Suspicions turn into numbers. Two studies published in Science and Nature confirm that AI chatbots, similar to those everyone uses, can shift voting preferences by several points, up to about 15% in controlled scenarios.

America

In the crypto ecosystem, some cases keep coming back like boomerangs. The case of Do Kwon, founder of Terraform Labs, is one of those matters that leave a lasting mark. As his court appearance approaches, US prosecutors are demanding a harsh sentence: twelve years in prison. A request that, beyond symbolism, recalls the shockwave caused by the collapse of the Terra ecosystem.

According to a study by the FINRA Investor Education Foundation, enthusiasm for cryptos has cooled. Indeed, only 26% of investors still plan to buy cryptos, compared to 33% in 2021. However, 27% still hold them, an unchanged level. There is less desire to buy more, but not necessarily a massive exit.

What if the promise of financial inclusion hides a major systemic risk? Popular in crisis-hit countries, stablecoins have become the preferred tool for millions of citizens to escape hyperinflation. However, behind this massive adoption, a growing concern: by channeling savings towards the digital dollar, these assets could weaken the most vulnerable economies. As their usage explodes, a dilemma arises: are stablecoins a bulwark for the people or a silent threat to states?

American Bitcoin Corp. (ABTC)—co-founded by Eric Trump—has released its October 2025 investor presentation, marking a major milestone in its evolution from a pure Bitcoin miner to a full-scale digital-asset ecosystem. The strategy focuses on building a U.S.-based Bitcoin powerhouse to reinforce America’s leadership in the global Bitcoin market.

Gold enters the 24/7 era. Driven by the record rally of the yellow metal, tokens backed by gold have just exceeded 1 billion dollars in daily volume. This milestone establishes tokenized gold as a trading and hedging tool, more agile than traditional ETFs.

Ripple accelerates while the market slows down. The company is preparing a raise of about $1 billion to accumulate XRP via a SPAC backed by a digital asset treasury structure (DAT). The timing is delicate: liquidations are piling up, Bitcoin falls, and Solana loses ground. However, the strategy is clear: stabilize the supply, speak to the corporate finance world, and expand crypto token usage in payments. Let's review the stakes.

Artificial intelligence is now part of everyday life, to the point of becoming essential. While its uses are appealing, especially to simplify daily life, it also fuels deep fears. A Pew Research Center survey, conducted in June 2025, highlights a paradox: Americans fear that AI will erode their humanity.

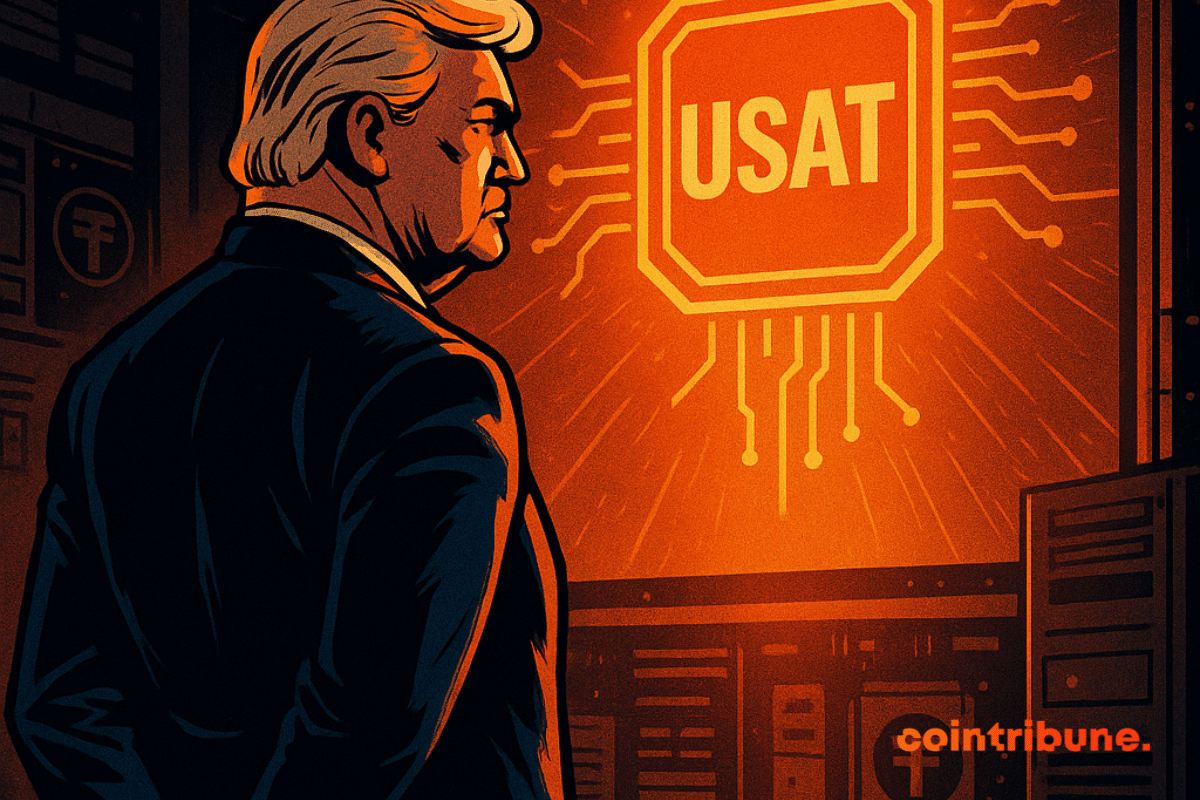

The cryptocurrency sector keeps surprising. Tether, already known for its USDT stablecoin, has just announced the launch of a new player: USAT. This dollar-backed stablecoin stands out with a clear ambition: to comply with new American legislation while consolidating the greenback's influence in the digital age. But the real surprise comes from its leadership: Bo Hines, former White House crypto advisor, now leads this strategic project.

The prospect of elections organized directly on the blockchain may no longer belong to the realm of science fiction. The decentralized Chainlink network, led by its co-founder Sergey Nazarov, is multiplying alliances with the Trump administration, paving the way for unprecedented government uses. Behind these agreements, a clear ambition: to make blockchain a tool of institutional trust.

American justice has judged the tariffs imposed by Donald Trump illegal, undermining his protectionist strategy. The president denounces an attack on a pillar of his return to power and now relies on the Supreme Court to decide.

Unknown to the general public but omnipresent behind the scenes of power, Palantir works with governments and multinationals by exploiting data. Valued at over 400 billion dollars after a 2000% increase since 2023, it represents either the investment opportunity of a generation or the next speculative bubble ready to burst.

The appetite of large institutions for Bitcoin remains intact, but it often manifests where it is least expected. In 2025, the Norwegian sovereign wealth fund, a major player in public asset management, has nearly tripled its indirect exposure to the leading cryptocurrency. No direct BTC purchases are planned, but a well-thought-out strategy allows it to establish a solid foothold in the crypto ecosystem.

The Democratic governor of Arizona, Katie Hobbs, has once again vetoed a pro-Bitcoin bill. The state could have created a public reserve from seized cryptocurrencies, as Texas and New Hampshire are already doing.

The American deficit is set to explode by 2.5 trillion dollars. This Republican fiscal bomb could paradoxically become the fuel for a historic rally for bitcoin in the face of the inevitable devaluation of the dollar.

In the shadow of tyrannies, outstretched hands receive satoshis. The HRF sows crypto light in the invisible pockets of silent resistances, where fiat no longer prevails.

As the American stock market experiences a period of turbulence, Warren Buffett, known as the Oracle of Omaha, has made a strategic withdrawal from certain American assets to strengthen his positions in Japan.

At the heart of a debate as lively as it is surprising, the crypto universe is under the spotlight. The digital revolution and financial freedom clash with the imperatives of national security. This article boldly and clearly explores the issues related to crypto-friendly regulations and the potential excesses of an exacerbated surveillance state.

Salvador recently announced a strategic partnership with Argentina to strengthen crypto regulation. This collaboration is part of a broader initiative by El Salvador to establish similar agreements with over 25 countries.

Donald Trump proclaims himself the winner of the 2024 American presidential election, provoking strong reactions around the world.

The BRICS have just completed their summit in Kazan, in an explosive geopolitical context. Between the war in Ukraine, conflict in the Middle East, and the American elections, the BRICS are increasingly establishing themselves as an alternative to America!

As China increasingly reveals its totalitarian face, Donald Trump and Kamala Harris raise serious concerns about their ability to defend Western interests against Beijing. Are they about to capitulate to Xi Jinping and abandon Taiwan?

The excitement around Bitcoin shows no sign of waning. The flagship crypto briefly reached $59,000 following the release of the latest Consumer Price Index (CPI) data in the United States, before experiencing a downward correction.

The US public debt is reaching record levels! Raising concerns about its devastating impact on the global economy.

As the United States faces the risk of defaulting on its debt, urgent actions are needed. One of them is to raise the debt ceiling. Some politicians, particularly Republicans, would like negotiations in this regard to take into account the interests of crypto firms. But for President Biden, that's a no-go!

For some time, the BRICS countries, including Russia and China, have been working to move away from the US dollar. Recently, China formalized an agreement with Brazil to trade state to state, without using the dollar. This desire for financial independence could be realized through the adoption of a digital currency.