Lagarde packing up? The ECB denies it, but the euro is already sweating. Macron wants to place his protégé. The Germans grit their teeth. Atmosphere in Frankfurt.

Bank

Washington throws its dollar stablecoins onto the Old Continent. Berlin says no. The Bundesbank draws its digital euro and its own stablecoins. The currency war is declared.

Washington on loop mode: crypto lobbies offer keys to local banks, but the Senate still hesitates. Towards an unlikely alliance to save the law? To be continued...

White House to Meet with Banks and Crypto Companies to Tackle Senate Standoff on Digital Asset Rules

The White House will meet banks and crypto companies on Monday to address stalled digital asset legislation and bridge industry divisions.

While the great powers hesitate, El Salvador stacks gold and bitcoin. Bukele dreams of a treasure safe from crises... and the Fed's lessons.

When crypto shakes Wall Street: Standard Chartered fears that stablecoins siphon off bank deposits. Subdued panic in glass towers and bankers' cafes.

A new industry report says most major UK banks are making it harder for people to move money to crypto exchanges. According to the findings, banks are widely blocking or limiting payments, even when customers use regulated platforms. Industry leaders warn that these practices are slowing growth and pushing innovation out of the country.

While small wallets tremble, banks are piling up bitcoin. CZ watches, half amused, half worried: the crypto Wild West is changing sheriffs without warning.

While the US Supreme Court plays the role of economic arbitrator, Bitcoin itself meditates at $90,000, like a tired crypto king waiting for a judge to revive its digital crown.

When the yen drowns, Metaplanet rows towards bitcoin: a strategy that makes Tokyo smile... except creditors. While Japan goes into debt, others stack BTC.

While Beijing is making its e-yuan grow, Washington debates whether cryptos can offer rewards. What if the real danger is not what we think?

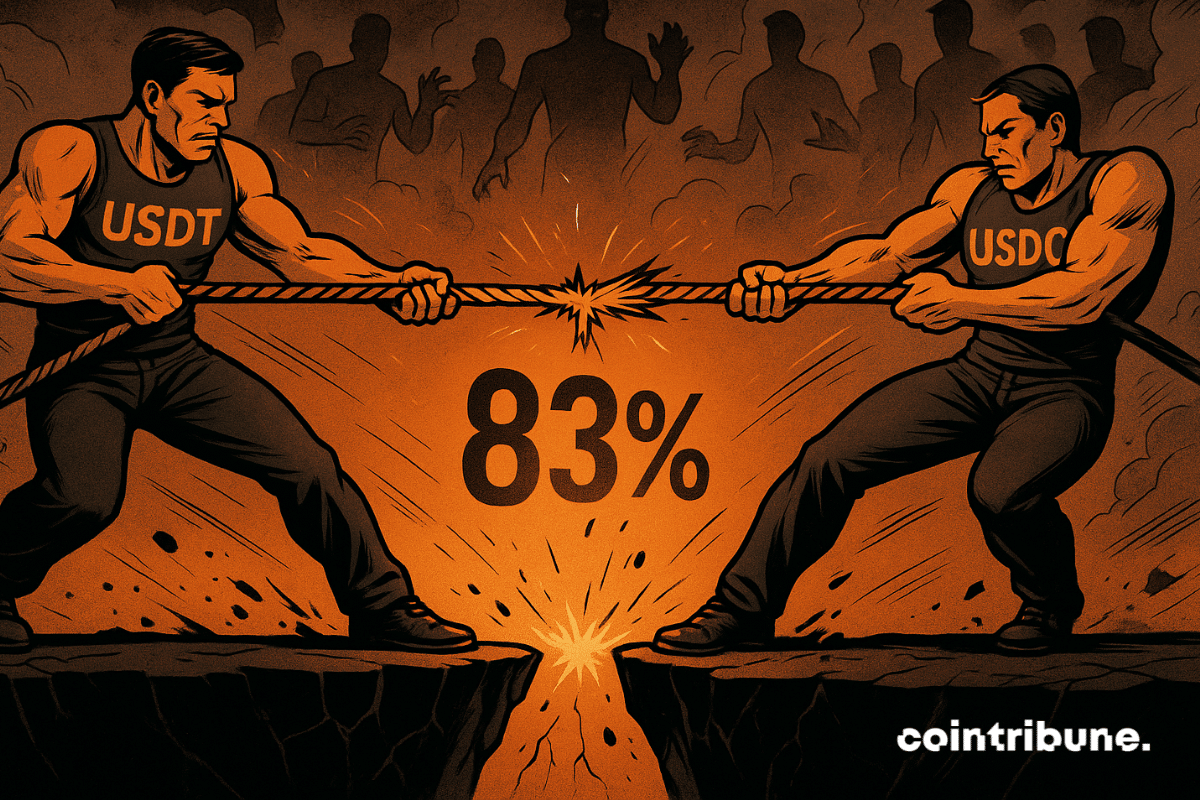

Coinbase CEO Brian Armstrong has warned US lawmakers against reopening the recently passed GENIUS Act, arguing that changes could reduce competition in the stablecoin market. He accused major banks of pushing Congress to weaken the law to protect their own interests. The comments come as debate grows over how stablecoins should be regulated in the United States.

The Bank of Japan is about to break with three decades of accommodative monetary policy. An almost certain rate hike puts markets under pressure. Contrary to usual expectations focused on the Fed or the ECB, it is Tokyo that worries. For bitcoin, the prospect of a stronger yen and the drying up of the carry trade revives fears of a liquidity shock. In an already fragile market, this pivot could redefine short-term balances.

Washington hardens its tone. The Office of the Comptroller of the Currency (OCC), the American banking regulator, denounces banking practices deemed discriminatory. In an unprecedented report, the agency accuses several major banks of restricting access to financial services for sensitive sectors, including cryptocurrencies. This phenomenon of "debanking," long denounced by the industry, could now be considered illegal. A strong signal sent to Wall Street, as the Trump administration intends to restore fair access to the banking system.

The OCC has clarified that U.S. banks can hold and use cryptocurrency to cover blockchain network fees, offering clearer guidance for digital asset operations.

Italy supports the European Central Bank's (ECB) digital euro project but sets its conditions. Italian banks, while welcoming this digital sovereignty initiative, request a financial effort spread over time. Facing heavy investments, the Italian banking sector wants to avoid a budget shock. Will this stance resonate with other European countries?

USDT and USDC are losing ground as new stablecoins and banks entering the market challenge their long-standing dominance.

Deutsche Bank analysts highlight Bitcoin’s growing role alongside gold as a potential asset for central bank reserves and global finance.

Deutsche Bank predicts Bitcoin could join gold in central bank reserves as markets mature and volatility eases, signalling growing institutional adoption.

The ECB freezes its rates, the FED is preparing to cut them... What if, in this monetary ping-pong, it was ultimately the real economy that served as the lost ball?

At this back-to-school period, major banks are revising their outlook. Faced with a clear slowdown in the American economy, the idea of two to three rate cuts this year is gradually taking hold. Investors, hanging on the Fed’s slightest signals, see in this change of course a potential turning point.

Faced with a wave of critical maturities on $4,000 billion of debt, Beijing launched an unprecedented monetary response. In August, the People's Bank of China injected $1,400 billion to avoid the suffocation of its bond market. More than an emergency measure, this intervention marks a strategic turning point in managing Chinese financial flows. In a context of global tensions, this technical gesture speaks volumes about Beijing's determination to maintain control over its economic cycle.

Standard Chartered has taken a major step in crypto by launching a fully regulated spot trading service for Bitcoin and Ethereum, specifically targeting institutional clients. This move makes it the first globally systemically important bank to offer direct access to dollar-paired crypto spot trading, opening the door for corporates, investors, and asset managers to gain exposure to digital assets under the umbrella of a trusted banking institution.

The Federal Reserve just made a big change that could make it easier for crypto companies to get bank accounts. On Monday, the Fed said it would no longer use “reputational risk” as part of its official bank supervision process. That vague label was often used to warn banks away from doing business with crypto firms, and many in the industry say it led to years of unfair “debanking.”

While Trump buries the digital dollar, Beijing is setting up its own on all continents. One click, one yuan, and finance trembles. The United States watches... gritting its teeth.

The global economy is set to experience its most sluggish decade since the 1960s. This forecast could reshape the balance of economic power on a global scale. The warning comes from the World Bank, whose latest report, published on June 10, 2025, paints a bleak picture of the near future amidst heightened trade tensions and prolonged political uncertainties.

In an article published this morning on Cointribune, we reported information that BNP Paribas had partnered with Pi Network to facilitate SEPA transfers in cryptocurrency. After thorough checks, this information turned out to be false.

The Fed turns a page in crypto regulation. By revoking two major directives imposed on banks since 2022 and 2023, the American institution reshuffles the cards of crypto supervision. Its new stance, embodied by letter SR 25-4, abandons the requirement for prior reporting in favor of an autonomous risk management approach. This is a discreet but strategic repositioning in a context where regulatory pressure is intensifying and the fault lines between financial innovation and institutional control are becoming increasingly visible.

The Bank of France finds itself in 2024 facing an unprecedented financial situation with an operating loss of 17.7 billion euros. This loss, far from being anecdotal, highlights deep vulnerabilities within the European financial system, exacerbated by inflation, rising interest rates, and the management of public debts.

While the Fed hesitates between caution and action, inflation runs rampant, and crypto wavers, poised for a week of financial roller coasters.