Every day, a number of crypto projects flood the market. Some manage to rise and make a place for themselves in this ever-changing ecosystem. But the truth is that most never break through and end up disappearing as quickly as they emerged. This is at least what a recent study by CoinGecko shows. It indicates that in recent years, cryptocurrencies have experienced explosive growth, leading to the flooding of the market with thousands of new crypto projects. The problem is that a large portion does not survive the dynamics of the sector. How can this be explained? That is what we will see together in this article.

Finance News

Discover how the increase in miner sales is impacting Bitcoin. Our article analyzes this recent development.

The trading volumes on Bitcoin ETFs launched by BlackRock, Fidelity, Ark Invest, and others are phenomenal.

Asked on Twitter, the ECB considers it highly unlikely to ever acquire bitcoin. However, the idea is gaining ground in the United States.

The Binance Coin has regained its former resistance around $337. Let’s explore the upcoming outlook for BNB. Situation of Binance Coin (BNB) The BNB price ended the year 2023 on a positive note, recording an impressive increase of over 40%. This movement confirms the bullish scenario…

The hegemonic position of the US dollar as the pivot of the global financial system is facing new challenges with the rise of crypto, according to a recent report by Morgan Stanley. This digital currency has both the potential to weaken and strengthen the role of the greenback.

At the 2024 World Economic Forum in Davos, China demonstrated economic strength that shook the foundations of Western forecasts. With an announced economic growth of 5.2%, surpassing the government's target of 5%, China not only defended its position as a global economic power but also implicitly challenged Western economic models.

The Nikkei index recently surpassed 36,000 points in the stock market, returning to its highest level since 1989.

The World Economic Forum in Davos is in full swing for its 54th edition. Bringing together global political, economic, and intellectual leaders, this annual summit aims to discuss current global challenges and find common solutions.

Coinbase is at the center of Bitcoin ETFs. In addition to generating desire, the dominance of the crypto exchange presents certain risks.

Bitcoin has experienced a decrease of over 15% after reaching a new high. Let's together examine the future prospects for the BTC price.

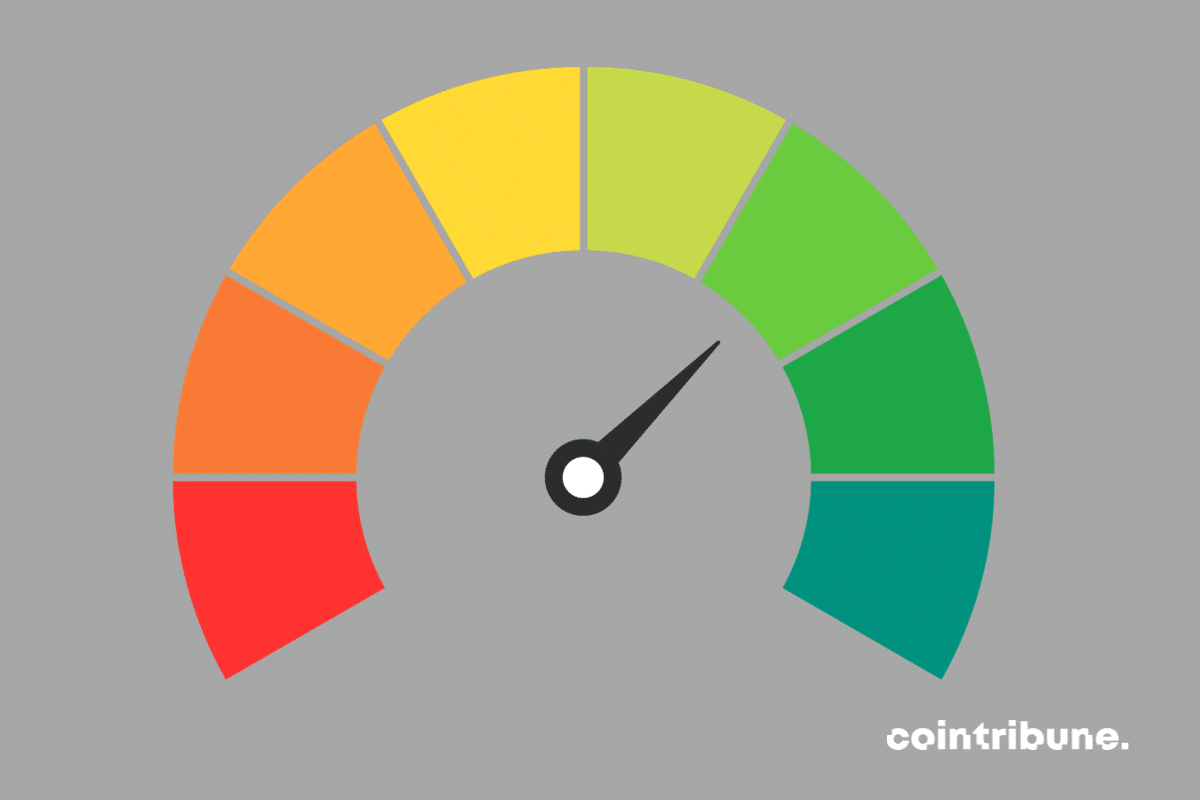

Thanks to the Crypto Fear and Greed Index, crypto analysts are able to gauge the market participants' perception of the dynamics of this industry. The latest news shows that this crypto indicator is displaying unusual mixed performance.

Despite the high-profile launch of ETFs, the bitcoin has returned to its level at the beginning of the year, above $40,000. Why?

Week after week, the world of cryptocurrencies continues to captivate and redefine the boundaries of digital finance and blockchain technology. This week was no exception, bringing a host of major developments, innovations, and surprises. In our weekly recap, we delve into the most significant and influential stories that have shaped the crypto ecosystem. From the historic approval of Bitcoin Spot ETFs by the SEC, to Standard Chartered's bold prediction on the price of Bitcoin, to the resilience of Binance Pay in the face of regulatory challenges, the outlook for Ethereum and XRP ETFs, and the explosion of development activity on Solana, we will review the highlights from the past week.

"The 2024 season of the economic calendar has just begun. What are the events that will shake up the crypto market this year?"

What projection could be made about the price of BNB, the native cryptocurrency of the Binance exchange, considering the particular year that was 2023 for this asset? Despite the legal challenges that Binance faces, the price prospects for BNB in 2024 appear promising. Here's why.

Throughout 2023, Dogecoin (DOGE) and Shiba Inu (SHIB) have stood out as some of the most relevant memecoins in the crypto market. What could their dynamics be in 2024? Let's explore that in the following lines.

Here is everything you need to know about Bitcoin ETFs launching this Thursday, January 11th.

The deployment of Bitcoin ETFs by BlackRock, Fidelity, and Ark Invest was predicted to herald a new era, but the decline persists.

We will look together at how an ETF listing can impact investors' choices and its performance.

The BRICS do not skimp on the implementation of their strategy to escape the economic domination of the US dollar. The alliance's monetary projects are attracting attention, especially the massive funds they are injecting to acquire significant amounts of gold.

Currently, attention is focused on the possible approval by the SEC of a Bitcoin Spot ETF. If this possibility materializes, the emergence of an Ethereum Spot ETF should mobilize the interest of the crypto community. A perspective that would only be beneficial for the ecosystem around the market's second largest crypto.

Bitcoin (BTC) has left an indelible mark on the crypto industry in 2023. This was achieved through an exceptional dynamic that saw the leading cryptocurrency double its value from the beginning of the year. Will the asset continue on this trajectory in 2024? Let's explore in this article the factors that can influence it in either direction.

After legalizing bitcoin, Prospera grants it another very important status.

The Chainlink crypto network becomes a DeFi engine in 2023 by revolutionizing financial collaborations and use cases.

"Cathie Wood, leader of ARK Invest, predicts a surge in Bitcoin to $1.5 million, supported by the blessing of Bitcoin ETFs."

The Bitcoin ETF has broken all records, but absurd facts have come to spoil the party, preventing Bitcoin from appreciating for now.

"""You must translate each text and preserve the context. Return me only the translated text without explanation or comment. This is the text to translate into language with language Code: "en": """

The power dynamics within the SEC are emerging. And after the Bitcoin ETF, eyes are already turning towards a possible Ethereum ETF.

The date of January 10, 2024 is now etched in golden letters in the annals of crypto. Indeed, the anticipation of this deadline for months by the crypto and financial community has not been in vain, as it has sanctioned the approval of a Bitcoin spot ETF. The decision of the Securities and Exchange Commission (SEC) was eagerly awaited on this date. And it is favorable. Now, a positive impact is expected on Bitcoin (BTC). But this outlook could also impact the entire crypto industry, including Ethereum. In this context, effects on the Ether (ETH) market, Ethereum's native crypto, are also being considered. That being said, how would ETH react to this new development? Let's see together in this article.