Unanimity in the markets is never trivial, especially in the crypto world. On Binance, over 72% of traders are betting on the rise of XRP. Such a strong consensus, in the absence of a fundamental catalyst, is unusual. No Ripple announcement nor a technical breakthrough, just a collective frenzy. This increased confidence is thought-provoking. Is it a sign of a real recovery or an excess of optimism ready to burst? The market might have a completely different interpretation.

Home » Archives for Luc Jose Adjinacou » Page 17

Luc Jose A.

Diplômé de Sciences Po Toulouse et titulaire d'une certification consultant blockchain délivrée par Alyra, j'ai rejoint l'aventure Cointribune en 2019. Convaincu du potentiel de la blockchain pour transformer de nombreux secteurs de l'économie, j'ai pris l'engagement de sensibiliser et d'informer le grand public sur cet écosystème en constante évolution. Mon objectif est de permettre à chacun de mieux comprendre la blockchain et de saisir les opportunités qu'elle offre. Je m'efforce chaque jour de fournir une analyse objective de l'actualité, de décrypter les tendances du marché, de relayer les dernières innovations technologiques et de mettre en perspective les enjeux économiques et sociétaux de cette révolution en marche.

Canada has just set a global precedent by approving the first spot ETFs backed by Solana (SOL), with staking options. While the United States struggles to move beyond Bitcoin and Ethereum, this Canadian initiative elevates Solana to the status of an institutionalized asset, marking a clear break in the hierarchy of listed cryptocurrencies. This is a strong signal for an ecosystem that has long been relegated to the background.

When Peter Brandt speaks, the markets listen. This trading veteran, active since the 1970s, dropped a bomb on the X platform: "Ethereum is a worthless trash." With over 700,000 followers and a reputation built on decades of technical analysis, Brandt is neither a troll nor an attention-seeking maximalist. His critique targets directly the second largest cryptocurrency in the market, which sparks a heated debate within the community and shakes the certainties of investors.

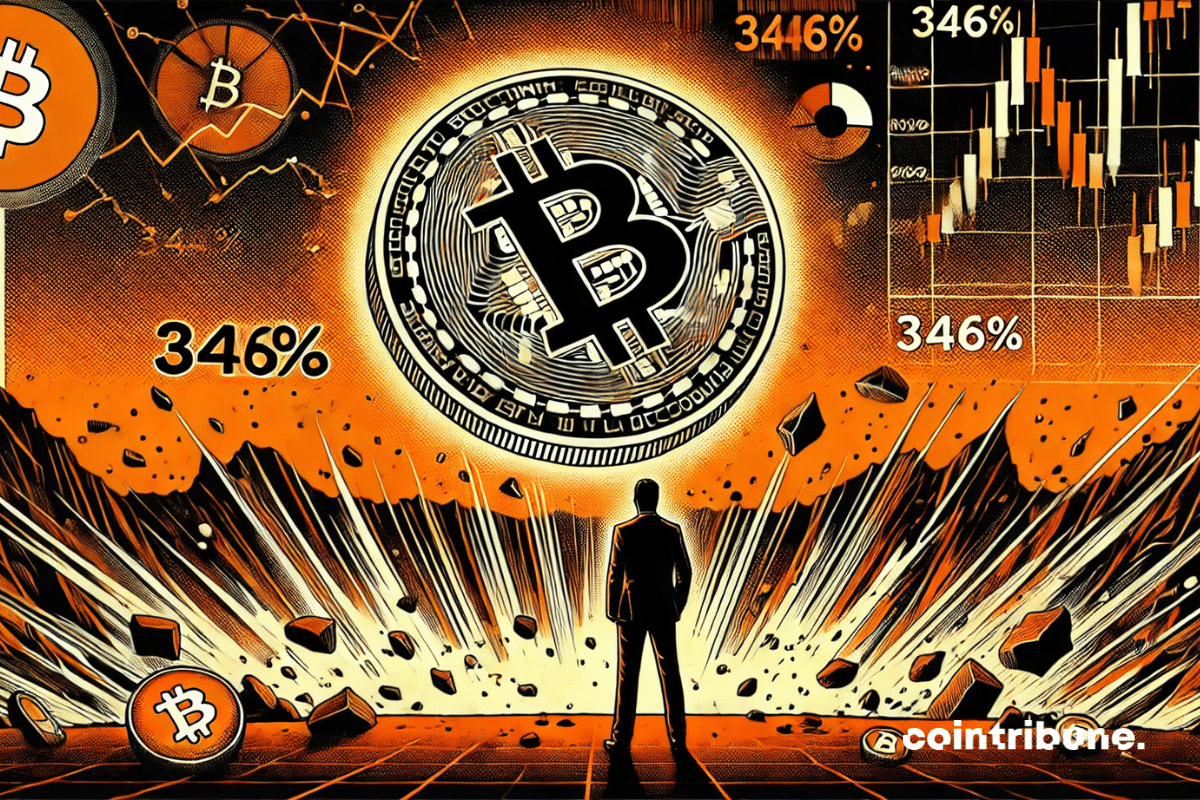

On April 13, Bitcoin surpassed $86,000 before plunging below $84,000, without any macroeconomic alerts or exogenous factors. This abrupt reversal can be explained by an unprecedented imbalance in liquidations: $52 million in long positions against only $15 million in short positions, representing a gap of 346%. This anomaly reveals a structural tension related to leverage, where excessive speculative optimism makes markets particularly sensitive to internal corrections.

XRP finds itself at a strategic turning point, facing technical resistance that could redefine its market trajectory. Since the settlement of the dispute between Ripple and the SEC, the asset has gained renewed confidence, but investors remain cautious. The crossing of this decisive threshold is being closely watched: a failure could stifle the current momentum, while a breakthrough would pave the way for new highs. Thus, it is now a time for confirmation for supporters of the bullish scenario.

As markets shake and capital flees risk assets, Michael Saylor stands firm. The founder of Strategy, indifferent to macroeconomic upheavals, has just added more than 22,000 bitcoins to his treasury. Indeed, the timing raises questions: BTC's correction is intensifying, and geopolitical uncertainty is settling in. However, Saylor does not waver. For him, bitcoin is not a gamble; it is a conviction. A sharp position, contrary to the consensus, which reignites the debate on the resilience of the maximalist strategy.

XRP is making a strong comeback among the major contenders at the top of the crypto market. Standard Chartered expects a surge of 500% by 2028, enough to surpass Ethereum in market capitalization. Such a scenario would place Ripple at the heart of new digital balances, just behind Bitcoin. This rise is supported by the momentum of tokenization, the growing commitment of institutions, and an improving regulatory climate. The hierarchy of cryptocurrencies may be on the verge of tipping.

As geopolitical tensions reshape global balances, the BRICS are accelerating the establishment of their own payment network. Led by Russia, this infrastructure aims to free itself from SWIFT and open a financial pathway outside of Western control. The announcement of its accessibility to non-member countries marks a strategic rupture. Beyond being a regional tool, BRICS Pay becomes a lever of global influence and a strong signal in favor of a multipolar monetary order.

XRP, the emblematic cryptocurrency of Ripple, is the subject of frontal attacks on its structure and philosophy. A blockchain expert questions its alleged decentralization and accuses the protocol of authoritarian drift. This criticism reignites a central debate in the industry: what truly constitutes a decentralized blockchain? Ripple, for its part, defends its design and claims resilience and efficiency. As pressure mounts, XRP finds itself at the heart of an ideological clash that could redefine the criteria for acceptability in the crypto universe.

Crypto in France is moving out of its phase of euphoria towards a more mature structuring. This 2025 study by Adan (Association for the Development of Digital Assets), conducted with Deloitte and Ipsos, presents a clear assessment: stabilized adoption, asserted industrial ambitions, but persistent challenges. Amid the rise of Web3, institutional openness, and regulatory barriers, the French ecosystem is carving its path towards sustainable integration. This survey sheds light on the springs of a dynamic in full redefinition, where the strategic future of cryptocurrencies in Europe is at stake.

On April 12, Donald Trump surprised the markets by lifting a series of tariffs on strategic technology products. This move, amidst the rivalry with China, instantly propelled bitcoin beyond $85,000. Far from a simple trade adjustment, this decision reshapes industrial balances and sends a strong message: American economic policy is now aligned with the interests of digital players and the crypto sector.

JPMorgan crushes forecasts but tempers euphoria. Through the publication of historical results for the first quarter of 2025, the leading American bank asserts its power amid ongoing volatility. However, Jamie Dimon is not celebrating victory. He warns of an accumulation of systemic risks, from inflation to geopolitical tensions. This dual signal, between accounting triumph and strategic warning, summarizes the paradoxes of a banking sector facing an uncertain world.

48,575 BTC moved in a single day: a rare, massive maneuver with heavy implications. On April 9, as trade tensions between Washington and Beijing rekindle uncertainty, nearly $3.6 billion in bitcoin was transferred to accumulation wallets, a record volume since 2022. Behind this movement, strong signals emerge: major investors seem to be betting once again on a market pullback to strengthen their position. This sequence could mark a strategic turning point.

The bullish dynamics of the crypto market are faltering. While the total market capitalization remains stable around $2.52 trillion, the declines seen in Bitcoin, Ethereum, and other heavyweights in the sector (XRP and Dogecoin) are feeding doubts. Faced with unbroken technical resistances, several traders fear entering a bearish cycle. The market, already fragile, could tip over if no rebound signal appears quickly.

In the midst of a commercial battle, the European Union agrees to negotiate the elimination of tariffs on Chinese electric vehicles. Supported by massive subsidies, these low-cost models disrupt the balance of the European market. This turnaround marks a turning point, as Europe, torn between industrial protectionism and ecological transition, opens itself to a risky compromise. In a key sector, this rapprochement could reshuffle the cards between two rival powers, linked by competition as much as by interdependence.