Since the beginning of the year, the dollar has collapsed against the euro and other major currencies. A trend that seems far from over. Markets are adjusting to an uncertain geopolitical context, fueled by the economic decisions of the Trump administration. How far will the decline of the greenback go?

Donald Trump

Dogecoin has dropped over 5% in the past seven days as bearish signals and political tensions weigh on market sentiment.

While monetary decisions now dictate the pace of global markets, the White House is preparing to shake up the institutional chessboard. Donald Trump has announced that a change at the head of the Federal Reserve could be decided "very soon." From Air Force One, he is directly rekindling his standoff with Jerome Powell, against a backdrop of ongoing disagreements over rates. By threatening the independence of the Fed, Trump is reviving an old fracture with major economic and political implications.

As markets scrutinize every move of the Fed and US public debt hits new records, Donald Trump is launching a vast fiscal project. His proposal is to extend and amplify the tax cuts of 2017. While his supporters see it as a growth lever, economists fear a massive budgetary drift. This text, dubbed "One Big Beautiful Bill", crystallizes the tensions between political ambition and financial viability.

When Musk threatens space and Trump cuts the funding, it's crypto that takes a hit. A duel of egos, billions vanished and bewildered investors... Who really benefits from the chaos?

The rift between Donald Trump and Elon Musk, once strategic allies, is now laid bare. Amidst vehement criticisms, accusations of ingratitude, and budgetary tensions, their public confrontation reveals the fault lines of a power shared between ballots and algorithms. This clash, sparked from the Oval Office to social media, could redefine the balances between political influence, industrial ambitions, and electoral prospects.

Trump launches his own stablecoin... but it's a cold shower! Artificial volumes, strategic failure, and explosive family gains: discover why USD1 resembles more a crypto setup than a monetary revolution.

A Trump Wallet without Trump inside? Here comes a crypto wallet, loaded with rewards... but the heirs swear they never scanned the QR code.

Tension is rising around the giant Republican budget bill, a pillar of the Trump agenda. It is Elon Musk, former advisor and head of Tesla, who ignites the debate by denouncing it as a "financial abomination." A few days after leaving the administration, his public charge upsets the political balance. As Congress prepares to finalize the text, this unexpected intervention resonates as a major warning about upcoming fiscal excesses.

Donald Trump has just lost a key battle over his tariff rights: a U.S. court has put the brakes on him. Discover how this decision shakes China, the markets, and challenges presidential powers.

Investor David Sacks details in an interview all the advances of Trump's pro-crypto policy.

Adam Back sees Donald Trump as a catalyst for the adoption of bitcoin. We provide all the details in this article!

Not seen Trump, but his pro-bitcoin envoys proclaimed in Vegas: America wants to mine, regulate, and dominate the crypto-world, while Beijing tightens the screws.

The announcement had the effect of a shockwave: Donald Trump gives his full support to the Bitcoin Act, an ambitious bill planning for the purchase of one million bitcoins by the U.S. government. Far from the usual controversies, this initiative marks a decisive turning point in the country’s economic strategy, with profound geopolitical implications.

Musk leaves the government before mandatory transparency. Tesla is in free fall, X is down, he seeks refuge in his factories. Is the economy of the empire already on borrowed time?

Trump, the king of communication, denies a crypto fundraising. Fake news or a bluff? The behind-the-scenes of a series where nothing is really certain.

Trump accelerates in crypto: raising $3 billion for bitcoin. Amid scandals and strategy, the Trump saga in blockchain continues to shake Washington.

Trump keeps the suspense going, Brussels breathes, the stock market dances. But behind the curtain, the threats still loom. Who will emerge victorious from this customs waltz?

The mix of politics, extravagance, and cryptocurrencies promised an explosive cocktail. It mainly resulted in culinary discomfort and hollow speech. During the highly selective dinner organized by Donald Trump to honor the biggest holders of his eponymous memecoin, one guest did not hold back: "ridiculous,” "junk," "bullshit." The event, meant to embody the seriousness of a committed crypto turn, turned into unintentional satire. And it was the hors d'oeuvres, like the promises, that went down poorly.

The BRICS Trade Ministers approved this week the "Declaration on WTO Reform and Strengthening the Multilateral Trading System." This is a document in which the group reinforces its commitment to strengthening the multilateral trading system. Additionally, the proposal includes reform of the World Trade Organization (WTO). This declaration also addresses issues such as data governance, sustainability, and strategies through 2030. Meanwhile, the President of the United States, Donald Trump, has once again threatened the European Union (EU) with a 50% tariff starting June 1.

A phone call, a truce? Trump puts away the customs missiles. The European economy is breathing, but for how long? Ursula whispers, Donald retreats. Suspense is high until July.

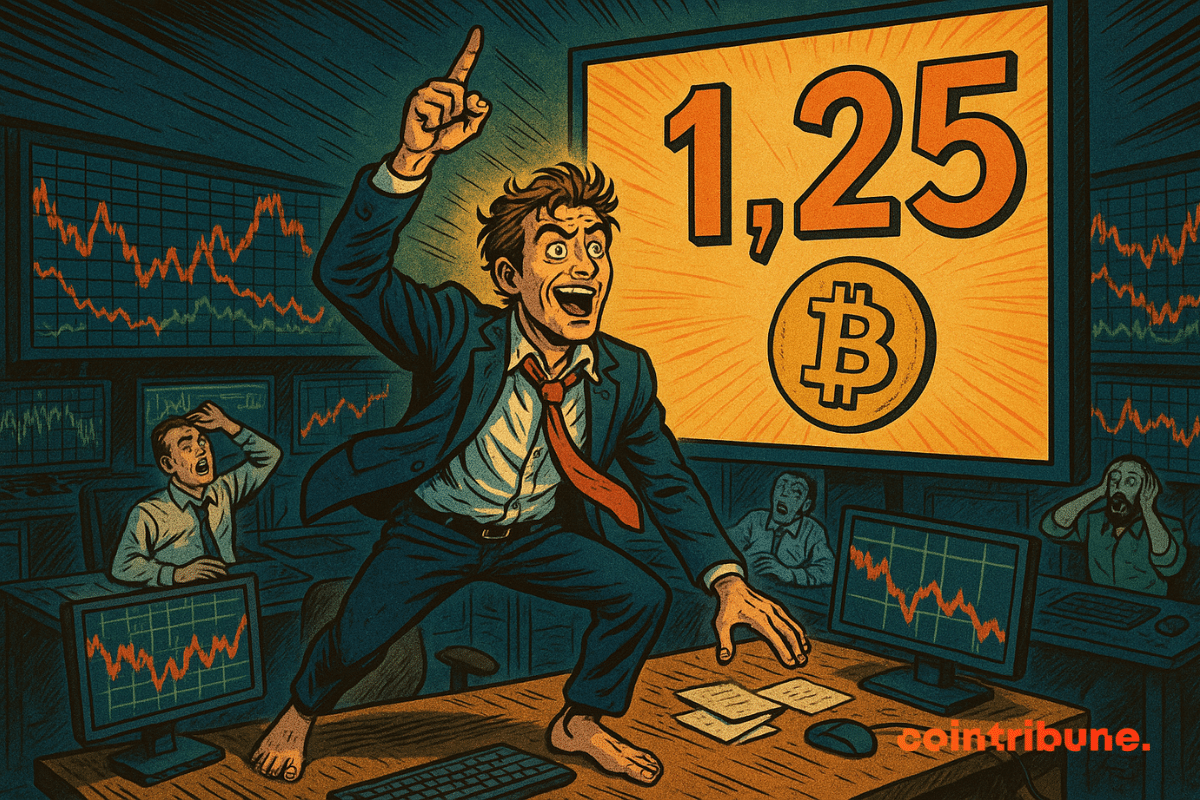

In a market where volatility is constant, James Wynn stood out with an extraordinary maneuver: a long position of $1.25 billion on bitcoin with a 40x leverage via Hyperliquid. A controversial figure in speculative trading, Wynn seemed to be riding a bullish wave... until an announcement from Donald Trump about a massive tax against the EU. Within a few hours, the geopolitical shock reversed the trend, melting away $29 million in potential gains, a bold bet caught up by the reality of the markets.

As geopolitical rivalries flare up, dedollarization reemerges as a lever of monetary sovereignty. For a long time, the BRICS have been at the forefront of this ambition, seemingly seeking to challenge the economic order dominated by Washington. However, a strategic repositioning by Brazil, an influential member of the bloc, disrupts this trajectory. By dismissing the idea of a common currency, the country reshuffles the cards of an already fragile project, revealing the limits of monetary coordination in the face of the reality of economic power dynamics.

The return of Donald Trump to the global economic arena was enough to shake the markets. On Friday, a terse statement on Truth Social ignited the powder keg: 50% tariffs on European imports starting June 1. The reaction was swift. Wall Street wavered at the opening, traders hurriedly adjusted their positions, and the crypto market felt the shock: Bitcoin dropped by 4%, leading to liquidations of over 300 million dollars.

Crypto, filet mignon, and democracy for sale? Trump treats 220 investors to tokenized wheat while senators shout corruption under the chandeliers of the Trump Golf Club.

Washington cuts in post-crash regulation: a small snip to the SLR to inflate the economy... or the next bubble? Thrilled banks, shivering taxpayers. Who pays the price?

Trump ready to sign his crypto laws before the summer break. The Senate is cleaning up, but the Trump family keeps their small affairs well protected.

Bitcoin has stood the test of time. Buying bitcoins today is significantly less risky than it was 10 years ago, 5 years ago, and even 1 year ago.

In Toronto, during Consensus 2025, Eric Trump revealed that a true global rush for bitcoin accumulation is underway. This statement comes as the Trump family becomes increasingly involved in the crypto industry, raising concerns among the Democrat camp, which denounces potential conflicts of interest and calls for an official investigation.

When Ukraine wants to create its Bitcoin vault, it resonates! But between pending laws and crypto-donations, the financial war has its new digital front.