The French make USB keys, the Americans make billions: Ledger crosses the Atlantic, hoping Wall Street will finally open the vaults of global crypto-finance for it.

Theme Payment

In 2025, bitcoin was not content to be just a store of value. It established itself as a central tool in digital payments. According to a Coingate report, it dominates the market again with 22.1% of transactions, driven by increasing adoption by businesses. This renewed interest marks a strategic turning point. Crypto is no longer on the sidelines, it is now integrated into real economic flows.

Central bank digital currencies (CBDCs) are set to redefine the global financial system, and India proposes an ambitious project for the BRICS countries. By aiming to interconnect CBDCs, the initiative could simplify cross-border payments and strengthen the integration of sovereign digital currencies in international trade. This advance, led by India, could transform economic relations among BRICS members and redefine global geopolitical dynamics.

Steak ’n Shake is positioning Bitcoin as both a customer payment option and a long-term treasury asset, signaling a deeper integration of cryptocurrency into its business model. The fast-food chain reported that its corporate Bitcoin holdings increased by $10 million in notional value, fueled by customer payments and rising same-store sales.

Polygon sacrifices 30% of its team to dominate crypto payments. We give you all the details in this article.

Société Générale, through its subsidiary SG-Forge, and the SWIFT network have just taken a major step forward in integrating blockchain with traditional finance. Together, they executed the settlement of tokenized bonds using a stablecoin backed by the euro, the EUR CoinVertible. This unprecedented experiment, compliant with the European MiCA framework, marks a key milestone towards concrete interoperability between classic banking systems and cryptos.

At Visa, it's no longer a toss-up with crypto: 91 million later, the card becomes the new favorite toy of decentralized financiers. To be continued…

While stablecoins have gained more than $100 billion in 2025 to peak at $307 billion according to DefiLlama, India is taking the opposite direction. The Indian central bank (RBI) states that only a sovereign digital currency guarantees monetary stability. In a global landscape where CBDCs struggle to impose themselves, New Delhi erects the e-rupee as a bulwark against the privatization of money.

Miami, Florida, USA — As blockchain payments gain enterprise adoption, privacy has become a critical requirement rather than a feature. Addressing this shift, Fhenix introduced Privacy Stages — a new framework for assessing onchain privacy — and demonstrated its capabilities through Fhenix402, a private implementation of Base’s x402 payments that makes transaction amounts fully confidential while remaining fast and intuitive.

The American dollar has lost 10.41% of its value over this year. A significant drop for the world's main reserve currency, amidst economic tensions and loss of confidence. Meanwhile, gold and silver have seen spectacular rises, becoming safe haven assets again. This movement reflects a shift in market balance, where the role of the dollar as a safe haven is increasingly challenged.

December 26, 2025 — Global cryptocurrency trading platform Zoomex today announced the official early registration for its latest payment product, the Zoomex Card.

The banknote arrives by container? The archipelago will draw its crypto. Meanwhile, Stellar slips tokens into the State's pockets. The IMF is counting the hours.

Tempo, the new Stripe-backed layer-1 blockchain, has launched its public testnet, offering stablecoin-native features, instant settlement and new tools for developers.

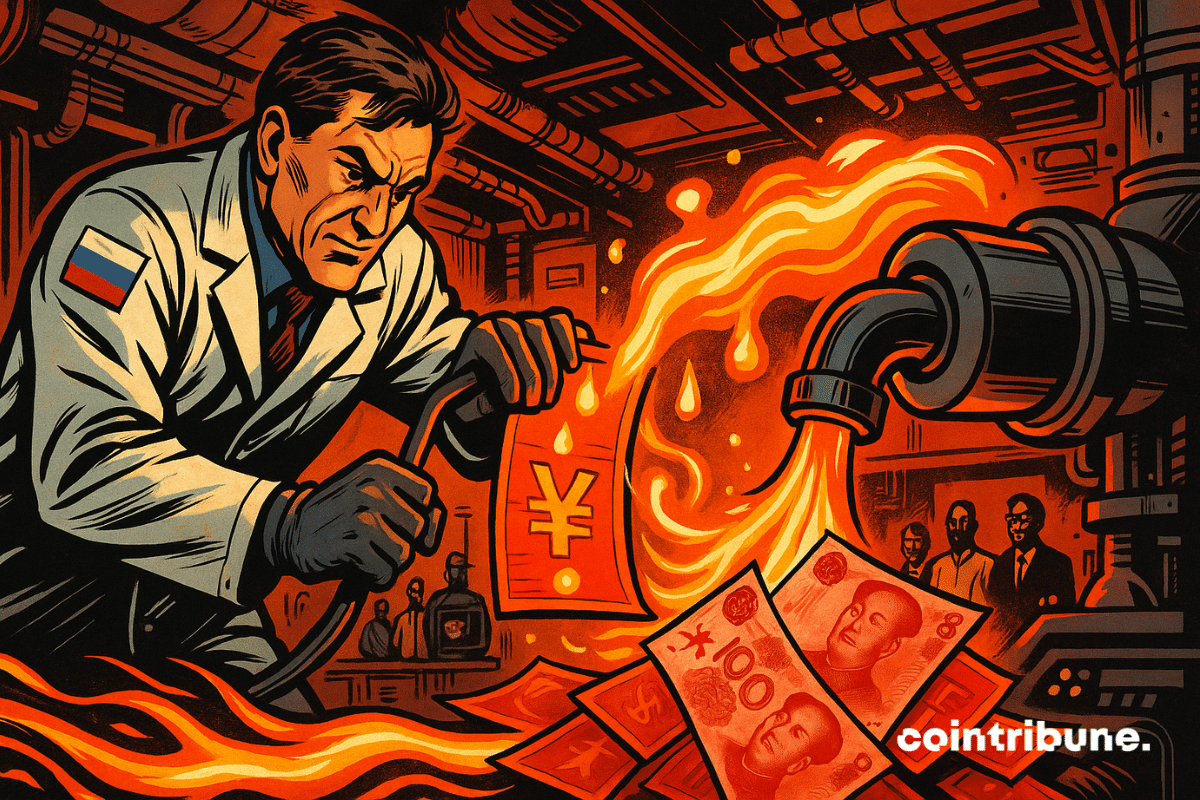

Faced with a colossal budget deficit and persistent Western sanctions, Moscow is ready to cross a historic milestone: issuing sovereign bonds denominated in yuan for the first time. More than a mere financial maneuver, this decision marks a strategic turning point towards a deliberate dedollarization and strengthened monetary integration with the BRICS. By betting on the Chinese currency, Russia aims both to stabilize its public finances and to structure a new circuit for its energy revenues outside Western channels.

Mastercard and Polygon make crypto transfers easier by replacing long wallet addresses with short, verified usernames for safer, simpler transactions.

What if the real economic threat was neither inflation nor rates, but a global liquidity collapse? This is the alert issued by Robert Kiyosaki, author of the bestseller Rich Dad, Poor Dad. In a series of messages on X, he claims that markets are wavering not because of fragile fundamentals, but because the world is severely lacking cash. A shortage that, according to him, could trigger a new wave of money printing with unpredictable consequences.

Visa is taking another major step in digital payments with a new pilot program that allows U.S. businesses to send stablecoin payouts directly to crypto wallets. Announced at the Web Summit in Lisbon, the initiative connects traditional bank accounts to blockchain-based transfers, aiming to speed up cross-border payments and support the expanding freelance economy.

By promising $2,000 per American, funded by tariffs, Donald Trump shakes up budgetary rules. Without waiting for legal approval, risky assets, led by crypto, are already anticipating the impact of such an injection. This political move, resembling a unilateral stimulus, triggers as much hope as doubt, between populist drift and speculative catalyst.

While central banks accelerate their digital currency projects, a statement disrupts the financial landscape: "money will be entirely digital." These words, spoken by Bill Winters, CEO of Standard Chartered during the Hong Kong FinTech Week 2025, outline the contours of a cashless future anchored on the blockchain. This is not just a technical evolution, but a structural shift in the global monetary system, which major institutions now seem to consider inevitable.

As the global monetary balance is reconfigured under the pressure of digital technologies and sovereign ambitions, Europe goes on the offensive. On October 29, the ECB approved a new technical phase of the digital euro project, the cornerstone of a future European payment system. The goal is to launch, by 2029, a public digital currency capable of competing with private solutions and foreign initiatives, while ensuring monetary control within the euro area.

U.S. bank Citi is taking a decisive step into digital payments by joining forces with Coinbase to pilot stablecoin transactions. The partnership marks a turning point in Wall Street’s embrace of blockchain-based money, following the U.S. GENIUS Act's approval earlier this year. As the stablecoin market heads toward a projected $4 trillion valuation by 2030, Citi’s move positions it at the forefront of institutional adoption.

In the midst of budget paralysis, the US public debt reaches 38 trillion dollars, a historic record. This threshold, revealed by the Treasury, raises questions about the budget trajectory of the United States, as monetary policy remains under pressure and crypto regulation remains unclear.

While cryptos wreak havoc in pockets and ideas, Francophone Africa plays a digital card... but wouldn’t this revolution have a little hint of the euro?

The dollar, the cornerstone of the global financial system, once again finds itself at the heart of a geopolitical controversy. Donald Trump accuses the BRICS of wanting to undermine its supremacy. In response, the Kremlin firmly denies any intention of destabilization, stating that the alliance does not target any foreign currency. Behind this tense exchange, one question remains: are the BRICS quietly working to reshape the global monetary order, or is this an alarmist reading of the ambitions of this emerging bloc?

Faced with a global financial system dominated by Washington, the BRICS are accelerating the implementation of an alternative payment network: BRICS Pay. This project, supported by a bloc expanded to ten countries, aims to reduce dependence on SWIFT and US sanctions. More than a simple technical initiative, it is a strategic bet to reshape the global monetary order and assert financial sovereignty in a world that has become multipolar.

The European Central Bank (ECB) is moving forward with preparations for a possible digital euro, marking another step in its ongoing multi-year project. In a recent notice, the ECB has signed agreements with several technology firms to develop key components of a potential digital currency. Although no final decision has been made, the groundwork underscores Europe’s push to modernize payments.

Strasbourg could soon become the first major French city to adopt a municipal crypto. What was yesterday reserved for Web3 activist circles is now entering the local public debate. The City Council has adopted an unprecedented motion: to study the feasibility of a local digital currency. The goal is to explore new economic, social, and technological avenues. An unprecedented initiative for a major French metropolis, which explores digital levers serving the local economy and citizen participation.

While Europe accelerates towards digital payments and prepares the digital euro, the ECB creates a surprise. It recommends keeping cash at home. This injunction reveals a reality too often overlooked in official speeches: the fragility of digital systems in the face of crises. Such a deliberate return to cash does not mark a step backwards, but a clear anticipation of systemic risks, between outages, geopolitical tensions and cyberattacks.

World Liberty Financial appears poised to build on its market entry by pursuing utility-focused growth. The crypto venture, backed by the Trump family, has outlined plans to issue a debit card and retail application, as per recent reports.

Promised for 2026, the digital euro is already causing waves: Lagarde sees sovereignty, Navarrete calls it a useless gadget, and banks fear a digital bank run.