The crypto industry is rocked by a series of major departures at Binance, one of the key players in the sector. These resignations, including that of the head of Binance UK and the director of Binance France, reflect the turbulence the crypto company is currently facing. Let's delve into the behind-the-scenes of these departures.

Theme Regulation

The European Union marks a decisive step in the crypto sphere. In response to the rise of this sector, the EU is arming itself with new rules to ensure greater tax transparency. But what do these standards mean for crypto holders and the industry itself?

Binance, the leading cryptocurrency exchange platform, is currently facing massive capital outflows. These movements appear to be motivated by growing concerns about regulation.

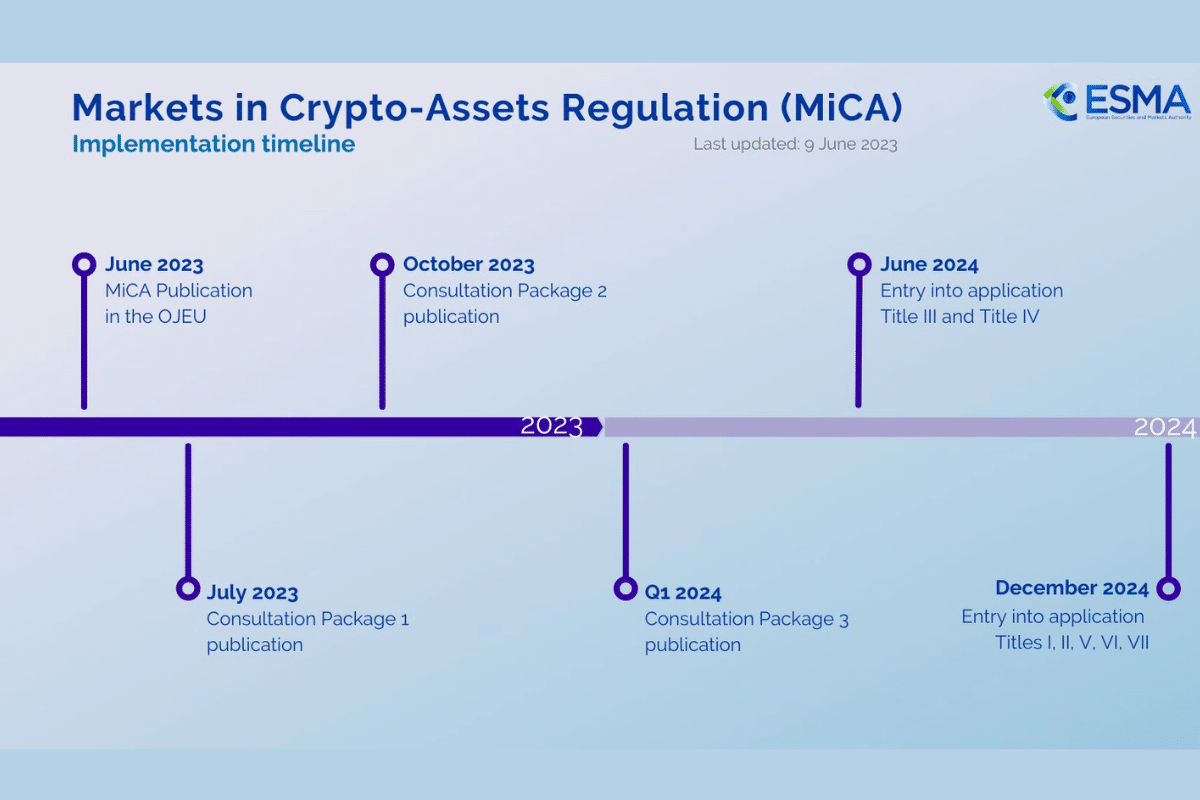

Crypto regulation remains a subject that is both complex and controversial. The reason for this is that, at the current moment, there is still no clear and harmonized legal framework within the European Union. Indeed, the European Parliament has already adopted the MiCA crypto standard. However, some uncertainties persist. Hence the second consultation launched by ESMA, the European Securities and Markets Authority.

The crypto community continues to closely monitor the legal battle between Ripple and the SEC. The reason is simple: the outcome of this legal saga will be crucial for the cryptocurrency market. And precisely, some news could change the game definitively. At the very least, it hints at a victory for Ripple against the SEC.

With over 100 million users, Binance easily claims the title of the world's largest cryptocurrency exchange. If CZ's exchange were to fall victim to the initiatives of U.S. regulators, others (Kraken, Coinbase, and the like) would melt away like snow in the sun. And apparently, the U.S. Department of Justice is preparing to launch an assault on this crypto behemoth with feet of clay.

In an environment where crypto regulation is tightening and legal battles are intensifying, Binance, the world's leading exchange platform, is facing challenges in several jurisdictions. We had the opportunity to interview David Prinçay, CEO of Binance France, to find out more about the current situation.

The European Union (EU) is currently preparing for the implementation of the MiCA crypto standards. This law aims to regulate stablecoins. Today, this regulation is sparking debates and concerns regarding its impact on the crypto market, especially on stablecoins.

In a matter of minutes, the image of Brad Garlinghouse standing in front of the SEC headquarters with Ripple's General Counsel, Stuart Alderoty, went viral within the crypto community. The photo appears to highlight the ongoing tensions between Ripple and the SEC.

In the vibrant financial hub of Mumbai, an announcement rings out, echoing like the dawn of a new era in the crypto universe. India's Finance Minister, Nirmala Sitharaman, has revealed that the Indian presidency of the G20 has initiated crucial discussions, aiming to establish a global regulatory framework for cryptocurrencies. But what does this move mean for the sector? And what role is India playing in this regulatory revolution?

The Binance liquidation scandal has taken another turn. US regulators, recently informed of the situation, may initiate an in-depth audit of the platform. A resounding event reminiscent of the beginnings of the FTX collapse.

France's digital horizon is taking on radically new shades, and the country is showing its readiness to anchor itself as Europe's cryptocurrency mainstay. On the threshold of 2024, France unveils its determination and strategy, breathing new life into cryptocurrency regulation.

In the midst of the U.S. presidential campaign, discussions are heating up around a variety of topics, including Bitcoin and cryptocurrencies, which are attracting a great deal of interest. Ron DeSantis, Governor of Florida and Republican candidate for 2024, is firmly in favor of cryptos. During his campaign tour of New Hampshire, DeSantis firmly promised to end Biden's “war on Bitcoin” and cryptos if he became president.

Donald Trump has declared in a speech that he will build the greatest economy in the history of the world. The former US president has in fact announced his candidacy for the 2024 presidential election. One might wonder whether his approach will be in favor of the crypto sector. Having always shown a certain reticence towards bitcoin (BTC), the crypto market was nonetheless doing well during his term of office. His re-election could breathe new life into this heavily repressed market.

Nasdaq backtracks! Its abandonment of plans for a cryptoasset custody service shakes up the industry. Nasdaq CEO Adena Friedman cites regulatory concerns in this surprise announcement. The decision could impact the future of institutional crypto adoption in the US.

For the time being, Gary Gensler is untouchable. He will continue to reign supreme in the offices of 100 F Street, NE Washington D.C. Especially in the absence of solid arguments against his policies. Yet the crypto community has never stopped finding a breach in the SEC's fortified line. Perhaps this latest initiative by pro-crypto lawyers will eventually succeed?

EU lawmakers have always stated their desire to control banks' dealings with cryptocurrencies. They have now taken a giant step towards achieving this goal. EU MEPs have reached agreement on the capital requirements for crypto-banks. The latter must therefore comply with the new measures in force.

Moody's is a well-known research and risk analysis company within the cryptosphere. On June 20, it published a most interesting report on crypto in the United States. Specifically, it highlights the political divisions in the US regarding crypto regulation.

A ship doesn't set sail across the ocean without the clear guidance of its captain, nor without keeping an eye on the uncontrollable forces of nature. Likewise, the bitcoin ship is preparing to set sail on its next bullish voyage, with two essential factors on board: regulatory clarity in the US and falling inflation.

The European Union is gearing up to write a decisive new chapter. The rules governing the Markets in Crypto-Assets (MiCA) are fast approaching, promising a series of far-reaching changes for companies in the cryptosphere.

Ripple CEO Brad Garlinghouse recently shared a video on Twitter to announce that his company's long-running legal battle with the Securities and Exchange Commission (SEC) was finally coming to an end. However, rather than feeling sorry for the failure, Garlinghouse emphasized that the case only marks the beginning of a wider struggle for the cryptocurrency industry and the need for regulatory clarity.

In the SEC VS Binance case, a US federal judge has rejected the request from the US regulator. Quick breakdown: Binance US assets will not be frozen. However, the judge demands further negotiations between the SEC and Binance lawyers. The goal is to define boundaries and resolve security issues.

In the tumultuous arena of cryptocurrencies, Bitcoin reigns supreme. However, its omnipresence is starting to reveal itself in an unexpected light: it has become a key player in divorce proceedings. The consequences of this intrusion into the marital sphere are raising new legal and ethical questions.

It can be said without a shadow of a doubt that Russia is practicing a policy of relaxation when it comes to cryptos. Unofficially, at least, the country is no longer opposed to their emergence as it was a few months ago. As a result, their usage should logically gain ground.

According to Balaji Srinivasan, our governments can deprive us of our cryptocurrency assets if they want to. They can indeed use Apple, through our iPhones and iPads, and Google if necessary. Let's explain!

The SEC has urged the judge to dismiss Coinbase's petition for an explanation on the rules applied by the stock market regulator in the crypto industry. Immediately, Paul Grewal, Coinbase's Chief Legal Officer, expressed concerns about this response. According to him, the SEC will continue to oversee the crypto sector by enforcing regulations forcefully.

Even today, crypto adoption in El Salvador is not unanimous. In the United States, for example, American senators have just submitted a new bill. The goal: to monitor the crypto adoption (specifically Bitcoin) in El Salvador and assess its economic impact.

European authorities are actively working on establishing a framework suitable for regulating cryptocurrencies. Currently, they are particularly concerned about how to prevent tax evasion related to the crypto sector. Additionally, the UK's tax administration (His Majesty's Revenue and Customs, HMRC) has recently released a consultation document on the subject. In parallel, France aims to strengthen its measures to combat tax evasion.

On May 12th, PitchBook, a capital market analysis company, published a concerning report regarding venture capital investments in the crypto sector. The document suggests that venture capital firms are less inclined to invest in the emerging industry. It turns out that the number of venture capital deals with crypto companies has decreased globally. Let's delve into the findings of PitchBook's report.

The issue of tax evasion is increasingly being debated. It's one of the key issues in the regulation of crypto within the EU. Stakeholders want to speed up the process of adoption.