While the stock market progresses timidly, it is the dollar that falters, weakened by the dual pressure of the new trade taxes imposed by Donald Trump and the ongoing hesitation of the Federal Reserve. In this tense atmosphere, investors oscillate between the quest for yield and the caution dictated by the surrounding instability. The apparent calm conceals a palpable nervousness: that of a market that knows that everything can tip at the slightest jolt.

US Federal Reserve (FED)

While markets were expecting a clear monetary shift in 2025, Jerome Powell, the chairman of the Federal Reserve, dampened hopes by pointing to an unexpected culprit: Trump. Yes, Donald Trump, back in the White House since January, is leaving his mark on the American economy, to the point of forcing the Fed to play for time. In a context where every word matters, Powell dropped a diplomatic bombshell, accusing Trump's policies of blocking interest rate cuts.

Bitcoin disappoints as it approaches its record. Ethereum might just steal the spotlight. All the details in this article!

Fed meeting June 2025: inflation, unemployment, trade tensions... Discover how these crucial issues could disrupt interest rates and why some are already betting on bitcoin. Don't miss out!

American inflation defied all doomsday predictions in April, falling to 2.3% despite the implementation of massive tariffs by the Trump administration. This unexpected decline raises a troubling question: what if analysts had exaggerated the impact of protectionist measures? Are fears of an inflationary spiral overstated?

The stock market reacts positively to the Fed's decision to keep interest rates unchanged. Discover the key figures in this article!

When the Federal Reserve opts for inaction, markets wobble. By keeping its rates unchanged this Wednesday, the world's leading central bank met expectations but did not alleviate tensions. Thus, amid persistent inflation, slowing consumption, and uncertainties about employment, the Fed's message remains deliberately vague. This strategy of waiting increases the nervousness of financial markets and fuels speculation, particularly in the crypto world, where every word of Jerome Powell is scrutinized as a crucial indicator.

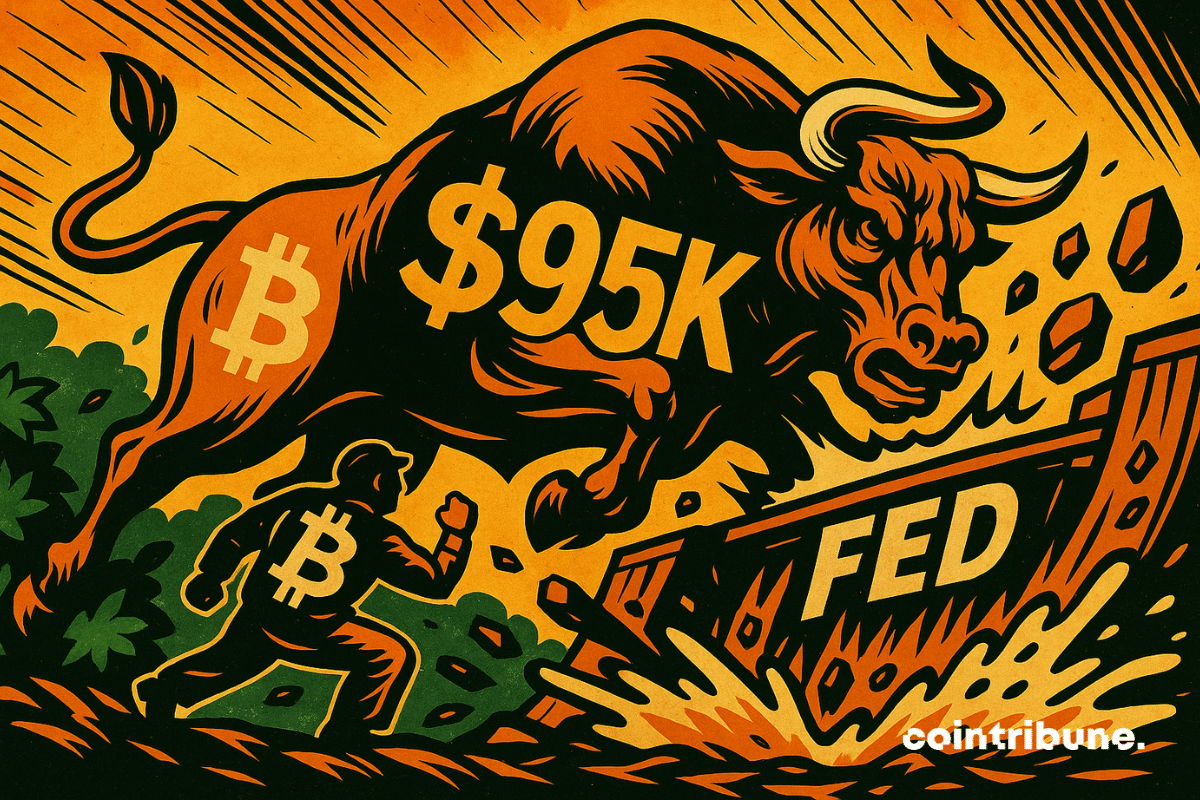

The Fed feigns hesitation, but its printer is spewing billions. Meanwhile, Bitcoin is climbing without looking back, immune to Powell's words and Treasury debts.

Market: after a loss of 2.4%, gold rebounds ahead of the FED meeting. A strategy to follow for investors? Analysis.

Powell slows down, Trump strikes, the markets are in a frenzy. Between surtaxes and threats of dismissal, monetary independence is riding a rodeo amid the discreet applause of 6-dollar eggs.

The dollar has slowed down, but global markets are holding their breath. After three weeks of rising, the greenback is losing ground, driven by a more robust employment report than expected. However, tensions persist: a resilient growth, stagnant rates, and ongoing tariff uncertainties. Cryptos are not exempt from this monetary ballet. For crypto traders, every fluctuation of the dollar redraws the risk map, shifts the boundary of volatility, and reshapes liquidity expectations.

With a low of deposits on exchanges, is Bitcoin showing signs of an imminent new bull run? Analysis.

The American economy, that giant which once seemed untamable, today wobbles on a tightrope, caught between heightened trade tensions and a loss of domestic confidence. While some spoke of a mere gust of wind, the storm could very well be of unexpected violence.

When Donald Trump challenges the bond market, it is not just a political confrontation: it is a systemic shock. The American president, driven by an interventionist economic vision, has triggered a wave of instability by upsetting the balances of interest rates and Treasury bonds. Opposing him is a relentless market that did not take long to react. This showdown, far from being anecdotal, reveals the fragilities of a strained economy and revives the debate on the reliability of traditional assets in times of uncertainty.

Jerome Powell, the chairman of the Federal Reserve (Fed), is facing increasing political pressure from Donald Trump, who is calling for an immediate reduction in interest rates. But Powell has no intention of yielding. Loyal to the independence of the institution he leads, he prefers to base his decisions on economic data rather than political demands.

The shadow of Donald Trump once again looms over American financial stability. His recent threat to fire Jerome Powell, chairman of the Federal Reserve (Fed), is not just another provocation. It is a political gamble that could crack the very foundations of monetary independence. A scenario where the impulsiveness of one man overturns the global economic chessboard. But behind the loud declarations lies a very real systemic risk, candidly analyzed by influential voices like Anthony Pompliano. Explanations.

In a recent explosive statement, Donald Trump did not mince his words regarding Jerome Powell. The American president stated that the "resignation of the Fed chief couldn't come soon enough" and that he would not hesitate to fire him if he wanted to.

Donald Trump has renewed his attacks against Jerome Powell, the chairman of the Federal Reserve. He accuses him of not acting quickly enough to lower interest rates. Amid political tension, this criticism reignites the debate over the FED's independence and its growing influence on financial markets.

While economists count illusions, Bitcoiners sense the truth. False data, weakening dollar: a new monetary dogma is being born before our eyes, far from official reports.

Binance is giving away bitcoins, traders are balancing between euphoria and price headaches, and the CPI hovers like a sentence. The question remains who will suffer: the bulls or the bears.

Bitcoin is facing increasing pressure since the resurgence of the trade war initiated by Donald Trump. While many hoped to see the asset detach from the influence of Wall Street, reality is catching up with the markets: the rise in U.S. bond yields is dampening initial enthusiasm.

Donald Trump recently triggered an economic shockwave by announcing new tariffs. In response, Jerome Powell, the Chair of the Federal Reserve (FED), warned that these measures could exacerbate inflation while slowing down growth. What will be the impact on interest rates? Find out here.

While the stock market stumbles, gold dances on the ashes of commercial promises. Trump stirs the embers, the Fed holds its breath in this theater of golden uncertainty.

All eyes are on the PCE index, a barometer of inflation in the United States. Due on March 28, this figure could trigger a upheaval in risky asset markets. Bitcoin, in the crosshairs, could be the first beneficiary or the first victim. In a climate of geopolitical tensions and monetary uncertainties, this publication represents a decisive test to gauge speculative appetite and the strength of the bullish momentum in cryptocurrencies.

While BlackRock sees the recession as a springboard for bitcoin, the Federal Reserve cools the enthusiasm for crypto. Between bold predictions and economic warnings, the market navigates troubled waters.

The crypto market is once again in a period of uncertainty, suspended on a single question: what will be the next decision of the American Federal Reserve? While bitcoin fluctuates below $85,000 and the crypto market's fear and greed index collapses to 23, investors hold their breath. The Federal Open Market Committee (FOMC) meeting concludes today, and all eyes are on Jerome Powell.

The crypto market is buzzing, traders are accumulating, stablecoins are soaring. A prelude to a bullish party or the swan song before an unexpected crash? The riddle persists.

The U.S. Securities and Exchange Commission (SEC) may soon abandon its initiative to require certain crypto companies to register as exchanges. Mark Uyeda, acting chairman of the SEC, has asked the agency's teams to explore ways to waive this regulatory change.

Financial and crypto markets continue to experience severe declines as investors await inflation data and the FED's decisions. Despite favorable regulatory advancements, Bitcoin and Ethereum are falling, in hope of a relief that will certainly come from the upcoming CPI and FOMC data. But what will it really be?

The American economy is facing a dynamic that could disrupt the existing balances: demand for long-term Treasury bonds is weakening, calling into question the strength of the dollar and fueling new economic uncertainties. As the Federal Reserve remains committed to a delicate monetary policy and inflation struggles to slow down, Bitcoin finds itself at a strategic crossroads. Historically viewed as a speculative asset, it is now seeing its status evolve as some U.S. states consider incorporating it into their reserves. The central question is thus: will Bitcoin suffer the effects of this uncertainty or will it seize the opportunity to assert itself as an alternative safe haven?