What if the threshold of 850 billion dollars held by the U.S. Treasury became the new catalyst for the crypto market? Arthur Hayes, co-founder of BitMEX, estimates that once the U.S. Treasury general account (TGA) is filled at 850 billion dollars, cryptos will enter a continuous upward phase. This position comes as the Fed has just cut its rates, reigniting debates on the impact of U.S. monetary policies on the dynamics of bitcoin and altcoins.

Trading Exchange RSS

France is preparing to give up its surplus nuclear energy to an American bitcoin miner instead of favoring the French solution.

Bitcoin is reportedly very bored. But when Michael Saylor talks about a "digital rush," one wonders: calm waters or storm brewing in the crypto arena?

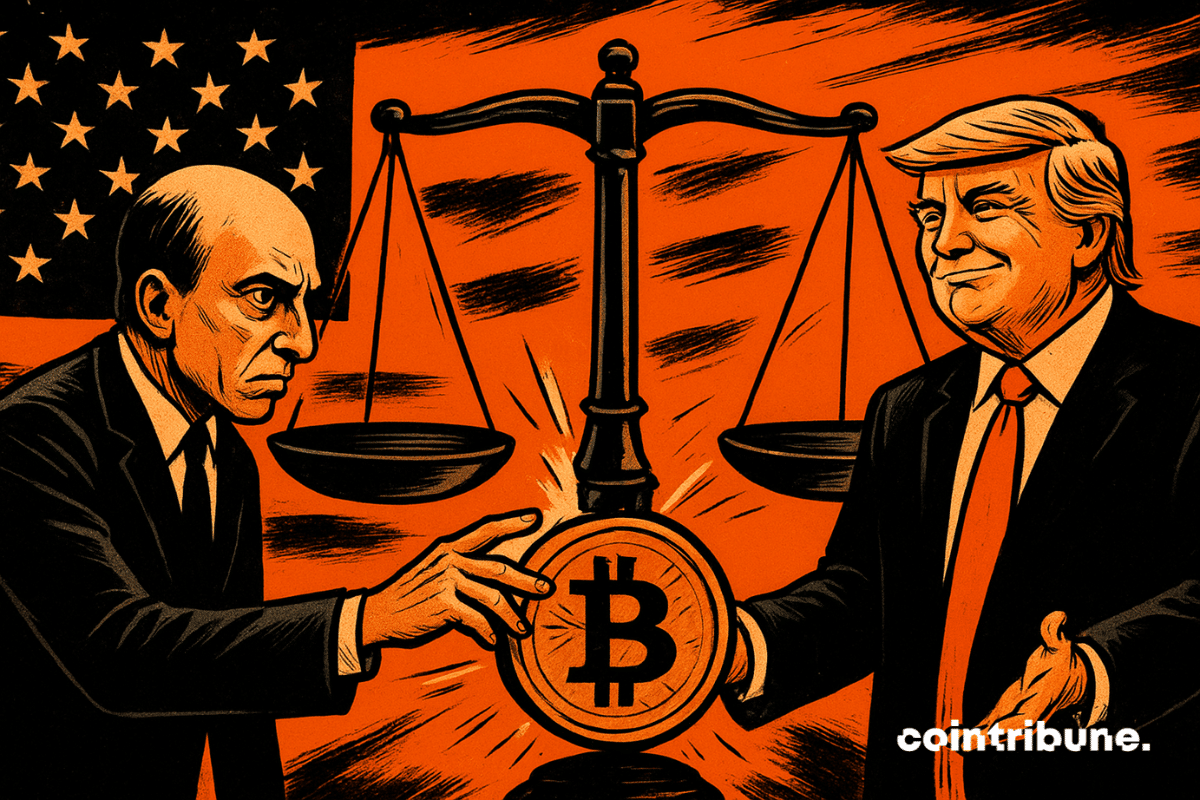

Paul Atkins, the current chairman of the U.S. Securities and Exchange Commission (SEC), and Gary Gensler, the agency’s former chief, both appeared before the media this week to discuss the regulatory atmosphere under the current administration, particularly policies proposed by President Donald Trump.

X is taking legal action against banned accounts that tried to regain access through bribery and fraud, some of which are linked to the larger Com network under FBI scrutiny.

Bitcoin is becoming scarce… at least on the open market. The “illiquid supply” has just registered a new high at 14.3 million BTC, while whales absorb more than the annual production. As a result, there are fewer coins available for sale and selling pressure is weakening.

MetaMask, the essential crypto wallet of the Ethereum ecosystem, could finally launch its token. Joe Lubin, CEO of Consensys, has just announced that this launch could happen "sooner than expected." A promise that excites traders… but also leaves many doubts.

Washington goes back to the drawing board. The US Treasury opens a new comment window to transform the GENIUS Act, the future framework law on payment stablecoins, into applicable rules. The stated objective is to secure the use of tokenized dollars while maintaining a workable playground for crypto innovation. Let's get into the specifics.

As the conflict in Ukraine drags on, the European Union opens a new front: that of cryptos. For the first time, Brussels plans to directly sanction crypto platforms, integrating these decentralized infrastructures into its economic measures against Moscow. A discreet but strategic shift, integrating cryptos into the realm of international pressure tools.

When equations shipwreck, a Google AI comes to the rescue. Result: stunned mathematicians and a scientific future that looks like science fiction.

The Bitcoin network has never been stronger. Its mining difficulty has just reached an all-time high at 142.3 trillion, up 29.6% since January. This figure reflects both the rise in hashrate power and the growing pressure on mining companies. While the blockchain strengthens against potential attacks, technical and economic requirements impose an increasingly tough selection among sector players.

This month could finally initiate a concrete turn in the endless FTX saga. Indeed, the FTX Recovery Trust plans to release 1.6 billion dollars for the creditors, marking the third wave of reimbursements since February. In a climate still imbued with distrust, this massive redistribution crystallizes hopes for a credible recovery. However, as payments progress, pressures intensify on the crypto industry, urged to close the chapter of the scandal and restore widely eroded trust.

Kevin Durant, two-time NBA champion and recognized investor, has just regained access to a Bitcoin wallet that had been inactive for nearly ten years. Created in 2016, at a time when BTC was trading around 600 dollars, this forgotten wallet illustrates the decisive role of time in the valuation of cryptos. Its reactivation reveals a spectacular gain: a 195-fold increase of the initial investment.

The tickchain Qubic (QUBIC) is making headlines with the launch of an ambitious marketing campaign in partnership with OKX, one of the largest crypto exchanges in the world. This initiative, endowed with an impressive budget, rekindles speculation about a potential listing of QUBIC on top-tier platforms.

Michigan has accelerated its push to establish a state-owned crypto reserve, with a key bill advancing to its second reading after months of legislative standstill. If passed, the measure will allow the peninsular state to hold 10% of its investment in digital assets.

With Bitcoin resuming its northward movement, the stage seems set for the firstborn crypto to touch new price levels. Bitcoin researcher Axel Adler Jr. even predicts a 70% chance of BTC reaching a fresh high in the next two weeks. However, data also shows more traders exiting positions around $114,000.

Ron Morrow of the Bank of Canada highlights the rapid growth of stablecoins and calls for clear rules to ensure safe and reliable digital payments.

The first U.S. Dogecoin ETF has launched, drawing strong trading activity even as Dogecoin’s price dips and large holders accumulate.

Since its spectacular launch in November 2022, ChatGPT has earned the status of a global benchmark in artificial intelligence. Nearly three years later, OpenAI’s chatbot has far surpassed the experimental stage: with more than 700 million weekly users, it now shapes global digital habits. A groundbreaking scientific study, relying for the first time on OpenAI's internal data, dissects 2.6 billion daily messages and reveals surprising trends about the real use of ChatGPT, challenging preconceived ideas about the adoption of conversational AI.

Infiltration in the crypto ecosystem: CZ denounces 60 fake developers linked to North Korea. All the details in this article!

Ethereum is about to reach a key milestone in its evolution. After months of intensive development, the Fusaka upgrade is now expected on December 3, 2025. This delay reflects a desire to balance security, scalability and attractiveness. What impact for users and investors?

What if bitcoin was racing against time? For Anatoly Yakovenko, co-founder of Solana, the advent of quantum computing is no longer a distant hypothesis. According to him, there is a 50% chance that a major breakthrough will occur within five years. A deadline that could obsolete bitcoin's current cryptography and force the market's leading crypto to urgently rethink its security architecture.

Trump, future Patron Saint of crypto? After Ulbricht and BitMEX, CZ hopes for his blessing. Between edited X profile and angry senators, Washington becomes a blockchain theater stage.

Nvidia joins the UK AI plan with a check for 683 million dollars. By betting on nScale, an entity stemming from crypto mining, the American giant bets on a sovereign infrastructure at the heart of Europe. This operation, as much economic as geopolitical, marks a turning point, as artificial intelligence is no longer an experimental field but a strategic lever of national power.

PayPal's stablecoin, PYUSD, has just crossed the $1.3 billion market cap milestone. At the same time, it now expands to Tron, Avalanche, and seven other blockchains thanks to LayerZero. Is the digital payment giant finally catching up to the leaders Tether and Circle?

Chainlink records its best performance since 2021 and approaches a decisive technical threshold. Driven by a rebound of more than 80% over the quarter, the crypto attracts analysts' attention as a long-term bullish configuration, rarely observed, is about to be validated. In a market seeking clear direction, LINK could start a new cycle, with projections suggesting a return to 100 dollars.

Solid gold Trump holding a bitcoin in front of the Capitol: crypto happening or presidential cult? Between pop culture and monetary policy, Washington becomes the theater of a curious spectacle.

The Bullish crypto exchange creates a surprise. Recently listed in New York, the exchange revealed second-quarter results significantly above expectations. Performances that exceed Wall Street forecasts. Bullish is also among the most publicized crypto IPOs of the year, alongside Circle, Gemini, and eToro.

What will China do if the United States truly start selling gold to embrace bitcoin?

Lawmakers from the U.S. Senate and House of Representatives recently met with crypto industry stakeholders to deliberate on key market structures and codify laws for establishing a strategic Bitcoin reserve.