A phone call, a truce? Trump puts away the customs missiles. The European economy is breathing, but for how long? Ursula whispers, Donald retreats. Suspense is high until July.

Tax

Between the requisitioned Livret A, lightly tapped fortunes, and a starving military budget, Manu juggles: finding billions without upsetting anyone, this is an art worthy of the French budget circus.

A dried-up river of euros, a shaken financial fortress: the Bundesbank wavers, its gold evaporates, while Merz inherits a throne without treasure, a kingdom in doubt.

Europe, threatened by the Trump storm, is on a knife's edge. Laurent Saint-Martin urges unity to counter the shadow of a destructive trade war looming.

Like a cowboy drawing his six-shooter, Trump unleashes reciprocal tariffs, awakening old economic ghosts and sowing panic for Bitcoin in the stock markets.

Trump brandishes his tariff sword, Bitcoin wobbles, sways, and stumbles, but like a dazed boxer, it gets back up, ready for a new round.

"America First" roars Trump, hammering taxes and drilling like a refrain. The Green New Deal expires, the economy trembles, the euro wonders.

Under the darkened skies of the budget, the Medef proposes a sharp reform: to withdraw retirees' valuable tax allowance. An idea where the economy dialogues with injustice.

In 2025, Americans anticipate a rise in the stock markets and an intensification of international conflicts. This duality could influence financial and crypto markets, making the current year both promising and uncertain for the United States.

A renowned financial analyst, Dr. Jim Willie, recently sounded the alarm about a massive debt crisis that could hit the U.S. economy in 2025. According to him, the United States is heading toward a critical point with $7 trillion in debt maturing, which could trigger a major economic crisis.

The U.S. Secretary of the Treasury, Janet Yellen, recently warned that the U.S. debt ceiling could be reached as early as mid-January 2025. According to her statements, the Treasury expects to hit this new limit between January 14 and 23, at which point extraordinary measures will need to be taken to avoid a default.

A connected Indian youth is biting into crypto with full force, under the watchful eye of the tax authorities. Surprising but true.

American economic policies are entering a new phase of confrontation. Donald Trump, at the dawn of his new presidential term, announces protectionist measures that revive trade tensions with several key partners. This project, which fits into a decidedly nationalist vision, could disrupt global trade relations. Between explicit threats and concrete measures, this initiative emerges as a turning point in international exchanges, affecting nations as diverse as China, Mexico, and Canada.

The announcement of the return of Donald Trump's protectionism represents a notable shift in transatlantic economic relations, as it threatens to reignite trade tensions between the United States and Europe. Faced with a policy that could once again shake international exchanges, France is ready to vigorously defend its interests. At stake are the strategic sectors of industry and agriculture, while the European Union contemplates new measures to protect its economy. Thus, between French determination and European consultation, the debate around American protectionism continues to intensify, with major implications for economic actors on both sides of the Atlantic.

New mandate for Trump: an explosive cocktail of a strong economy, with frantic drilling and impactful tariffs. The party begins!

In 2023, the removal of the residence tax on primary residences eased the burden for many households, but this measure also created a financial shortfall of nearly 20 billion euros in local government coffers. Today, faced with significant budget deficits and an increase in property tax that is no longer sufficient, the government is considering a "universal territorial contribution" (UTC). Supported by certain political figures, this measure aims to rebalance local resources through contributions from both homeowners and tenants.

As the debate over budgetary receipts rages on and tensions mount, a new tax of 40 billion euros could further destabilize France's already fragile economy. In a statement this Sunday, October 27, Pierre Lellouche, former minister, sounded the alarm: "the French economy will suffer a shock that will bring it to a halt at the worst possible moment." This heavy statement comes in a context where economic recovery is more necessary than ever, but where room for maneuver is shrinking day by day.

Here is a budget! Barnier sizes, cuts, siphons... and the French grumble louder than ever.

Heated debate at the FED! Inflation and interest rate cuts divide financial experts who can no longer understand each other.

French banks, experts in tax evasion and deforestation, know how to plant the planet and pluck their clients!

The month of August is of crucial importance for taxpayers in France, with three major tax deadlines to watch out for. These dates, related to payments, tax assessments, and correction possibilities, are crucial for effective tax management and compliance with legal obligations.

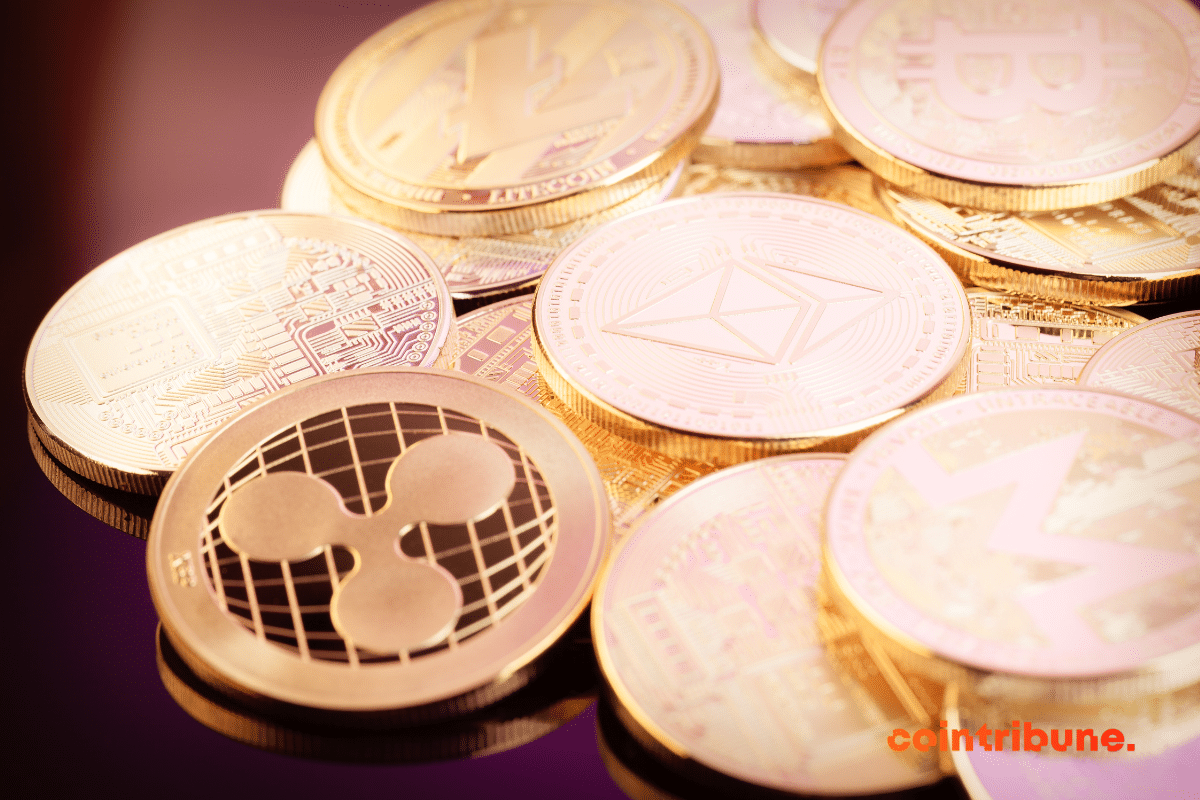

Cryptocurrency staking has become a popular method for digital currency holders to grow their assets. However, with the rise of this practice, the tax implications associated with staking have become a major concern for investors worldwide. Each country applies its own tax rules to staking, which can significantly impact returns. This article provides an overview of the taxation of staking in various jurisdictions in 2023, and offers practical advice for cryptocurrency investors to succeed in this complex and evolving field.

Altcoins, variations of the famous cryptocurrency bitcoin, have gained popularity and acceptance in the financial market. However, this rise raises a crucial question: what taxation applies to these digital currencies? Understanding the taxation of altcoins is important for investors and cryptocurrency holders, as it directly influences the profitability and legality of their investments. This article aims to clarify the tax rules related to altcoins, addressing the specifics of their taxation, reporting obligations, and strategies for optimal tax management.

The issue of tax evasion is increasingly being debated. It's one of the key issues in the regulation of crypto within the EU. Stakeholders want to speed up the process of adoption.