The Bitcoin network is going through a turbulent period. Its computing power, the hashrate, records a sharp drop, the most significant in several years. This major technical decline draws the attention of mining specialists and analysts, at a time when the crypto ecosystem is already under increasing pressure. Between market volatility and declining mining profitability, warning signals are accumulating, revealing a tense start to the year for sector players. This performance drop raises questions about the operational resilience of the network.

Theme Bitcoin (BTC)

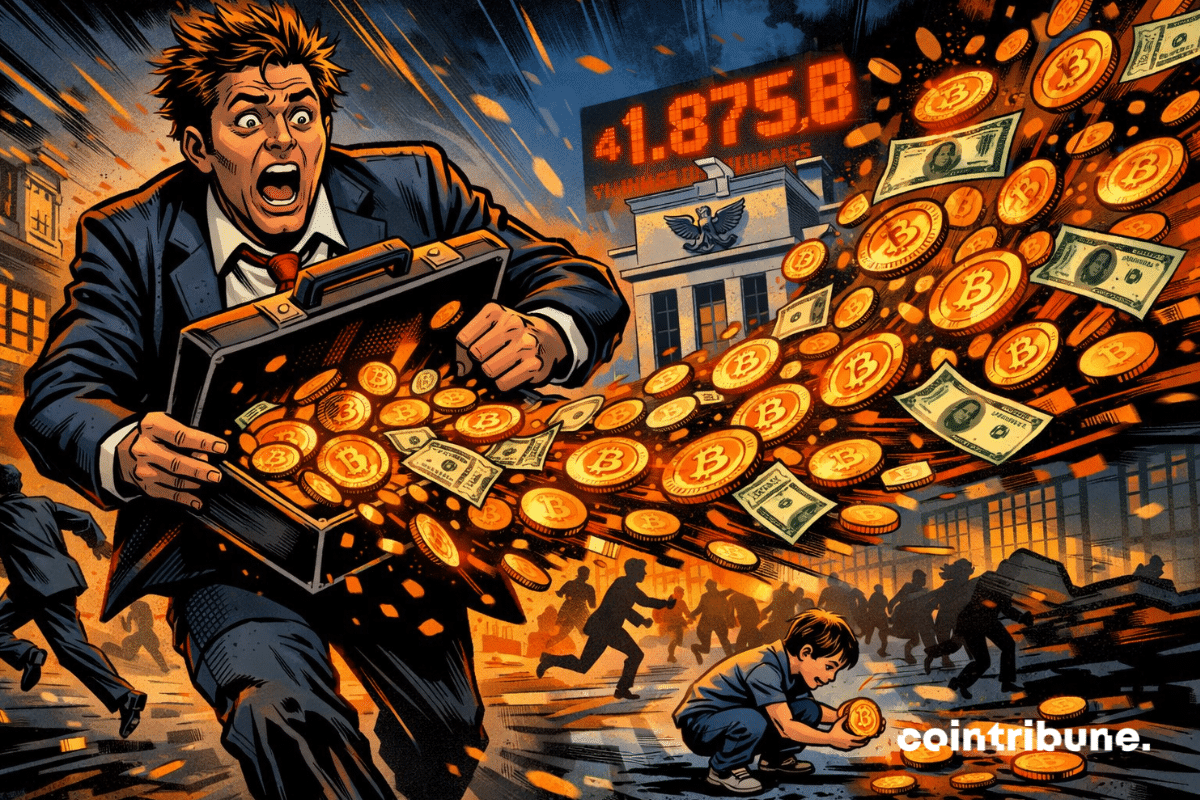

In just five days, crypto ETFs suffered massive withdrawals totaling $1.82 billion. This hemorrhage, occurring in the context of a widespread crypto downturn, raises questions about the future of institutional investments. Why are funds fleeing? What possible scenarios lie ahead in the coming months?

Panic on the crypto planet: whales flee, the small ones bite the hook... what if this widespread fear was just a foretaste of a spectacular comeback?

Bitcoin has just lost its place among the ten most valuable assets in the world. This downgrade, far from trivial, reveals a growing fragility of the crypto market, caught up by revived volatility. While traditional markets rebound, the iconic crypto suffers rare intense selling pressure. Behind this brutal setback, the entire solidity of the narrative around bitcoin wavers, questioning its ability to withstand macroeconomic shocks and violent market adjustments.

Binance plans to move its primary user protection fund from stablecoins into Bitcoin within the next 30 days, marking a major shift in how the exchange backs emergency safeguards. The transition will convert the Secure Asset Fund for Users (SAFU) entirely into Bitcoin, reflecting what company leadership describes as long-term confidence in Bitcoin’s role in the digital economy. Critics and industry observers warn that increased exposure to Bitcoin’s price volatility could weaken user protections during periods of market stress.

In Washington, Trump is plotting his revenge: a former hawk ready to embrace Bitcoin and bring the Fed back into line, while Powell counts down the hours.

The crypto market is going through a period of uncertainty where indecision reigns. For several weeks, investors have been operating in an atmosphere of distrust fueled by a Fear & Greed index stuck in an extreme fear zone. Prices are stagnant, volumes are eroding, and no clear signal manages to revive confidence. This emotional inertia, coupled with a lack of technical direction, reflects a latent tension that weighs heavily on market dynamics. Doubt is settling permanently within the ecosystem.

The crypto market has just crossed a critical threshold at the beginning of this year. On Thursday, January 29, 2026, bitcoin abruptly fell below $83,000, triggering a wave of sales that wiped out the last hopes for stabilization. Such a drop occurs in an already tense macroeconomic climate, where investors are reducing their exposure to risky assets. More than a simple technical pullback, this movement revives fears of a deeper correction.

While the great powers hesitate, El Salvador stacks gold and bitcoin. Bukele dreams of a treasure safe from crises... and the Fed's lessons.

Bitcoin falls to around $85,200, its lowest level at the beginning of the year, in a climate of widespread tension in the markets. While gold regains ground as a safe haven, tech stocks retreat, pulling the Nasdaq down. This new shock in the crypto market triggers concern among investors, both professional and retail, as Bitcoin seems to lose its status as an alternative in times of uncertainty.

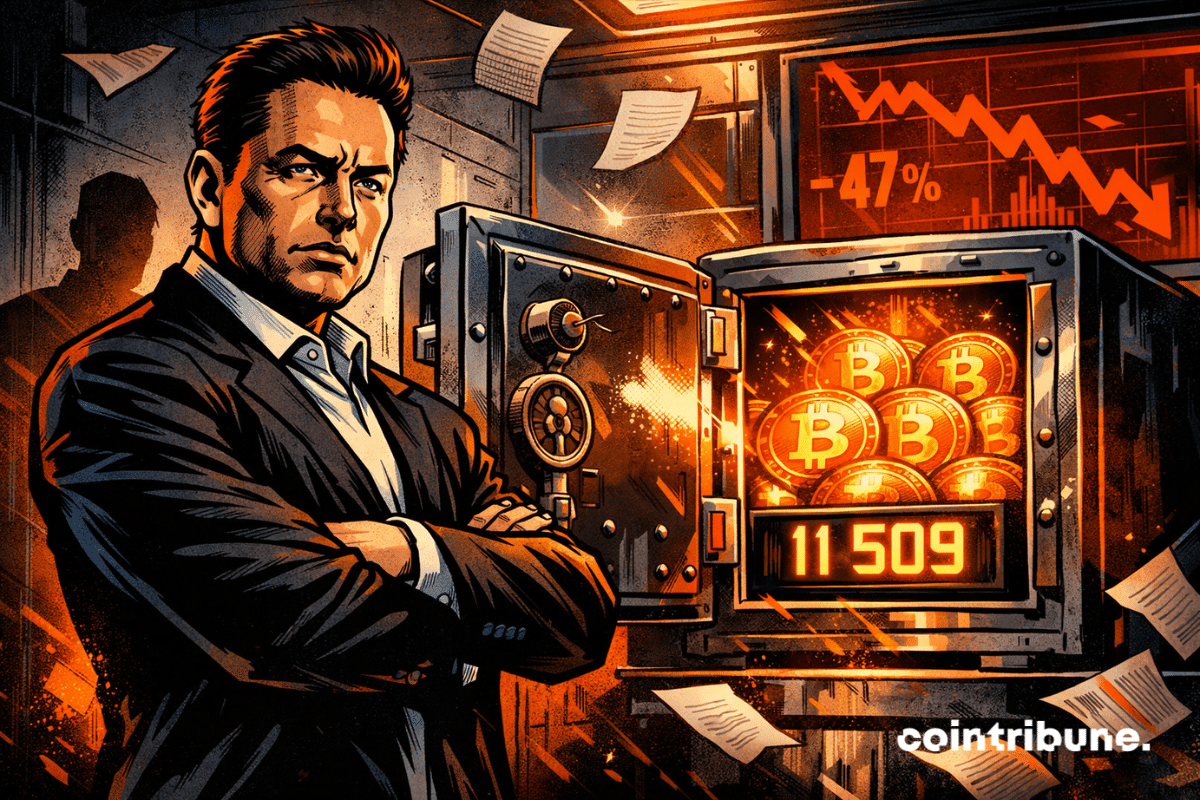

Tesla did not touch its Bitcoin reserves in the fourth quarter of 2025. Yet, the company had to record a “digital assets” loss of about 239 million dollars after taxes, simply because the BTC price declined over the period.

US Bitcoin spot ETFs saw 1.875 billion dollars leave over eight trading days as Bitcoin consolidates and the Fed holds interest rates steady, highlighting cautious investor sentiment.

AI data centers nibble away at electricity and the patience of local residents: the same recipe as with bitcoin, but wrapped in a well-oiled progress discourse.

While gold smashes a new record above $5,300 per ounce, bitcoin stalls below $90,000. This stark contrast between two assets often described as safe havens raises questions. Why is the precious metal attracting massive capital while the leading crypto is stuck? In a tense economic context, this gap reveals a shift in investors' perception in the face of uncertainty.

While the Fed is buying time, the dollar is nosediving. And while Trump congratulates himself, bitcoin is smiling. The global economy, much less so...

October is often awaited as the flagship month for bitcoin, but recent data challenges this myth. According to quantitative analyst Timothy Peterson, February would actually offer more reliable performance, supported by solid statistics and repetitive market patterns. While January ends on an uncertain note, a new seasonal signal could emerge. What if the real "Uptober" now falls in February? This shift could well redefine crypto investment strategies this year.

Global markets are entering a concentrated period of macroeconomic risk that could shape sentiment into early February. Five key U.S. economic releases are scheduled for January 27, increasing pressure on already cautious investors. Crypto markets remain highly sensitive in this environment, with Bitcoin still absorbing the majority of capital flows.

A South Dakota bill aims to authorize public funds investment in Bitcoin. All the details in this article.

While bitcoin has been oscillating without a clear direction for months, several publicly traded companies continue to massively increase their reserves. This gap between price sluggishness and institutional actors' enthusiasm intrigues the markets. Far from a mere treasury choice, this strategy reflects deliberate bets on bitcoin's future as a strategic asset. Thus, the latest data confirm a persistent accumulation dynamic, revealing silent but structured confidence within the crypto economy, even amid prolonged uncertainty.

A rare signal, dreaded by traders, has resurfaced on the bitcoin chart. For the first time since 2022, the asset crosses a critical technical zone, reviving the memory of a prolonged bear market. This moving average crossover, often associated with lasting reversals, fuels concerns of an already seen scenario. While post-halving euphoria struggles to convince, this return to a forgotten configuration could well mark an unexpected turning point in the current BTC cycle.

Bitcoin has extended its decline following a sharp market shock in October, while traditional safe-haven assets continue to climb. Data from on-chain analytics and price movements suggest investors are withdrawing funds from crypto and shifting toward assets seen as more stable during periods of uncertainty. A falling stablecoin supply has added to concerns that a broader market recovery may take longer to materialize.

Metaplanet has just sent a clear signal to the market: the company does not intend to let its trajectory be dictated by a set of accounting entries. Yes, the company expects a heavy annual loss in 2025. And yet, it is raising its operational targets and announcing almost a doubling of sales in 2026. Said like that, it sounds like a paradox. In reality, it is mainly a clash of vocabulary between accounting and cash.

Michael Saylor warns that ambitious developers, even with good intentions, could unintentionally put Bitcoin’s network at risk.

While bitcoin seemed to be initiating a rebound at the beginning of this year, the momentum suddenly froze. Around 88,000 dollars, the asset struggles to convince, held back by a climate of political and monetary uncertainty. Institutional investors are easing off, cooled by tensions in Washington and the Fed's wait-and-see approach. While some indicators reveal a continued upward trend, signals from the derivatives markets tell another story: that of a market that doubts, observes, and waits.

Bitcoin wobbles again, caught in the turmoil of a tense global economic context. As sensitive political deadlines approach, fear returns to the markets and revives a well-known pattern: the fall of the dollar often precedes a bottom for BTC. This inverse correlation, already observed in previous cycles, intrigues investors once again. While bitcoin tries to rebound, macroeconomic signals multiply and suggest a new episode of high tension for the market's leading crypto asset.

Bitcoin under pressure, Strategy surprises. This new massive purchase fuels tensions within the crypto community. Details here!

When Washington argues, crypto collapses! Between shutdown threats, a thunderous Trump and triumphant gold, bitcoin discovers it is not truly a golden refuge.

The crypto market is going through a brutal digestion phase since the October shock. However, a message comes up from the professional desks. Indeed, many institutions believe that bitcoin is worth more than its current price. The idea is not new, but the timing is intriguing.

Bitcoin is trading around $87,000 as market momentum slows. Bloomberg’s Mike McGlone warns investors to stay cautious amid early 2026 market pressures.

Binance founder Changpeng Zhao (CZ) has issued a stark warning about the future of work as artificial intelligence spreads across industries. He argues that rapid AI adoption will erase millions of jobs worldwide. Against that backdrop, Zhao believes cryptocurrencies can serve as financial protection for those who prepare early.