Ethereum facing a diversification crisis: a bug could paralyze everything

Ethereum, a cornerstone of the digital economy with a network value of 278 billion dollars, faces a significant challenge. The majority of its validators depend on a single software, Geth. This situation raises concerns about the risks of centralization and vulnerability.

The Reliance on Geth: A Non-Negligible Risk

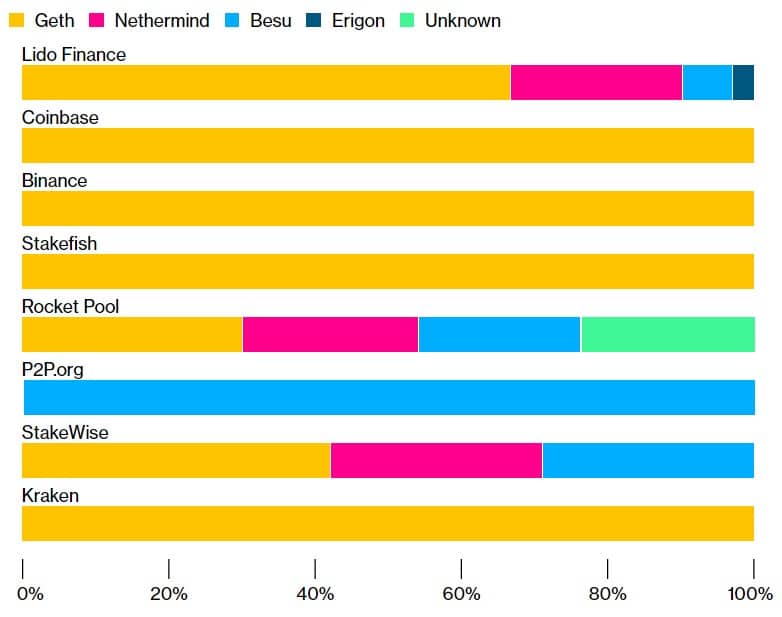

Coinbase, Lido Finance, and Binance, leaders in Ethereum staking services, are in a precarious position. Nearly 80% of Ethereum’s validators use Geth to connect to the network.

This situation can be considered as Ethereum’s Achilles’ heel. Indeed, a bug in Geth could, in theory, halt the processing of transactions on Ethereum. According to experts, such a scenario is catastrophic, leading to losses for investors and potentially splitting the network.

The recent outage caused by a bug in the less-used software, Nethermind, has brought this issue to light. Although Nethermind represents only a small fraction of validators, the incident has prompted increased awareness. The reliance on Geth is criticized even more as its dominance makes the Ethereum network vulnerable.

Major players such as Coinbase, Binance have acknowledged the risk and are now exploring alternatives to Geth. These platforms manage together nearly 13 billion dollars in staked Ether, according to StakingRewards.

This search for diversity comes after years of reliance on a single software client. It reflects a belated realization of the risks of centralization in a field where decentralization is a founding principle.

Towards a Crucial Diversification to Save Ethereum

This situation shows that diversification is no longer an option, but a necessity. Moreover, it highlights a blatant contradiction with blockchain principles.

The response of platforms, although belated, shows an awareness. In fact, there is a noticeable decrease in the use of Geth, which went from 84% to 78% in less than two weeks, since the Nethermind bug on Ethereum. Coinbase and Kraken are indeed turning towards new software clients. However, Binance’s reaction remains unknown.

How Ethereum responds to this challenge will determine not only its survival but also its adherence to the ideals of decentralization. Software diversification is thus essential for the network’s resilience. The question is indeed more than a technical necessity, it is vital for the future of the Ethereum network.

Maximize your Cointribune experience with our 'Read to Earn' program! Earn points for each article you read and gain access to exclusive rewards. Sign up now and start accruing benefits.

Click here to join 'Read to Earn' and turn your passion for crypto into rewards!

Je suis passionnée par les cryptomonnaies, un monde que j'ai découvert il y a peine 3 ans. Mon seul but est de vous informer de cet univers incroyable à travers mes articles.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.