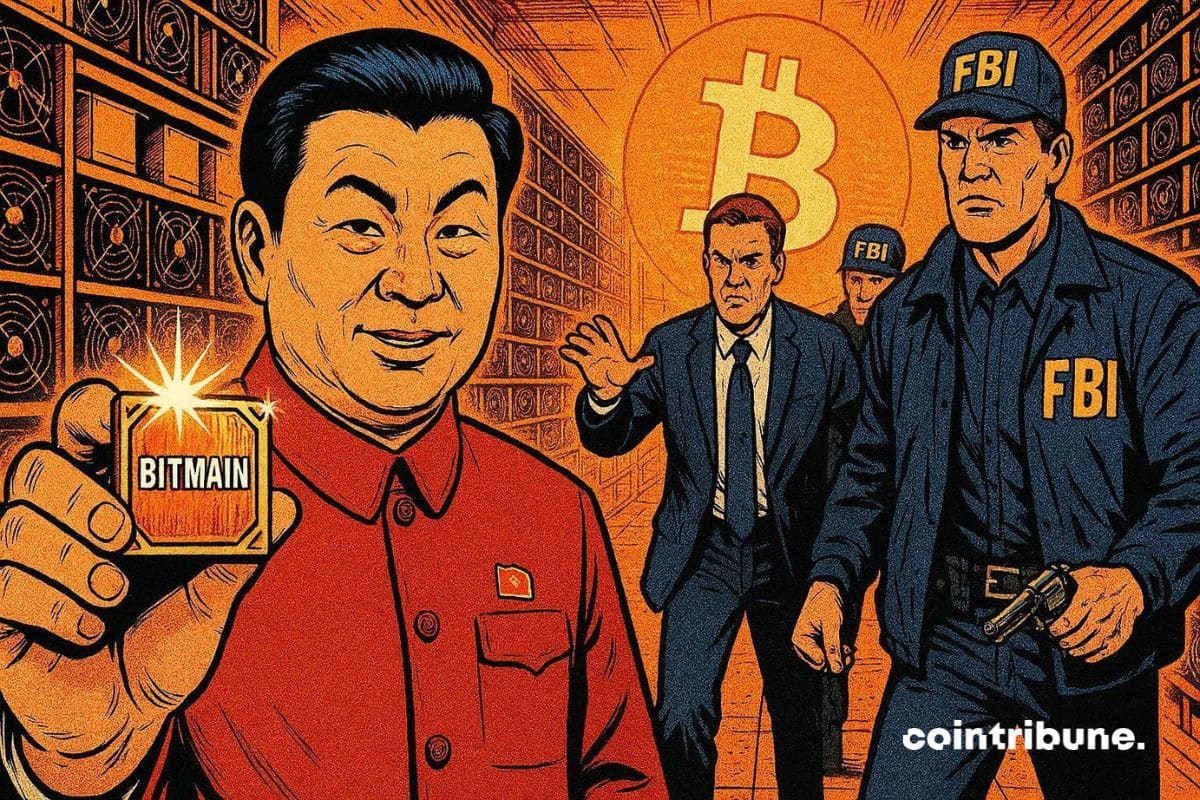

Bitmain, the world's leading manufacturer of mining machines, has launched a series of exceptional discounts on its equipment, including its latest models. This decision comes in a context of strong pressure on the sector: decline in hashprice, bitcoin crash, profitability in decline. Far from a classic commercial strategy, this operation reflects the tensions that the mining ecosystem is going through. Thus, the market leader is looking to quickly clear its stock.

Cryptocurrency mining in Russia is helping support the ruble, with officials noting its growing role in the economy and financial flows.

Reports of a renewed crackdown on Bitcoin mining in China’s Xinjiang region triggered concern across crypto markets this week. Early claims warned of severe hashrate losses and widespread shutdowns. Mining data reviewed after the initial reaction suggests, however, that the impact was brief and far smaller than first reported.

For the first time in six weeks, institutional bitcoin purchases surpassed the supply coming from mining. This subtle reversal, revealed by CryptoQuant data, occurs in a market undergoing consolidation, marked by a retreat of retail investors.

As the Bitcoin network crosses the zetahash threshold, the profitability of mining companies collapses. The hash price has fallen below 40 dollars per PH/s/day, a critical level that threatens the viability of many players. Faced with this paradox, companies in the sector are redirecting their strategies towards renewable energies. However, behind the ecological argument, it is an economic survival logic that dominates, revealing a profound transformation of the mining energy model.

Bitcoin has just crossed $91,000, but the euphoria is not spreading to all market segments. Mining company stocks fell 1.8% over the week, while trading volumes dropped 25%. This decline reflects less a simple technical pause than a deeper malaise in a sector weakened by rising production costs.

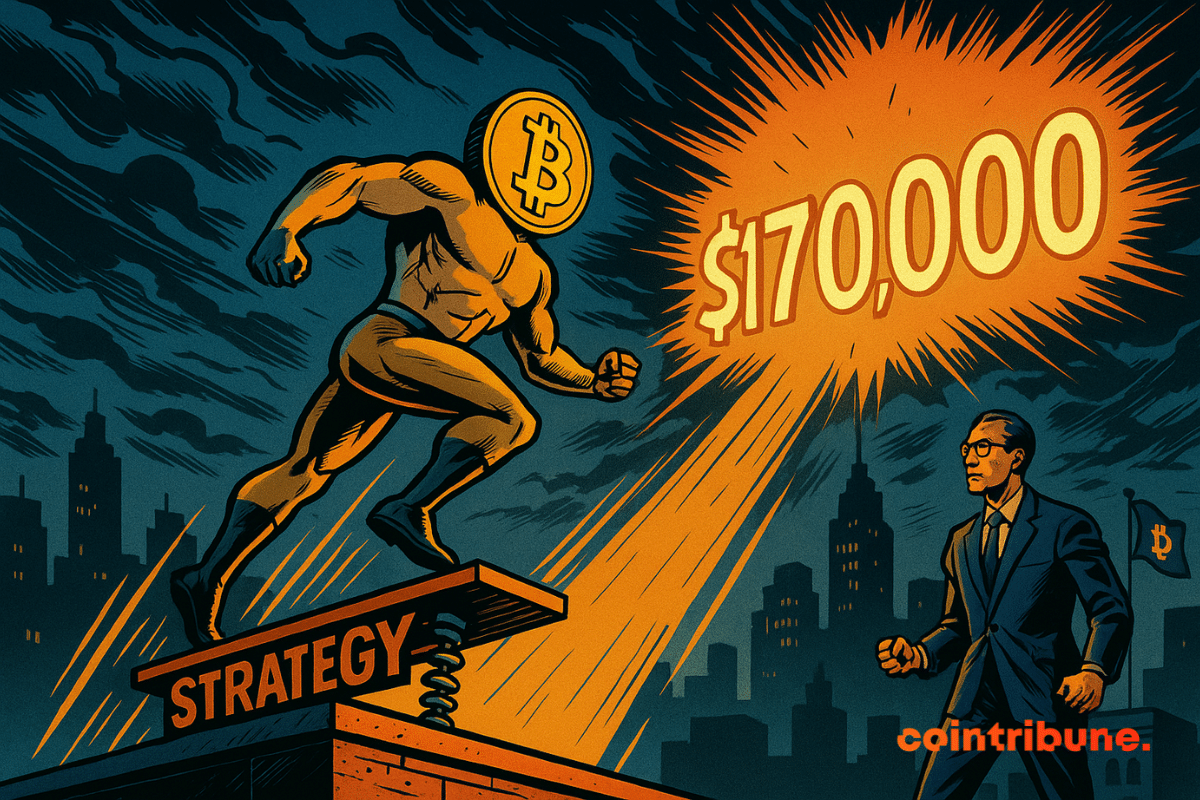

When a company named Strategy becomes the compass of bitcoin, even JPMorgan takes out its calculator. Bull run or crash? The answer lies between MSCI, reserves, and a few well-placed billions.

Bitcoin is collapsing, miners are coughing, and some flee to AI: when digital gold turns into an electric burden under maximum stress!

Bitcoin tumbles, miners migrate to AI. Microsoft pays, stocks rise… But their profits? Still striking. The future is now written between cloud and a gamble.

Banned but coveted, China plays it cool and reconnects its bitcoin machines. Silence in Beijing, but business is booming in provinces where electricity costs nothing.

A solo Bitcoin miner defied the odds to secure a rare block, earning 3.146 BTC worth around $266,000.

Bitmain, Chinese giant of Bitcoin mining, raises concerns in Washington. A secret investigation reveals fears of espionage and sabotage via these ultra-dominant machines. At stake: American security, the interests of the Trump family, and the future of crypto-mining.