Michael Selig, nominated to lead the CFTC, will face his Senate confirmation hearing on November 19 as lawmakers review his approach to crypto regulation.

News

Uncertainty hovers over crypto markets as macroeconomic conditions slow down the usual November bullish momentum. Will bitcoin manage to maintain its reputation as the best performing month of the year?

She dreamed of being a queen, handled bitcoins by the thousands... and ended up on the London judicial throne! Dive into the crypto universe where scammers aim high, very high.

Brazil has taken a significant step toward bringing stablecoin activity under its traditional financial system. New regulations issued by the Banco Central do Brasil (BCB) grant stablecoin transactions the same legal treatment as foreign-exchange operations and subject crypto companies to a licensing regime similar to that of banks.

Injective has just deployed its native EVM mainnet, marking a turning point in the evolution of layer 1 blockchains. This integration allows Ethereum developers to leverage the power of Cosmos without sacrificing performance. But will this technical feat be enough to reverse the downward trend of the INJ token, down more than 60%?

An online survey sparked controversy: more than 80% of respondents believe that Lightning is not "real bitcoin." A massive figure, and a clear divide between technical promise and market perception. The debate exploded on X, opposing pro-Lightning figures and sharp critics. Let's summarize, decode, and project.

While the crypto market remains under pressure due to global economic uncertainties, XRP continues to disappoint despite concrete advances. Why such a discrepancy between its fundamentals and its price? For Versan Aljarrah, a recognized analyst and founder of Black Swan Capitalist, the answer is straightforward. As long as XRP remains correlated with bitcoin, it will remain trapped by chronic volatility. This statement reignites the debate on the strategic independence of Ripple’s flagship asset.

It was said to be gone, buried, burned... But here comes Shiba Inu barking again! A crypto building in the shadows, while others play disposable stars.

The crypto universe seems to be restarting: NFTs on fire, memecoins going wild! Discover why the market is exploding.

After more than 40 days of paralysis, Washington is beginning to emerge from the crisis. On Monday evening, the Senate voted on a temporary funding law aimed at reopening federal agencies, including the SEC, essential to the crypto ecosystem. If the House approves the text this Wednesday, the government could resume its activities by the end of the week. This outcome is closely watched by the markets, as several key cases for the blockchain industry are awaiting revival.

Bitcoin was supposed to take off after the US budget chaos. Result? ETFs on strike, Solana showing off... and investors biting their nails, eyes fixed on December.

As states tighten their control over cryptos, an old bitcoin theft resurfaces amid a geopolitical rivalry. LuBian, a Chinese mining pool, reportedly lost more than 127,000 BTC in 2020. Remaining discreet for years, the case suddenly resurfaces as Beijing now accuses the United States of having seized these funds, now valued at over 14 billion dollars, through an intelligence operation. The suspicion of a state confiscation reignites tensions between two superpowers.

While Wall Street panics over the AI bubble, Softbank sells everything, invests everywhere... and hits the jackpot! But how long will the billion-dollar machine run without bugs?

Bitcoin shows signs of stabilizing after October’s declines, with seasonal trends and renewed investor interest pointing to a potential year-end rebound.

Institutional adoption of digital cash is gaining momentum, marking what BNY describes as a major structural shift in global finance. The bank projects that the combined market for stablecoins, tokenized deposits, and digital money-market funds (MMFs) could reach $3.6 trillion by 2030. Stablecoins are expected to account for about 41.6% of that total, with tokenized deposits and digital MMFs making up the remainder.

While the small ones sell, the big ones stuff themselves with ETH. A mysterious update named Fusaka might hide a tricky move... or a boon!

Bitcoin’s sharp rebound, fueled by optimism over the end of the 40-day U.S. government shutdown, has split traders. While most market watchers welcomed the recovery, aggressive short sellers faced a costly squeeze. High-risk trader James Wynn is at the center of the turmoil after a series of rapid losses pushed him into an even larger short bet.

While the United States struggles to align on crypto regulation, the Senate breaks the deadlock. The Agriculture Committee has just unveiled an ambitious bill aimed at clarifying the roles of regulators, CFTC and SEC, and laying the foundations for a coherent legal framework. Led by Senators Boozman and Booker, the text also addresses key concepts such as DeFi, DAOs, and blockchain. This is a first step towards more readable regulation.

The institutional crypto market has just reached a major milestone. The U.S. Treasury and the IRS now authorize crypto ETFs and trusts to participate in staking and redistribute rewards to their investors. This decision could well disrupt the world of digital asset investment.

As the specter of a historic shutdown recedes in the United States, bitcoin has rebounded, surpassing $106,000. The Senate approved temporary funding, narrowly avoiding a prolonged paralysis of federal institutions. This political progress was enough to revive the appetite for risk, propelling the leading crypto into a bullish dynamic. In a market where Washington's decisions act as a catalyst, this return to stability strengthens the correlation between macroeconomic news and crypto investors' behavior.

Progress toward ending the U.S. government shutdown is driving market optimism with crypto gains and renewed ETF hopes.

While some flee the crypto ship, Saylor fills up on bitcoins. And if the stubborn captain was right? Guaranteed plunge into Strategy's digital vaults.

Coinbase is selling its tokens left and right, Monad is rowing toward the masses, and crypto is finally tasting the joys of fair auctions... Americans included. And with no fees, please!

As the American shutdown crisis nears its end, another signal captures crypto investors' attention. No less than eleven ETFs backed by XRP have just appeared on the DTCC website, the key body of the American financial markets. While this registration does not signify regulatory approval, it demonstrates a concrete step toward a possible listing on U.S. markets. It is a major technical milestone for XRP, which could revive institutional interest in the asset.

When crypto plays central banker, the Fed sweats under its suit. Stablecoins, hidden treasures, and plummeting rates: guess who really runs the world?

Bitcoin reaches $160,000 and may be ready to explode? In this article, discover why the crypto market is heating up again.

A recent token purge by Binance founder Changpeng Zhao (CZ) has brought unwanted memecoin drops back into the spotlight. His public donation address once again attracted developers seeking attention, and their deposits were removed in a decisive move signaling a firmer stance.

The CFTC is preparing to launch leveraged spot crypto trading as early as next month, introducing new oversight to protect investors and strengthen the market.

Facing a historic wave of cyberattacks shaking the crypto ecosystem, a French company captures global attention. Ledger, a pioneer of physical wallets, records rapid growth as individuals and institutions seek safe havens. Driven by this explosive demand, the company now plans a stock market debut in New York, a strategic decision embraced, described by its CEO as the new epicenter of crypto capital.

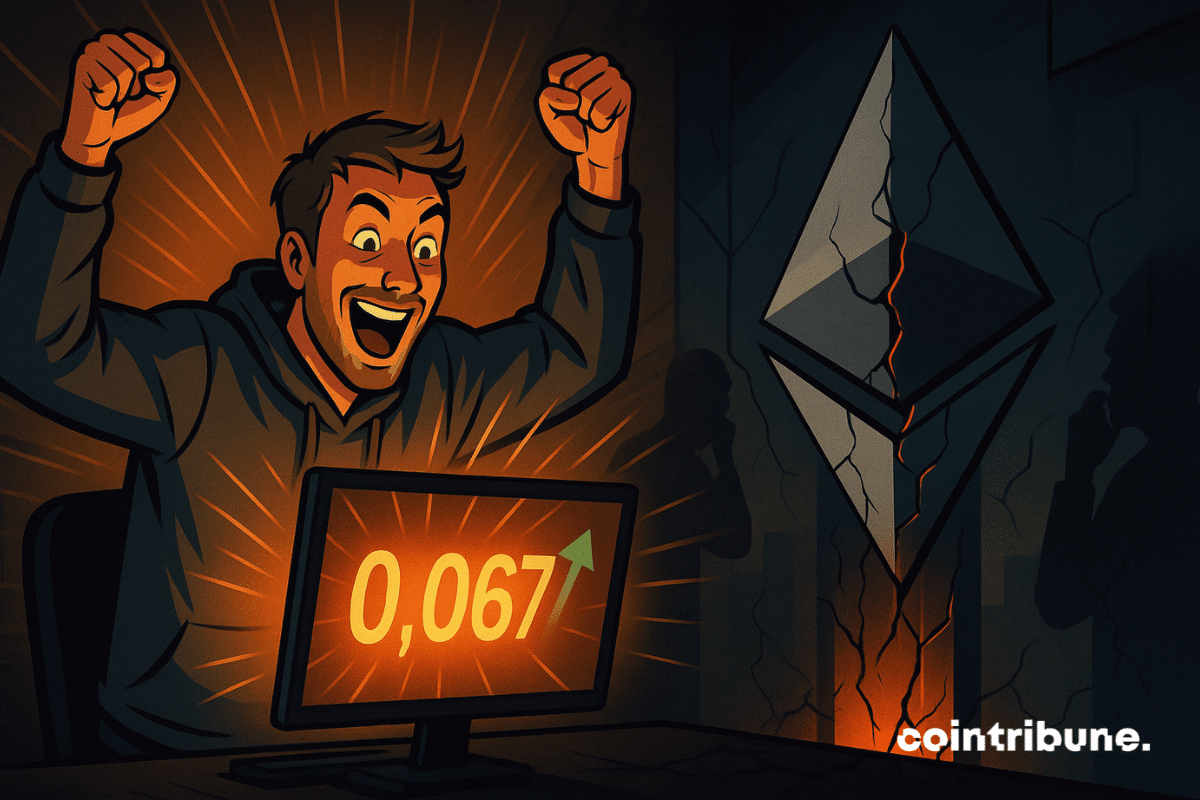

Making a transaction on Ethereum now costs only a few cents. This Sunday, gas fees plunged to 0.067 gwei, a level never seen in years. While traders praise this spectacular drop, it raises questions about the economic viability of Ethereum's model.