In an economic climate marked by geopolitical tensions and a wait-and-see approach regarding the Fed's decisions, Morgan Stanley disrupts the consensus. The investment bank anticipates seven rate cuts in 2026, starting in March, with a terminal rate between 2.5% and 2.75%. This sharp projection, published on June 25th, contrasts with the prevailing caution and reignites debates about the U.S. monetary calendar.

Short news

While the market focuses on price curves, a key indicator of real activity has collapsed. Payment volume on the XRP Ledger has dropped by nearly 70% in just a few days. Behind this discreet withdrawal lies a deeper questioning of the network's vitality, its concrete adoption, and the robustness of its operational model.

Crypto reserve in Arizona: a bill passed despite criticism from the governor. Discover the details in this article!

When crypto takes to the track, Bitget makes a sharp turn with MotoGP. Speed and trading meet, at high speed and at zero cost for innovation.

Bitcoin is tightening its grip on the crypto market as institutional interest grows. Meanwhile, XRP climbs, and Ethereum and Solana face shifting investor focus.

Thanks to OptimumP2P, Ethereum increases the communication speed between its nodes.

Michael Saylor's company, Strategy (formerly MicroStrategy), could soon be included in the prestigious S&P 500 index. According to analyst Jeff Walton, it has a 91% chance of achieving this within the next 5 days. However, a crucial condition must be met: Bitcoin must remain above a critical threshold.

While Bitcoin struts its stuff, Ethereum is digging its furrow. Discreet but robust ETFs, stealthy rebalances, rock-bottom fees... what if the little brother became the darling of the big wallets?

The investment giant BlackRock surprised the crypto market by resuming its massive purchases of Ethereum, just 24 hours after making a spectacular sale of over 8,000 ETH. Why this sudden turnaround?

Donald Trump's surprise announcement of a ceasefire between Iran and Israel has caused a real earthquake in the energy markets. Oil prices plunged by more than 5%, while global stock markets soared. Is this geopolitical calm sustainable?

Trying to time the crypto market is a nightmare for most investors. FOMO, sharp corrections, contradictory signals… Volatility brings both opportunity and anxiety. Fortunately, there’s a calmer approach already embraced by 59% of crypto holders: Dollar-Cost Averaging (DCA). What if you could enjoy it stress-free, without having to attend classes every day? Kraken offers a simple, automated, and ultra-flexible solution to help you build a crypto position over time, without obsessing over market dips.

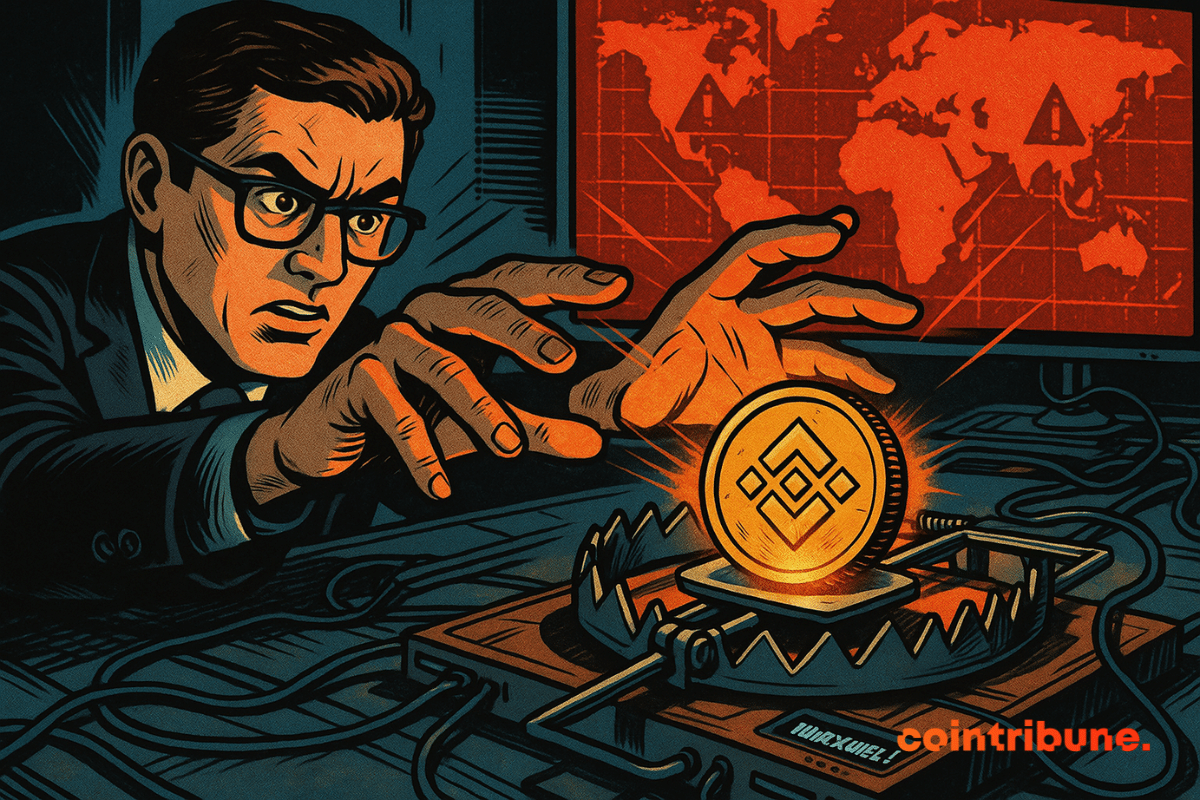

Financial markets are going through a fascinating period, where the boundaries between traditional finance and cryptocurrencies are increasingly blurred. BNB, the native token of the Binance ecosystem, is taking a bold new step by becoming the cornerstone of an institutional initiative listed on Nasdaq, fueled by an impressive raise of 100 million dollars.

Despite the drop in Ethereum, whales are maintaining their positions. In this article, find an analysis of the key data to know.

The crypto market exploded upwards on Monday evening, propelling bitcoin above $105,000 after Donald Trump announced a ceasefire agreement between Iran and Israel. This news instantly transformed investor sentiment. But is this euphoria sustainable in an ongoing fragile geopolitical context?

Bitcoin’s original promise was rebellion: digital gold, a hedge against inflation, a way out of the fiat system. But if the latest Binance Research report is any indication, it may be playing a different role today: not fighting the dollar, but backing it.

Trump rewards holders of his memecoin with a private dinner. Immediate reaction: Adam Schiff, a Democratic senator, draws up a law to regulate the use of cryptocurrency by political officials. A confrontation that mixes digital assets, conflicts of interest, and electoral calculations.

Trump Media dives into bitcoin with $2.3 billion. But behind the announcement, there is a colossal stock buyback and a strategy that is shaking up U.S. regulations. Will it take everything?

As an American strike targeting Iranian nuclear sites raised fears of a regional escalation, bitcoin briefly fell below $99,000 before making a swift rebound. In less than 24 hours, the asset erased its losses, defying usual panic logics. This sequence reveals a strategic mutation: bitcoin is no longer just a speculative asset; it is becoming an indicator of resilience against geopolitical shocks.

Is the crypto universe in danger? Trezor confirms an incident. A new attack method worries experts! Details here.

Pompliano bets one billion dollars on Bitcoin. Huge merger with a SPAC. Its goal: to turn Bitcoin into an institutional financial asset. But beware of volatility!

The world of French tech is reaching a new milestone. Sequans, a specialist in IoT semiconductors, chooses Bitcoin to strengthen its financial strategy. A rare, bold decision that carries significant meaning in the current economic context.

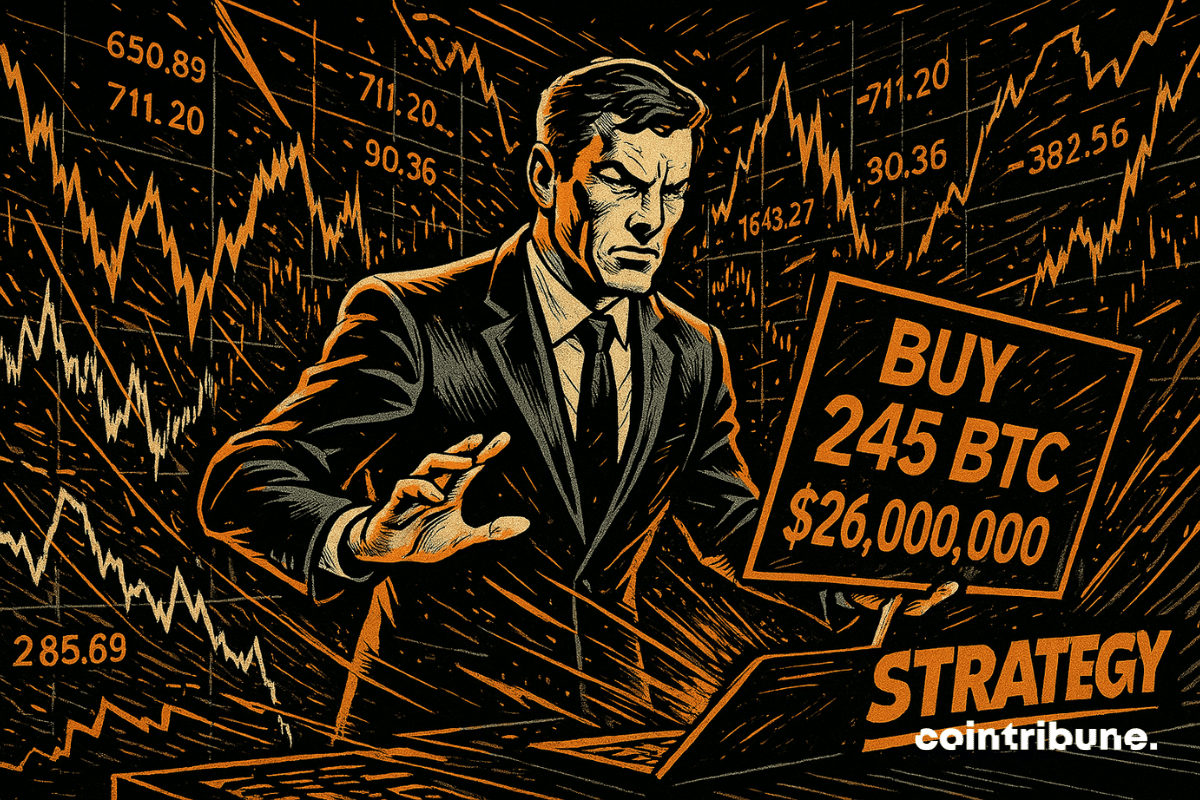

Saylor persists and signs: 245 BTC at 26 million dollars. While some tremble, he firmly believes that Bitcoin will one day reach 21 million. A strategy that defies the obvious.

Despite a drop in Bitcoin below $100,000 following U.S. strikes in Iran, the options market remains remarkably optimistic. Investors are positioning themselves heavily for a recovery, despite increased volatility. Is this a risky bet or a clear-sighted anticipation of a rebound?

As bitcoin continues to divide institutions, Texas catches everyone off guard. In a gesture as symbolic as it is strategic, the state adopts a public Bitcoin reserve, boldly declaring its ambition to play a central role in tomorrow's digital economy. An initiative that challenges the traditional codes of public finance management and could very well set a precedent.

Between financial scandal and assumed strategy, Michael Saylor remains committed to his bet on bitcoin. The details in this article!

The conflict between Israel and Iran raises fears of a major escalation, yet U.S. indices are flirting with their all-time highs. Following U.S. bombings in Iran, this situation could change very quickly, casting doubt on a sudden market collapse.

While XRP is experiencing a notable surge, on-chain data paints a much less euphoric picture. In the background, record volumes of profit-taking by long-term holders are multiplying, injecting a silent but significant selling pressure. This disconnect between visible euphoria and structural signals raises doubts about the rally's strength. Several technical indicators suggest an increased risk of a reversal in a market where the balance seems increasingly precarious.

The calm will have been short-lived. Within a few hours, Bitcoin dropped below $99,000, triggering a chain reaction: over a billion dollars in positions liquidated, altcoins shaken up, and volatility reignited. The episode, marked by rare brutality, reminds us of the relentless mechanics of leveraged markets. After several weeks of calm, the correction hits hard, sweeping away the illusion of a controlled recovery. Reckless traders bear the cost of excessive confidence, in a market always quick to flip.

As the crypto universe once again wavers under geopolitical shocks and market whims, a silent player charts its course, come hell or high water: Chainlink. In an atmosphere saturated with uncertainties, the oracle protocol appears to have awakened a peculiar appetite among the whales, those market creatures that never move for nothing.

BNB wanted to play the technical rockets, but it was geopolitics that pulled the trigger. Result: the crypto dives, forecasts collapse, and Binance suffers.