Bitcoin (BTC) : Imminent Correction? Crypto Analysis of January 16, 2023

Bitcoin saw a drop of over 15% after reaching a new high. Let’s take a look at the future prospects for the BTC price together.

Current Situation of Bitcoin (BTC)

Following the listing of Bitcoin spot ETFs, the price of Bitcoin reached a new high at $49,100. However, contrary to expectations, it was from this level that Bitcoin began to decline, bringing it to around $41,500. This drop caused the Bitcoin price to reintegrate its old range, located between $45,000 and $40,000, thus raising concerns among investors. Nevertheless, the medium and long-term trend remains bullish, as suggested by the 50 and 200-day moving averages that stay above the current price. Currently, Bitcoin is consolidating in a range around $42,700. Regarding technical indicators, oscillators such as the RSI and MACD are around the median threshold. A divergence between these oscillators and the price of Bitcoin indicates a potential period of consolidation or decline ahead.

The current technical analysis was carried out in collaboration with Elie FT, an enthusiastic investor and trader in the cryptocurrency market. Today, he is an instructor at Family Trading, a community of thousands of self-directed traders active since 2017. You will find Lives, educational content, and mutual assistance about financial markets in a professional and warm atmosphere.

Focus on Derivatives (BTCUSDT)

In the recent decline of Bitcoin, its open interest decreased by about 12%. This represents nearly $1 billion in positions (long and/or short) on Bitcoin contracts. It is surprising to note that this reduction in open interest did not lead to significant liquidations. Moreover, on January 12th in the early afternoon, a divergence between the open interest and the price of Bitcoin was observed. While the price of Bitcoin was declining from $46,300, its open interest saw an increase. This trend could indicate increased interest from sellers at that time. At present, the open interest of Bitcoin seems to be stagnating, which can be interpreted as a sign of indecision among traders.

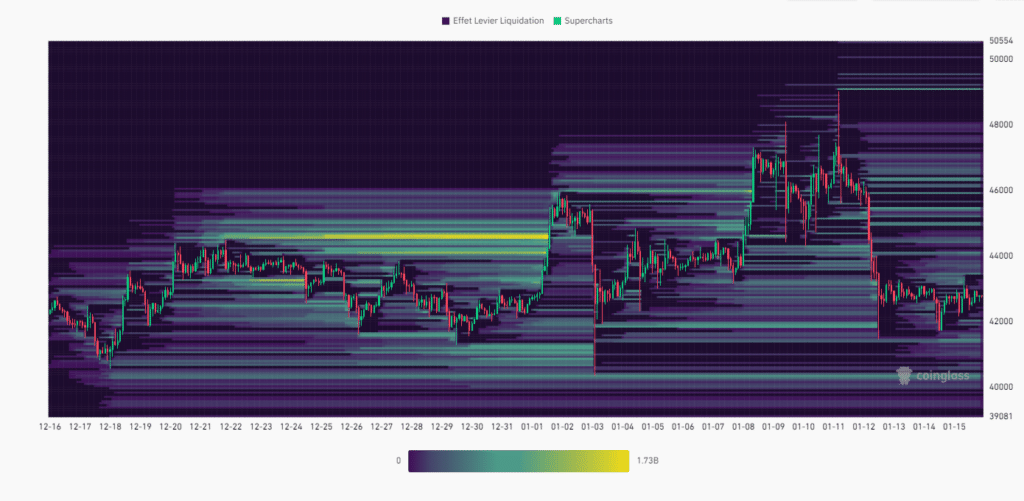

The BTC/USD liquidation heatmap shows that Bitcoin has passed through a zone where various orders have been accumulating since the beginning of January. Already, significant orders have formed, notably above the current price. However, the most substantial and closest liquidation zone to the price is around $40,000. As the market approaches these levels, we could witness a massive triggering of orders, which would potentially increase the cryptocurrency’s volatility. These zones thus represent major points of interest for investors.

Potential Scenarios for Bitcoin (BTC) Price

If the Bitcoin price manages to stay above $40,000, we can anticipate another increase to the $45,000 threshold. The next resistance to consider, if the upward movement continues, would be around $49,000 or even $50,000. At this stage, this would represent an increase of nearly +16%.

If the Bitcoin price fails to hold above $40,000, a return to $38,000 could be envisioned. The next level to consider, if the downward movement continues, would be around $37,000 or even $36,500. At this stage, this would represent a decline of nearly -14%.

Conclusion

After failing to reach $49,000, the Bitcoin price experienced a bearish movement, bringing it back into its old range between $45,000 and $40,000. It seems that interest from sellers has occurred. However, it is premature to conclude that the overall bullish trend is in danger. However, the continuation of this bearish movement could begin to support the hypothesis of a correction. Therefore, it is important to remain vigilant against potential “fake outs” and market “squeezes” in each scenario. Finally, let’s remember that these analyses are based solely on technical criteria and that the price of cryptocurrencies may also rapidly evolve due to other more fundamental factors.

Maximize your Cointribune experience with our 'Read to Earn' program! Earn points for each article you read and gain access to exclusive rewards. Sign up now and start accruing benefits.

Family Trading est une Communauté de traders a compte propre active depuis 2017 offrant Lives, contenus éducatifs et entraides autour des marchés financiers dont celui des cryptomonnaies avec à ses côtés Elie FT, investisseur et trader de passion sur le marché crypto.

The contents and products mentioned on this page are in no way endorsed by Cointribune and should not be construed as its responsibility.

Cointribune strives to provide readers with all relevant information available, but cannot guarantee its accuracy or completeness. Readers are urged to make their own inquiries before taking any action with respect to the company, and to assume full responsibility for their decisions. This article does not constitute investment advice or an offer or invitation to purchase any products or services.

Investing in digital financial assets involves risks.

Read more