The Aave community narrowly approves the first stage of its "Aave Will Win" reform. This close vote paves the way for a new economic framework, supported by significant funding demand and active user participation.

Finance News

Dividend at 11.5% and stock under pressure: Strategy bets everything on bitcoin. Should this be seen as a strong signal or an increased risk? Analysis!

Is crypto dead? Kalshi refuses to let its bettors profit on Khamenei's corpse. Refunds everything, gets called a killjoy. Meanwhile, at Polymarket, people are cashing in without remorse.

Bloomberg and Kaiko are teaming up to put institutional-grade market data directly on-chain, improving transparency, automation, and reliability in tokenized finance.

MetaMask's fox pulls out its credit card at Uncle Sam's. Even New York opens its doors. While exchanges tremble, it builds its empire. Clever.

This Saturday, February 28, 2026 marks a major turning point in the escalation in the Middle East. After US-Israeli airstrikes against the Iranian regime and its military capabilities, Tehran retaliated by effectively blocking the Strait of Hormuz. On VHF maritime waves, the Guardians of the Revolution broadcast a clear message: "No ship is allowed to pass." The major oil companies are already suspending their shipments. Will the Brent barrel cross the symbolic threshold of 100 dollars?

Millions still lack basic financial tools. Ethereum’s global reach offers a different path. Could a blockchain network meaningfully support people that the traditional system overlooks? Rising on-chain activity and stronger utility across the Ethereums Ecosystem suggest that the conversation is shifting.

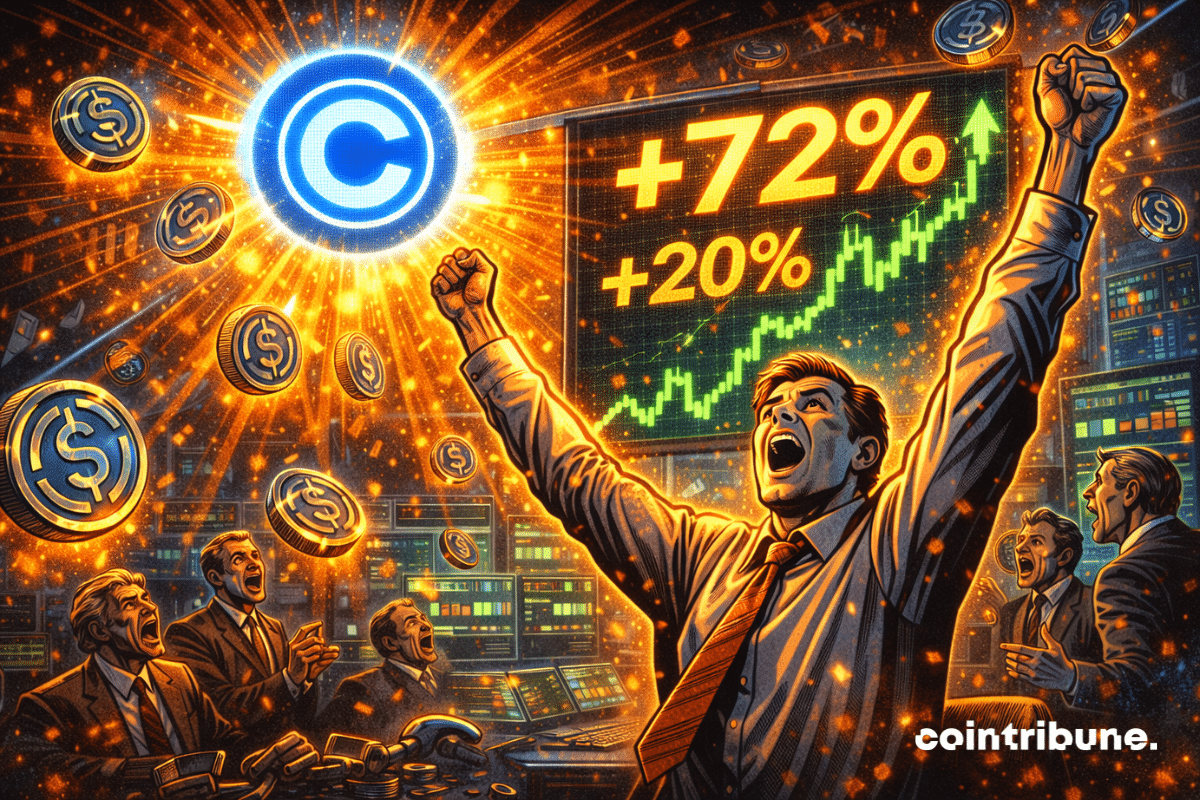

While the market cries, Circle is thriving. 770 million in revenue, USDC soaring, a blockchain accelerating. The others? They look at their shoes, embarrassed.

European investors now have a new way to access Bitcoin-backed corporate yield. 21Shares has launched an exchange-traded product (ETP) tied to preferred shares issued by Strategy, the company led by Michael Saylor and widely recognized as the largest public holder of Bitcoin.

Despite the crypto market pullback, over one billion dollars is flowing into RWAs. Are investors already changing strategies?

Remember Libra, Zuckerberg's baby strangled by regulators. Five years later, daddy is back. But this time, he lets Stripe hold the bottle.

Stripe could acquire PayPal, merging technological innovation and a massive user base to establish itself as a key player in digital payments and cryptocurrencies.

The Ethereum Foundation has stepped up its involvement in decentralized finance, committing new resources to its DeFipunk initiative even as ETH trades under pressure. The move comes at a time when Ethereum’s price structure remains weak, with sellers in control across several timeframes. While market sentiment leans bearish, the foundation appears focused on shaping the long-term direction of DeFi within its ecosystem.

Tokens 2025 end up in the scrapyard: -71% median. Meanwhile, Coinbase and Circle stocks are flying off the shelves. Institutions change their business. Logical.

Bitdeer Technologies has fully liquidated its corporate bitcoin holdings, reporting zero BTC on its balance sheet as of Feb. 20. A weekly production update posted on X confirmed the move. The decision marks a sharp break from common industry practice, where most listed miners continue to accumulate or hold reserves. It also comes at a time of tightening mining margins and the company's recent capital raises.

An AI project victim of a token rug pull scam. Result: the word "bitcoin" becomes taboo on its Discord. Crypto, please don't talk about it.

Grayscale Investments has increased Cardano’s ADA weighting in its Smart Contract Fund to 20.12%, up from 19.50%, marking another consecutive allocation boost. ADA now accounts for more than one-fifth of the portfolio, reinforcing its role as a core holding within the multi-asset vehicle. The move comes during a period of sustained price weakness for the token. Even so, the portfolio positioning suggests continued conviction in Cardano’s long-term role among leading smart contract networks.

Wall Street has just experienced one of its worst weeks with $8.3 billion in stocks sold in only seven days. A massive capital flight that raises questions: is this a sign of an imminent crisis or a historic opportunity for Bitcoin and cryptos?

Donald Trump raises tariffs to 15%. The decision, announced in a tense electoral atmosphere, revives the American protectionist line and puts trade policy back at the center of the economic debate. Traditional markets reacted. Cryptos, however, remained stable. This contrast raises questions about the real sensitivity of the crypto market to political and trade shocks.

By setting a deadline of about ten days to decide between a diplomatic agreement and military action, Donald Trump has placed Iran back at the center of a high international tension sequence. The American president stated he is considering a limited military strike to pressure Tehran on its nuclear program, even as discussions are ongoing. Between strategic pressure, naval deployment, and a tight timetable, Washington and Iran are now advancing on a particularly fragile diplomatic line.

MARA makes a big move by taking control of 64% of Exaion, EDF's technological gem. A strategic acquisition marking the end of traditional Bitcoin mining and the start of an era dominated by artificial intelligence (AI).

Washington opens a new explosive trade front. After being overruled by the Supreme Court on his use of emergency powers, Donald Trump immediately announced a 10% global tariff on imports. This decision renews trade tensions at a time when markets remain particularly sensitive to political shocks. Between institutional confrontation, alternative legal strategy, and increased volatility risk, this episode could have effects far beyond U.S. borders.

The United States Supreme Court has just struck hard. In a rare decision, it declared illegal the international tariffs imposed by Donald Trump, removing a trade tool he wielded as a geopolitical weapon. A judicial slap that could reshuffle the cards of his economic policy. But how far will this confrontation between the White House and the judiciary go?

Elemental Royalty will let shareholders receive dividends in Tether Gold, providing a digital alternative to traditional cash payouts.

The digital euro is moving out of the laboratory into concreteness. The European Central Bank now sets a precise schedule: payment service providers will be selected as early as 2026, followed by the launch of a one-year pilot in 2027. After years of studies and consultations, the project reaches an operational milestone. Behind these deadlines lies a global ambition: to sustainably embed the digital euro at the heart of the European payment system and redefine the balance of power in the Eurozone.

BlackRock has just launched a new Ethereum ETF promising 82% of staking revenue to investors! But behind this product lie high fees and centralization risks that even worry Vitalik Buterin.

Elon Musk’s social platform X is moving deeper into financial services with the upcoming launch of “Smart Cashtags,” a feature designed to improve how users track and reference stocks and cryptocurrencies. While rumors have circulated for months about X entering the trading space, executives have made one thing clear: the platform will not execute trades. Instead, it aims to enhance financial data visibility and asset identification.

RWAs rose over 13% in the past 30 days, showing resilience and growing institutional adoption even as crypto markets struggled.

Ray Dalio warns that the post-WWII world order has collapsed, with global leaders acknowledging a new era defined by power, economics, and rivalry.

X is preparing to introduce Smart Cashtags, a new feature that will let users view stock and cryptocurrency data directly from their timelines. The rollout is expected in the coming weeks, according to X head of product Nikita Bier. Alongside the feature launch, the company is tightening rules around spam and automated activity linked to crypto promotions.