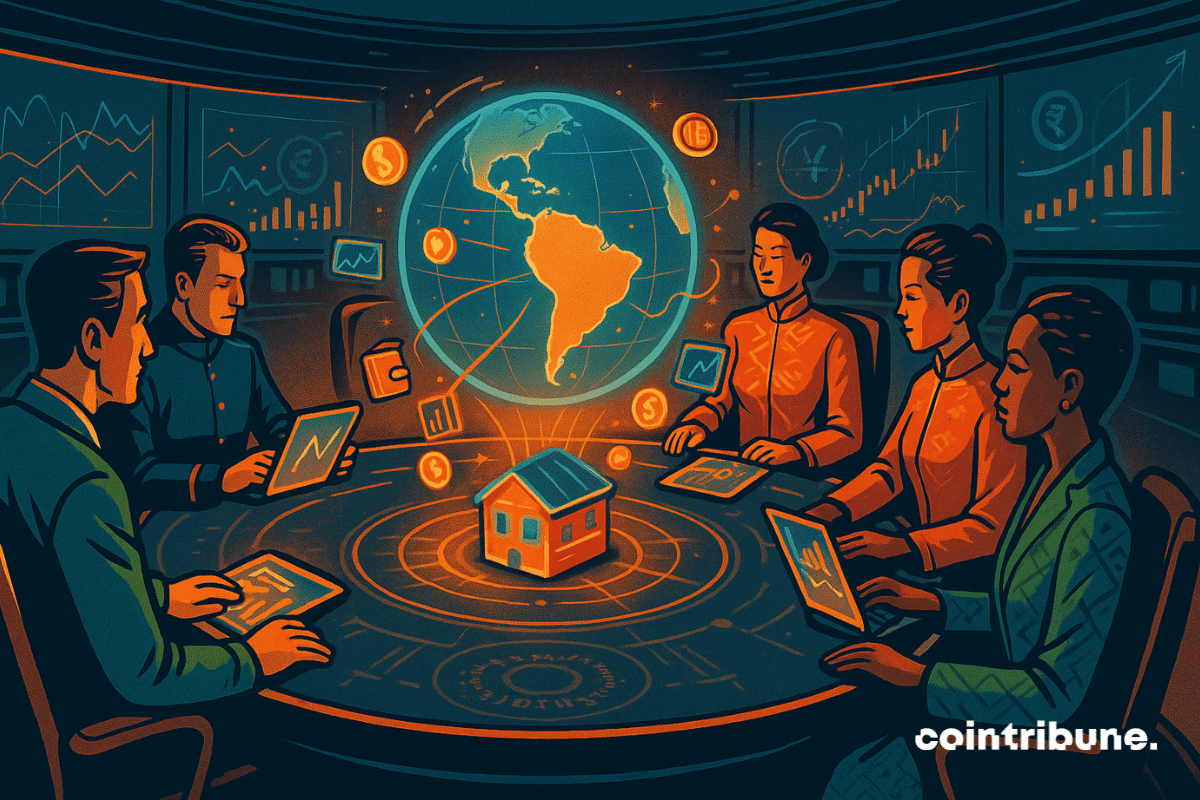

At a time when DeFi is reinventing uses through groundbreaking innovations, certain trends are literally exploding. In this technological cacophony, RWA — these tokenized real-world assets — are tracing a stunning trajectory: +260% by 2025, for a market of 23 billion dollars. Behind this figure lies a promise: that of tangible, stable returns, grounded in the real economy. A remedy for crypto volatility, a bridge to the traditional world. "Real yield is the new grail," insiders are already whispering. And at the heart of this rise in power, Credefi is quietly laying out its game.

Finance News

The BIS stands up to defend the Fed. Can the economy withstand a monetary crisis? The details in this article!

When bitcoin ETFs are making numbers like never before, investors are jigging while Wall Street rediscovers crypto, their eyes fixed on curves that rise steadily.

While the markets hesitate, Saylor is accumulating bitcoins by the thousands. Another 4,980 units? At this rate, it's the FED that will end up calling him.

It's hard to believe, but Donald Trump is favorable to bitcoin becoming the international reserve currency par excellence.

A Solana ETF that stakes, analysts rejoicing, and the SEC saying nothing... Could REX Shares be trying to make crypto dance on the regulatory floor?

Kalshi has raised $185 million in new funding, boosting its valuation to $2 billion as it plans to expand access to its prediction markets and grow its technology team.

Rio is set to host a high-stakes BRICS summit, marked by two historic absences: Xi Jinping and Vladimir Putin. The Chinese president is withdrawing for the first time since 2013, while his Russian counterpart remains in the Kremlin, targeted by an arrest warrant from the ICC. At a time when the bloc wants to assert itself against the dollar and strengthen its influence, these withdrawals weaken the group's unity and raise doubts about its geopolitical trajectory.

Has the crypto casino definitely closed its doors? Probably. There are signs that cannot be mistaken...

While Wall Street sets more records, the dollar is collapsing at an unprecedented rate since 1973. This wide gap is not trivial. It reflects a global shift fueled by geopolitical tensions, a Federal Reserve under political pressure, and macroeconomic uncertainties. The benchmarks are crumbling, and markets are seeking safe havens. In this silent but brutal reconfiguration, cryptocurrencies are once again asserting themselves in the strategic landscape, propelled by their decentralized logic in the face of state currency instability.

"Driven by an unexpected easing in the Middle East and a resurgence of stock market optimism, the S&P 500 closed this Thursday at 6,141.02 points, nearing its all-time high. Increasing by 0.8%, the benchmark index marks a significant rebound since its low in April, despite ongoing uncertainties regarding trade tariffs and regional stability."

Creating an efficient trading bot has long been a hassle. It required a combination of technical expertise, patience, and countless manual attempts. Beginners soon gave up. Even advanced users wasted precious time. With the launch of its AI Agent Optimizer, Runbot is shaking things up. This new conversational assistant turns strategy optimization into a simple exchange with artificial intelligence. No code. No technical lines. Just a clear discussion that leads to more effective strategies.

Russia no longer tests. It imposes. By decreeing the mandatory integration of the digital ruble into the national banking and commercial system, Moscow leaves no room for doubt. The transition to a controlled, programmable, and centralized currency is underway. Gone are the ambiguities of experimentation, making way for the architecture of an unprecedented monetary system where each transaction could, tomorrow, be traced, regulated... or even blocked. This choice is not merely technological: it is political, strategic, almost ideological. For behind the apparent modernization of payments lies a much larger game.

In an economic climate marked by geopolitical tensions and a wait-and-see approach regarding the Fed's decisions, Morgan Stanley disrupts the consensus. The investment bank anticipates seven rate cuts in 2026, starting in March, with a terminal rate between 2.5% and 2.75%. This sharp projection, published on June 25th, contrasts with the prevailing caution and reignites debates about the U.S. monetary calendar.

While Bitcoin struts its stuff, Ethereum is digging its furrow. Discreet but robust ETFs, stealthy rebalances, rock-bottom fees... what if the little brother became the darling of the big wallets?

Bitcoin is gaining altitude, energized by the ceasefire agreement between Iran and Israel. A new high is in sight.

As the lines between traditional finance and blockchain become increasingly blurred, Mastercard and Chainlink are crossing a decisive threshold. In a partnership announced this Tuesday, they unveil a fiat-to-crypto conversion solution directly on-chain, designed for Mastercard cardholders. This initiative, far from being anecdotal, redefines access to cryptocurrencies and lays the groundwork for a new era of hybrid payments between traditional finance and Web3.

Despite a decline in profits, companies in the CAC 40 are increasingly attentive to their shareholders. In 2024, they maintain record payouts, contrary to traditional economic signals. In an environment marked by sluggish growth, rising inflation, and unstable markets, this strategy raises questions. Is it a sign of strength or a risky bet? While shareholder profitability remains a priority, the gap between distributed profits and actual performance raises doubts about the sustainability of this model.

Donald Trump's surprise announcement of a ceasefire between Iran and Israel has caused a real earthquake in the energy markets. Oil prices plunged by more than 5%, while global stock markets soared. Is this geopolitical calm sustainable?

Trump Media dives into bitcoin with $2.3 billion. But behind the announcement, there is a colossal stock buyback and a strategy that is shaking up U.S. regulations. Will it take everything?

Pompliano bets one billion dollars on Bitcoin. Huge merger with a SPAC. Its goal: to turn Bitcoin into an institutional financial asset. But beware of volatility!

The conflict between Israel and Iran raises fears of a major escalation, yet U.S. indices are flirting with their all-time highs. Following U.S. bombings in Iran, this situation could change very quickly, casting doubt on a sudden market collapse.

Can the dollar lose its global supremacy? What was once speculation is now taking a concrete diplomatic turn. As the BRICS summit approaches in Rio, major emerging economies are placing local currency transactions at the heart of their strategy. This shift occurs within a context of growing geopolitical tensions and demands from the Global South for a more balanced financial system. Behind this dynamic lies a possible redefinition of the rules of global trade.

When Trump insults, Waller anticipates, Powell temporizes and the economy stalls: who will win this strange dance of rates orchestrated between inflation, unemployment, and a monetary nerve war?

A coffee, an unfindable place, a disappearance: in Maisons-Alfort, crypto comes out of the virtual to end up in a bag, version grand banditisme 3.0.

The economic center of gravity is shifting towards the South, and both Beijing and Moscow want to dictate the pace. Ahead of the BRICS summit in Rio, Vladimir Putin and Xi Jinping are unveiling an unprecedented initiative: a joint investment platform dedicated to global South countries. Designed as a lever of influence and emancipation from circuits dominated by the West, this announcement marks a key step in the construction of an alternative financial order led by emerging powers.

After two years of suffocation, the French real estate market is showing measurable signs of recovery. Driven by falling interest rates and price stabilization, the first concrete signals are confirmed by FNAIM figures and field observations reported by Laforêt. Caution is gradually giving way to a recovery, admittedly still fragile but tangible. In an uncertain economic environment, this flicker gives new life to a sector long paralyzed. The question remains whether this momentum can be sustainable.

Inflation impoverishes billions of people while enriching a few million millionaires. Bitcoin is the antidote.

DeFi is booming, billions are piling up, Aave rejoices, Maple innovates, Morpho asserts itself... What if crypto credit became the true banker of Web3?

Elon Musk is continuing his transformation of X into a multifunctional super app, inspired by Asian models. This week, Linda Yaccarino, CEO of the platform, announced the upcoming arrival of integrated trading and investment services. Such a major strategic evolution could redefine everyday financial usage, while bringing X closer to Musk's long-held ambition: to become a total ecosystem, combining social networking, payment, and financial services, at the heart of a rapidly evolving digital landscape.