When Grayscale tells us everything is fine for bitcoin, Naoris draws its anti-quantum shield. What if the enemy is not who we think it is?

Article long

The Bitcoin Queen hangs up. Exhausted but clear-headed, Lummis leaves a void. Regulators, traders, and crypto lobbyists wonder: who will now whisper in the ears of senators?

Until December 30, 2025, the MiCA-regulated platform offers a welcome bonus to new European users. Full breakdown.

There are alerts that slam like a door. And then there are those that creak, slowly, until they become impossible to ignore. Mike McGlone, senior commodity strategist at Bloomberg Intelligence, clearly places his message in the second category: for him, 2026 could resemble a big end-of-cycle decompression. Not just a “pullback”. A broader, dirtier, more contagious move.

The topic of “bitcoin versus quantum” comes up in waves. This week, it is no longer just a debate among researchers. Part of the ecosystem is pushing to accelerate a concrete update. And another is resisting strongly, considering the alert premature.

Crypto 2025: invisible hackers, billions lost, a rogue state involved... What if your wallet was the next silent victim?

Hyperliquid submits a rare decision to its validators: to recognize as excluded from the supply the 37 million HYPE accumulated in its assistance fund, an address without a private key funded by trading fees. This governance vote, without on-chain action, could remove nearly one billion dollars from the circulating metrics. In a context where readability of economic data becomes central, the protocol plays a strategic card to clarify its tokenomics and strengthen its credibility.

The crypto market was hit by a wave of heavy corrections as a rough weekly outing triggered cautious sentiment among investors. During the downturn, heavy liquidations were recorded as some whales took profits while others moved to limit losses. On-chain data shows increased activity from large Bitcoin and Ethereum holders. In fact, U.S. spot Bitcoin and Ether ETFs recorded combined outflows of over $580 million on Monday, extending a broader trend of capital exits. As these heavy outflows persisted, market watchers observed whales rotating capital into a new game-based memecoin project.

Aave enters a new growth phase after the SEC ends its investigation, planning V4, Horizon, and a mobile app to drive growth in 2026.

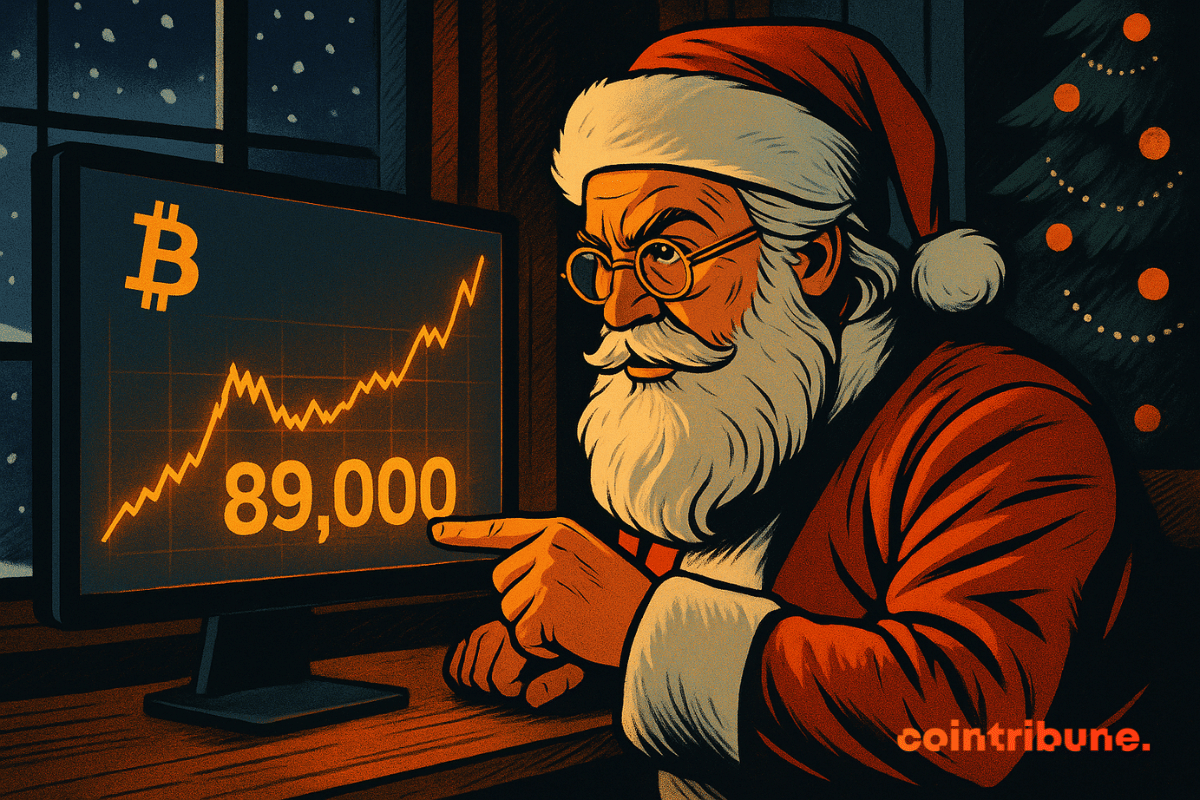

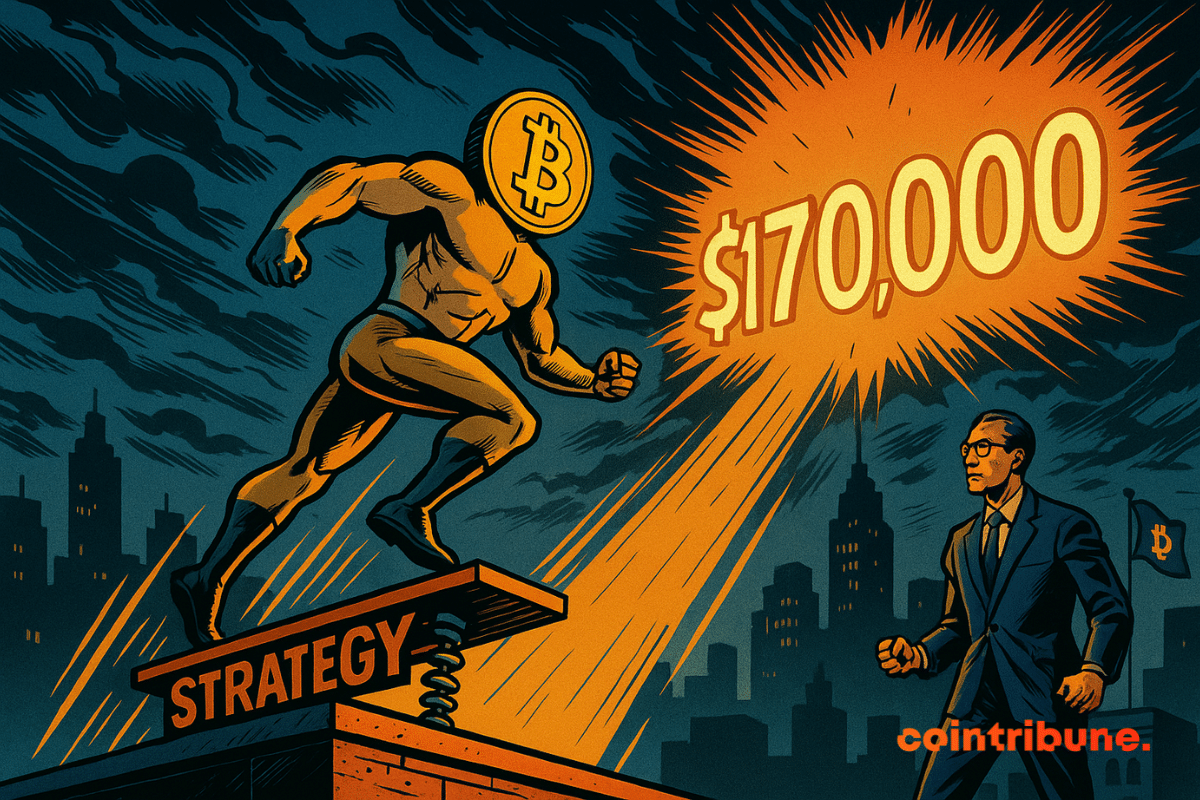

Grayscale shakes up certainties. In its latest report, the asset manager anticipates a new ATH for bitcoin by June 2026, breaking with the traditional four-year cycle. Against a backdrop of rising public debt, inflationary pressure, and a changing regulatory framework in the United States, this projection relies on clear macroeconomic signals. At a time when trust in fiat currencies is eroding, Grayscale sees bitcoin as a safe haven asset undergoing a structural transformation. Such a vision challenges and redefines market benchmarks.

In 2025, Nvidia is no longer just a capitalization machine. The company has found another acceleration, this time political. Donald Trump, against part of his own camp, chose to open a very costly door for it.

Kevin Hassett, a leading contender to chair the Federal Reserve (Fed), said the central bank would remain independent even if it faces pressure from the White House. His remarks come as financial and crypto markets watch closely for signals on interest rates and the future path of U.S. monetary policy.

Bitcoin increasingly moved independently from US stocks in the second half of 2025. While equities benefited from rate cuts and strong earnings, Bitcoin entered a correction after its October peak, highlighting a clear market divergence.

Wall Street vibrates for a ghost! Satoshi Nakamoto appears at the NYSE… with a statue. From code to statues, bitcoin claims its place in the temple of capitalism.

Do Kwon, the founder of Terraform Labs, has just been sentenced to 15 years in prison for a historic $40 billion fraud. Between ruined victims and relentless regulation, does this conviction mark the end of excesses in crypto?

Crypto markets have started coughing again. No spectacular crash this time, but a slow loss of breath: crypto trading volumes are declining, prices are correcting, and even spot bitcoin ETFs are turning red. For JPMorgan, the picture is clear: the appetite for risk is fading, and the market stalls just as it was supposed to confirm its strong comeback.

While Wall Street digests its ETFs, Paul Atkins unwraps an unexpected gift: crypto becomes emancipated, ICOs resurrect. A cooler SEC than ever?

Bitcoin stays over 90,000 dollars after a volatile weekend, with traders watching key levels and the Fed meeting to gauge whether momentum can return.

BlackRock discovers Ethereum staking and joins the yield banquet. But who is really dining at the table? The investor, the institution... or the tax authorities watching?

These companies thought they were riding the bitcoin wave, but they are drowning in their own debts. The crypto king is nosediving, and the kings of leverage are getting slapped.

Jupiter Lend clears up claims of 'zero contagion' and explains how vaults operate amid user concerns.

As the DeFi protocol Balancer suffers a devastating $128 million hack in less than 30 minutes on November 3, 2025, the crypto industry faces an existential question: how can blockchain infrastructure defend against both today's sophisticated exploits and tomorrow's quantum threats? With DeFi protocols losing over $3.1 billion in 2025 alone, Naoris Protocol emerges as a pioneering solution, having processed over 98 million post-quantum transactions and mitigated 463 million cyber threats on its testnet. The protocol's innovative Sub-Zero Layer architecture and Dilithium-5 cryptography represent a fundamental shift in how the industry approaches security, transforming every device into a defensive node rather than a potential vulnerability.

"He who does not move does not feel his chains." Rosa Luxembourg’s phrase resonates strangely in the digital age. Digital currency today reveals invisible chains that many still do not perceive. Cash quietly disappears, replaced by a recorded, analyzed, and continuously interpreted world. Every transaction becomes data, and every data a lever of control. Privacy is no longer a moral luxury, but a political fault line. Institutions defend transparency as a condition of stability. Freedom advocates see privacy as a fundamental guarantee. This tension reshapes our relationship to power, trust, and individual autonomy. The central question is no longer just about technology, but about what we accept to reveal in order to exist. This text explores the existential battle of monetary privacy: protecting human dignity when everything becomes traceable.

After several weeks of waiting, Cointribune finally unveils the brand new version of its Read2Earn program: a redesigned, enhanced system entirely dedicated to rewarding your crypto curiosity. If you read Cointribune every day, this update will transform your experience: from now on, every article read has value, every step taken brings you closer to a reward, and every session becomes concrete progression in your Web3 adventure.

When a company named Strategy becomes the compass of bitcoin, even JPMorgan takes out its calculator. Bull run or crash? The answer lies between MSCI, reserves, and a few well-placed billions.

Alphabet is back in focus after a Bloomberg report indicated rising investor confidence in its in-house semiconductor strategy. Interest in the company’s tensor processing units (TPUs) is reshaping expectations for future revenue and altering market sentiment. Many investors now see the chip program as a potential long-term growth driver, not just a tool used within Google Cloud.

During Binance Blockchain Week, Peter Schiff was invited by Changpeng Zhao to authenticate a gold bar live. Unable to confirm its authenticity, the economist simply replied: "I don't know." A brief but revealing scene, which reignites the debate between physical gold and bitcoin, and raises questions about the verifiability of assets in a world increasingly oriented towards decentralization and blockchain transparency.

Bet on the victory of a candidate or a token from your crypto wallet? Trust Wallet believes in it strongly... If you don't win, at least you will have guessed the news.

Bitcoin is collapsing, miners are coughing, and some flee to AI: when digital gold turns into an electric burden under maximum stress!

Flash crashes, digital dominos and states lying in wait: the IMF sees tokenization less as a revolution than as an explosive cocktail ready to blow up finance... but hush, it's bubbling.