The future of the US dollar seems more uncertain than ever after JPMorgan's alarming predictions. Jamie Dimon, its CEO, mentions an inevitable crisis that could disrupt the global economy. The BRICS are cited as major players in this situation. Why such a statement, and what could be the consequences for the global economy?

Dollar

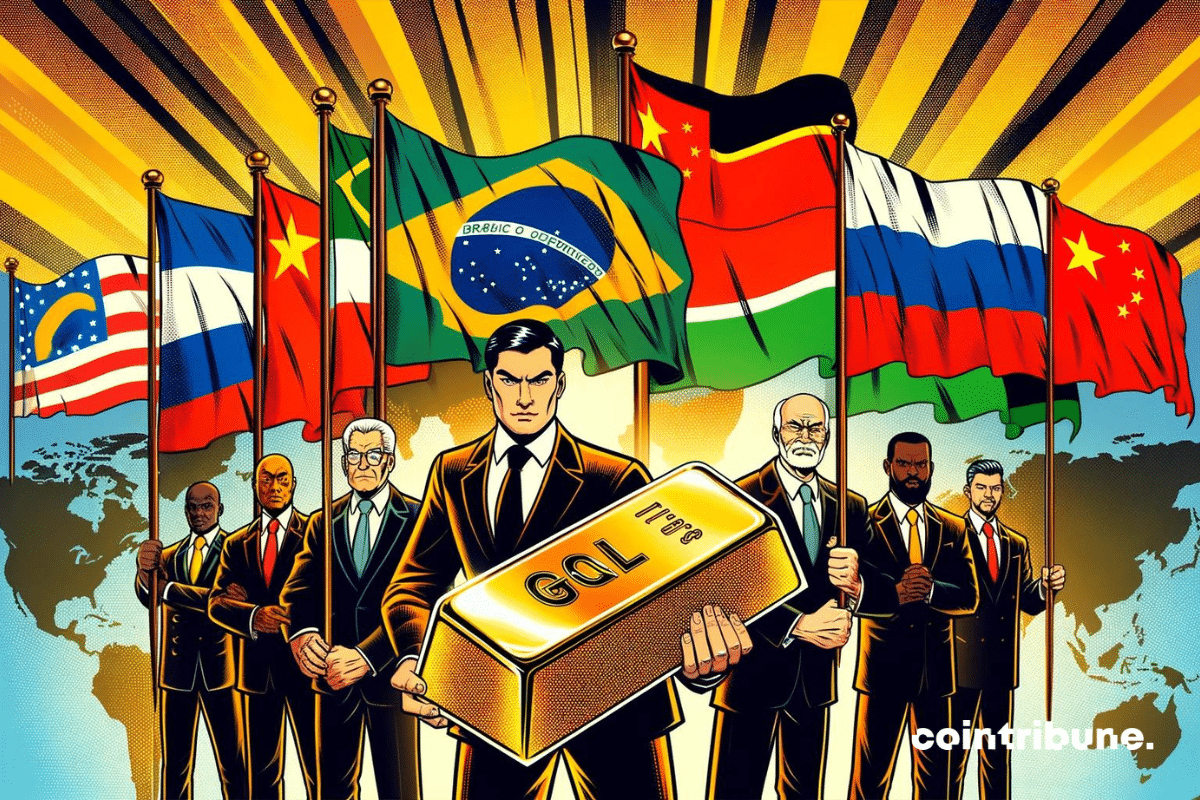

The BRICS countries are actively working on creating a single currency, a project recently confirmed by Kazem Jalali, the Iranian ambassador to Russia. This initiative aims to reduce global dependence on the US dollar and promises to disrupt the global economy if it comes to fruition. This currency could reshuffle the deck of global economic power, but also deeply impact the dollar. Here are three concrete ways in which the BRICS currency will affect the US dollar.

Liberal democracy seemed invincible, triumphing over the forces of fascism and communism. Two decades later, this supremacy is seriously being called into question. Information dynamics in the technological age and geopolitical alliances are threatening liberal democracy in the 21st century. Are we heading towards communism in the coming years?

De-dollarization, a recurring concept in economic discussions, is the subject of a lively debate. While some view this movement led by the BRICS as an imminent threat to the dominance of the US dollar, eminent experts reject this idea as unfounded. This article explores why the idea of de-dollarization is seen as a "big joke" by some experts.

During this period of economic turbulence marked by soaring inflation and a constantly increasing national debt, many are turning to cryptos as a potential alternative to the dollar. However, a new analysis by Morgan Stanley highlights the reasons why the US dollar maintains its supremacy and explains why it is unlikely that cryptos could replace it in the near future.

Beijing and Bangkok will de-dollarize their trade by promoting their national currencies. With CBDCs? What about Bitcoin?

The BRICS were known to be considering a currency. This time, it seems to be truly official. In a strategic move aimed at reshaping the global economy, BRICS countries are actively working on creating a new currency. This development could mark a major turning point in the fight against the dominance of the US dollar and have profound repercussions on international trade. As emerging economies seek to reduce their dependence on the dollar, this initiative appears as a significant challenge to the established economic order, with potential implications for the entire global financial system.

Vladimir Putin used his state visit to China to hammer home that the United States unfairly benefits from the dollar's status as the international reserve currency. Let's use Bitcoin instead.

Several countries, including China, are working to reduce their dependence on the dollar by promoting the use of their own currencies in international transactions. However, despite the ambitious attempts at monetary diversification undertaken by this BRICS member, some experts remain skeptical about their success. According to their analyses, the dollar will withstand external pressures and retain its supremacy over the Chinese currency.

China is accelerating its de-dollarization with record sales of US Treasury bonds. The world will soon need a new reserve currency: Bitcoin.

The IMF admits that geopolitical tensions bode ill for the dollar. The BRICS want to cut ties. Why not adopt Bitcoin?

One of the basic tenets of MMT is that the government has no budget constraint. Yet this dangerous theory has colonized the highest echelons of government.

North Korea has expressed its desire to join the BRICS bloc, a move that could redefine its enduring geopolitical isolation. This announcement comes at a time when BRICS are seriously considering reshaping the global financial architecture, notably by creating an alternative currency to the US dollar. Pyongyang's interest in this group of emerging powers raises multiple questions about its motivations and the potential implications for global balance.

New nail in the coffin of the dollar. India and Nigeria no longer want to trade with the greenback.

Saudi Arabia and other nations like Indonesia warn Europe against seizing Russian foreign reserves. Bitcoin on standby.

The dollar is the Gordian knot of geopolitical tensions. The signals in this direction are now legion. Bitcoin is biding its time.

The 3rd largest economy in terms of GDP is on the brink of collapse with a colossal debt and a free-falling currency. If the trend continues, the problems will be terrible for the entire world...

The petrodollar empire is faltering. Elon Musk knows it and warns that Washington would do well to reduce budget deficits.

The yen collapses against bitcoin, which has appreciated by over 150% over the past year.

As the crazy growth of the US debt of over 34,600 billion dollars continues to worry, the BRICS deliver a new blow to the greenback. China and Russia, two founding members of the alliance, have planned 260 billion dollars of commercial exchanges without using any US dollars. Only Russian ruble, Chinese yuan, and some euros. Other members of the coalition are expected to follow suit soon. Perceiving the immediacy of the threat, the USA react by combining threats and diplomacy. Details.

The Wall Street Journal reports that the United States is preparing to cut Chinese banks off from the dollar. This financial bombshell would be a boon for bitcoin.

As the BRICS alliance intensifies its de-dollarization efforts, the success of this initiative remains uncertain. While several countries are considering joining or already adhering to this movement, the supremacy of the US dollar remains unchallenged. Indeed, despite the coordinated efforts of the BRICS member countries, the dollar continues to outperform the currencies of these nations.

The seizure of Russian assets by the United States will have serious repercussions on the international monetary system. It would be a godsend for bitcoin.

The G7 is meeting this week to reach an agreement aimed at siphoning off the 300 billion dollars belonging to Russia. Need bitcoin?

Times are tough for the US dollar. Once a symbol of stability and a pillar of the global economy, it now faces a gradual erosion of its supremacy. Amid fluctuating monetary policies and geopolitical tensions, the foundations of its dominance are being challenged. Like the BRICS, many countries are ditching the US dollar for various reasons.

The monetary influence of BRICS is increasing day by day. The latest news reports that the Chinese currency, the yuan, has surpassed the dollar as the most used currency in Russia. This change aligns with the alliance's desire to reduce their dependence on the American currency.

The ECB versus the Fed: global finances are at stake. Understand the risks and challenges of the current situation.

The BRICS have announced their plan to launch their own currency to break free from dependence on the dollar. While waiting for this project to materialize, the alliance is shunning the dollar through various strategies. One of the most recent ones is the massive use of gold by the BRICS to support their local currencies.

The famous bitcoiner and entrepreneur Balaji Srinivasan has just published a diatribe against the United States. According to him, the federal government is on the verge of bankruptcy and being swallowed by trillions of dollars in debt. Faced with such a crisis, the Fed would activate the largest money-printing policy in American history to divert money from taxpayers.

The BRICS plan to break away from the reliance on the US dollar will have a significant impact on the United States. An effect that, according to analysts, will affect three vital sectors of the American economy, including banking and finance, technology, and trade. This is not to mention the consequences of a debt crisis.