The standoff over the succession at the head of the Federal Reserve intensifies. While a Republican senator blocks any progress as long as the investigation targeting Jerome Powell is not completed, the Treasury Secretary proposes a bold strategy: why not fight both battles at once? A political chess game that could redefine the Fed's future.

US Federal Reserve (FED)

In Washington, Trump is plotting his revenge: a former hawk ready to embrace Bitcoin and bring the Fed back into line, while Powell counts down the hours.

Crash or simple pause? Bitcoin drops while gold rises. The refuge asset duel intensifies. Details here!

Jerome Powell, chairman of the Federal Reserve, is the subject of a criminal investigation. The information, confirmed on Sunday, comes amid strong political tensions in the United States. It raises questions about the central bank's independence from the executive branch. Beyond Wall Street, this case also resonates in the crypto market. In a climate of institutional distrust, bitcoin regains its place at the heart of the debate as a non-sovereign asset.

Is bitcoin climbing? Or plunging? Between juicy injections, cautious politicians and Harvard funds, 2026 promises a well-spiced crypto saga... with guaranteed suspense on the regulation front!

Bitcoin threatens to finish the year in the red. Can it still rebound before the end of 2025? An analyst warns of a crucial technical threshold.

Crypto debanking suffocates businesses, but Cynthia Lummis sees a glimmer of hope: the "skinny accounts" of the Fed. Could this solution finally put an end to arbitrary bank account closures? After the Strike vs JPMorgan case, the senator takes action.

The crypto market enters 2026 in a climate of caution. Despite several rate cuts decided by the Fed in 2025, the expected rebound did not materialize. Bitcoin, Ether, and major assets declined, contrary to expectations. Monetary policy remains unclear, economic data are weakened, and the Fed hints that a pause could occur as early as the first quarter. This context rekindles tensions in an already weakened market.

Bitcoin is not weakening due to its own limits, but because the global economic climate is reshuffling the risk cards. Between contradictory signals from the United States and monetary inflections in Japan, investors are reconsidering their priorities. Indeed, the flagship crypto, which has been a market driver in recent months, is retreating in portfolios. This shift says nothing about its intrinsic solidity, but everything about the prevailing nervousness in the face of a monetary policy that remains, for now, unpredictable.

Bitcoin suddenly dropped to 86,700 dollars on Monday, December 15, triggering more than 210 million dollars in liquidations in one hour. This rapid and unexpected move surprised the market, recalling the strong vulnerability of cryptos to volatility and economic tensions.

Donald Trump launches this week the interviews to designate the successor of Jerome Powell at the head of the Fed. A crucial decision that could change everything: interest rates, financial markets, and even the Bitcoin price. Who will be chosen and what impacts for crypto?

The US Federal Reserve could well be starting a decisive turning point. According to the latest data from the CME FedWatch Tool, markets now estimate an 85% probability of a rate cut as early as December. A rapid development, which contrasts with the firmness displayed in recent months. If this scenario is confirmed, it will mark the end of an unprecedented monetary tightening cycle and could disrupt the balance of financial markets.

Bitcoin is navigating turbulent waters as November comes to an end. After a sharp drop below $81,000, the cryptocurrency attempts a timid recovery around $88,000. Traders are now scrutinizing technical signals while a "death cross" looms over daily charts. The Thanksgiving week promises its share of macroeconomic turbulence. Will BTC manage to reclaim $100,000?

November 2025 sees the Fed paralyzed by uncertainty, while Trump multiplies attacks against Powell, calling him a "mental patient." Between frozen rates and presidential insults, the crypto market wavers. Who will emerge victorious from this chaos?

Caution settles in on the markets. In a few weeks, investors have seen their hopes for monetary easing vanish while Bitcoin lost its momentum. But does this correction signal a simple pullback or the start of a real bear market?

Uncertainty hovers over crypto markets as macroeconomic conditions slow down the usual November bullish momentum. Will bitcoin manage to maintain its reputation as the best performing month of the year?

American Bitcoin ETFs experienced a massive outflow of capital last week. Institutional investors turned away after Jerome Powell dashed hopes of a rate cut in December. Contrary to this, Solana ETFs stand out with record inflows.

Tom Lee, an iconic figure of crypto optimism, just unveiled a projection that is a bombshell in the ecosystem. According to him, Bitcoin could reach between 1.6 and 2 million dollars by 2030. But that's not all: he even mentions a 3 million scenario. How does he justify such ambition?

The US Department of Labor will publish inflation data on Friday despite the government shutdown. An unusual decision five days before the Fed's crucial interest rate decision. Crypto investors are holding their breath.

It's historic. Tomorrow, October 21 in Washington, the US Federal Reserve hosts the elite of the crypto sector for an unprecedented conference on payment innovation. Sergey Nazarov from Chainlink, the heads of Circle, Paxos, and Coinbase: all will be front and center. Stablecoins, tokenization, AI... An agenda that says a lot about the new era the Fed seems ready to embrace.

The GENIUS law, presented as the solution to secure stablecoins, hides alarming flaws according to the Federal Reserve (Fed). Michael Barr sounds the alarm: systemic risks, regulatory arbitrage, and threats to your crypto investments. Are stablecoins really stable?

The European stock market has just closed an exceptional week. The STOXX 600 rises by 2.8% and continues to break records. Health, banks, and mining lead the way, driven by palpable optimism.

Bitcoin climbs, Wall Street applauds, but the RSI coughs: does too many ETFs kill the ETF? The king asset flirts with euphoria… and traders already feel the chill.

Bitcoin consolidates above 100,000 dollars, driven by institutions and the anticipation of the outcome of the "BITCOIN Act."

On the brink of a total shutdown, Washington shakes global markets. This Monday, September 29, the budget deadlock in the US Congress revives the specter of a shutdown as early as Wednesday, plunging investors and institutions into uncertainty. In an already uncertain climate, marked by central bank hesitations and the fragility of US indicators, this political stalemate raises fears of a major loss of visibility. Investors are repositioning urgently, between a flight to safe havens and anticipation of macroeconomic turbulence.

What if an overly soft banker awakened the bitcoin beast? Behind the Trumpian nominations, a financial parabola ready to explode… Novogratz lights the fuse, hide the dollars!

Economy: JPMorgan anticipates tensions on the Fed and integrates stablecoins without fearing for its deposits. We tell you more here!

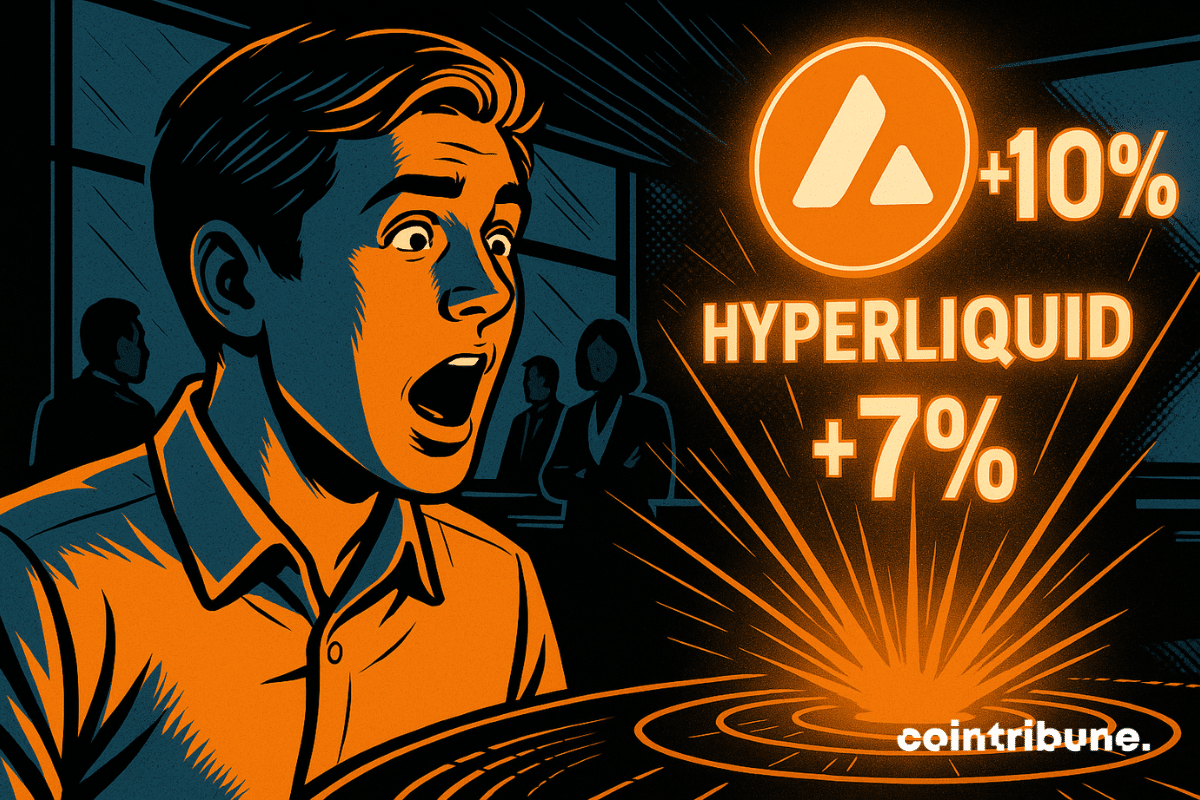

Barely announced, the Fed's rate cut has reignited crypto market enthusiasm. However, behind this surge lies another driver: the leverage effect of project-specific announcements. Avalanche (AVAX) and Hyperliquid (HYPE), driven by aggressive strategies, captured most of the bullish flows. Between monetary steering and targeted initiatives, token performance depends as much on macroeconomic decisions as on their ability to convince on the ground.

Powell cuts timidly, Trump shouts louder than ever, and crypto cheers. In Washington, the FED lowers its arms, while Bitcoin and stablecoins revise their choreography.

Wednesday, bitcoin is at stake: between the Fed's boost, the 117,000 $ wall and hungry whales, guaranteed suspense for the crypto market star.