Valeria Fedyakina, a 24-year-old Russian influencer known online as “Bitmama,” has been sentenced to 7 years in a prison colony after running a major crypto scam that stole over $21 million from investors. Russian prosecutors say some of the stolen funds were used to support Ukraine’s military, a claim that adds a geopolitical twist to this case.

Short news

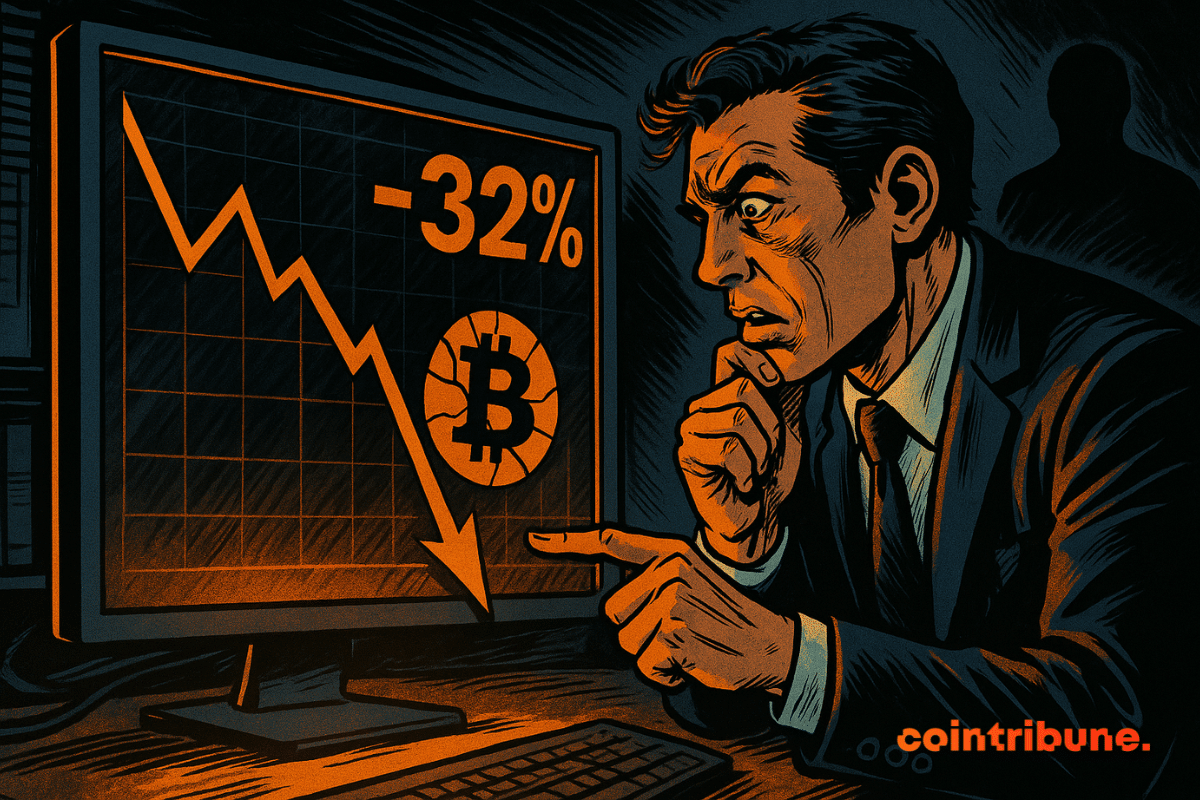

Since Bitcoin established itself as a serious store of value in the eyes of companies, a new category of players has emerged: Bitcoin treasury companies. Presented as the pioneers of the finance of the future, they are now faced with a harsh reality. According to a chilling report from the venture capital fund Breed, the vast majority of them are on the verge of extinction, trapped in a spiral that is as predictable as it is fatal.

Crypto cards are now competing with traditional banks for everyday purchases in Europe. With nearly half of transactions under 12 dollars, these new payment tools are transforming consumer habits. A silent revolution that is redefining the future of European payments.

On the occasion of Pi2Day, celebrated every June 28, Pi Network unveiled two strategic features: a no-code application creation tool powered by AI and a community staking mechanism to promote projects. This initiative marks a turning point towards a more accessible platform, governed by its users. By focusing on intelligent automation and the decentralization of referrals, Pi Network aims to redefine the rules of mobile-first Web3, at the intersection of technological innovation and community engagement.

Fewer movements, more silence: Bitcoin breathes. But behind the candlesticks, Trump is getting angry, Powell is trembling, and the dollar is melting... Is it enough to awaken a sleeping crypto queen?

Solana bombards DEXs, Ethereum takes the hit... but behind the sparkle, a network coughs and memecoins tumble. The crypto king trembles, but can the prince reign without an active throne?

While public opinion gets bogged down in debates over ETFs and speculative bubbles, the U.S. government is taking action. Discreetly, but resolutely. Behind the walls of the Capitol, a strategic reserve of bitcoin is being established. This is no longer theory: it is now confirmed. And this revelation changes the game.

The XRPL network is becoming increasingly competitive: is a rise in XRP coming soon?

"For several weeks now, Coinbase's (COIN) stock has been on the rise, reaching a historic high of $382 before closing at $369.21. This surge is not coincidental: it reflects both a major regulatory turning point in the United States and the profound strategic transformation undertaken by the crypto company, which is determined to become one of the pillars of global digital finance."

Grayscale upends the crypto hierarchy: XRP, ADA, and BNB fall out of its Top 20 in favor of Morpho and Avalanche. Details here!

As the crypto market oscillates between regulatory uncertainty and technical expectations, XRP captures the attention of the most strategic investors. For over four months, Ripple's flagship asset has remained stuck between $2.00 and $2.60, in a consolidation that intrigues. This stability, unusual for such an exposed crypto, fuels speculation about a possible breakout.

Wall Street continues to set records, and crypto holds its breath. As the Nasdaq and S&P 500 reach historical highs, the prospect of monetary easing by the Fed revives bullish scenarios. In this climate of optimism, a question arises: is Bitcoin ready to cross a new symbolic threshold? With favorable macroeconomic signals and renewed institutional interest, the hypothesis of BTC exceeding $112,000 resurfaces, fueled by the dynamics of traditional markets.

Bitcoin’s long-term holders hit record accumulation, showing strong confidence amid steady market conditions.

Cointribune invites you to take part in a brand-new Read to Earn quest in partnership with Runbot. This time, your reading can earn you much more than just knowledge: in just a few simple steps, you can unlock exclusive credits on Runbot and enter a draw to win a share of the $400 prize pool.

The bitcoin market, usually quick to get excited at the slightest institutional whisper, seems today to be sending a clear message: long-term confidence is present. For 13 consecutive days, Bitcoin ETFs in the United States attracted nearly 3 billion dollars, an undeniable sign that major investors are no longer betting solely on a hype effect but on a solid trend.

World Liberty Financial is preparing to make its WLFI token tradable while rolling out a stablecoin audit and a new app to simplify crypto use.

For a long time reserved for bitcoin, the role of strategic treasury asset is now expanding to other cryptos. Upexi, listed on Nasdaq, is a concrete illustration of this: it has strengthened its treasury with 735,692 SOL, valued at over 105 million dollars. And that's not all: the company also announces the tokenization of its shares on the Solana blockchain.

Pioneering in the market of proof of humanity, the company Tools For Humanity aims to increasingly expand the database of its Worldcoin project. It is only under this condition that it will be possible to effectively distinguish between humans and machines in the digital world. By prioritizing users verified by World ID in transactions on Worldchain, Sam Altman's company wants to encourage even more people to use the famous Orb and iris scan.

In recent days, the crypto market has been closely watching a particularly reliable technical model. With a historical accuracy of 78%, this model could herald the imminent arrival of a new peak for Bitcoin. Is the market ready to surpass its previous records?

Billions are flowing in, but Bitcoin remains stagnant. While spot ETFs recorded record inflows in June 2025, the leading cryptocurrency barely reacts. Just a 2% increase for the month is a trivial move in a market accustomed to violent surges. This unexpected calm, despite unprecedented institutional momentum, raises questions among observers. What does this inertia really reveal? Behind the visible flows, a new equilibrium is emerging in the crypto arena, far from the classic patterns of speculative euphoria.

The race for bitcoin among companies has taken a new turn. Metaplanet, a Japanese company undergoing transformation, has just surpassed a symbolic milestone by overtaking Tesla in the ranking of the largest corporate bitcoin reserves. Who would have imagined that a struggling former hotel company would compete with Elon Musk's giant?

Will crypto replace banks for AI? The radical hypothesis of Tether is becoming clearer. The details in this article!

Kraken, often discreet but never truly withdrawn, has just taken a strategic step that could reshuffle the crypto market in Europe. By obtaining its regulatory license under the MiCA framework, the platform is stepping into the big leagues at a continental level, just behind Coinbase, but not too far behind to be considered lagging. In an environment where compliance is becoming a must-have, Kraken chooses to embrace regulation rather than circumvent it. And this choice could pay off handsomely.

The U.S. is facing a serious financial challenge. The national debt is now over $36 trillion, and rising interest rates are making it more expensive to borrow money. Much of the debt that was issued during the COVID-19 era is about to roll over, meaning it needs to be refinanced at today’s much higher rates.

The Federal Reserve just made a big change that could make it easier for crypto companies to get bank accounts. On Monday, the Fed said it would no longer use “reputational risk” as part of its official bank supervision process. That vague label was often used to warn banks away from doing business with crypto firms, and many in the industry say it led to years of unfair “debanking.”

While Americans pamper stablecoins, the Bank of France bares its teeth: crypto, dollar, and sovereignty do not mix well for the guardians of the monetary temple.

Russia no longer tests. It imposes. By decreeing the mandatory integration of the digital ruble into the national banking and commercial system, Moscow leaves no room for doubt. The transition to a controlled, programmable, and centralized currency is underway. Gone are the ambiguities of experimentation, making way for the architecture of an unprecedented monetary system where each transaction could, tomorrow, be traced, regulated... or even blocked. This choice is not merely technological: it is political, strategic, almost ideological. For behind the apparent modernization of payments lies a much larger game.

The ceasefire in the Middle East triggers a new rise in bitcoin.

After weeks of consolidation and volatility, Ethereum is regaining its strength and has shown a spectacular increase of 15% from its lows. This remarkable rebound puts ETH back in a strategically technical position where $2,800 becomes a credible target.

"On the eve of an extraordinary options expiration estimated at 20 billion dollars, the crypto market holds its breath. With bitcoin hovering around 107,800 dollars, every price movement becomes a battle between buyers and sellers. In this strategic duel, billions are at stake. The outcome will depend on the buyers' ability to lock in key levels before the outcome. Maximum pressure builds as the fateful deadline approaches."