Unusual Polymarket bets on Maria Corina Machado surged hours before the Nobel Peace Prize announcement, raising suspicions of insider trading.

Prediction Market

As the crypto market collapses, BNB hits a record at $1,370. Discover all the details in this article!

Investor sentiment around Bitcoin is heating up once again, driven by renewed market optimism and bullish projections from key industry figures. A recent social media poll conducted by MicroStrategy CEO Michael Saylor has become a focal point for discussions about Bitcoin’s year-end potential. Amid growing institutional interest and other positive metrics, many market participants are betting on a strong year-end finish for the firstborn coin.

Despite a 19% increase, Solana raises concerns: massive sales and a drop in new crypto addresses undermine the momentum. Details here!

The possibility of a U.S. government shutdown is dominating prediction markets, with traders betting heavily on the outcome. Platforms like Kalshi and Polymarket show a strong consensus that negotiations in Washington are unlikely to deliver a deal in time. Rising volumes and market probabilities above 85% suggest that participants see a shutdown as the most likely outcome.

Tether is on a trajectory that could elevate it to become the most profitable crypto company in history. All the details here!

The crypto market finds bullish momentum again. Some altcoins benefit from massive short covering. Details in this article!

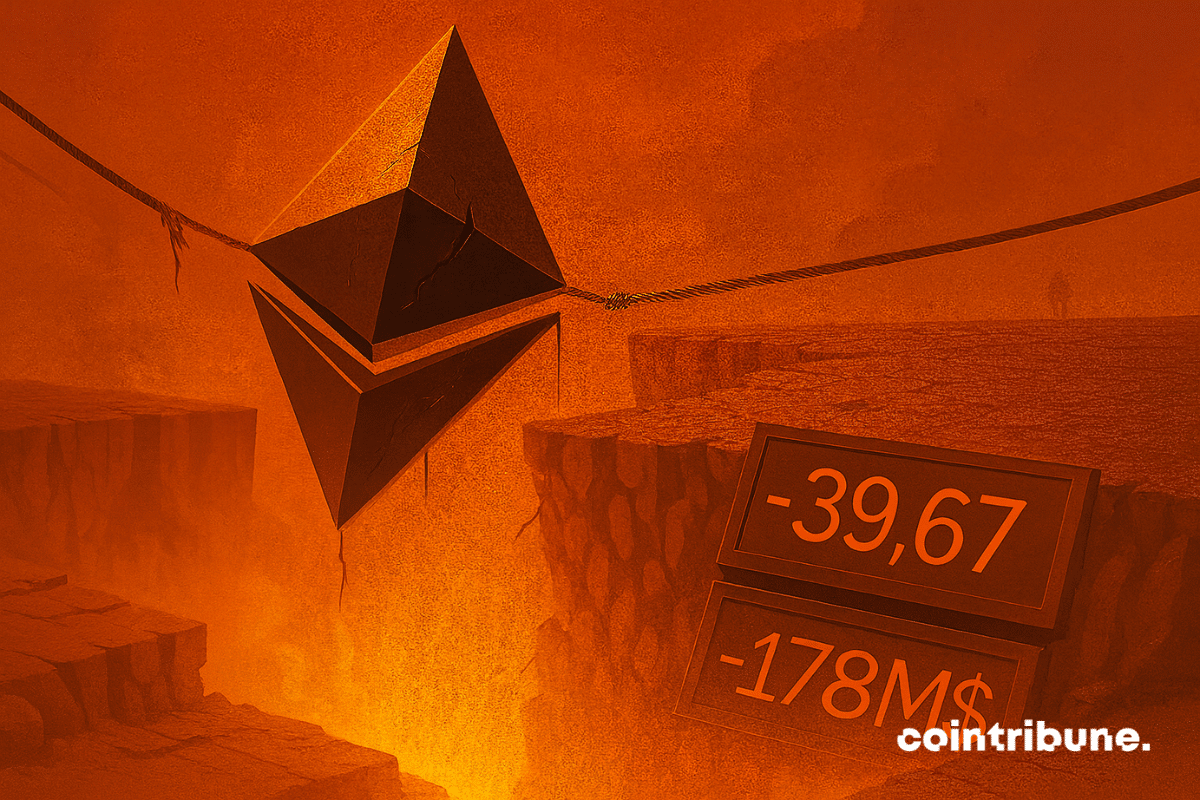

Ethereum falls below $4,000. Liquidations, ETFs outflows, but record accumulation behind the scenes. Complete analysis of the reversal.

Polymarket introduces annualized rewards for long-term positions, supporting accurate pricing in high-profile political and global markets.

Dogecoin crypto tests the 0.24 $ threshold between negative technical signals and hope for an imminent ETF. Which scenario will win?

Solana does not need a three-piece suit to convince. The network is advancing, fast, and sometimes against the usual crypto habits. Pantera Capital says it bluntly: we are approaching a tipping point. The market, perhaps, has not yet adjusted its glasses.

With Bitcoin resuming its northward movement, the stage seems set for the firstborn crypto to touch new price levels. Bitcoin researcher Axel Adler Jr. even predicts a 70% chance of BTC reaching a fresh high in the next two weeks. However, data also shows more traders exiting positions around $114,000.

Anthony Scaramucci, the founder of SkyBridge Capital, has projected a turbulent path for Bitcoin before it eventually climbs to half a million dollars. Speaking with Coinage, the veteran investor warned that the cryptocurrency could face a sharp decline of up to 40%, even as he maintains confidence in its long-term potential.

Donald Trump Jr. joins Polymarket’s advisory board as the platform gains new investment and grows its role in prediction markets.

Bitcoin drops below $120,000 following Scott Bessent's statements. What should be expected from the market in the coming days?

While bitcoin oscillates around critical thresholds, between selling pressures and bullish technical signals, investors wonder: simple market breathing or prelude to a new surge towards 75,000 dollars

The dollar is roaring, and Bitcoin is taking a hit. That’s the scenario taking shape as the U.S. Dollar Index (DXY) climbs past 99.98 points, reaching its highest level in two months. This upward move coincides with the Federal Reserve’s decision to keep interest rates unchanged—a strong signal to markets, though not necessarily a favorable one for Bitcoin.

In a world where Bitcoin mining seems reserved for industrial giants, a solitary miner has just defied the odds. With a simple machine and a good dose of perseverance, he earned $373,000 by solving a block all on his own. A rare achievement that reminds us that, in the realm of Bitcoin, boldness still has its place.

MicroStrategy continues to surprise. While most companies adjust their cash reserves with cautious investments, the firm led by Michael Saylor continues to forge a radically different path. Staying true to its "Bitcoin first" strategy, MicroStrategy has just announced a $2 billion fundraising, primarily intended for the purchase of new BTC. This is not just a financial operation: it is a manifesto. Behind this decision lies an ideological confrontation between two visions of the monetary world. And MicroStrategy, once again, chooses its side unambiguously.

Dogecoin dominates the crypto market: +75% volume and resistance at $0.27 tested! All the details in this article.

PENGU, the NFT of Pudgy Penguins on Solana, explodes after a record sweep of CryptoPunks. All the details in this article.

The world of crypto is not short on spotlights, flashy predictions, and promises of decentralized tomorrows. Yet, behind the utopian speeches and soaring tokens, another indicator, much more discreet, is turning red: developer engagement. And what if, in 2025, the vitality of blockchains was no longer measured by their market capitalization, but by the sweat of those who build them?

Since El Salvador raised the orange flag in 2021 by adopting Bitcoin as legal tender, the country has not ceased to make headlines. Between the messianic vision of President Nayib Bukele and international fascination, the narrative seemed clear: every day, El Salvador bought one BTC. However, the curtain has just fallen. An official report from the IMF, accompanied by a letter signed by the highest financial officials in the country, states flatly: no Bitcoin purchases since February 2025.

After years of uncertainty and tug-of-war between innovation and crypto regulation, the United States finally seems ready to define its course on the burning issue of crypto. On July 17, the Securities and Exchange Commission (SEC) heralded a historic legislative turning point: the passage of the GENIUS Act in the House of Representatives. This ambitious text, now on its way to Donald Trump's desk for enactment, aims to lay the groundwork for clear, proactive, and decidedly future-oriented regulation. Behind the acronyms and well-rehearsed speeches, a message is emerging: crypto is no longer a regulatory anomaly but a strategic lever for the American economy.

While some are watching for the slightest sign of a pullback, Bitcoin and Ether-backed ETFs continue their triumphant march. In a single day, these financial products attracted nearly $600 million, a sign of institutional appetite that shows no sign of weakening. This wave of enthusiasm outlines the contours of an increasingly assertive adoption of cryptocurrencies within traditional portfolios.

Ethereum climbs 20% amid Bitcoin's decline. Is the crypto market changing its leader? Full analysis here.

On Tuesday, in a turn as unexpected as it is symbolic, the United States House of Representatives canceled crucial votes on two major cryptocurrency bills. This setback, occurring during the height of "Crypto Week," follows a procedural failure that exposes the deep political divisions surrounding the regulation of digital assets. While attention was focused on the imminent adoption of the "Clarity" and "GENIUS" texts, discussions are now stalled, casting uncertainty on the future of the U.S. crypto framework.

Quantum computing, often seen as a sword of Damocles hanging over blockchains, has fueled fantasies and speculations for more than a decade. In this universe of uncertainty, Vitalik Buterin, co-founder of Ethereum, presents a contrarian diagnosis: lucid, quantified, but above all, confident. For him, the arrival of machines capable of breaking current cryptographic foundations is not a fatality, it is a deadline. And Ethereum will be ready for it.

For a long time, bitcoin reigned supreme as the uncontested master of the cryptocurrency realm, particularly in the area of exchange-traded funds (ETFs). But today, a turning point is taking place. Discreetly, methodically, Ethereum is beginning to nibble away at market shares and is capturing the attention of institutional investors. A recent report from CoinShares highlights this astonishing dynamic: ether is no longer just following; it is asserting itself. Behind the numbers lies a reality taking hold: the dominance of bitcoin in crypto ETFs is no longer so evident.

It feels like 2021 again. Cardano is one of the best performers among blue chip coins, and the 10th largest cryptocurrency by market cap has surged 29% in just seven days, reaching $0.747 at the time of writing. In the past 24 hours alone, it added nearly 4%, driven by a wave of bullish momentum across the altcoin market.

.27 on burning crypto mountain chart" class="img img--ratio w-auto h-auto" src="data:image/svg+xml,%3Csvg%20xmlns='http://www.w3.org/2000/svg'%20viewBox='0%200%200%200'%3E%3C/svg%3E" data-lazy-srcset="https://www.cointribune.com/app/uploads/2025/07/explosion-volume-crypto-dogecoin-resistance-a-franchir.png 1200w, https://www.cointribune.com/app/uploads/2025/07/explosion-volume-crypto-dogecoin-resistance-a-franchir-300x200.png 300w, https://www.cointribune.com/app/uploads/2025/07/explosion-volume-crypto-dogecoin-resistance-a-franchir-1024x683.png 1024w, https://www.cointribune.com/app/uploads/2025/07/explosion-volume-crypto-dogecoin-resistance-a-franchir-768x512.png 768w" data-lazy-sizes="(max-width: 300px) 100vw, 300px" data-lazy-src="https://www.cointribune.com/app/uploads/2025/07/explosion-volume-crypto-dogecoin-resistance-a-franchir.png">

.27 on burning crypto mountain chart" class="img img--ratio w-auto h-auto" src="data:image/svg+xml,%3Csvg%20xmlns='http://www.w3.org/2000/svg'%20viewBox='0%200%200%200'%3E%3C/svg%3E" data-lazy-srcset="https://www.cointribune.com/app/uploads/2025/07/explosion-volume-crypto-dogecoin-resistance-a-franchir.png 1200w, https://www.cointribune.com/app/uploads/2025/07/explosion-volume-crypto-dogecoin-resistance-a-franchir-300x200.png 300w, https://www.cointribune.com/app/uploads/2025/07/explosion-volume-crypto-dogecoin-resistance-a-franchir-1024x683.png 1024w, https://www.cointribune.com/app/uploads/2025/07/explosion-volume-crypto-dogecoin-resistance-a-franchir-768x512.png 768w" data-lazy-sizes="(max-width: 300px) 100vw, 300px" data-lazy-src="https://www.cointribune.com/app/uploads/2025/07/explosion-volume-crypto-dogecoin-resistance-a-franchir.png">