China's hegemonic ambitions in the economic sphere have been well-known. The desire of the Asian giant and its BRICS partners to move away from the dollar is essentially an expression of this ambition. This ambition has recently seen progress involving the euro, the currency used in the European area.

Dollar

Today, within the Eurasian Economic Union, economic transactions are settled with national currencies, which are increasingly overshadowing the dollar. Most economic exchanges involving Russia are now conducted in rubles. The euro and the dollar are undergoing displacement. This transformation in the global financial landscape cannot go unnoticed. The possibility of a common commercial currency emerging within the BRICS is back at the center of discussions. In a recent interview, Russian economist and politician Sergei Glaziev dropped a bombshell: a common BRICS currency is inevitable. Details.

The explosive rise of Bitcoin and crypto in general is undeniable. Among the many harbingers of this new financial era, the announcement by Standard Chartered, a colossal $840 billion bank, to enter the Bitcoin arena is undoubtedly one of the most significant.

The Iraqi government will ban all cash withdrawals and transactions in US dollars starting from January 1, 2024.

At the heart of a monetary revolution, Bitcoin challenges conventions and shakes the foundations of finance. Financial turmoil has always been the stage for engaging debates, conflicts of interest, and strong opinions. In this world where fiat currencies reign supreme, a recent statement by tech magnate Elon Musk has stirred the pot: according to him, fiat currency is the biggest scam of our time. But to understand this bold declaration, one must first delve into the complex world of Bitcoin.

What is the cumulative inflation since 2010? What is the extent of purchasing power loss?

China is one of the United States' fiercest competitors for global hegemony. At least in economic terms. To achieve this, the country seems to be pursuing a strategy of limiting or even reducing its investments in the United States. Saudi Arabia, which has just joined the BRICS, also seems to be doing the same, further confirming its plans to leave the dollar behind.

The 15th BRICS summit ended on Thursday, August 24, with some big news. That of the creation of BRICS+. An expanded version of the organization's membership. Members that include some of the world's biggest crude oil suppliers. Global geopolitics are potentially no longer the same.

Australia's leaders have begun to reduce the number of banknotes in circulation in the country. This brings to an end more than 60 years of reign by greenbacks and pennies, which will gradually have to give way to digital money. What substitute for cash: bitcoin, other cryptocurrencies or CBDC? Let's find out!

In South Korea, gold bars can now be purchased as easily as energy drinks. Since September 2022, gold vending machines have been installed in shopping malls by GS Retail. They are accessible on a self-service basis and are very popular with the public! Interestingly, most shoppers are in their twenties and thirties. This brings the debate about access to physical precious metals back onto the table.

Avec plus de 40 % de la population mondiale et près de 26 % de l’économie mondiale, les BRICS s’affirment de plus en plus comme une puissance émergente au point de concurrencer les grands groupes comme le G7. Ce regroupement de pays émergents a le vent en poupe et enregistre de nombreuses demandes d’adhésion. Ces demandes risquent de ne pas être acceptées de sitôt, car le Brésil serait contre l’expansion du groupe, selon certaines sources.

Bitcoin is a technological earthquake that is reshaping finance, energy, politics and morality with the aim of regenerating humanity.

It's a done deal. China now uses the yuan more than the dollar in its international trade. A requiem for the imperial currency.

Binance, the world's largest crypto exchange platform, will be listing the very first digital dollar. For this occasion, find out everything there is to know about FDUSD, from its creator to how it works, and all the benefits the CZ-based company has to offer.

Inflation has been galloping for almost two years, mainly due to the profligacy of central banks. Since then, central banks have turned around and become a little more vigilant. Nevertheless, they face a colossal dilemma: the peril of debt or the peril of inflation. It's reasonable to assume that central banks will react this time, as they have every other time: by rearming their monetary bazooka. If so, it could well be the return of happy days for bitcoiners. Let's talk bull run.

The BRICS nations have great ambitions for the global financial system. They have already announced plans to create a common currency for the organization's members. But their project goes beyond monetary issues. They want to counterbalance global geopolitics, and the initiative is of interest to many countries around the globe.

Democratic presidential candidate Robert Kennedy has outlined the policies he will implement regarding bitcoin if elected president.

According to analysts, the ongoing sell-off in the US dollar has always pulled bitcoin down. But bitcoin's correlation with DYX won't last forever, argues Acheson, former head of research at CoinDesk and Genesis.

Central banks continue to accumulate gold. Geopolitics and inflation redefine the rules of the game.

Performance in the first half of 2023 has been largely supported by liquidity. Furthermore, the good news in June was the agreement reached on the debt ceiling limit. It has been increased until 2025, which subsequently reassured a number of financial market operators. It's not the agreement itself on the ceiling limit that's worth keeping an eye on, but rather the impacts of a liquidity squeeze on Bitcoin and the crypto market for the second half of the year.

ADA, Cardano's native cryptocurrency, is currently showing a bullish trend despite the bear market and is trading around $0.30. However, some signals indicate that a potential decline in the asset's valuation cannot be ruled out.

The main event of this weekend was the Saint Petersburg International Economic Forum. Sharing the stage with his Algerian counterpart, the Russian president predicted the end of the dollar.

A solo miner defies the odds and hits the jackpot! With a one in 5,500 chance, this independent miner struck gold by solving a Bitcoin block worth 6 BTC, approximately $160,000. What makes this remarkable feat even more impressive is that it was achieved using mining hardware that is six years old.

Ever since El Salvador made Bitcoin an official currency within its territory, the country has been facing a campaign of distrust and surveillance from the United States. Without hiding their deep unease, the Joe Biden administration has implemented legal measures to protect the American financial system from the repercussions of the Salvadoran government's decision. Why do the USA feel threatened, and what actions have they taken in response? Find all the answers in this article.

Nine countries led by Iran launch an alternative to the SWIFT network. Simultaneously, BRICS discusses the end of the dollar in Cape Town.

Elon Musk, the renowned technologist and futurist, predicts that the dollar will soon be worth next to nothing.

As the United States faces the risk of defaulting on its debt, urgent actions are needed. One of them is to raise the debt ceiling. Some politicians, particularly Republicans, would like negotiations in this regard to take into account the interests of crypto firms. But for President Biden, that's a no-go!

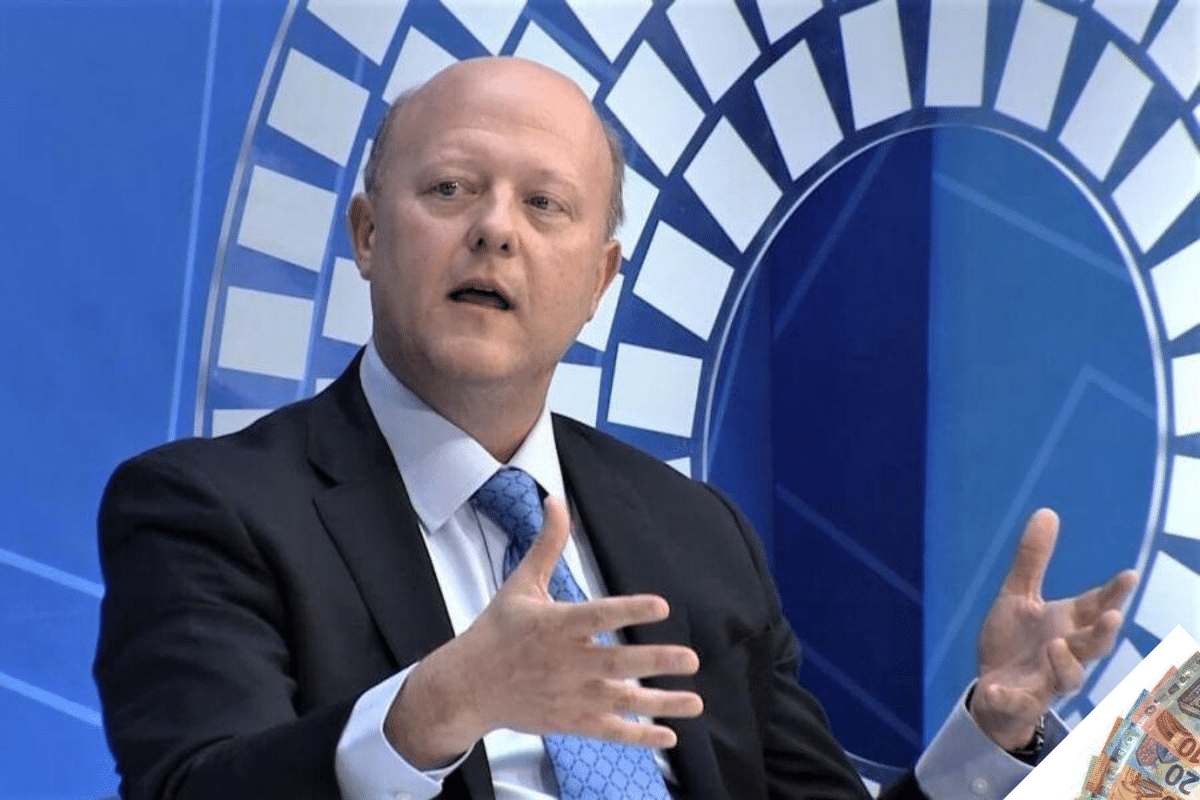

In a recent interview, Jeremy Allaire, CEO of Circle, emphasizes the urgency of taking the threat of de-dollarization seriously. As more nations take steps to reduce their dependence on the US dollar, Allaire warns of the potential consequences of this growing trend.

Right now, the dollar is at the center of global economic debates. Some have already announced that the era of American currency hegemony is coming to an end. And in the currently bleak economic context of the country, some are considering how to adapt to this anticipated change. Bitcoin could contribute significantly to this.

Blockchain analysis platform Santiment is optimistic about the upcoming price increase of five cryptocurrencies. However, the context favors a significant decrease in altcoin prices compared to Bitcoin (BTC). Nevertheless, Santiment believes that Litecoin (LTC) and four other altcoins are undervalued.