Looks like Coinbase bulls are gunning for those November 2021 highs. $COIN

— TrendSpider (@TrendSpider) March 25, 2024

If $BTC can make a new ATH, seems likely. 🪙 pic.twitter.com/bOrz4zbwgq

A

A

Crypto: Is Coinbase about to surpass Binance?

Thu 28 Mar 2024 ▪

5

min of reading ▪ by

Getting informed

▪

Centralized Exchange (CEX)

At Coinbase, after a tumultuous year in 2022, things finally seem to be clearing up in 2023. The American cryptocurrency exchange is boasting impressive performance: a skyrocketing COIN stock on the stock markets, record profits, and many other successes. But what is the secret behind this success story? Some wonder if Coinbase is benefiting from a boost from the U.S. government to destabilize its rival, Binance.

The Coinbase Boom

Despite some turbulence, including a dispute with the United States Securities and Exchange Commission and recent technical outages that have tarnished its reputation, Coinbase seems to be on the right track.

If $BTC can reach a new ATH, that seems likely.”

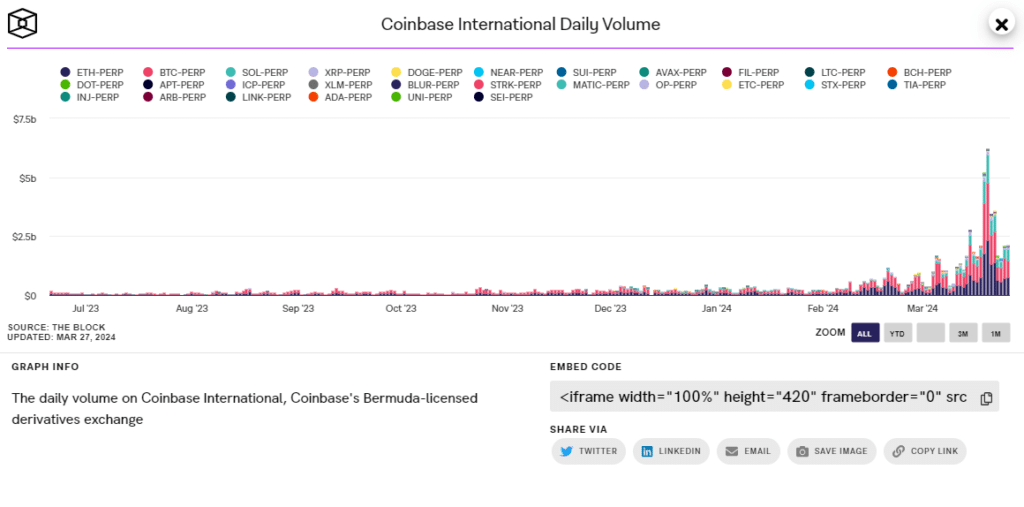

At the heart of cryptocurrency transactions, Coinbase International Exchange sees its figures explode, signing an exceptional performance. In March, daily transaction volumes neared an incredible peak of six billion dollars. A rapid ascent marked by shattered records and growing demand.

This upward trend is not by chance, as pointed out by the analysis from CryptoPolitan. It stems from the market’s clear response to the availability of a reliable and regulated international trading platform. A Coinbase spokesperson highlighted the importance of this growth, putting the exchange in a favorable position for continued expansion and possibly even overtaking Binance.

But that’s not all. Simultaneously, the price of Coinbase shares is soaring. A surge of more than 10% in 24 hours, 44% in February, and 346% last year, propelling the stock to over $280. A trend that reflects the strength of the cryptocurrency market, registering a spectacular growth of more than 61% since the beginning of the year.

However, despite this remarkable performance, the stock remains below its historical high of November 2021 which set its price at $381. Nevertheless, this progress demonstrates a growing interest in the cryptocurrency market and the crucial role played by Coinbase in facilitating international exchanges for its clients.

A Spectacular Comeback in the Crypto Markets

The last quarter of 2023 has been most generous for Coinbase, the American cryptocurrency giant, as noted by Decrypt. According to the Q4 results, the San Francisco-based company realized a considerable profit of 273.4 million dollars, reversing what was once a losing trend. A notable financial metamorphosis since that same time last year the company reported a staggering loss of 557 million dollars.

The secret of this transformation? Coinbase has taken advantage of the interest generated by its stablecoin USD Coin (USDC), registering a vertiginous increase of about 18%, for an impressive amount of 171.6 million dollars.

But the good news doesn’t stop there. The exchange has also lightened its financial burden by reducing its debt by 413 million dollars. A feat praised by investors, as Coinbase’s shares surged shortly thereafter, a sign of regained confidence.

This upswing is partly due to the general improvement in the cryptocurrency market. With the soaring value of bitcoin throughout 2023, driven by the much-anticipated arrival of cryptocurrency ETFs, Coinbase has capitalized on this trend by providing custody services and other offerings to numerous bitcoin issuers.

But… the SEC Prevails Over Coinbase: Crypto Under Surveillance

According to the latest probes by U°Today, the United States Securities and Exchange Commission scored a partial victory against Coinbase, the American leader in cryptocurrencies. The decision allows the SEC to pursue Coinbase, claiming that its program involves the unregistered sale of securities.

This is a blow for Coinbase which sought to dismiss the action. The SEC maintains that certain cryptocurrencies on Coinbase are securities. Judge Polk Failla questioned the agency’s interpretation of the law but dismissed Coinbase’s request, citing a sufficient plea from the SEC.

The court’s decision was surprising, with analysts expecting a 70% likelihood of a Coinbase victory. Both parties are now preparing for a discovery phase.

Maximize your Cointribune experience with our 'Read to Earn' program! Earn points for each article you read and gain access to exclusive rewards. Sign up now and start accruing benefits.

A

A

La révolution blockchain et crypto est en marche ! Et le jour où les impacts se feront ressentir sur l’économie la plus vulnérable de ce Monde, contre toute espérance, je dirai que j’y étais pour quelque chose

DISCLAIMER

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.