Jerome Powell's term will expire in May 2026, and Donald Trump has already announced that he is considering three to four candidates to replace him. This crucial decision could radically transform American monetary policy and create shockwaves in global financial markets.

Dollar

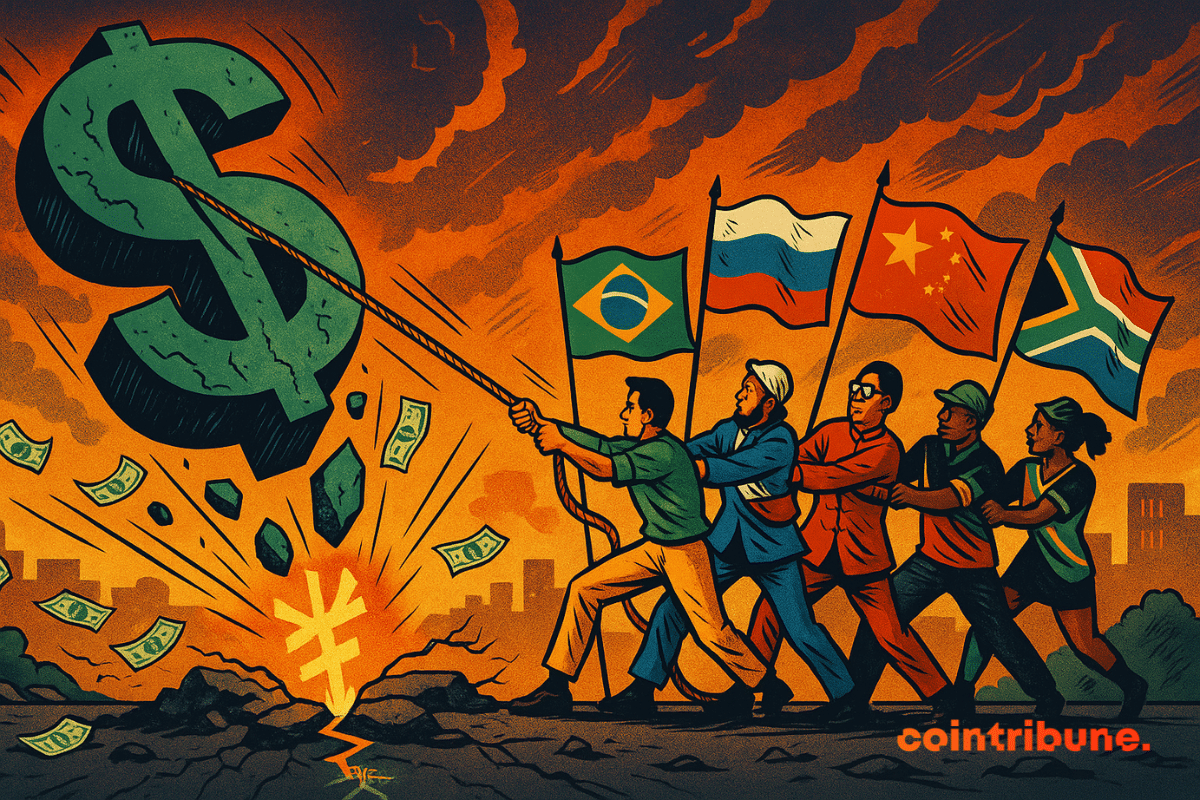

Donald Trump's announcement of 10% tariffs on BRICS countries reignites a strategic debate: are the United States risking, in their bid to defend their leadership, to accelerate de-dollarization? Behind this commercial offensive lies a deeper rift, where emerging powers seek to break away from the dominance of the greenback. As geo-economic tensions intensify, the question arises: is Washington not hastening the questioning of the monetary order it strives to preserve?

"While the dollar plays the tightrope and Trump brandishes his tariffs, Washington unveils a crypto-crutch: stablecoins, a techno remedy or a digital mirage of a wavering empire?"

The debate on leaving the euro is resurfacing regularly in France. With new presidential elections set for 2027, a victory for the National Rally could lead to an exit from the euro. The French could very well come out of it ruined!

Under the pretext of stablecoins in Hong Kong, Beijing is moving its pieces. Crypto on the menu, control for dessert? JD and Ant are rolling out the digital carpet, but beware of the invisible strings.

While Wall Street sets more records, the dollar is collapsing at an unprecedented rate since 1973. This wide gap is not trivial. It reflects a global shift fueled by geopolitical tensions, a Federal Reserve under political pressure, and macroeconomic uncertainties. The benchmarks are crumbling, and markets are seeking safe havens. In this silent but brutal reconfiguration, cryptocurrencies are once again asserting themselves in the strategic landscape, propelled by their decentralized logic in the face of state currency instability.

Economist Peter Schiff is openly opposing the U.S. government on the future of stablecoins. While Washington relies on these cryptocurrencies to strengthen the dollar, Schiff predicts the opposite. But is he right to be concerned?

While Trump buries the digital dollar, Beijing is setting up its own on all continents. One click, one yuan, and finance trembles. The United States watches... gritting its teeth.

A discreet yet massive shift is redefining the global monetary balances. Indeed, over 90 countries, led by the BRICS, are abandoning the dollar in their international exchanges. In its place, the yuan, the ruble, or the rupee are gradually taking over. This strategic realignment, far from being a mere technical adjustment, challenges the financial order built around the United States since the post-war period. A stated desire for economic sovereignty and a direct challenge to American hegemony over global flows are at the root of this movement.

June 13, 2025 marks a turning point in the Iran-Israel conflict. Massive Israeli strikes targeted the heart of the Iranian military infrastructure. Iran retaliated later that evening with 300 ballistic missiles, crossing a new threshold in this long-standing war.

Since the beginning of the year, the dollar has collapsed against the euro and other major currencies. A trend that seems far from over. Markets are adjusting to an uncertain geopolitical context, fueled by the economic decisions of the Trump administration. How far will the decline of the greenback go?

As the BRICS summit in Rio approaches, Ron Paul sounds the alarm: a monetary shift is underway. The parliamentarian mentions a "Rio Reset," a coordinated offensive by emerging economies to marginalize the dollar in global trade. Behind this statement lies a broader dynamic: the emergence of a multipolar financial order. As monetary tensions intensify, the initiative backed by the BRICS could accelerate a paradigm shift with global consequences.

Morgan Stanley shakes the markets. Indeed, the investment bank forecasts a 9% drop in the US dollar within a year, bringing the currency down to its lowest levels since the pandemic. A shocking projection, published on May 31, which challenges the greenback's dominant status in the global monetary order and fuels fears of a lasting shift in international financial balances.

The Dollar is skyrocketing, gold is faltering, mining giants are collapsing... What is happening behind the scenes of the global economy? Discover why bitcoin might just emerge unscathed from the monetary shockwave!

The former chief economist of the IMF, Kenneth Rogoff, accuses Bitcoin of contributing to the de-dollarization movement of the economy and weakening the supremacy of the dollar.

What if the euro finally established itself as a global reference? In Berlin, Christine Lagarde surprised her audience by asserting that the European single currency could replace the dollar as the main pillar of international reserves. Behind this bold statement, the president of the ECB outlines a clear strategy: to provide the European Union with the necessary levers to exert financial and geopolitical influence. Thus, in a reshaping world, this ambition redefines monetary power dynamics and places the euro at the center of a new global equilibrium in the making.

The American Congress recently approved the "Big, Beautiful Bill," Donald Trump's budget proposal, hailed as a strong resurgence of Republican economic policy. However, for Peter Schiff, this text marks a dramatic turning point. The economist sees it as a destructive mechanism that prepares for the inevitable downfall of the dollar and an unprecedented monetary shock.

As geopolitical rivalries flare up, dedollarization reemerges as a lever of monetary sovereignty. For a long time, the BRICS have been at the forefront of this ambition, seemingly seeking to challenge the economic order dominated by Washington. However, a strategic repositioning by Brazil, an influential member of the bloc, disrupts this trajectory. By dismissing the idea of a common currency, the country reshuffles the cards of an already fragile project, revealing the limits of monetary coordination in the face of the reality of economic power dynamics.

While the major emerging powers are making calls to reduce their dependence on the US dollar, a key player has just slammed the door on any desire for a break: India. In a tense international context, where Western sanctions are pushing some countries to explore alternatives to the dollar-dominated monetary system, New Delhi chooses to play the stability card. By stating that it has "absolutely no interest" in engaging in a de-dollarization dynamic, India sends a strong signal to its partners within the BRICS and the Global South.

Unbeknownst to the general public, a monetary shift is taking place in Europe. The US dollar is losing ground there. Since the beginning of the year, foreign companies and funds are demanding payments in local currencies, revealing a strategic fracture at the heart of continental finance. This movement, far from being anecdotal, aligns with the ambitions of the BRICS, who are determined to erode the hegemony of the greenback. Discreetly, it is the very architecture of international trade that is wavering, driven by an emerging alliance in search of economic sovereignty.

The world of investing has been revolutionized over the past decade by the democratization of ETFs and passive management. However, this investment strategy is beginning to show signs of worrying fatigue. With potentially overvalued markets and anemic return forecasts for the next decade, it becomes urgent to question ETFs.

The crypto greenback is waging its war: while rivals battle in plain sight, USD1 climbs the rankings, propelled by the Trumps and boosted by billions.

The global monetary architecture is shaking on its foundations. By reducing the share of the dollar in their exchanges to 33%, the BRICS are signaling a historic break. Their trade now largely relies on their own currencies. Behind this shift lies a deliberate strategy to fragment a system dominated by the greenback. This is no longer an intention; it is a movement underway. And it is reshaping the balances of a financial order that has until now been under the influence of Washington.

The Fed feigns hesitation, but its printer is spewing billions. Meanwhile, Bitcoin is climbing without looking back, immune to Powell's words and Treasury debts.

The dollar has slowed down, but global markets are holding their breath. After three weeks of rising, the greenback is losing ground, driven by a more robust employment report than expected. However, tensions persist: a resilient growth, stagnant rates, and ongoing tariff uncertainties. Cryptos are not exempt from this monetary ballet. For crypto traders, every fluctuation of the dollar redraws the risk map, shifts the boundary of volatility, and reshapes liquidity expectations.

And what if the dollar was no longer the only compass for stablecoins? Around the world, a tide is forming: governments, regulators, and companies want alternatives. Between monetary sovereignty and geopolitical ambitions, crypto is taking an unexpected turn.

Bitcoin once again takes center stage. Hunter Horsley, CEO of Bitwise, takes boldness to its peak. He envisions a Bitcoin capable of competing not only with digital gold but also with the dollar and U.S. Treasury bonds. Consequently, he mentions a potential market of $50 trillion. So, can we really contemplate such a transformation?

As international monetary tensions intensify, China is ramping up its offensive against the dominance of the dollar. Beijing is formalizing the launch of a strategic plan to impose its own international payment system. This initiative marks a major turning point in the redefinition of global financial flows, reinforcing China's ambition for a multipolar economic order. By directly targeting traditional networks dominated by the West, this maneuver is now capturing the attention of markets, governments, and major financial institutions.

While the dollar tap dances on a thread of presidential tweets, the euro is trotting towards the monetary throne, galvanized by the missteps of its starry rival.

Between Washington and the BRICS, India is performing a balancing act. Officially tethered to the dollar, it nonetheless allows favorable signals towards monetary alternatives to leak through. In a context of geopolitical reconfiguration where the American currency crystallizes tensions, New Delhi's ambivalent stance intrigues as much as it worries. Between overt loyalty and discreet strategies, India asserts itself as a key player in the global monetary showdown.