Bitcoin v30 expands OP_RETURN, triggering technical discord: between ambitious modernity and betrayal of roots, the protocol's core heats up faster than a saturated node!

Theme Bitcoin (BTC)

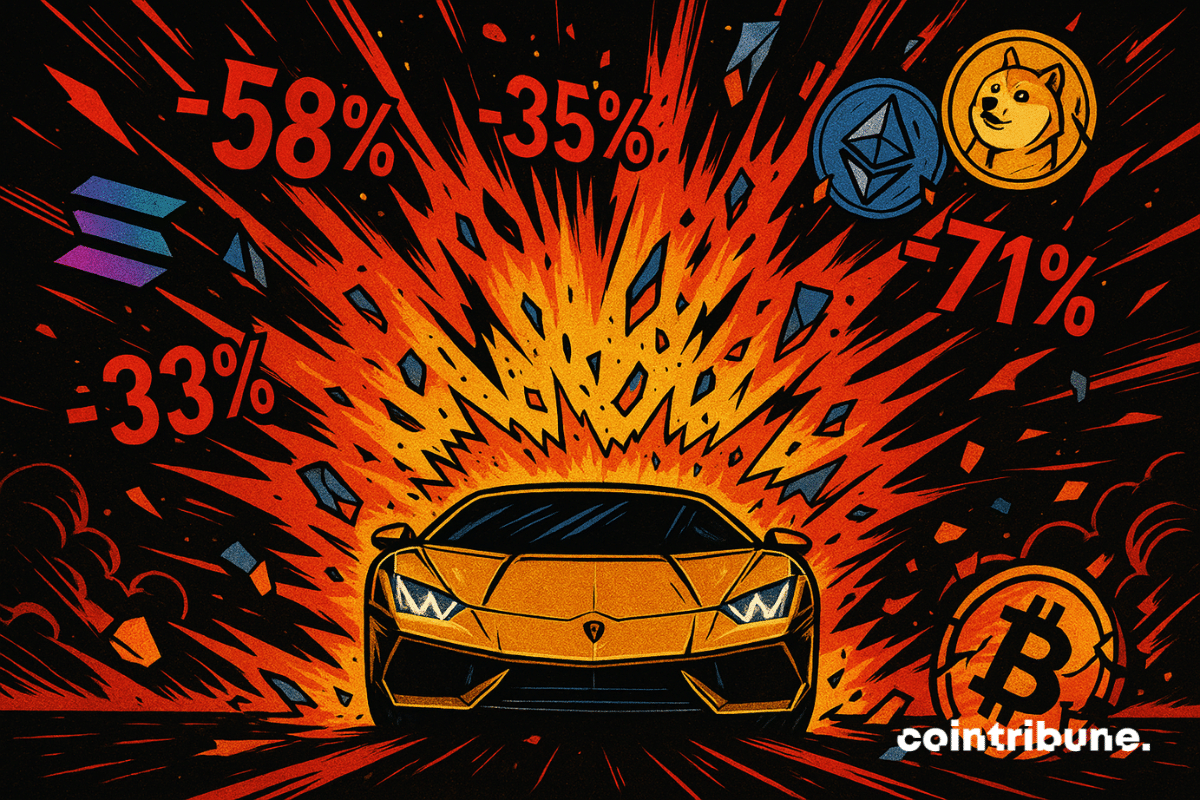

Bitcoin collapses, Trump threatens, Beijing counterattacks, and cryptos suffer: meanwhile, Dogecoin still seeks a way out of the crisis. Should we laugh or buy?

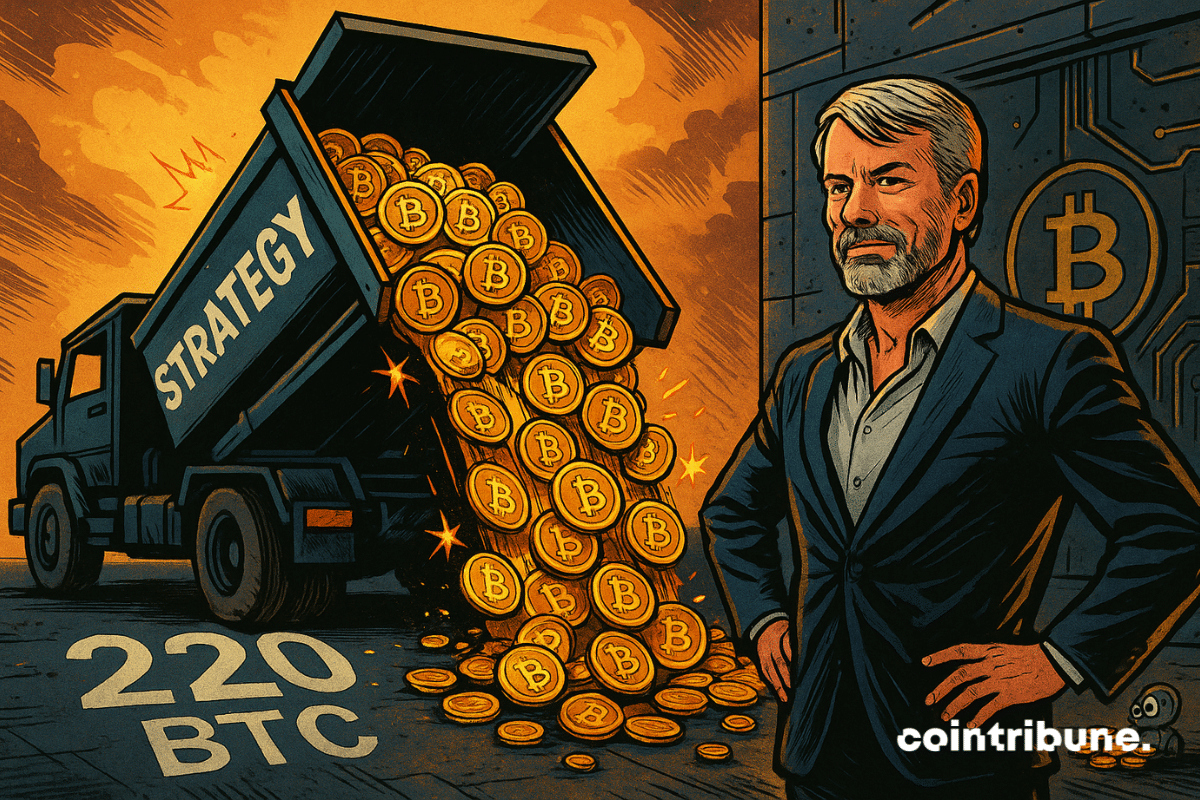

Despite the recent drop in the crypto market, Strategy continues its purchases. The American company acquired 220 BTC for $27.2 million, at an average price of $123,561 per unit. With more than 640,000 bitcoins in reserve, it confirms a continuous accumulation strategy, unique among institutional investors.

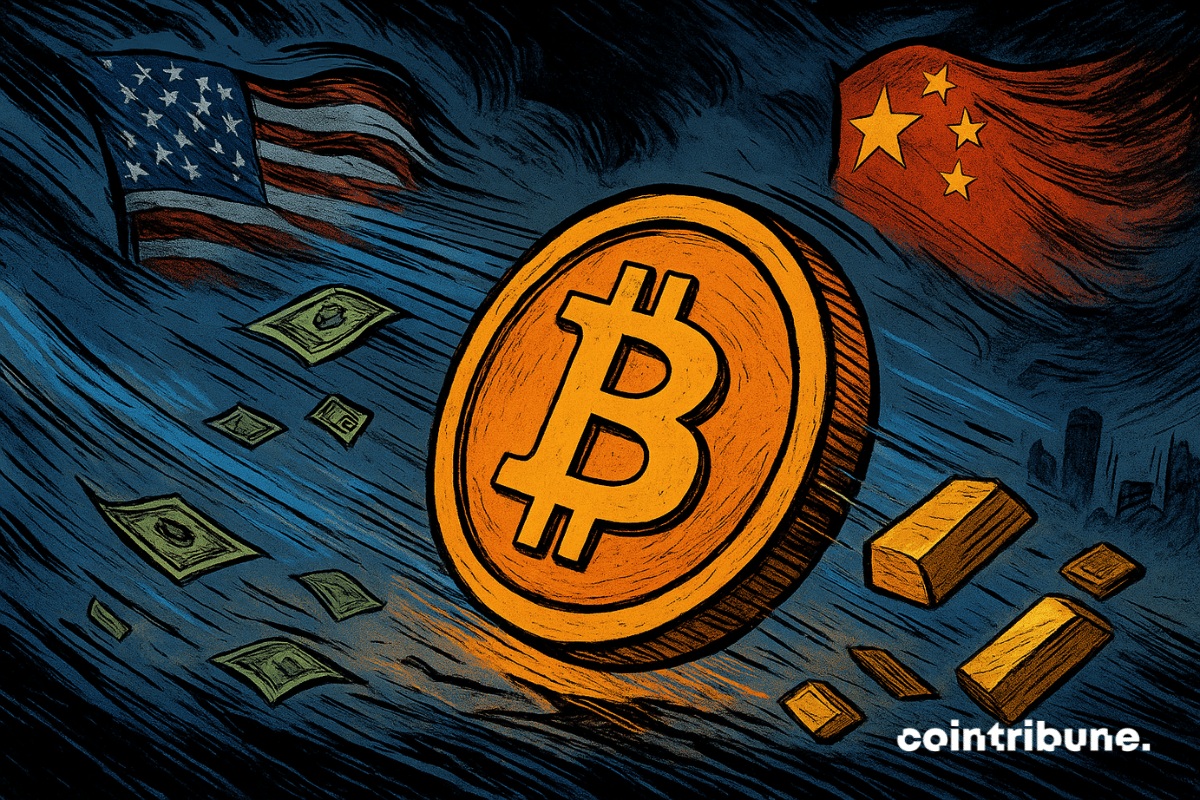

Tether CEO Paolo Ardoino sees Bitcoin and gold as a hedge capable of outlasting other currencies, reflecting the company’s strategic focus.

Bitcoin’s next major rally could take it well beyond previous highs, according to Pantera Capital CEO Dan Morehead. In a recent interview with CNBC, Morehead outlined a long-term view that envisions Bitcoin reaching $750,000 within five years. He also predicted a sharp consolidation across the blockchain industry, led by Bitcoin, Ethereum, and Solana. His remarks coincided with new investment initiatives centered on Solana’s growing market position.

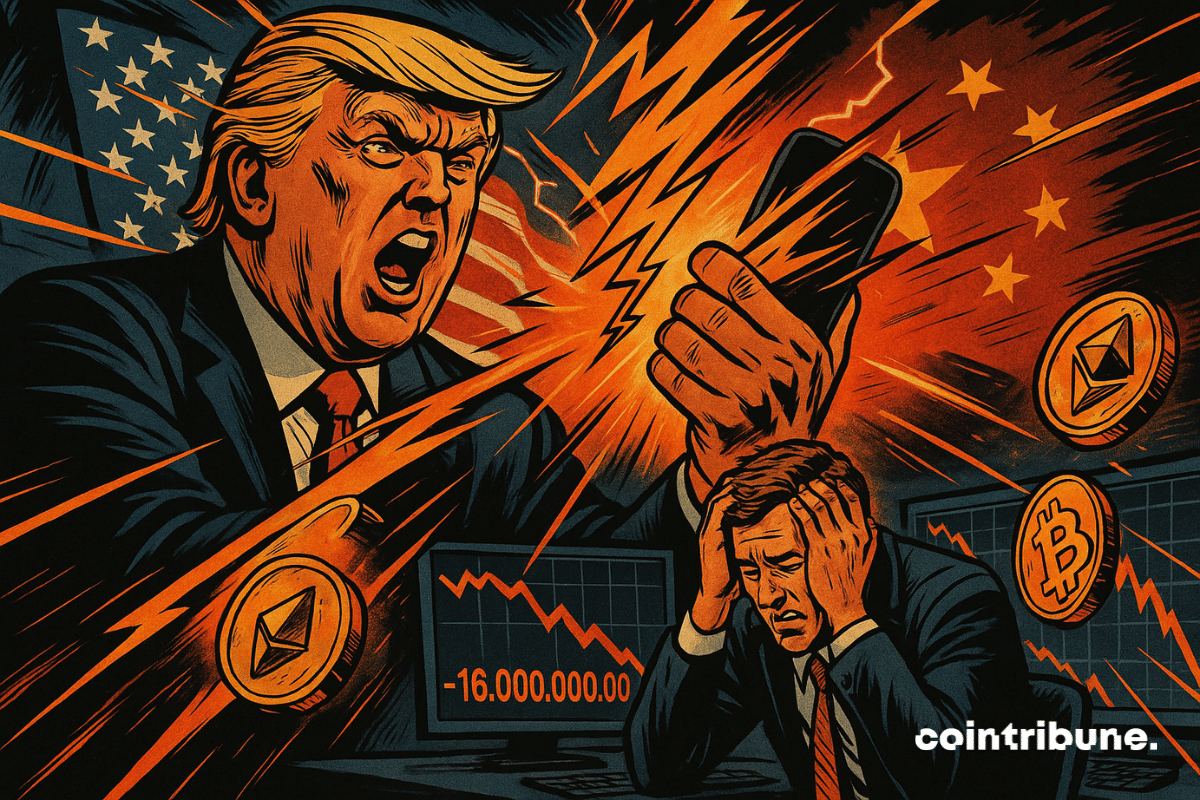

A trader operating on the decentralized platform Hyperliquid reportedly pocketed over 150 million dollars by betting against the market a few minutes before a major political announcement triggered a crypto crash. The operation, as spectacular as it is unsettling, revives suspicions of insider trading. A few days later, the same player opens a new short position of 160 million, fueling speculation about his identity and access to information.

Bitcoin is testing a major technical pattern that, in the past, has often marked the beginning of historic rallies. As the crypto attempts another golden cross, the crossover of the 50- and 200-day moving averages, eyes turn to the 110,000 dollar level. This key level could revive the market's bullish momentum if it holds. If it breaks, some analysts fear a sharp cycle reversal.

The Sino-American trade war may be worsening, but the lights remain green for bitcoin.

This Saturday, the body of Konstantin Ganich, an influential figure in the Ukrainian crypto scene, was found in a Lamborghini, amid the market collapse. The announcement, relayed on his official Telegram channels, immediately shook the community. This brutal tragedy reminds us that, behind the displayed profits and luxury cars, psychological pressures remain immense in a universe where every price drop can turn into a tragedy.

After a spectacular drop that tested investors' nerves, bitcoin is slowly regaining its composure. This brutal correction, though painful, could prove beneficial for what lies ahead. Analysts are now scrutinizing the charts for clues, and several technical signals suggest a vigorous recovery.

Bitcoin ended the week under pressure as investors rotated toward safer assets amid renewed US-China trade tensions and broader market weakness. Despite robust inflows into Bitcoin exchange-traded funds (ETFs), derivatives data suggest traders remain cautious about the sustainability of current price levels.

Trump sneezes on tariffs, Wall Street catches a cold, crypto convulses: 1.6 million traders liquidated, 19 billion evaporated. The crash is no longer a threat, it's a slap.

Russia is experiencing a quiet rush towards cryptos. Driven by Western sanctions, de-dollarization, and an uncertain economic climate, nearly 20 million Russians now hold these assets. Thus, crypto becomes a financial escape for the masses. Faced with this massive adoption, the government can no longer look away. A new monetary era is now emerging in Russia.

While central banks multiply gold purchases in an uncertain economic context, Deutsche Bank draws an unprecedented parallel with bitcoin. In a published report, the German bank highlights common dynamics between the two traditionally opposed assets. This analysis questions the place that bitcoin could hold in official reserves in the medium term.

Bitcoin enters retirement accounts! Starting October 15, 2025, Morgan Stanley allows all its clients to invest in Bitcoin ETFs. The end of a taboo! Discover the risks, opportunities, and impacts on the crypto market. #Bitcoin #MorganStanley #Crypto

This Friday, Donald Trump announced 100% tariffs on all Chinese products, in response to a commercial offensive from Beijing. The reaction was swift, as bitcoin dropped below 110,000 dollars, falling to 102,000 dollars on Binance, its worst performance since the end of June. The crypto market thus turned red in widespread panic.

After a marked rebound on support, bitcoin broke through its last major resistance, reaching a new ATH at $126,293. Discover the technical outlook for BTC's future evolution.

Arthur Hayes announces it: bitcoin crashes linked to the 4-year cycle are over! But beware, this does not mean all risks have disappeared. Discover the 3 new rules for investing in 2025 and how to benefit before everyone else.n#Bitcoin #BTC #ArthurHayes #Crypto

97% of Bitcoin’s circulating supply is now profitable, with most holders seeing gains and key support levels holding steady.

A new report by blockchain analytics firm Chainalysis reveals that more than $75 billion in cryptocurrency linked to illicit activity could soon be within reach of law enforcement. The findings come as governments consider forming official crypto reserves, raising questions about how seized digital assets could fit into national financial strategies.

Bitcoin has just crossed 126,000 dollars, but the market remains surprisingly quiet. This ascent without frenzy, rare in a universe where spectacular rises often precede violent drops, intrigues analysts. Unlike usual cycles, the apparent calm of the metrics fuels both confidence and curiosity. Should we see in this the beginnings of a new paradigm for the flagship crypto asset?

BlackRock’s spot Bitcoin exchange-traded fund (IBIT) has surpassed 800,000 BTC in assets under management, following an eight-day inflow streak that brought in over $4 billion. The milestone marks a significant step in institutional adoption of Bitcoin, coming less than two years after the fund’s launch in January 2024.

Robert Kiyosaki warned of a weakening U.S. dollar and urged investors to protect their wealth by shifting to gold, silver, and cryptocurrencies.

While bitcoin reaches a new all-time high at $126,000, the prevailing sentiment is that the market is already inaccessible. However, contrary to this impression, recent data paint a very different picture. According to Cosmo Jiang, partner at Pantera Capital, over 60% of investors still have no exposure to cryptos. This revealing figure reminds us that the majority of the adoption potential is yet to come.

"All that glitters is not gold." This 17th-century proverb applies wonderfully to flashy innovations. For several years, Artificial Intelligence (AI) has been presented to us as a revolution comparable to electricity or the Internet. But is it really a revolution? Or rather a spectacular optimization of what already exists? As we know it, AI revolutionizes nothing. It merely oils the gears of an already established system and mainly fits within the continuity of a centralized paradigm. At the same time, another technology, much less publicized but much more radical, pursues its trajectory: Bitcoin and decentralization. Unlike AI, Bitcoin does not just improve existing systems. It questions them, and sometimes even makes them obsolete. The true revolution today, the only one, is Bitcoin. Because it does not make the old world faster, it builds a new one.

BlackRock’s iShares Bitcoin ETF has quickly grown to nearly $100 billion, surpassing longtime funds and fueling strong investor interest in Bitcoin.

Bitcoin and gold are both hitting record highs, with analysts projecting Bitcoin could reach $644K after its next halving as gold continues to surge.

Despite a correction of more than 4% after a historic peak at $126,219, bitcoin maintains a solid bullish momentum, supported by robust institutional fundamentals. Massive flows to ETFs and renewed Wall Street confidence paint the picture of a maturing market. From Citibank to JPMorgan, the giants of American finance now anticipate a rise to $150,000 by December.

Bitcoin is soaring to $125,000 and disappearing from platforms: 114,000 coins flown away, investors in cold panic. Rush for digital gold or just a gimmick?

The end of the year looks very promising for bitcoin. Even the major American banks are very optimistic.