Washington opens a new explosive trade front. After being overruled by the Supreme Court on his use of emergency powers, Donald Trump immediately announced a 10% global tariff on imports. This decision renews trade tensions at a time when markets remain particularly sensitive to political shocks. Between institutional confrontation, alternative legal strategy, and increased volatility risk, this episode could have effects far beyond U.S. borders.

Finance News

The United States Supreme Court has just struck hard. In a rare decision, it declared illegal the international tariffs imposed by Donald Trump, removing a trade tool he wielded as a geopolitical weapon. A judicial slap that could reshuffle the cards of his economic policy. But how far will this confrontation between the White House and the judiciary go?

Elemental Royalty will let shareholders receive dividends in Tether Gold, providing a digital alternative to traditional cash payouts.

The digital euro is moving out of the laboratory into concreteness. The European Central Bank now sets a precise schedule: payment service providers will be selected as early as 2026, followed by the launch of a one-year pilot in 2027. After years of studies and consultations, the project reaches an operational milestone. Behind these deadlines lies a global ambition: to sustainably embed the digital euro at the heart of the European payment system and redefine the balance of power in the Eurozone.

BlackRock has just launched a new Ethereum ETF promising 82% of staking revenue to investors! But behind this product lie high fees and centralization risks that even worry Vitalik Buterin.

Elon Musk’s social platform X is moving deeper into financial services with the upcoming launch of “Smart Cashtags,” a feature designed to improve how users track and reference stocks and cryptocurrencies. While rumors have circulated for months about X entering the trading space, executives have made one thing clear: the platform will not execute trades. Instead, it aims to enhance financial data visibility and asset identification.

RWAs rose over 13% in the past 30 days, showing resilience and growing institutional adoption even as crypto markets struggled.

Ray Dalio warns that the post-WWII world order has collapsed, with global leaders acknowledging a new era defined by power, economics, and rivalry.

X is preparing to introduce Smart Cashtags, a new feature that will let users view stock and cryptocurrency data directly from their timelines. The rollout is expected in the coming weeks, according to X head of product Nikita Bier. Alongside the feature launch, the company is tightening rules around spam and automated activity linked to crypto promotions.

In Munich, the applause did not dispel the unease. One year after the verbal attacks of 2025, the transatlantic relationship remains marked by distrust. Facing still wary European leaders, Marco Rubio tried to reaffirm the strength of the partnership between the United States and Europe. But behind the diplomatic formulas and historical references, one question remains: are words enough to compensate for political decisions that have permanently weakened trust?

The Euro prepares its grand return to the world stage. By expanding the EUREP, the ECB strikes a historic blow to strengthen the liquidity and influence of the European currency. A decision that could redefine the financial balance against the Dollar and the Yuan.

Vitalik Buterin calls for a change of course for prediction markets, which he sees trapped in a short-term speculative logic. According to him, these platforms could become much more than betting tools: real instruments for hedging economic risk. This position comes as these markets gain influence in the crypto ecosystem and beyond.

Central bank digital currencies (CBDCs) are moving closer to reality across much of the world. Policymakers often present them as faster and more efficient tools for payments and cross-border transfers. Yet billionaire investor and founder of Bridgewater Associates, Ray Dalio, argues that control remains at stake with such systems.

The boundary between traditional and decentralized finance continues to erode. This time, it is BlackRock that is shifting the lines. The global asset management giant has connected its tokenized fund BUIDL, backed by US Treasury bonds, to the Uniswap infrastructure. An initiative that goes beyond simple technological experimentation, as it materializes the entry of a major institutional player onto the operational rails of DeFi.

Ondo Finance integrates Chainlink to bring live pricing to tokenized U.S. stocks, allowing them to serve as collateral in Ethereum DeFi.

Crypto: Trump wants to disrupt global transfers with an international exchange platform. All the details in this article!

The crypto market is entering a new phase according to Mike Novogratz. End of explosive gains? Analysis of a major turning point in this article!

The SEC under Atkins lets go of Binance and Sun, coincidentally just as Trump and his crowd are feasting on WLFI… Coincidence or nepotism? The defrauded voters want more.

Digital gold bangs the 6 billion mark on the blockchain... Tether and Paxos are cashing in while Bitcoin coughs. But is it really gold or just a pretty lottery ticket?

Beast Industries has acquired Step to help teens and young adults develop practical money skills through mobile banking and financial education.

Polymarket has escalated its dispute with U.S. state regulators by filing a federal lawsuit against Massachusetts, arguing that prediction markets fall under exclusive federal oversight. At the center of the case is whether individual states can restrict event-based contracts already regulated at the federal level. Ultimately, the ruling could determine how prediction markets operate across the United States.

The standoff over the succession at the head of the Federal Reserve intensifies. While a Republican senator blocks any progress as long as the investigation targeting Jerome Powell is not completed, the Treasury Secretary proposes a bold strategy: why not fight both battles at once? A political chess game that could redefine the Fed's future.

Payments firm Block Inc. has begun notifying hundreds of employees that their roles could be cut during annual performance reviews. As per reports, the move is part of a broader restructuring as the company adjusts its business focus. Workforce changes may affect up to one in ten staff members. Management is pushing to align teams with revised product priorities and cost targets.

Gold collapsed in just a few hours, surprising investors and analysts after a historic peak. This sudden shock revealed the speculative mechanisms shaking global markets. Amid the flood of interpretations, that of Scott Bessent, former strategist of the Soros fund and current advisor to the US Treasury, hits the mark. He accuses leveraged speculation by Chinese traders, amplified by margin tightening, for causing what he calls a "speculative blow-off."

While market attention is focused on every move of the Federal Reserve, a subtle adjustment is emerging. Economist Lyn Alden mentions the Fed entering "gradual print" mode: a progressive monetary creation, calibrated to nominal GDP growth. Far from the massive injections of 2020, this subtle strategy could disrupt interest rate expectations, redefine the balance of financial markets, and profoundly influence the evolution of cryptos like bitcoin.

The market collapses, traders panic... and BitMine doubles down! Tom Lee bets everything on Ethereum while the crypto is being cut down by the stock market chainsaw.

Markets are holding their breath ahead of the next Fed meeting with a possible monetary turning point as early as March. As inflation slows and the political context becomes more complex, an unexpected signal is gaining strength. According to CME data, more than 23% of traders are now betting on a rate cut. This shift in sentiment, still a minority but growing, could well reshuffle the cards.

Two Democratic senators demand an urgent investigation into undisclosed Chinese investments in SpaceX. As Elon Musk has just merged his space giant with xAI for $1.25 trillion, Washington wonders: what if Beijing had already set foot in the most sensitive technologies of the United States?

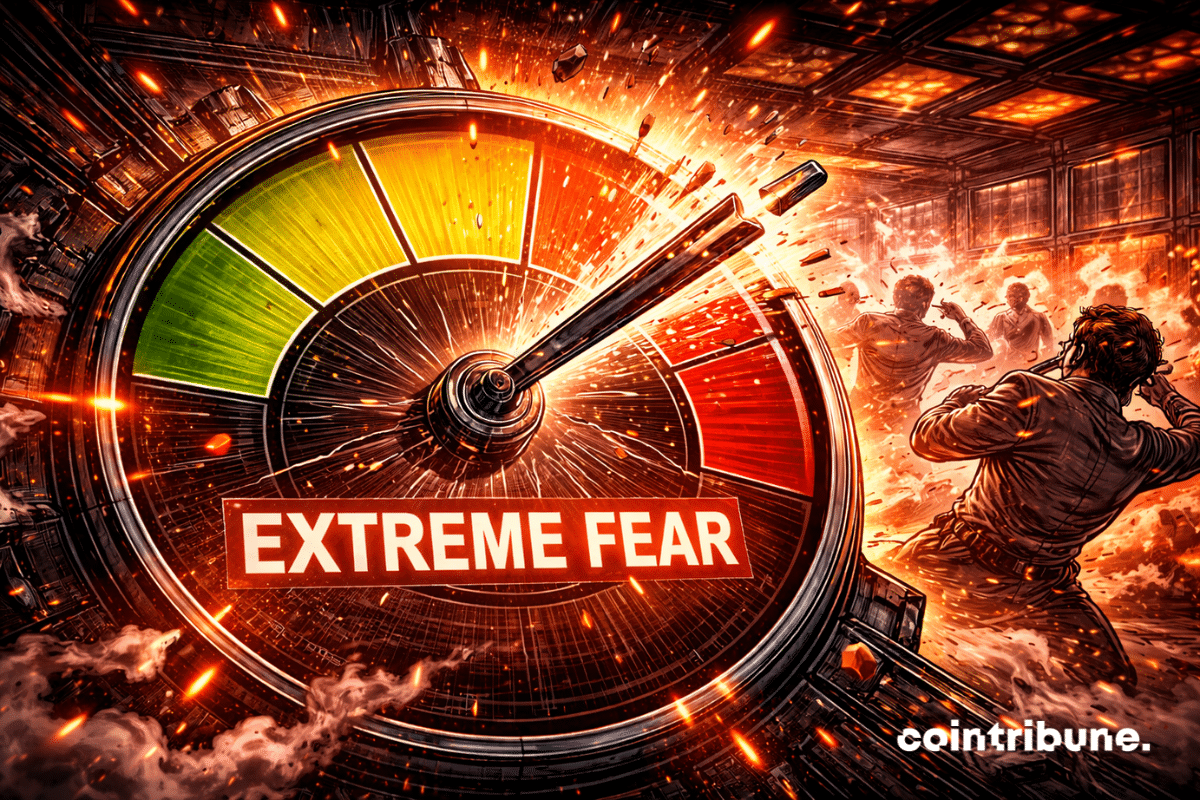

The crypto market has sharply declined. In a few hours, major assets lost several months of gains, bringing bitcoin, Ethereum and Solana back to forgotten levels. After the 2025 momentum, investors hoped for consolidation. Instead, a wave of panic took over. More than 2 billion dollars were liquidated, revealing an atmosphere of extreme fear. The entire ecosystem is affected, from tokens to listed stocks, indiscriminately.

Gold recovered to 5,000 per ounce after a historic drop, with major banks including J.P. Morgan forecasting further gains later in 2026.