Real World Assets (RWA) come strong in 2026 and four projects alone capture 70% of the market activity! These are Hedera, Chainlink, Avalanche, and Stellar. Why such domination and what opportunities do they offer investors?

Avalanche (AVAX)

Institutions are betting big on Avalanche to tokenize their assets. The network records a spectacular growth of 950% in one year, driven by BlackRock and other financial giants. Yet the AVAX token continues to collapse. How to explain this paradox?

While crypto ETFs dance with billions, VanEck bets on Avalanche: a well-calculated gamble, between yield, blockchain, and institutional insight.

At Visa, it's no longer a toss-up with crypto: 91 million later, the card becomes the new favorite toy of decentralized financiers. To be continued…

October is shaping up to be a pivotal month for the crypto market, with more than $1 billion worth of tokens preparing to enter circulation. A series of major token unlocks from leading projects, including Aptos, Ethereum Name Service (ENS), ImmutableX, and Bittensor, is set to test market resilience and liquidity. With billions in previously locked assets set to move freely, investors are bracing for heightened volatility and short-term price fluctuations across the board.

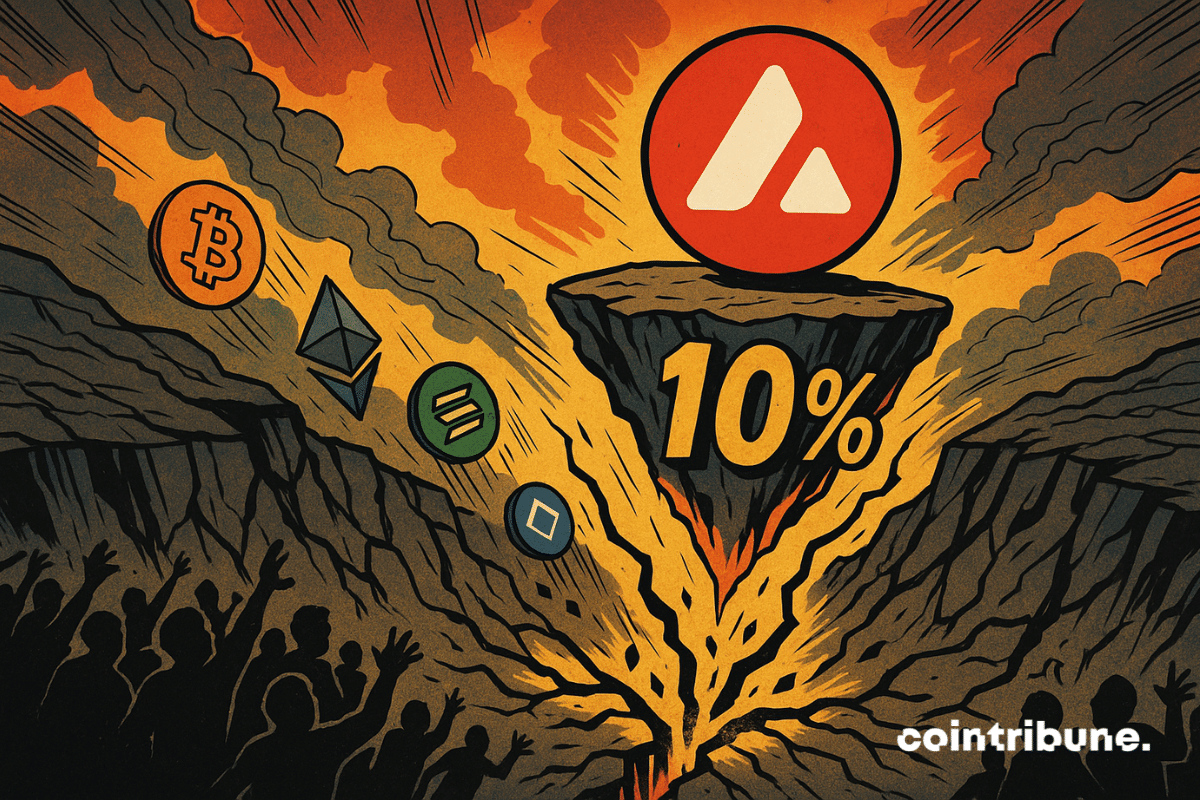

While the crypto market begins a new phase of pullback, Avalanche surprises. The AVAX token jumped 10% this Tuesday, reaching 33 dollars, at the very moment when major capitalizations showed losses. The crypto thus stands out by an opposite dynamic, built and supported by significant players.

Barely announced, the Fed's rate cut has reignited crypto market enthusiasm. However, behind this surge lies another driver: the leverage effect of project-specific announcements. Avalanche (AVAX) and Hyperliquid (HYPE), driven by aggressive strategies, captured most of the bullish flows. Between monetary steering and targeted initiatives, token performance depends as much on macroeconomic decisions as on their ability to convince on the ground.

Avalanche Foundation is aiming to raise $1B by creating two US treasury companies that will purchase AVAX at discounted prices.

Boom of RWA in crypto: +11% in one week. Focus on this revolution led by Ethereum and BlackRock.

While Bitcoin strengthens its hegemony, XRP awaits a verdict, Avalanche slips, and the crypto-sphere holds its breath: suspense, ETF lurking, and whales lying in wait.

While the SEC is considering, Grayscale acts: a crypto ETF on Avalanche is emerging, between juicy staking, altcoin ambitions, and the promise of a jackpot... if all goes well.

The Avalanche crypto heats up under a tough resistance. Between pending ETFs, reduced fees and millions burned, AVAX sharpens appetites... and could soon outshine the competition.

As the summer heat reaches its peak, the crypto market could experience an unexpected cooling. In August, the value of token unlocks could drop by half to around 3 billion dollars, down from over 6 billion in July. A sharp decline, certainly, but far from signaling a lasting calm.

Grayscale upends the crypto hierarchy: XRP, ADA, and BNB fall out of its Top 20 in favor of Morpho and Avalanche. Details here!

While the SEC raises its eyebrows, OpenSea distributes XP. Rewards, quests, treasures... the NFT market is preparing its SEA token and reinventing crypto in its own way.

After a marked correction, avalanche stagnates under key levels: between selling pressure and latent bullish bias. Find our complete technical analysis and AVAX outlook.

While all eyes are on the development of RWAs in the Ethereum ecosystem or on the new Ondo blockchain, Avalanche positions itself as an outsider in this market. Indeed, the investment management company VanEck has just made an investment fund available to support the growth of RWAs in the Avalanche ecosystem.

What if one of the largest banking groups bet on an outsider rather than the king of the market? In a report that shakes up certainties, Standard Chartered identifies Avalanche (AVAX) as the token to watch by 2029, with an expected performance surpassing that of bitcoin. This bold bet from a major financial institution illustrates a new interpretation of the crypto landscape, where modular and business-oriented blockchains are overtaking the historical giants. A strong signal that could redefine upcoming investment strategies.

The numbers are falling, dry and relentless. In one month, developer activity on Ethereum, a cornerstone of the crypto ecosystem, has dropped by 11.8%. A decline that is not isolated: BNB Chain, Polygon, Arbitrum… All are seeing their metrics crumble. Worse, according to Santiment, some networks are losing up to 25% of their activity. This gradual desertion of coders, the nerve of blockchain innovation, is not a simple fluctuation. It is a critical signal for a sector that once dreamed of being unstoppable.

Crypto ETFs are crashing down like an uncontrollable wave. Avalanche joins the dance, but history has taught us that markets sometimes have a short memory... and a brutal correction.

Global investment firm VanEck has just registered an Avalanche exchange-traded fund (ETF) in the state of Delaware, becoming one of the first issuers to pave the way for a spot AVAX ETF. This initiative comes paradoxically amid a significant decline in the AVAX token, which has lost more than half of its value since January 2025.

The Avalanche Foundation, in collaboration with Rain, has just announced the launch of the Avalanche Card this Wednesday. This new card will allow users to spend their cryptocurrencies wherever Visa is accepted, with initial support for USDC, USDT, AVAX, and wAVAX.

MetaMask facilitates the conversion of crypto assets to fiat! 10 new blockchains supported. Discover the details in this article.

Despite a 14% drop, the AVAX crypto shows an increase in trading volume and accumulation of investors. Detailed analysis!

The year 2025 marks a decisive step for the crypto market. Indeed, regulatory pressure is intensifying, while institutions are strengthening their presence in the sector. In this rapidly changing environment, some projects manage to stand out by combining innovation with strategic adoption. For investors, identifying the most promising altcoins relies on several criteria: scalability, institutional adoption, technological performance, and return potential. Thus, among the most strategic choices for January 2025, Solana (SOL), Cardano (ADA), and Avalanche (AVAX) stand out due to their optimized infrastructures and growing adoption, thereby consolidating their place at the heart of Web3.

Amidst the upheavals of the crypto market, a wisdom awakens: the lows extend, and opportunities whisper to the bold.

The crypto market is buzzing with Avalanche (AVAX) establishing itself as one of the best-performing assets in recent weeks. With its value doubling in record time, AVAX has captured the attention of investors while also rekindling speculation about a potential prolonged rally. As the Avalanche platform continues to strengthen its ecosystem, could this price surge signal a lasting change, or indicate imminent overheating?

Cryptocurrencies are evolving at a breakneck pace, and the era of altcoins seems to finally have its moment of glory. After the success of Bitcoin ETFs, attention is now turning to other digital assets, particularly Cardano (ADA) and Avalanche (AVAX). The rise of Spot ETFs for these altcoins could well…

Avalanche is launching a Visa card to pay with cryptos: finally a solution to spend your bitcoins at the supermarket!

Ethereum 2.0, or how to turn a technological revolution into a damp squib. Proof of Stake hasn't changed the game.